The USDA National Agricultural Statistics Service (NASS) released the midyear Cattle report on July 23, which provided a snapshot of the U.S. cattle inventory, as well as a glimpse into cow-calf producers’ intentions for retaining heifers.

July’s Cattle report estimated the U.S. cattle herd at 100.9 million head, 1% less than the 2020 estimate of 102.2 million head. The number of beef cows is 2% lower than a year earlier at 31.4 million head, but the number of dairy cows is estimated 2% above last year’s level at 9.5 million head. The 2021 calf crop is expected to be 35.1 million head, down slightly from last year.

According to the Cattle report, producers intend to keep about 4.3 million beef heifers as beef cow replacements, 2% fewer than producers intended to keep at this time last year.

Based on the number of beef cows on July 1 and beef cow slaughter in the first half of the year, the Economic Research Service (ERS) estimates that 13% fewer beef heifers entered the herd in first-half 2020 than a year earlier. The ERS webpage “Livestock & Meat Domestic Data” has a table titled “Heifers Entering the Herd,” which estimates heifers for beef cow replacement that entered the herd this year (January-June) at 2.3 million head.

While fewer heifers are being retained for beef cow replacement, milk replacement heifers are 3% above the previous year. Other heifers either on feed or available to be placed into feedlots are estimated at 7.6 million head or 3% below a year ago.

According to the July National Agricultural Statistics Service (NASS) Cattle on Feed report, the number of cattle on feed in feedlots with capacity of 1,000 head or more totaled 11.3 million head on July 1, 2021, down 1% from the same time last year. The NASS report also estimated the sex of cattle on feed as 6.98 million steers, 1% lower than the previous year, and 4.32 million heifers, 2% lower than a year ago. Heifers represented 38.2% of cattle on feed on July 1, compared to 38.59% last year.

The ERS webpage “Livestock & Meat Domestic Data” has a table titled “Feeder Cattle Supplies Outside Feedlots,” which estimates the number of cattle available to place in feedlots at 36.1 million head, 600,000 head or 1.6%, less than this time last year.

2021 beef production forecast reduced on lighter weights as drought continues to impact the beef industry

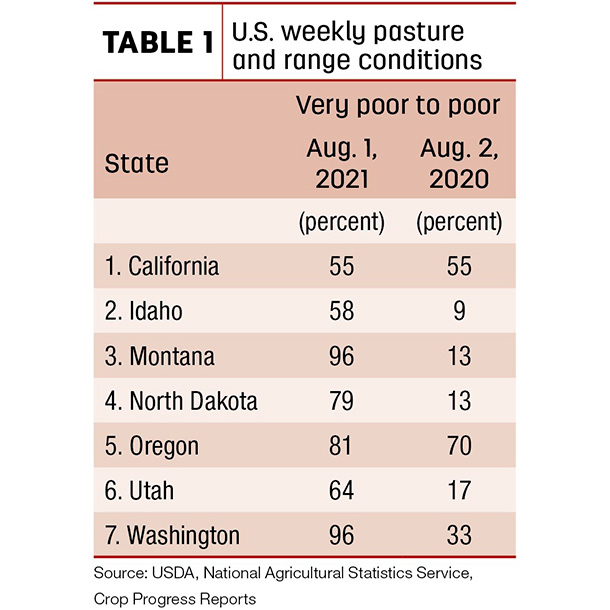

Based on the USDA NASS Crop Progress report for the week ending Aug. 1, 2021, dry and low-moisture soil on pastures and ranges continue to worsen in some of the northwestern states (see Table 1).

Some states experienced very poor to poor conditions on as much as 80% to 90% of their pasture and range areas. According to U.S. Drought Monitor data, on Aug. 3, approximately 32% of the cattle inventory was in areas experiencing some level of drought.

