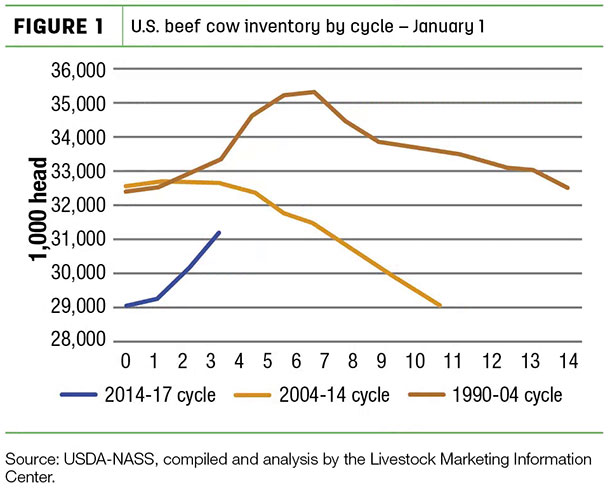

Figure 1 shows the beef cow inventory for the current cattle cycle (2014-present) as well as the two previous cattle cycles.

The current rate of expansion has been much more aggressive than the last two cattle cycles. From 2015 to 2016, beef cow inventory was up nearly 3 percent, while it was up about 3.5 percent this past January over January 2016. Accordingly, we are now seeing placements of feeder cattle increase.

Thanks to favorable rains and drought recovery in the predominant cattle-producing regions of the U.S., along with strong market signals to expand, the 2011 beef cow inventory has now been surpassed. Now people ask when the expansion phase will end.

Where and when beef cow inventory will top out is anyone’s guess. Some analysts expect the peak will occur in 2018, while others have 2020 pegged for the peak.

Many factors will impact where it will land. Three of the many factors are weather and pasture conditions, domestic and international consumer demand, and producer profitability.

Timely rains will have to continue for forage production, allowing cattle to stay on pasture. Strong international and domestic demand will help support prices, which should foster continued expansion in the beef cow herd. Thankfully, beef demand has been strong, even helping to sustain a price rally this past spring.

Most factors culminate and impact whether producers make a profit or not. To stay in business, producers must make a profit. Even with some recent price rallies, prices have in general declined from their record-high levels in 2014 and 2015.

With this overall price decline, profit margins have tightened for many producers. While overall cattle prices may not decline much more, they will until the point the tides are turned and producers begin to liquidate, sending us into the contractionary phase of the cattle cycle.

To stay in business and manage through times of tight margins, producers must keep their pencils sharp and use them often. Purchasing and marketing options must be continually assessed.

As of May 2017, there is a $7-per-hundredweight discount between the September 2017 and January 2018 feeder cattle futures. A drop in price during the fall may not surprise many as most spring-born calves are weaned and brought to market during this time.

Producers with spring-calving herds generally have a few different marketing options to evaluate: wean early and market calves before the fall price slump, wean in October and market the calves then or wean the calves in October and precondition them before selling them in December.

To determine which may be the best option for you, it is important to look at future values of cattle, not just the current price spreads between weight classes. Currently, a 450-pound steer calf in Oklahoma City is estimated to bring $201.98 per hundredweight ($910 per head) in August, based on the futures price and historical basis values.

A 550-pound steer in Oklahoma City is estimated to bring $170.88 per hundredweight ($940 per head) in October, while a 650-pound steer in Oklahoma City is estimated to bring $159.20 per hundredweight ($1,035 per head) in December.

By completing a few calculations, we can determine the value of gain for taking the calf from August to October is $0.31 per pound, while it is $0.95 per pound going from October to December. Estimating value of gain is really only one piece of the overall equation, though. Beyond knowing your own animal performance estimates, it is critical to know your own cost of gain in each of these options.

While the value of gain going from August to October is low, cost of gain should also be low at this time since the calf can still be on its mother’s side. The value of gain going from October is much more substantial, but the costs will be as well. The calf will need to be weaned and processed, placed on feed and may face more health challenges.

To estimate if you can make a profit, knowing your cost of gain will be crucial. Prices will also have changed dramatically since the time of this writing, so it will also be important to recalculate expected value of gain with updated numbers.

In the grand scheme of beef cattle production, this is just one of many pieces of analysis that must be done. To weather any cyclical downturn in the markets, one must be an astute financial manager. ![]()

VOG calculations

Chicago Mercantile Exchange (CME) Feeder Cattle Futures as of April 28, 2017

- August 2017: $151.975

- September 2017: $151.925

- October 2017: $150.875

- November 2017: $148.975

- January 2018: $144.200

Historical Basis Values based on Oklahoma City National Stockyards

- 400- to 500-pound steer in August: $50 per hundredweight

- 500- to 600-pound steer in October: $20 per hundredweight

- 600- to 700-pound steer in December: $15 per hundredweight

Expected prices in Oklahoma City

- 450-pound steer price in August 2017

$151.975 + $50 = $201.975

- 550-pound steer price in October 2017

$150.875 + $20 = $170.875

- 650-pound steer price in December 2017

$144.200 + $15 = $159.200

VOG from 450- to 550-pound steer

((170.875 x 5.5) – (201.975 x 4.5)) / 100 = (939.81 – 908.89) / 100 = $0.31 per pound

VOG from 550- to 650-pound steer

((159.200 x 6.5) – (170.875 x 5.5)) / 100 = (1,034.80 – 939.81) / 100 = $0.95 per pound