Marketings of fed cattle are expected to be higher during 2018, supporting higher slaughter during the year, while carcass weights are also expected to increase.

Slaughter up, but lighter weights hamper production

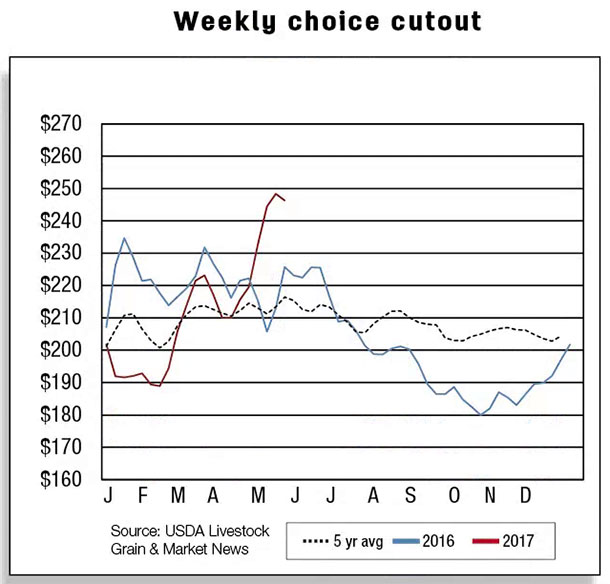

In the first quarter of 2017, commercial beef production climbed to 6.3 billion pounds, up 6 percent from the same period in 2016. Meat packers achieved three consecutive months of year-over-year increases in production, and the increase is reflected in the harvesting of 526,600 more cattle than in 2016.

Production was hamstrung by a 10-pound drop in the average dressed weight as fed cattle were marketed at lighter weights and the slaughter mix contained proportionally more heifers and cows.

Although the magnitude of the year-over-year decline in weights is expected to moderate during the year, the average carcass weight for the year is expected to be below earlier levels. Lower expected carcass weights resulted in a reduction of the full year’s total beef production forecast to 26.3 billion pounds.

Cattle prices climb as packers increase slaughter to offset lower weights

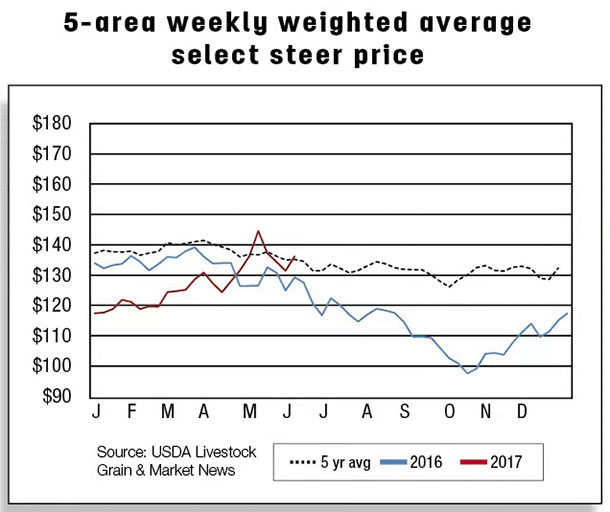

Fed steer prices showed atypical strength during April and into May. The demand for market-ready cattle boosted the 5-Area Direct steer price in April to $131.31 per hundredweight (cwt), above the first-quarter estimate of $122.96 per cwt.

The second-quarter 5-Area Direct steer price is projected at $127 to $133 per cwt, reflecting strong prices through early May. Expectations are that prices will remain relatively strong, despite declining from recent peaks, as packers maintain relatively high rates of cattle slaughter to mitigate the effects of lower carcass weights.

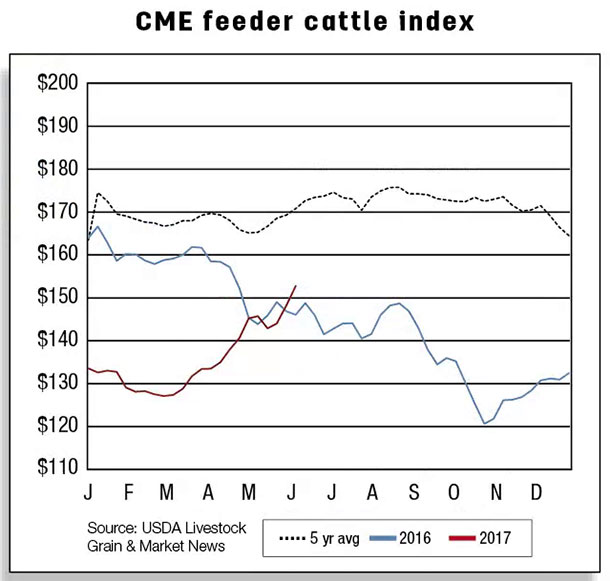

Feeder steer prices have benefited nicely from increased fed cattle prices, averaging $139.27 per cwt for April. Improved returns for feedlot operators have helped stimulate demand for calves. Currently, feedlots have seen returns strengthen on the higher fed cattle prices and relatively cheap feeders purchased two quarters earlier.