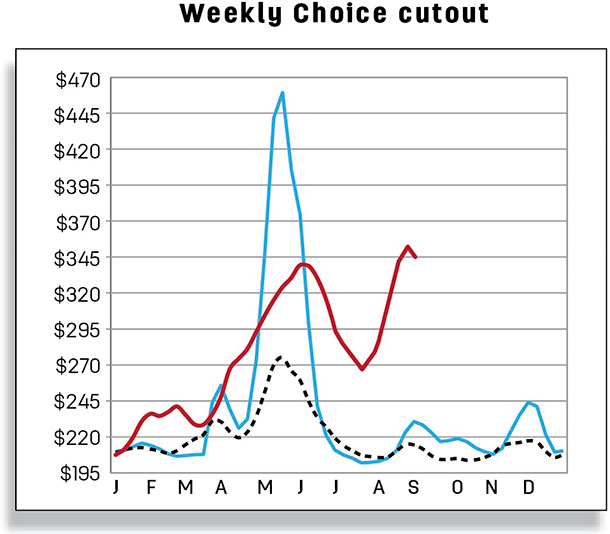

For the week ending July 24, average cattle carcass weights were 15 pounds below the average carcass weight the same week last year. Steer, heifer and cow average carcass weights were 9, 13 and 7 pounds, respectively, below last year. While average carcass weights were lower, cow slaughter was up 16% over the same period from a year earlier. Given expected tight forage supplies, cow-calf producers will remain relatively aggressive in cow culling in 2021, and third- and fourth-quarter cow slaughter expectations were raised, increasing the proportion of lighter-weight cattle in the slaughter mix. The 2021 beef production forecast was reduced by 33 million pounds from the previous month to 27.87 billion pounds, based primarily on lighter expected carcass weights through the second half.

Cattle prices are forecast higher in the second half of 2021 and in 2022

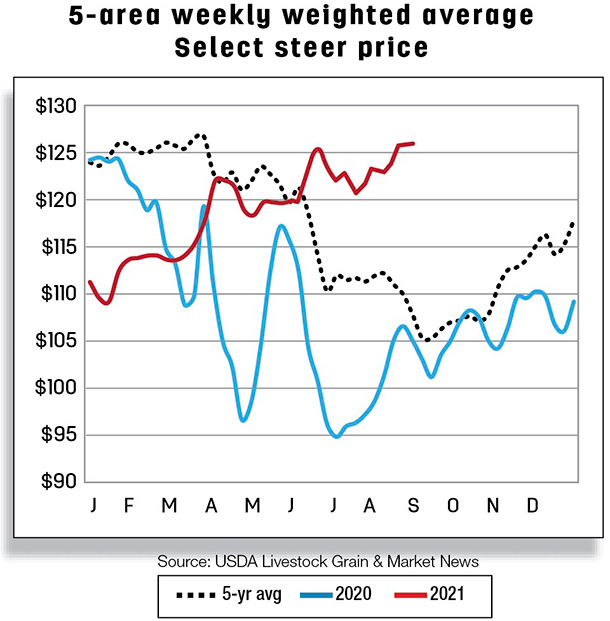

The July 5-area price for fed steers was $122.03 per hundredweight (cwt), up more than $25 year over year and about $9 higher than the July 2019 average price. The average 5-area steer price for the week ending Aug. 8 was $123.83, over $22 above a year ago. While fed steer prices have been on the rise, fed steer slaughter was slightly lower for the week ending July 24, compared to a year earlier.

The forecast for third- and fourth-quarter fed steer prices was raised $4 to $124 and $127 per cwt, respectively. Given these changes, the 2021 annual price forecast for fed steers was raised $2 to $121.2 per cwt from the previous month. The 2022 annual price forecast for fed steers was raised $4 from the previous month to $126 per cwt on tighter supplies of fed cattle and firm demand.

