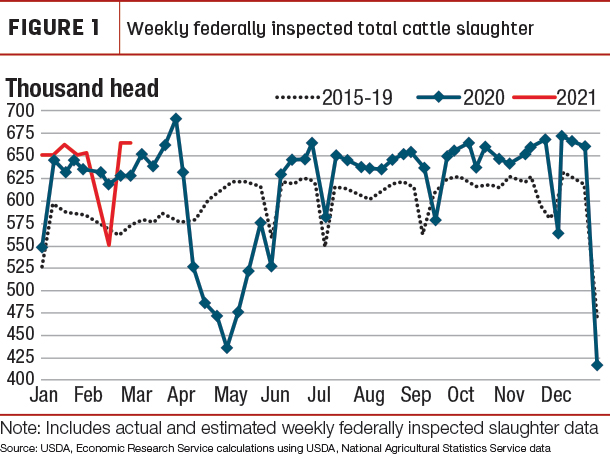

The severe winter event in mid-February that dipped as far south as Texas disrupted packing plant operations, further-processing facilities and delivery of cattle to plants. As a result, there was a drop in weekly cattle slaughter, as shown in Figure 1.

Based on the USDA Agricultural Marketing Service (AMS) report of Actual Slaughter Under Federal Inspection for the weeks ending Feb. 13 and 20, cattle slaughter dropped by over 2% and 12%, respectively, below the same weeks a year ago. The week of Feb. 20 was the lowest weekly total of federally inspected cattle slaughter for a non-holiday week since the week of May 16, 2020. However, the packing industry responded with two weeks of the largest slaughter volumes since the first week of December 2020.

Because of the weather disruption, there is a temporal shift of expected steer and heifer marketings out of the first quarter to be marketed in the second quarter. In addition, there is greater expected cow slaughter in the first half of the year, which raised first-half beef production from the previous month.

In addition to the impact from the winter storm, most cattle sale barns in the Plains were closed during the third week of February, lowering expectations for placements of cattle in feedlots during the month. However, the expectation that relatively high wheat prices may discourage the grazing out of small-grains pastures and move more cattle into feedlots sooner than previously expected is anticipated to shift placements from the second quarter to the first quarter. As a result, some fed cattle marketings are expected to shift from the fourth quarter to the third quarter. This resulted in no change to total second-half 2021 beef production forecast.

Carcass weights are beginning typical lower seasonal movements as the pace of fed cattle marketings picks up, but the winter storm likely advanced the trend at a slightly faster rate. However, expected weights in first-quarter 2021 are unchanged from the previous month as adjustments were made at that time with the effects of the storm implied.

As a result of the increase in expected slaughter in the first half of the year, the forecast for 2021 beef production is up 40 million pounds from the previous month to 27.6 billion pounds.

