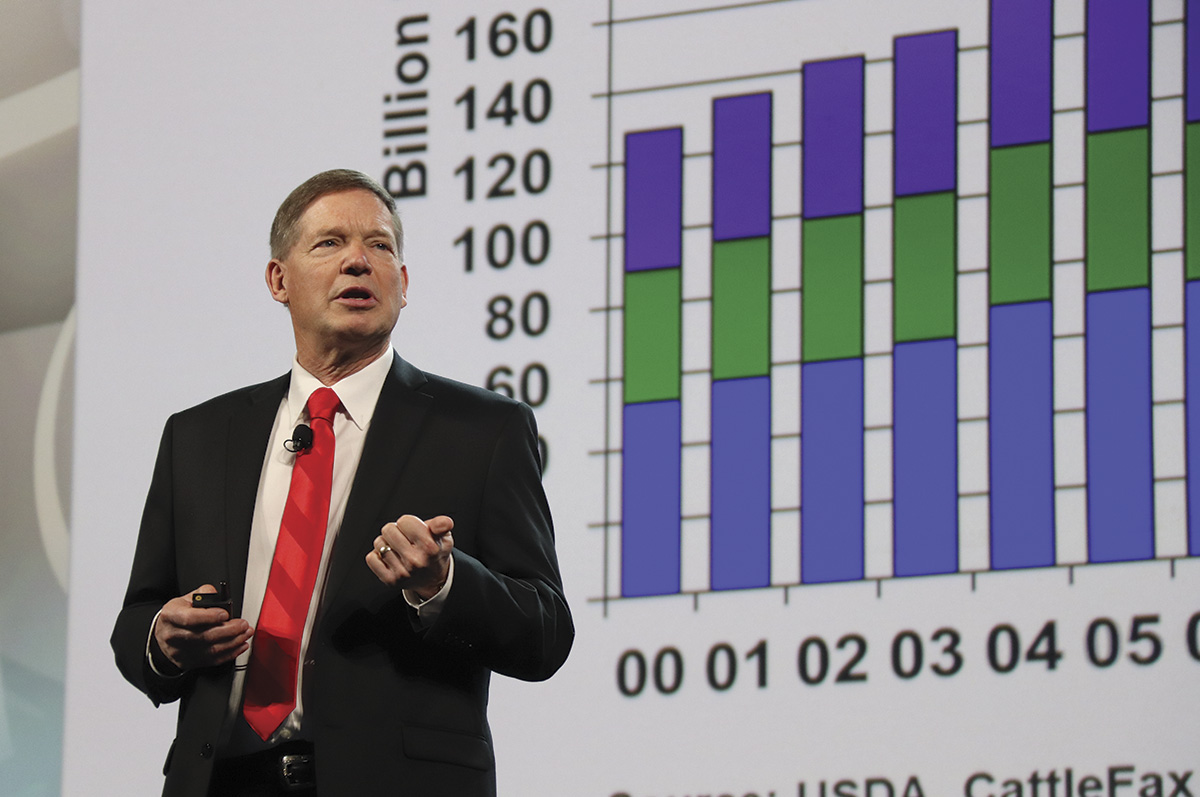

CattleFax CEO Randy Blach, joined by analysts Kevin Good and Mike Murphy, shared their projections and takeaways for the cattle, grain and energy markets in the coming year with ranchers attending the National Cattlemen’s Beef Association (NCBA) Cattle Industry Convention in Houston. CattleFax meteorologist Matt Makens also presented a global weather outlook, with some insights closer to home.

Blach told ranchers attending the industry outlook session that value-added programs paying high premiums have boosted beef demand and spread wealth throughout the industry. “A handful [of] years ago, we’re sitting here in this conference having this conversation, and everybody was worrying, ‘Well, if we keep making these cattle better, there won’t be any premiums left.’ How far off was that assumption?”

The year 2021 showed a record for large wholesale grade premiums to $58. Choice to Select spread was $17 per hundredweight (cwt), Certified Angus Beef (CAB) to Choice spread was $19, and the CAB to Prime was $18. “Even though we’ve had this kind of increase in supply, Prime went from 2 percent of our supply to 10 percent,” Blach said. “Record premiums – what’s that tell you? That tells us our consumers are voting with their pocketbook[s] and they want more marbling. They want the good stuff. They love the taste of grain-fed beef, and they want that on a more regular basis.”

Driven by those premiums and value-added programs, CattleFax forecasts show strong price growth for calves, feeder calves, fed cattle and bred cows in 2022. All four segments of the industry – cow-calf, stocker, feeder and packer – should see a combined profitability of $800 per head to be shared among them.

CattleFax’s $800 profitability margin per head is the second-highest in the history of the industry, Blach said. “Again, I can’t tell you whether the cow-calf producer will make 200 of that, and the feeders are making 100, and stockers are going to make 100, and packers are going to make 300. The market will sort all that out.”

Offering a warning on the price discovery debate, Blach said that value-added programs fuel $1 billion per year into the industry, and changes that create imbalance are a warning. Secondly, if price discovery leads to a contract library, the four major packing companies could still have an informational advantage above the thousands of feeders in the country.

“We are seeing the leverage shift; you’re going to see less margin at the packer level, less margin at the retail level as we work through 2022 and on into 2023. You’re going to see more of that margin shift back into producer markets.”