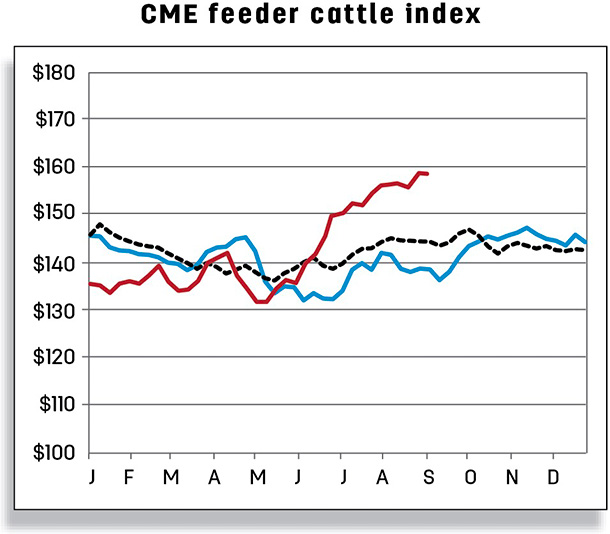

For the week ending Aug. 10, Oklahoma City National Stockyards’ feeder steers weighing 750-800 pounds averaged $156.55 per cwt, $13.62 above a year ago. The third- and fourth-quarter forecasts were raised by $7 to $153 per cwt and $5 to $153 per cwt, respectively. The feeder steer annual price forecast was increased by $3 to $145.10 per cwt from the previous month. The annual forecast for 2022 was also raised by $5 to $152 from the previous month.

Beef imports higher in June; import forecasts raised

In June, U.S. beef imports totaled 320 million pounds, surpassing last June’s imports by 3.9% or 12.1 million pounds. This month’s beef imports were the third-largest since June 2015. U.S. beef imports from New Zealand, Brazil, Uruguay and Argentina were all notable. New Zealand supplied the U.S. with the second-largest beef shipment in over 14 months in June, with most of the beef consisting of processing-grade beef. Beef imports from Brazil were up year over year and year to date. Uruguay and Argentina also contributed to June’s increased beef imports.

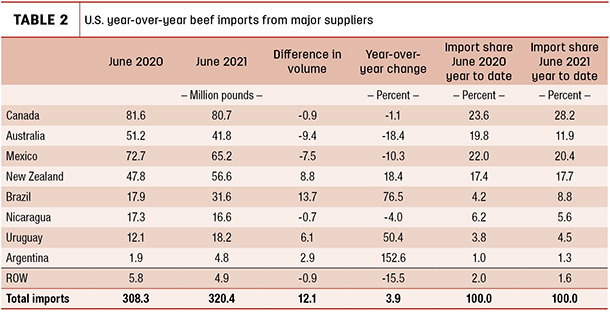

In contrast, U.S. beef imports were down from three of its largest suppliers relative to a year ago. Canada, the U.S. largest beef supplier, was fractionally lower in June, accounting for 25% of U.S. total beef imports. While imports from Australia were down year over year, June’s shipment was the largest volume imported since November. Mexico, the second-largest U.S. supplier in June, shipped almost 8 million pounds or 10% less in June than a year earlier. Beef shipments were also down from Nicaragua and from other minor suppliers, but these reductions were offset by strong imports from Brazil, New Zealand, Uruguay and Argentina (Table 2).

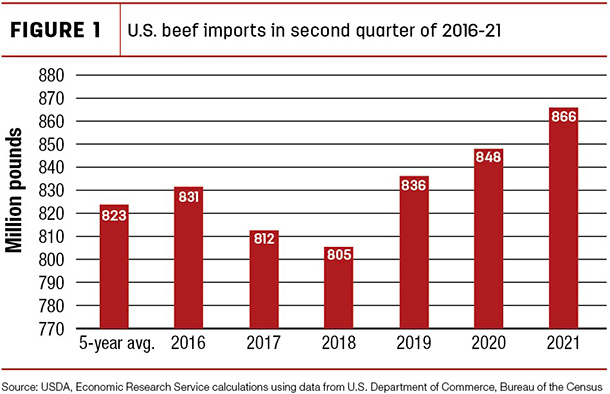

Over the past several years, the second quarter has been a strong trading period for U.S. beef imports. Figure 1 compares second-quarter beef imports with the five-year average and other years.

U.S. beef imports in the second quarter of 2021 were the largest volume since 2015. The large beef imports of 320 million pounds during the month of June provided the push for a strong second-quarter finish.

The forecasts for beef imports in the third and fourth quarters were raised by 20 and 30 million pounds from the previous month to 830 and 725 million pounds, respectively. This anticipated increase is expected to be driven mostly by strong U.S. imports from suppliers other than Australia. The annual forecast for 2021 beef imports is raised to 3.12 billion pounds. The annual forecast for 2022 is increased by 160 million pounds from the previous month to 3.15 billion pounds on expected lower U.S. cattle slaughter and beef production.