Cattle prices largely unchanged despite gains in cutout

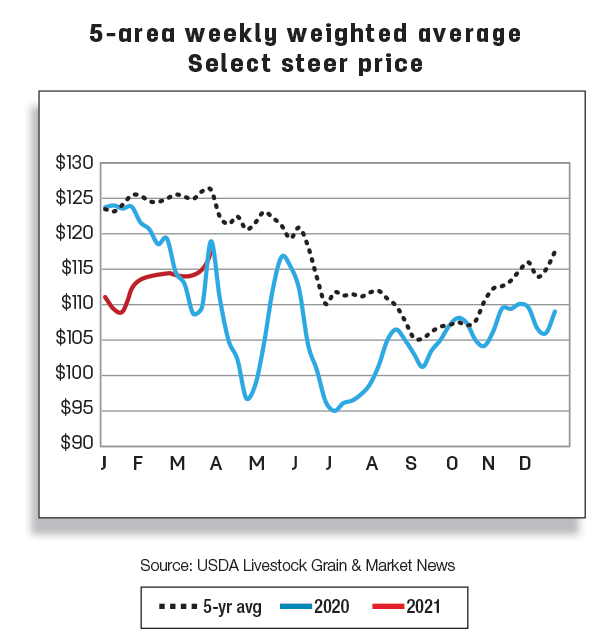

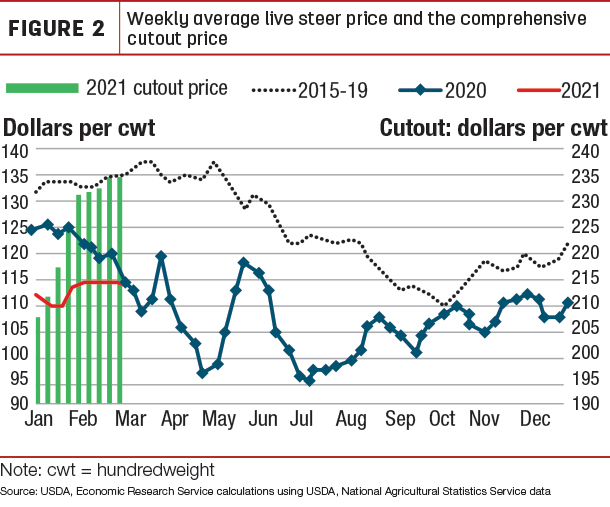

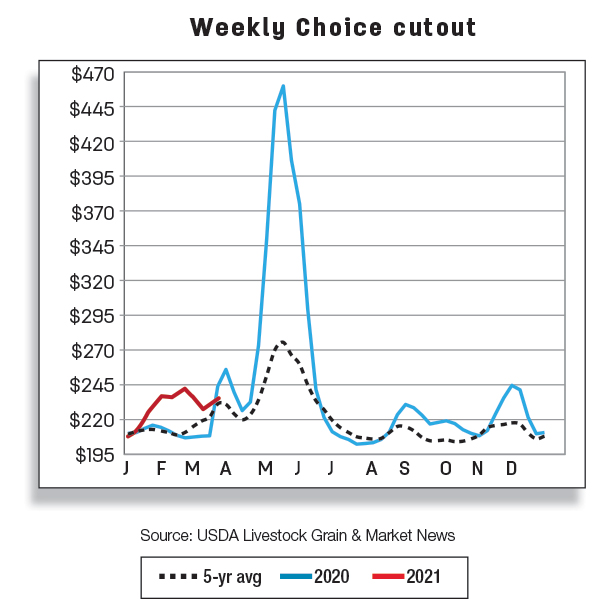

As depicted in Figure 2, live steer prices in the 5-area marketing region are nearly flat since the first week of February, hovering around $114 per hundredweight (cwt), despite a strong rally in the comprehensive cutout to near-record levels for the month of February.

An abundant supply of fed cattle on feed over 150 days on Feb. 1 that is greater than the same time last year, along with the inability to process a portion of those cattle due to the winter storm system in February, likely did not support higher prices in line with typical seasonal patterns. The 2021 live steer price forecast is unchanged from the previous month at $115 per cwt.

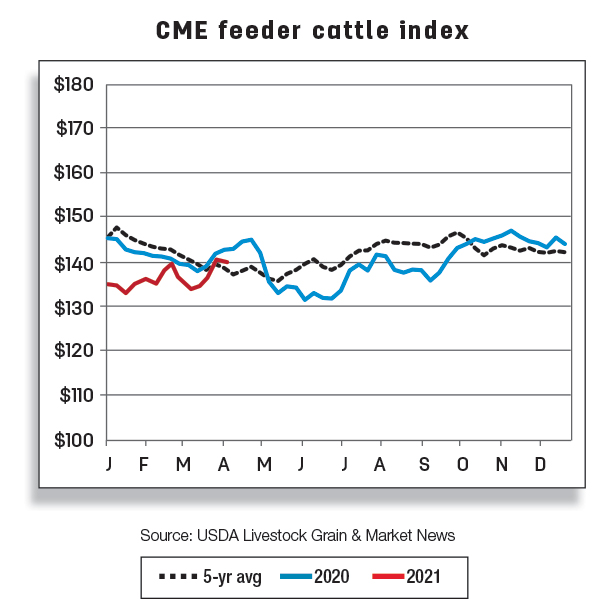

Feeder steer prices for February 2021 averaged $131.82 per cwt for steers weighing 750 to 800 pounds sold in the Oklahoma City National Stockyards, just over $6 above a year ago. However, prices for the first two weeks of March are almost $8 above the same month last year, and the first-quarter 2021 forecast is raised $1 to $133 per cwt. The feeder steer price forecasts for the rest of 2021 remain unchanged from the previous month.

Cattle import and export

The U.S. import cattle forecast is lowered by 100,000 head to 2 million head in 2021, largely due to the expected impacts of bovine tuberculosis restrictions that will be placed on live cattle originating from or transiting through certain areas of Mexico effective April 17, 2021. USDA’s Animal and Plant Health Inspection Service downgraded 11 regions across Mexico and reclassified them as nonaccredited for live cattle export to the U.S. U.S. cattle exports are raised by 10,000 head to 335,000 head.

