Further, U.S. beef imports in the first quarter reached levels not seen since 2016, when production was 17% less than the current quarter. Record production and high imports likely helped build beef supplies in cold storage at the end of March to 11% above last year.

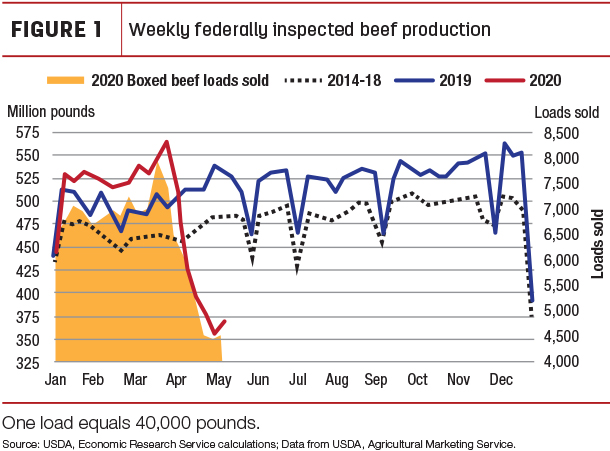

However, the impact of COVID-19 on beef production in April and early May was significant. As shown in Figure 1, beef production peaked during the week ending March 28.

From there, production quickly declined – and at an exceptional pace. As the spread of COVID-19 hit many meatpacking facilities, they had to temporarily close operations or reduce shifts to adjust to labor force absences. Facility-specific health protocols and social distancing may inhibit plants’ processing ability to return to normal kill levels as employees try to return to work. To an extent, kill schedules will depend on each facility’s ability to manage the situation at their plants. Further, the capacity to produce beef at pre-COVID-19 levels may remain an issue into 2021.

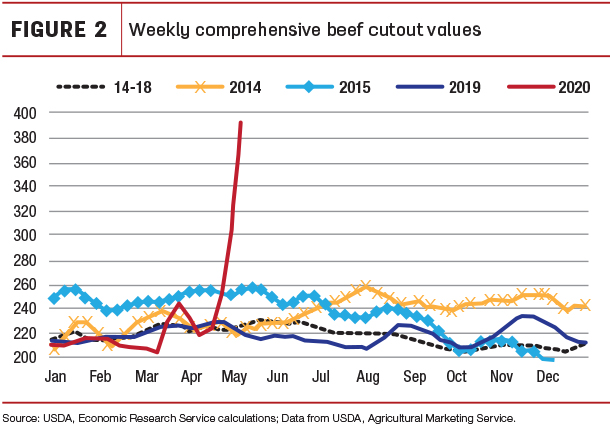

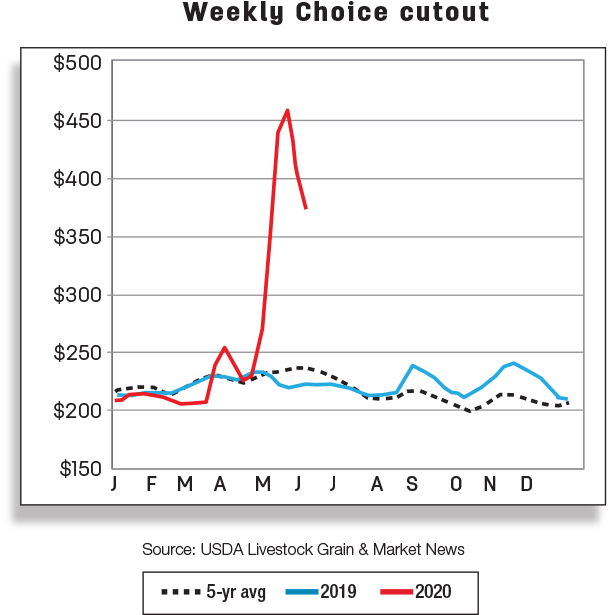

In late March, as consumers prepared to shelter in place, retail demand for beef increased, as suggested in Figure 1 by boxed beef loads sold. However, despite strong demand, boxed beef sales diminished quickly as production deteriorated in the weeks following. The effects of limited production had a large impact on beef prices, as shown in Figure 2 .

