The biggest surprise in the report was the nearly 1% larger placement total during December 2020 than during December 2019. Pre-report estimates were for lower placements than a year ago, and the small increase was slightly outside the range of expectations. Total placements were 1.84 million head, which is the second-largest total for December (behind 2005) since the series began in 1996.

At the state level, the biggest placement increases from December 2019 by number of head were in Iowa, Colorado and Nebraska, which were up 21,000, 15,000 and 15,000 head, respectively. Placements in Texas and Oklahoma were lower than a year ago, down 30,000 and 16,000, respectively. This was the last Cattle on Feed report for a volatile 2020. A look back at the monthly placement totals for the year show a 4.1% decline in placements during calendar year 2020 as compared to 2019.

This report also included placements by weights. Placements of heavier cattle increased in December as compared to a year ago with the exception of the greater-than-1,000-pounds category. Cattle weighing 900-999 pounds were 15.8% higher compared to December 2019. Placements in the 800-to-899-pound group were up 7.5%, and the 700-to-799-pound group were up 2.9%. The under-600-pounds category and the 600-to-699-pounds category were down 1.1% and 4.4%, respectively.

Also included in this report was the quarterly update of cattle on feed by class. The estimates for feedlot mix on Jan. 1, 2021, were 61.85% steers and 38.15% heifers. This is up slightly from these same estimates in October 2020 and very near the feedlot mix reported in January 2020. The percentage of heifers in the feedlot mix trended up from 2015-19 as a result of the cattle cycle, but 2020 quarterly totals were slightly lower than 2019 due in part to the feedlot disruptions in the spring and summer.

Marketings of fed cattle were up 1%, which was near the pre-report expectations. This was the second-largest marketings total for a December since 1996, trailing only 2010. Altogether, the total number of cattle on feed on Jan. 1 was very near year-ago levels. Looking ahead, higher feed prices are likely to impact feedlot decisions, including a potential preference toward larger placements.

The markets

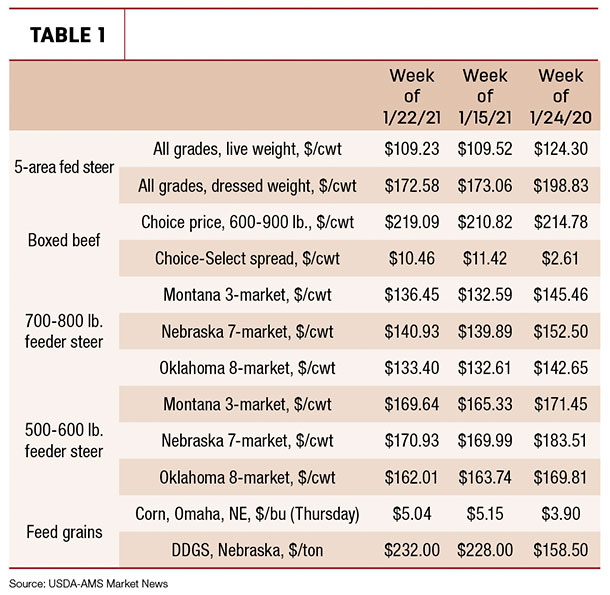

The big news last week was the strong rally in cattle futures and the jump in the cutout. The March contract for feeder cattle jumped $11, while the other contract months were up too. The Choice cutout was up about $8 from the week prior. Corn futures dropped last week but regained some strength in trading today. Corn and dried distillers grains (DDGs) prices remain elevated compared to a year ago. ![]()

This article originally appeared in the Jan. 25, 2021, Livestock Marketing Association In the Cattle Markets newsletter.

-

Josh Maples

- Assistant Professor and Extension Economist

- Mississippi State University