January imports trend downward on low shipments from Australia

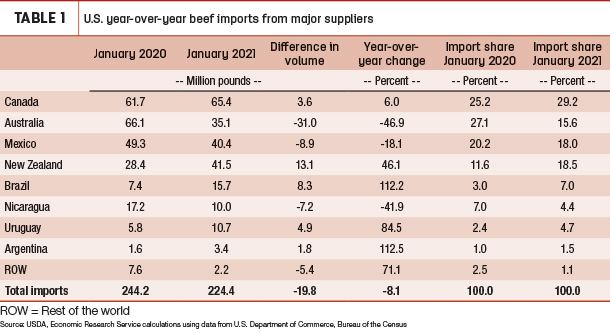

According to the latest data from the U.S. Department of Commerce, Bureau of the Census, beef imports in January totaled 224 million pounds, down 8.1% (or 19.8 million pounds) compared to a year ago. The reduction was mostly driven by Australia’s lowest shipment to the U.S. in January since 2005. Exportable beef supplies in Australia have become limited as more heifers and cows are held back for breeding and expanding the herd. Australia shipped 31 million pounds less beef year-over-year, falling from the top U.S. beef supplier in January 2020 to the fourth-largest in January 2021.

The second-largest reduction of 8.9 million pounds came from Mexico, whose imports were at the lowest volume shipped to the U.S. in January since 2016. In addition, Nicaragua supplied only 58% of the beef that it shipped to the U.S. a year earlier. Combined, these reductions produced the lowest January beef import total since 2014.

Stronger imports were recorded for a few countries. The greatest increase came from New Zealand, which supplied 13.1 million pounds more beef to the U.S. than a year ago. Although the increase in beef imports from Canada was modest, Canada accounted for about 29% of the U.S. total beef imports. The U.S. also imported more beef from Brazil, Uruguay, and Argentina year-over-year. However, the decreases in January beef imports from Australia and Mexico more than offset the increases in imports from other major suppliers.

The forecast for the first-quarter beef imports was lowered 10 million pounds to 690 million pounds from the previous month due to the tightening of beef supplies in Australia and greater beef demand competition from Asia. Twenty million pounds were shaved off U.S. beef imports in the second, third and fourth quarters to 780, 770 and 695 million pounds, respectively. The reason for these later reductions was similar to those in the first quarter but with the addition of reduced beef shipments from New Zealand. The 2021 annual forecast for beef imports was revised from the previous month’s total of 3.01 billion pounds to 2.94 billion pounds.

Beef exports up in January on robust shipments to China

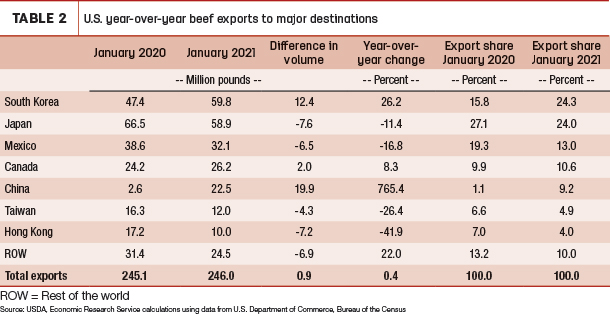

January beef exports were up less than 1 million pounds year-over-year at 246 million pounds. The rise in part reflects large shipments of U.S. beef to China, which were 19.9 million pounds more than the previous year. In January, China moved from the seventh-largest U.S. beef destination to the fifth-largest.

The second-largest increase in beef volume came from South Korea, up 12.4 million pounds from a year ago. The U.S. beef exports to South Korea were the largest volume ever shipped in the month of January, making the country the top U.S. beef destination. Shipments to Canada were also up slightly in January, and Canada remains the fourth-largest U.S. beef destination.

In contrast, there were some reductions in beef shipments to major destinations. The more sizable reductions were to Japan (-7.6 million pounds), which dropped to second place as an export destination, and Hong Kong (-7.2 million pounds). Less beef was also exported to Mexico than a year earlier. Mexico continues to be challenged with a weaker currency relative to the U.S., making U.S. beef products relatively expensive for Mexican consumers. Shipments to Taiwan were down from a year ago as well. However, increases in beef exports to China, South Korea, and other major destinations were larger and were able to offset the reductions in January 2021.

The first-quarter forecast for beef exports is unchanged from the previous month at 750 million pounds. The annual forecast for 2021 totals 3.145 billion pounds. Beef exports for 2021 are forecast to be just below the 2018 record level.

Analyst Christopher Davis assisted with this report.