Carcass weights are also expected to be higher which, together with an increase in slaughter numbers, provides almost 500 million additional pounds of beef compared to 2018. Both domestic and foreign demand will absorb the increase in supplies.

Aggregate domestic beef disappearance next year is expected to grow by 1.2 percent, the retail equivalent of 58.8 pounds per capita, compared with 58.1 pounds per capita in 2018.

2018 beef production lower on slower marketings

Commercial beef production in first-quarter 2018 settled at almost 6.5 billion pounds, 2.6 percent higher than a year earlier. So far in the second quarter, based on USDA Agricultural Marketing Service (AMS) reports of federally inspected cattle slaughter, steer and heifer slaughter volume and carcass weights are below expectations.

Consequently, the second-quarter 2018 production forecast was cut by 305 million pounds to 6.8 billion pounds. For the third and fourth quarter of 2018, the production forecast was also cut on a slower pace of marketings, but that reduction was partly offset by heavier expected carcass weights.

Consequently, the second-quarter 2018 production forecast was cut by 305 million pounds to 6.8 billion pounds. For the third and fourth quarter of 2018, the production forecast was also cut on a slower pace of marketings, but that reduction was partly offset by heavier expected carcass weights.

As a result, the full-year production forecast for 2018 was reduced from last month’s forecast (at the time of this writing) by 420 million pounds to a total of 27.2 billion pounds.

Despite large numbers of cattle on feed, expectations of fewer marketings in 2018 are based on the current and expected pace of fed cattle slaughter. The percentage of cattle on feed over 120 days has grown seasonally since the beginning of the year.

However, the percentage on April 1 has grown to historical norms. It is anticipated marketings will track closer to historical norms as the industry works through the volume of cattle on feed and those to be placed in the coming quarters. This likely translates to cattle being on feed longer, and this pattern is expected to carry over into 2019.

Carcass weights drop in second quarter; rebound in late 2018 and 2019

As expected, cattle carcass weights seasonally drop from January through the spring before bottoming out in May. Based on AMS reports of federally inspected cattle slaughter, monthly steer carcass weights dropped 17 pounds from March to an estimated 861 pounds in April.

Meanwhile, heifer carcass weights dropped 22 pounds from March to an estimated 798 pounds in April. However, steer and heifer carcass weights remained about 12 and 7 pounds, respectively, above April 2017.

It should be noted the large drop in carcass weights vis-à-vis March reflects, in part, a seasonal shift toward a greater proportion of cattle weighing under 600 pounds placed in feedlots in fourth-quarter 2017. Cattle placed at lighter weights are likely marketed at lighter weights.

In first-quarter 2018, the reverse happened, as more cattle were placed in feedlots at weights heavier than 800 pounds. In combination with the expectation more cattle will be on feed longer, the anticipated average carcass weights were increased. As noted earlier, this may partially offset lowered expectations for slaughter during 2018.

Cattle prices have a spring bounce in second quarter

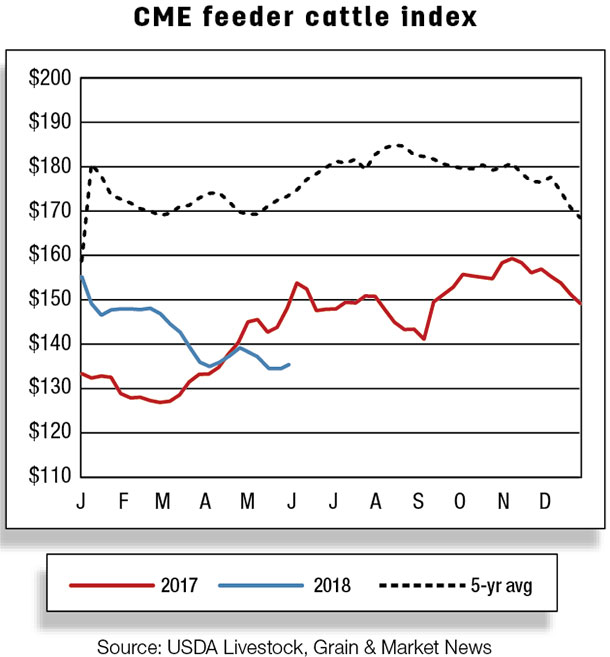

Feeder steer prices at the Oklahoma National Stockyards recovered from their 2018 monthly low of $141.55 per hundredweight (cwt) in March to $146.51 per cwt in April. Prices have benefited, as supplies of cattle outside feedlots are tight. Feeder steer prices are expected to average $142 to $146 per cwt in the second quarter. Annual feeder steer prices for 2018 are forecast to average $138 to $144 per cwt. In 2019, average annual feeder steer prices are expected to average $135 to $147 per cwt.