Figure 2 illustrates the weekly comprehensive beef cutout value, an all-inclusive value of wholesale beef prices, which skyrocketed to new heights well beyond recent records set in 2014 and 2015. Beef production may have reached its low in early May.

Reduced slaughter capacity backs up fed cattle

By volume and percentage, fed cattle have had a more dramatic reduction in slaughter than have non-fed cattle. In the weeks following the peak fed cattle slaughter (steers and heifers) during the week ending March 28, the beef industry has lost 40% of slaughter capacity. Further, the weekly slaughter volume of cows and bulls has declined about 12% to 14% over the same period.

The most recent disruption to the beef market occurred in August 2019 after a fire halted operation at a Tyson beef plant in Kansas for four months. That plant accounted for 5% to 6% of weekly fed cattle slaughter and, after a period of adjustment to redirect those cattle to alternative slaughter locations, packers were able to increase capacity with increased slaughter on Saturdays to make up for the loss.

However, the current situation does not allow for plants to easily make up for lost slaughter capacity given workforce challenges. Based on recent maximum slaughter levels for the second quarter, there is likely a significant shortfall in slaughter since it peaked the last week of March. As a result, feedlots are having to continue to feed their cattle longer, and this is likely to be an issue into 2021 as the industry works through the feeder cattle awaiting placement in feedlots. This will likely add to the number of cattle outside feedlots, which was estimated to be over 3% more on April 1, 2020 (see table “Feeder Cattle Supplies Outside Feedlots” on the ERS webpage Livestock & Meat Domestic Data).

Production – lower in 2020 – expected to set a record in 2021

The beef production forecast for second-quarter 2020 was lowered by 1.3 billion pounds to 5.6 billion pounds, 17% below last year and the lowest for the quarter since 1990. Expected cattle slaughter was lowered as packing facilities adjust to workforce challenges stemming from COVID-19 infections in several plants. However, the reduced slaughter was partly offset by higher expected dressed weights as a result of fed cattle remaining on feed longer and by the proportion of fed cattle slaughtered expected to grow through the rest of the quarter.

The production forecast for the second half of 2020 was also lowered from the previous month on the expectation that beef packing facilities which principally slaughter fed cattle will continue to adjust slaughter capacity as facilities implement social distancing and other health protocols that will slow the daily pace of slaughter. This more than offsets heavier expected average dressed weights and higher expected non-fed cattle slaughter as producers cull cows in response to low returns. As a result, the annual beef production forecast for 2020 was reduced by 1.7 billion pounds from the previous month to 25.8 billion pounds, about 5% below 2019 levels.

The initial forecast for 2021 commercial beef production is expected to set a record for production at 27.5 billion pounds, as cattle placements in feedlots during second-half 2020 are expected to be slaughtered in 2021. In addition, higher expected dressed weights as the result of feeding cattle longer will support higher production.

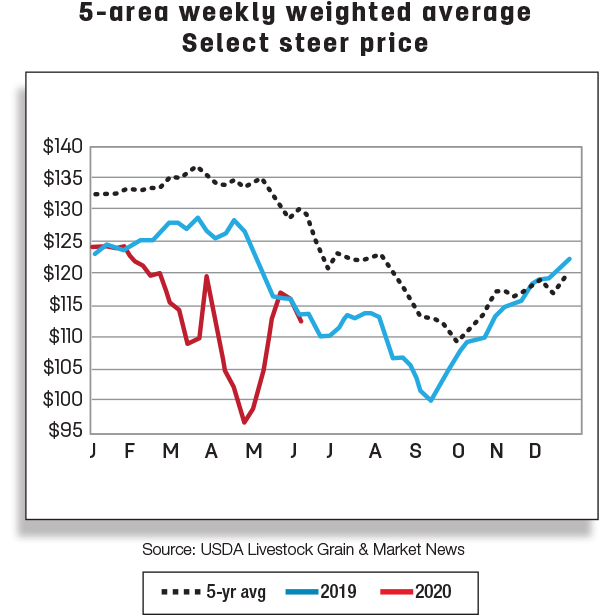

Lower cattle prices expected for an extended period

The buildup in fed cattle supplies that are market ready is expected to have a substantial and lasting effect on fed cattle prices. Prices will remain low as the supply of market-ready cattle remains above the sector’s ability to process them, and the supply issue is expected to linger through 2021. As a result, the 2020 price forecast for fed steers was reduced to $104.10 per hundredweight (cwt) as average prices are expected to dip below $100 per cwt in the second and third quarters and then rebound modestly in the fourth quarter. The first-quarter 2021 price forecast is expected to remain relatively low at $101 per cwt. However, prices are expected to improve later in 2021 as demand recovers, leading to an annual price forecast of $109 per cwt, almost 5% higher than 2020.

