In 2020, the U.S. exported $7.6 billion in beef and variety meat products (down 6% from 2019); variety meat exports to all partners accounted for 11.8% of that value, down from 12.4% in 2019. When the value for hides and all offal products is added, the total offal value plus hides accounted for 20.7% of the export value in 2020, down from 22% in 2019. Variety meats account for a significant percentage of the export value, so what value do these byproducts add to the finished steer?

The Agricultural Marketing Service (AMS) of the USDA reports the byproduct drop value for steer. On Feb. 23, 2021, the hide and offal value from a typical slaughter steer was estimated at $9.71 per live hundredweight and includes values for cattle hides, variety meats (i.e., cheeks, hearts, tripe, etc.) and tallow. This value equates to $135.94 for a 1,400-pound steer. This value has been increasing recently and is at a level last seen in May 2018.

Products that add the greatest value to the byproduct value reported by AMS are the hide, tallow, tongue, tripe, oxtail and cheek meat. International destinations provide markets for products not typically consumed in the U.S. Japan and Mexico are the leading importers of U.S. variety meats, importing $369 million and $228 million worth of variety meats in 2020. Japan is the leading importer of beef tongue, while Mexico leads in beef tripe. As their import levels of variety meats change, so does the value contribution of tongue and tripe change in the overall byproduct value calculation, which ultimately will impact the finished steer price.

Beef and beef byproducts are typically produced in nearly fixed proportions; however, when packers experienced line disruption in 2020, many plants changed fabrication methods to keep more whole muscles/primals intact and keep less offal to maximize line speed. The decrease in beef and offal provided less opportunities for exports, and byproduct values decreased to $6.79 in May 2020. When these edible offal products are not exported, they will often go into rendering or into pet food and ultimately decrease the overall value of the finished steer.

With the continued recovery from COVID-19 disruptions, byproduct production has mostly returned to pre-COVID-19 levels, and given the relatively fixed pounds of byproducts per 1,400-pound steer, the byproduct drop value contributions have been increasing due primarily to changes in demand. Beef exports are expected to be up almost 6% in 2021. As exports of beef and variety meats rises, additional support to the finished steer price is provided.

The markets

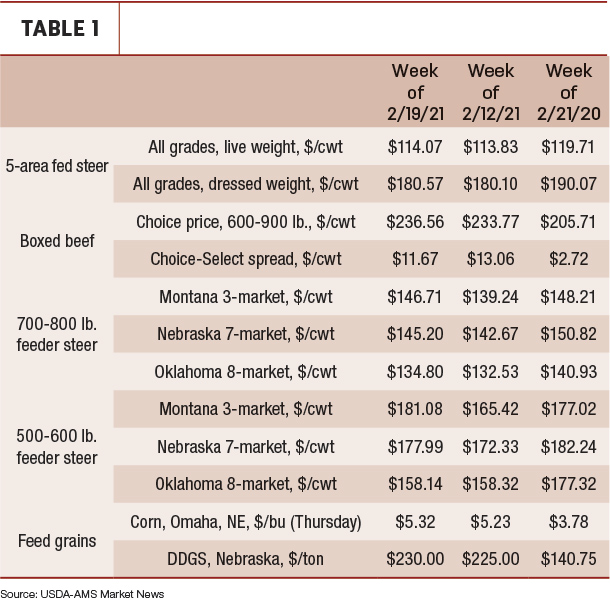

Old crop corn price continues to increase, while December futures prices remain stable. USDA acreage has provided the recent stability for the December corn price. Corn is currently at the tightest levels in seven years. However, with the recent lack of any new exports and the attention given to South American markets, prices are not getting any new news to support the high prices. Although the trend is still upward for corn prices, upward trends need new news to continue.

Live cattle prices are facing downward pressure. The February contract expired on Friday, and the bearish cash market will pull the April futures price with it.

The Cold Storage report on Feb. 23, 2021, estimated total pounds of beef in freezers was down 3% from January, but up 6% over 2020.

This originally appeared in the Livestock Marketing Information Center’s Feb. 23, 2021, In the Cattle Markets newsletter.