Cattle inventory liquidation over the past three years – to the sum of almost 3 million head – has created a tighter supply of beef cattle going into 2022, and price dynamics will keep paying off for the industry.

Supplies will be even thinner in the coming year, CattleFax Senior Analyst Kevin Good said to those at the National Cattlemen's Beef Association (NCBA) Cattle Industry Convention in Houston, Feb. 2.

The Jan. 1 beef cow inventory count showed a decline of 718,000 cows to 30.1 million, while overall head were at 91.9 million, down almost 3 million since 2019. Good said drought recovery will determine by late summer how drasticly production could drop.

“The decline of cattle numbers over the past two years will continue,” Good said. “About a third of the cow herd through last year was exposed to drought conditions. Now if you look at where we're starting this year … you can see that about two-thirds of the beef cow herd is actually in dry conditions or worse, and 40 percent are in drought conditions. So as we start this year, we've got some headwinds. Until this pattern changes, we are going to continue to see cow slaughter at a level that’s still a liquidation pace.”

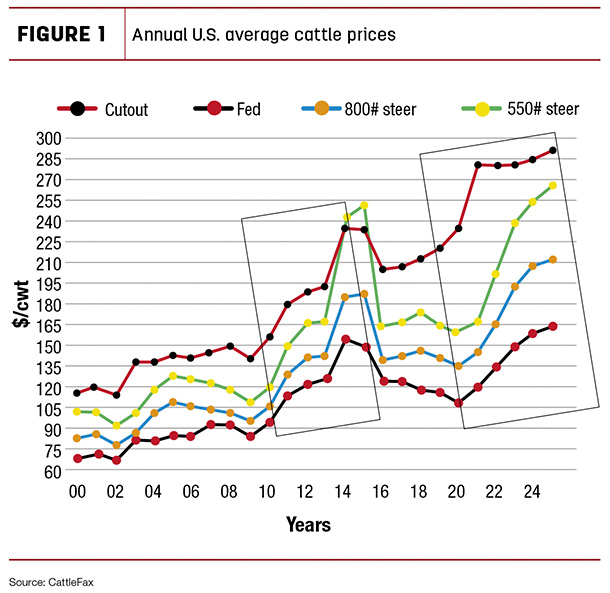

The limited supply should boost calf values among all key categories – calves, feeder calves, fed cattle and box cutouts (see Figure 1).

Fed cattle steers – $140 per hundredweight (cwt) average in 2022, going in the $130-$155 range.

Feeder steers (800 pounds) – $150 to start the year, after a $144 per cwt average in 2021. Average will be $172 in 2022 and be in the $158 to $184 range.

550-pound calves – Average price will go from $170 in 2021 to $205 in 2022, staying in the $170 to $230 range.

Cull cows – will see highest start since 2016 at $66 per cwt, going to a $75 average, in the range of $65 to $85.

Bred cows – Average price in 2021 was $1,580 and is forecast to go to $1,825 this year and stay in the $1,600 to $1,800 range.

Production outlook

More cattle are entering feedlots through the beef-on-dairy segment, Good explained. “We’re seeing more and more of those animals move into the system. The number is probably somewhere close to 3 million today out of the 9-million-plus dairy cows, and it’s only going to get bigger as we go forward.” Even with those additions, production figures are forecast to drop in the second half of the year, especially fourth quarter, which is rare trend. “Generally, what that means is you’re walking into tighter supplies over time from a cycle standpoint.”

Beef cutout values have surged in the past two years, driven by tighter supply. But Good said that trend may see beef prices “take a little bit of a breath.” Demand remains high in markets while supplies are tight, and beef prices have gone up twice the rate of inflation, “which means there’s more real dollars that have come into our business. But we’ve got a consumer out there that more than likely is going to have a little bit of inflation pressure. So, for our purposes today, we’ve got a smaller increase in price at wholesale.”

Segment leverage

The debate in recent years has been why so much leverage on cattle price has swung heavily to packers and away from cow-calf producers at a time when boxed cutout values are consistently above $250. So how, Good asked, does leverage improve over time? Declining supplies over the next four years will favor cow-calf ranchers, aided in next part by more shackle space coming from packer expansion. The third component is packer participation.

“Just common sense to packers bidding is that two packers bidding is better than one, three packers bidding is better than two, four packers bidding is better than three. And that’s the simplest way of looking at it. The sooner we see better participation, the sooner we get the front-end supply to a spot where we have that participation, obviously, leverage swings much quicker.”

The rate of packer expansion will start in 2022 with a conservative estimate of an additional slaughter capacity of 2,500 head per day. Between 2023 and 2025, an additional 4,000 head increase is the conservative estimate. But the operative factor, Good added, will be labor availability heading into the next three years. “We can build brick and mortar, but we’ve got to have somebody to work the plants.”