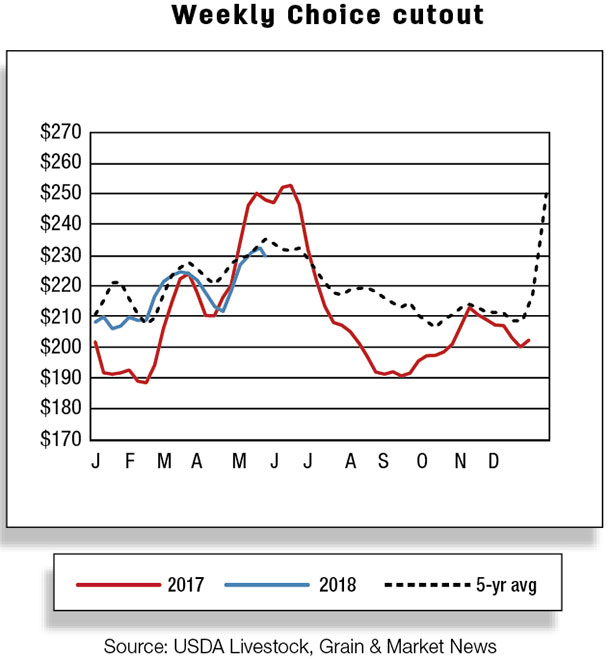

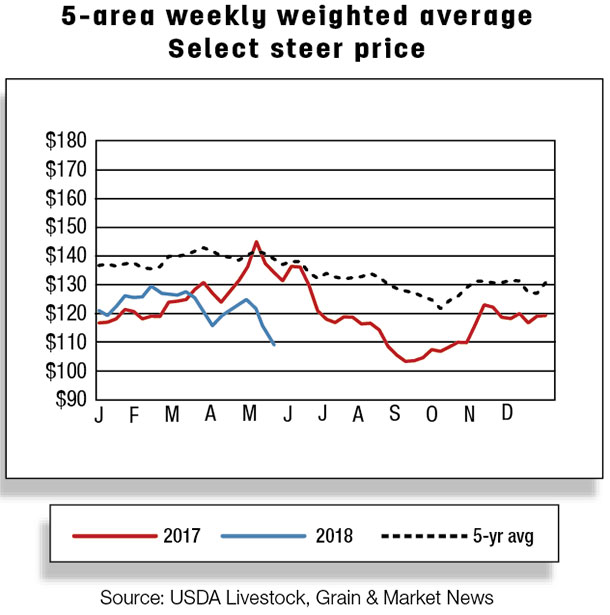

Weekly weighted average fed cattle prices rebounded from the 2018 low of $116.73 per cwt for the week ending April 8 to $124.81 per cwt for the week ending May 6. Firm demand and a moderate marketing pace will likely support fed steer prices in the second quarter to average $116 to $120 per cwt, about $2 above the previous month’s forecast.

However, fed cattle prices will likely edge lower in the second half of the year as the supply of fed cattle increases and carcass weights make their seasonal rebound. The 2018 annual price for fed steers in the 5-area marketing region is forecast to average $114 to $119 per cwt. Looking ahead to 2019, annual fed steer prices are forecast to average $113 to $122 per cwt.

U.S. beef exports to set new record in 2019

U.S. beef exports in 2019 are forecast at 3.15 billion pounds, a new record volume. This is up 3.8 percent from the current year and is based on expected firm global demand and a projected increase in U.S. beef supplies. Increased exports are expected to ship mainly to Asian markets.

U.S. beef exports increased 12 percent in first-quarter 2018 from year-earlier levels, to 730 million pounds. Double-digit year-over-year export growth in the first three months of the year, particularly to South Korea (+28.8 percent), Hong Kong (+33.7 percent) and Taiwan (+36.7 percent), pushed exports to a record high in the first quarter.

As a result of higher-than-expected first-quarter shipments, the 2018 beef export forecast is revised upward from the previous month’s forecast to 3.035 billion pounds. The forecasts for remaining quarters in 2018 were unchanged from the previous month.

Beef imports forecast higher in 2019

U.S. beef imports in 2019 are forecast at 3.14 billion pounds based on sustained demand for lean meat in the U.S. and higher production among beef suppliers. Most of the increased imports for 2019 are expected from major suppliers in Oceania and North America. U.S. beef imports in first-quarter 2018 were up 3.3 percent from the previous year to 722 million pounds.

Among major suppliers, Canada (+23.6 million pounds), New Zealand (+10.8 million pounds) and Nicaragua (+8.6 million pounds) supplied most of the volume increases and raised their market shares compared to a year ago.

Increased beef production in Canada and New Zealand in the beginning of 2018 boosted their respective shipments. Year-over-year declines in import volumes were mainly from Mexico (-23.6 million pounds) during the first-quarter 2018 period.

Lower-than-expected first-quarter imports pulled down the 2018 import forecast to 3.032 billion pounds. Forecasts for the remaining quarters of 2018 were unchanged from the previous month’s forecast.

First-quarter 2018 U.S. cattle imports lower, exports up

U.S. cattle imports through March 2018 declined by 9.7 percent from the previous year to 467,305 head. AMS weekly import estimates show growing imports in recent weeks from Mexico.

However, the 2018 U.S. cattle imports forecast from the previous month was left unchanged at 1.905 million head. The 2019 cattle import forecast is increased slightly to 1.96 million head based on expected growing cattle production in Mexico and normal pasture conditions in the U.S.

First-quarter 2018 cattle exports reached 37,633 head, up 18 percent from year-earlier levels. Cattle exports for 2018 are unchanged from the previous month at 160,000 head. A slight decline is forecast for 2019 exports to 150,000 head. ![]()

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.

Analyst Lekhnath Chalise assisted with this report.