Iowa State University (ISU) held a webinar May 29 outlining what producers need to know before applying for financial assistance through CFAP. The webinar was facilitated by Kristine Tidgren, director of the ISU Center for Agricultural Law & Taxation. She was joined by ISU extension ag economist Chad Hart and Iowa-based Farm Service Agency (FSA) ag program specialists Katie Kramer and Justin Muir.

“We have seen ag prices across the board slide down significantly because of the spread of the coronavirus,” said Hart. “In response to this, we saw not only Congress step up with the CARES Act and a few other coronavirus-specific acts, but the USDA has been utilizing their funding resources to create this CFAP package that we see before us today in order to respond to the market turbulence that we’ve seen due to the virus outbreak.”

CFAP is a $19 billion program formed from several pieces of legislation and existing USDA authority through the Commodity Credit Corporation (CCC). It includes $3 billion for direct food purchases and redistribution through food banks throughout the country and $16 billion for direct financial support to agricultural producers. That support is based on how hard the coronavirus hit that market, based one of two indicators: a 5% or greater decline in price between Jan. 15, 2020, and April 15, 2020, or losses due to supply chain disruptions from COVID-19.

The USDA’s definition of a producer who is eligible for CFAP payments is “A person or a legal entity who shares in the risk of producing a crop or livestock and who is entitled to a share in the crop or livestock available for marketing, or would have shared had the crop or livestock been produced and marketed.”

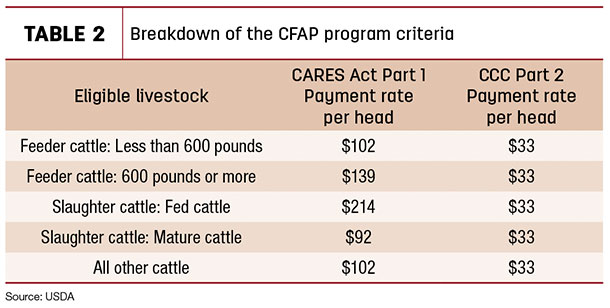

Hart said there would be two payment rates – one responding to the drastic drop in prices, especially early in the year and extending through March and April. Those funds will come from the CARES Act. The other rate is reacting to the current market behavior. These funds will come from the CCC. “What we’ve seen on the livestock side is that the drop was significant but that some recovery has occurred. And that does matter when you’re looking at the construction of the CFAP payment.”

Eligible commodities include malting barley, canola, corn, upland cotton, millet, oats, soybeans, sorghum, sunflowers, durum wheat and hard red spring wheat. Wool, dairy products, cattle, hogs, sheep and more than 40 specialty crops are also eligible for payments through CFAP.

The CFAP application period opened May 26 and will close Aug. 28, 2020. The CFAP application, the AD-3114 form, can be submitted to any USDA Service Center. Producers only need to fill out only one application, even if they grow crops in more than one county. The applications are done by self-certification – documentation will only be required upon spot check.

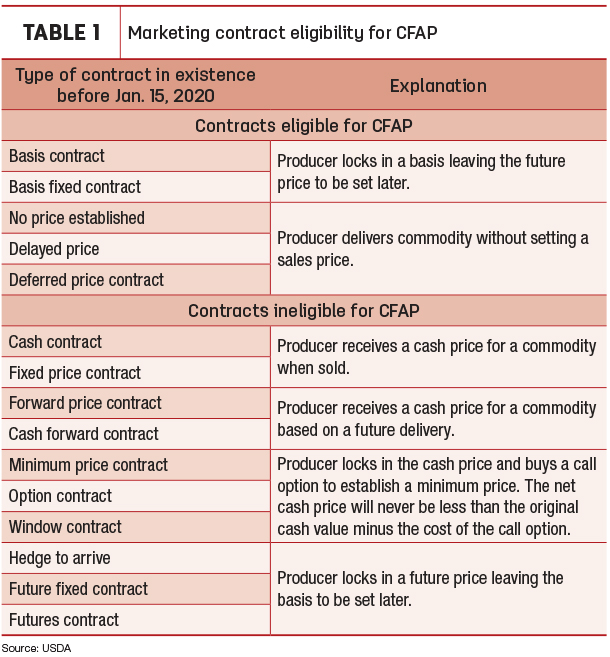

All USDA Service Centers are still closed to the public. Applications can be accessed at the Farmers CFAP website and can be faxed, emailed or mailed to the office. Non-specialty crop producers will need to provide two numbers: their total 2019 crop production and their self-certified inventory, subject to price risk as of Jan. 15, 2020. Some contracts are not eligible for CFAP payments (Table 1).

Livestock

Payments for livestock will be drawn from two sources:

- CARES Act funds: Payment is calculated by multiplying the number of livestock sold between Jan. 15 and April 15, 2020, by the payment rate per head. This includes calves born after Jan. 15, as long as the mother was owned on Jan. 15.

- CCC Charter Act funds: Payment is calculated by multiplying the highest livestock inventory of each classification of cattle between April 16 and May 14, 2020 (Table 2).

Adhere to the following definitions when classifying cattle for a CFAP application:

- Feeder cattle less than 600 pounds – any cattle weighing less than 600 pounds. This includes young calves. Any calves born between Jan. 15 and April 15 would be accounted for here.

- Feeder cattle 600 pounds or more – cattle weighing more than 600 pounds, but less than slaughter cattle-fed cattle as defined.

- Slaughter cattle-fed cattle – cattle with an average weight of 1,400 pounds (including cattle with a weight of 1,200-1,600 pounds), which yield average carcass weights of 800 pounds and are intended for slaughter.

- Slaughter cattle-mature cattle – Culled cattle raised or maintained for breeding purposes, but were removed from inventory and are intended for slaughter.

- All other cattle – commercially raised or maintained bovine animals not meeting the definition of another category of cattle in this rule, excluding beefalo, bison and animals used for dairy production or intended for dairy production. This is where producers will list their reproducing cow herd.

A CFAP payment calculator is available to help give producers an idea of the payments they would receive. Review the information on Farmers.gov website or call your county FSA office for more information. ![]()

-

Carrie Veselka

- Editor

- Progressive Cattle

- Email Carrie Veselka