Grain and energy outlook

In his grain and energy outlook presentation at the National Cattlemen’s Beef Association Cattle Industry Convention in Houston, CattleFax analyst Mike Murphy outlined three key components of the current and future market situation.

1. Interest rates will go up.

2. Supply chain issues are persistent but should continue to improve as the year progresses.

3. Inflation, especially as regards energy, will increase, leading to higher costs for transportation and shipping.

U.S. energy stocks to use have been depleted after two years of growing demand and slower production. “We've really drawn down on the stocks, and we haven't been in a situation where we've been able to see enough production increase to offset the demand for all of our products related to the energy sector,” Murphy said. “This is really important because when you start talking about those types of stocks, and you couple that without increasing demand, you put yourself in a situation where the market needs to get high enough to try to ration the usage of our product.”

The U.S. is a long way from getting back to the pre-COVID-19 levels of production and supply in crude oil. The rig counts are recovering slowly because of labor issues and a lack of investment in fossil fuel production. While the federal estimates predict a slow recovery for fossil fuel consumption, Murphy suggests a quicker recovery to pre-COVID-19 consumption levels and that the gap between global production and global consumption will become much smaller. “We could easily see prices up there towards $100 or $110 a barrel. … We’re certainly going to see crude oil prices move higher.”

Higher prices aren’t the only things to watch out for. “We have to expect a lot of volatility in this market, and that'll be the case for many of our commodities that we deal with, energy in particular,” he said. “Taking that back to the economic side of things, the cost to be able to transport goods and services, cattle and grain, is going to be more as we go through 2022.”

Feed grain acreage

Corn plantings are down 1.5 million acres from last year at 91.8 acres; soybeans are holding steady at 87.3 million acres. Winter wheat acres are up 749,000 acres. Spring wheat is going to be the key. Murphy predicts a swing from corn production into spring wheat in Minnesota and the Dakotas, bumping the planting up by 1.5 million acres. Cotton acres are also expected to increase by about 800,000 acres. “That shift in that northern Corn Belt will be the difference in terms of us losing corn acres and that shift going into spring wheat.”

Murphy said ethanol producers have been as profitable in the last several months as they have been in two years and are trying to build stocks up to meet that demand out there, so the amount of corn being utilized for ethanol production has increased. Domestic demand for ethanol should increase steadily as more people get out and about as COVID-19 restrictions lift.

Exports are more of a wild card. China will continue to have demand, but that can change depending on their problems with African swine flu and resulting demand (or lack thereof) for corn. The U.S. is one of the few countries that has corn to export, so the market and demand should remain steady and relatively balanced, regardless of crop yields in South America.

Corn yield is estimated at about 180.6 bushels per acre in 2022-23. Murphy said corn prices should, fortunately, remain elevated, since higher costs for inputs like fertilizer mean higher breakevens across the board. “We know long term that farming tends to be a break-even business like many commodities, but that cost of production is high, and it'll sustain itself because of all these inflationary pressures.”

Kevin Good

Cattle price outlook

Good told attendees that cattle inventory liquidation over the past three years – to the sum of almost 3 million head – has created a tighter supply of beef cattle going into 2022, and price dynamics will keep paying off for the industry.

Supplies will be even thinner in the coming year. The Jan. 1 beef cow inventory count showed a decline of 718,000 cows to 30.1 million, while overall head were at 91.9 million, down almost 3 million since 2019. Good said drought recovery will determine by late summer how drastic production could drop.

“The decline of cattle numbers over the past two years will continue,” Good said. “About a third of the cow herd through last year was exposed to drought conditions. Now if you look at where we’re starting this year … you can see that about two-thirds of the beef cow herd is actually in dry conditions or worse, and 40 percent are in drought conditions. So as we start this year, we’ve got some headwinds.

“Until this pattern changes, we are going to continue to see cow slaughter at a level that’s still at liquidation pace.”

The limited supply should boost calf values among all key categories – calves, feeder calves, fed cattle and box cutouts.

- Fed cattle steers – $140 per cwt average in 2022; going in the 130 to 155 range.

- Feeder steers (800 pounds) – $150 to start the year, after a $144-per-cwt average in 2021. Average will be $172 in 2022 and be in the $158 to $184 range.

- 550-pound calves – Average price will go from $170 in 2021, to $205 in 2022, staying in the $170 to $230 range.

- Cull cows – Will see highest start since 2016 at $66 per cwt, going to a $75 average, in the range of $65 to $85.

- Bred cows – Average price in 2021 was $1,580 and is forecast to go to $1,825 this year and stay in the $1,600 to $1,800 range.

Production outlook

Production figures are forecast to drop in the second half of the year, especially fourth quarter, which is a rare trend. “Generally, what that means is you’re walking into tighter supplies over time from a cycle standpoint.”

Beef cutout values have surged in the past two years, driven by tighter supply. But Good said that trend may see beef prices “take a little bit of a breath.” Demand remains high in the markets while supplies are tight, and beef prices have gone up twice the rate as inflation, “which means there’s more real dollars that have come into our business.”

“But we’ve got a consumer out there that, more than likely, is going to have a little bit of inflation pressure. So for our purposes today, we’ve got a smaller increase in price at wholesale.”