However, feedlot operators could face declining returns if fed cattle prices decline with increased supplies of cattle in the second half of the year. To the extent declining fed cattle prices squeeze feeders’ margins, feedlot operators may opt to keep cattle on feed longer in an attempt to push bids higher.

The result would be increasing average dressed weights. Looking ahead, the USDA forecasts increased marketings in 2018, which are expected to pressure fed cattle prices. The 5-Area Direct price is forecast to average $116 to $124 per cwt in the first quarter of 2018 and $113 to $123 for the year.

March beef exports robust; imports tepid

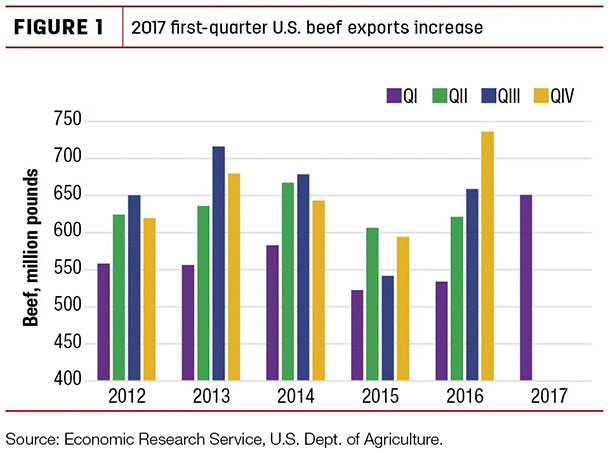

March 2017 beef and veal exports were estimated at 234 million pounds, an increase of 25 percent above March 2016. Exports to Japan, South Korea, Mexico, Canada and Taiwan were robust, all registering double-digit percentage increases.

Strong foreign demand, lower U.S. beef prices and a relative weakening of the U.S. dollar against major trading partners are likely factors enhancing U.S. beef export competitiveness.

The first quarter of 2017 ended with beef exports higher by 22 percent from the same period a year ago at 651 million pounds. Preliminary export sales data for April suggests continued export strength in the second quarter. The USDA has raised its beef export forecast to 2.81 billion pounds for 2017. Exports in 2018 are forecast at 2.84 billion pounds.

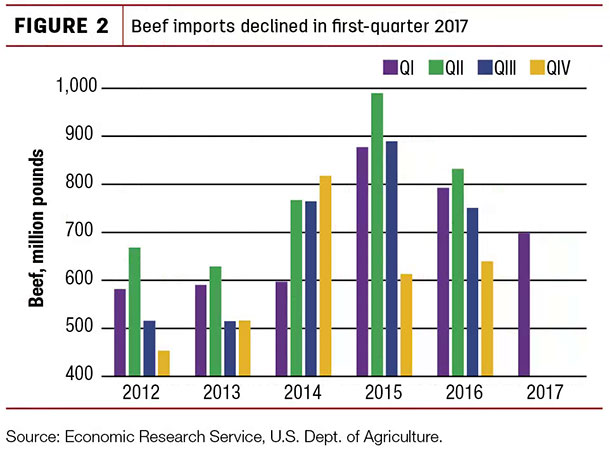

Conversely, March 2017 beef imports were 271 million pounds, down 1 percent from the same period last year. The decline is mostly attributable to Oceania, as Australia continues to experience tight cattle supplies due to its herd rebuilding process.

During the first quarter of 2017, U.S. beef imports were 12 percent lower than the same period a year ago at 699 million pounds. The U.S. is expected to import about 2.76 billion pounds of beef in 2017. A slight increase is expected next year, with total 2018 imports forecast at 2.82 billion pounds as supplies in several exporting countries expand.

U.S. cattle trade to increase in 2018

Cattle imports in March 2017 were down from the same period a year ago at about 217,000 head, with 17 percent fewer animals from Canada. However, first-quarter cattle imports were about 6 percent higher than the same period in 2016, at about 518,000 head, attributed to larger imports from Mexico.

Total cattle imports for 2017 are expected to be 1.68 million head. For next year, total cattle imports are forecast slightly higher at 1.72 million head. Cattle exports in 2017 are forecast at 95,000 head, becoming higher in 2018 at 120,000 head. ![]()

Analyst Lekhnath Chalise contributed to this report.