Beef exports up in June, but lighter carcass weights are expected to lower in the rest of 2021 and 2022

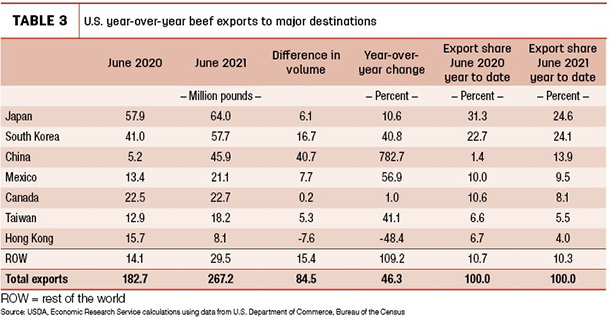

U.S. beef exports in June remained robust, totaling 267 million pounds, up 85 million pounds from a year earlier when export supplies were limited due to production and logistic constraints caused by COVID-19. For the second consecutive month, six of the seven major U.S. export destinations were up year over year. Japan, currently the largest U.S. beef destination, accounted for 24% of June’s total exports and 25% of U.S. exports year to date. U.S. exports to Japan have been underpinned by a favorable tariff rate.

South Korea is the second-largest beef destination for the U.S., supplying over 24% of Korea’s beef during the first half of 2021. The U.S. has been a major beef supplier to South Korea, partly because it has a lower tariff rate relative to Australia, New Zealand, Canada and Mexico. Beef exports to South Korea have been supported by firm demand. Exports to China continue to be up year over year as import demand for animal proteins remains strong because of China’s limited domestic supplies of pork. China was the major source of the difference in June’s increase in beef exports, with the U.S. shipping over 40 million pounds more to China than in the previous year.

Other noteworthy trading partners who made sizeable contributions to the increase in beef exports in June included Mexico and Taiwan. Shipments to Mexico in June were up 57% or almost 8 million pounds compared to a year ago, mainly because of the economic challenges the country experienced in 2020 from COVID-19. U.S. beef exports to Taiwan were up over 41% or over 5 million pounds in June. Canada, the fifth-largest destination for the U.S., was up only 1% year over year. In contrast, U.S. beef exports to Hong Kong were down about 8 million pounds or 48% from a year ago (Table 3).

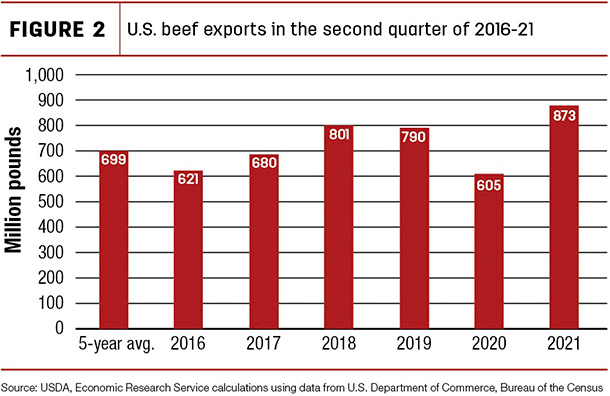

Figure 2 shows second-quarter beef exports from 2016-21 compared with the five-year average.

The U.S. exported record levels of beef in the second quarter of 2021, totaling 873 million pounds, 72 million pounds or 9% larger than the previous record in 2018. Japan and South Korea are the two largest beef markets for the U.S., and during the second quarter, the U.S. shipped 210 and 209 million pounds, respectively. Besides Japan and South Korea, China was the other key trading partner who contributed substantially to growth in beef exports in the 2021 second quarter.

The forecast for beef exports in the third quarter was lowered by 20 million pounds from the previous month to 880 million pounds. The annual forecast for 2021 was lowered to 3.38 billion pounds. In 2022, the forecast was lowered by 50 million pounds to 3.27 billion pounds on expected slower slaughter pace and limited exportable supplies.