Speaking to producers at the National Red Angus Conference in September, Odde, a Kansas State University professor of animal sciences and industry, presented Superior Livestock Auction data revealing trendlines on sales prices. The database covers 24 years, 82,793 beef calf lots comprised of 25 million cattle, highlighting which calf health programs, premiums and genetic breeds have an effect on prices.

“Prior to [these data], we had lots of states with preconditioning sales, green tag programs, and most never went very far,” Odde said. “Mostly, supply-driven programs didn’t have the structure to be sustainable. So what Superior has done is really profound.”

Superior’s database also reflects industry production from the key segments of ranching in multiple regions of the country, Odde explained.

“We think Superior data represents cow-calf operations about 300 cows or bigger. We don’t just mean the video auction market, but we think it represents the sizable cow herds, and how a lot of those ranchers actually think.”

Vaccination and weaning

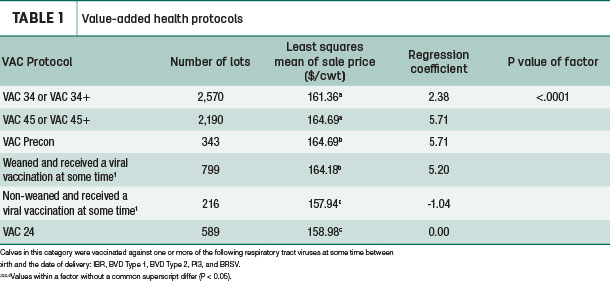

Odde showed how vaccination programs since 1995 have seen greater participation as producers follow health protocols for reasons related to quality and profit. The key programs have been:

- Vac 24 – Calves vaccinated at 2 to 4 months of age, sold off the cow

- Vac 34 – Vaccinated three to four weeks prior to weaning, sold off the cow

- Vac 45 – Calves weaned for 45 days and given two rounds of vaccinations

- Vac Precon – Similar to Vac 45, but for put-together calves as opposed to ranch-origin calves

The data started in 1995 with 40% of lots consisting of non-weaned, no vaccination calves. That percentage dropped quickly. By 2005, it was fewer than 3%, and in 2013, it was 0%.

“By 2013, we had to change program,” Odde explained. “They used to be the base we compared everything to. There’s not enough lots now to compare them to. So we had to make Vac 24 the base.”

Vac 24 lots started around 1% and climbed to 10% in 2013, where it’s hovered since. Vac 34 programs became the most prevalent, jumping from 11% in 1995 to 50% of the database lots in 2018. Vac 45 lots started at 3%, jumped to 21% in 2004 and have remained around 29% to 30% since 2014.

“Why hasn’t that continued to grow?” Odde asked. “These are calves typically in the 5- to 8-dollar-per-hundredweight (cwt) range higher than a Vac 24 grouping is. For some producers, that's enough to participate in, and for others that don’t have the facilities, management or labor, it’s probably not enough.”

Odde said by comparing prices through a “multiple regression” method, researchers can determine factors’ effect on sales price while weighing other variables. For Vac 34, the premium in 2005 was $2.45 per cwt, resulting in a 550-pound calf getting around $13.48. Vac 45 calves were around $7 to $8 per cwt, but went to $5.85 in 2017.

“So they’re premiums, but they’re not exorbitant,” he said. “I participated in a discussion, and veterinary colleagues were saying preconditioning is a no-brainer and everybody ought to wean calves on the ranch 45 days before they sell them, and that’s not practical for everybody in our industry and everybody ought to recognize that.”

Odde said the biggest value-added protocol is weaning, not necessarily the vaccination (see Table 1).

Additional price factors

In 2018 datasets, the median number of calves in a lot was 85, and the base weight for calves was 560 pounds. Number of days in the feedlot was 59 days, with a price per cwt around $162.

Odde said research has shown genetic trends for weaning weights are going up, but regional differences do apply. Northern Plains calves have seen those weights flatten. “We’re not seeing the weaning weights grow. The phenotypes move in the same direction as genotypes.”

Prices for steers typically were $16.51 higher than heifers and have gone up since 2018, mostly related to carcass size.

“What we think is carcass weight has increased. We think steers have a little more value relative to heifers because more value is going to heavier carcass weights.”

Regionally, the Rocky Mountain and Northwest regions pull higher prices, followed by the South Central and Southeast regions. Rocky Mountain prices were $8.30 per cwt higher than the Southeast, followed by the West ($4.17) and South Central ($4.06) regions.

Breed compositions

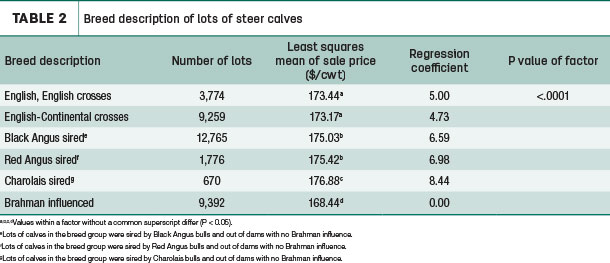

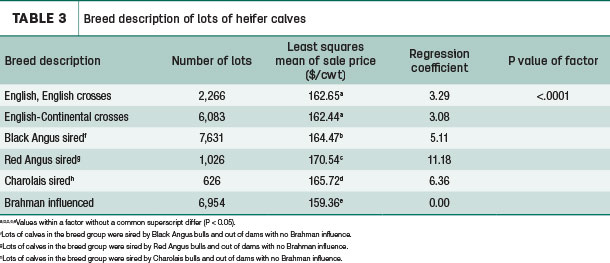

In the past two years, Odde’s research team dove into Superior Livestock breed composition data and sale prices of beef steer and heifer calves, over a six- to eight-year period.

Steer calf results compared six combinations: Brahman, Charolais, Red Angus, black Angus, English-Continental crosses and English crosses (see Table 2).

“What you see is Charolais-sired calves have the highest prices,” Odde said of steers. “Red Angus and black Angus have about the same [price coefficient], sometimes a dollar or less-than-a-dollar [difference].”

On the heifer side, the differences can be more distinct. Red Angus-sired heifer calves saw an $11.10 difference per cwt over the base Brahman prices (see Table 3).

Odde closed by noting that increases in death loss seen in feedlots in various regions around the country may have some factors related to a lack of cattle heterosis.

“We’ve sacrificed some heterosis, and I think that’s maybe part of what our issue is in terms of calf health performance in the feedyard,” Odde explained. “I would say calf health continues to be a very important issue even though we’ve probably got better vaccination programs and calf health programs than we had previously.” ![]()

-

David Cooper

- Managing Editor

- Progressive Cattle

- Email David Cooper

PHOTO: Dr. Ken Odde addresses audience members at the National Red Angus Conference in Iowa. Photo courtesy of Red Angus Association of America.