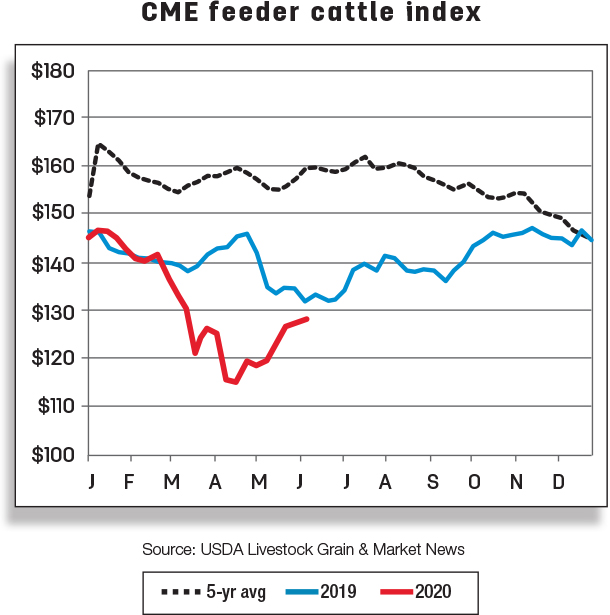

As a consequence of lower fed cattle prices and of having to keep cattle on feed longer as packing facilities adjust slaughter schedules lower, feedlot margins are being squeezed. Feedlots have substantially reduced placements in February and March and are likely less willing to bid aggressively for feeder cattle. Based on recent price data, the second-quarter 2020 feeder steer price was lowered by $2 to $121 per cwt.

The third-quarter 2020 price forecast was lowered $5 to $123 per cwt, and the fourth-quarter 2020 price was lowered $17 to $118 per cwt. As a result, this month’s annual price forecast for 2020 was $124.50 per cwt, close to the previous month’s forecast. The price forecast for first-quarter 2021 is expected to remain relatively low at $125 per cwt. Feeder steer prices are expected to improve in the second half of 2021 on increased demand. The 2021 annual feeder steer price is forecast $131.50 per cwt, more than 5% higher than 2020.

Cattle import and export forecasts are reduced for 2020 but higher in 2021

U.S. cattle imports for 2020 first quarter totaled 530,196 head, about 36,889 less than the previous year. The 2020 forecast for cattle imports was revised down by 65,000 head from the previous month to 2 million head to reflect weaker cattle demand due to COVID-19. Cattle imports impacted the most are those imported for slaughter, which account for 25% of U.S. total cattle imports. The forecast for cattle imports in 2021 is 2.025 million head, a 1% increase over 2020 but not expected to exceed 2019.

Cattle exports in the first quarter of 2020 were estimated at 68,745 head, which was 11.4% more than were exported in 2019. The forecast for cattle exports in 2020 was lowered 20,000 head to 265,000 head, 13% lower than 2019. Cattle exports are forecast at 280,000 head in 2021, about 6% more than 2020 and 8% less than 2019.

Beef imports are expected to be lower in 2020 but to rebound in 2021

March beef imports totaled 299 million pounds, an increase of 28.7 million pounds year-over-year from 270.3 million pounds in 2019. March imports showed a 10.6% year-over-year increase. The largest increases in shipments came from major markets such as New Zealand, Mexico, Nicaragua and Australia. Reductions in beef imports were seen from Canada and Brazil.

First-quarter beef imports totaled 774 million pounds, the highest since 2016. Imports during the first quarter of the year were up about 5% from a year ago, largely attributable to expanded shipments from Australia (+24.4 million pounds), New Zealand (+8.2 million pounds), Mexico (+13 million pounds), Nicaragua (+9.5 million pounds), Argentina (+5.5 million pounds), Costa Rica (+4.7 million pounds) and Ireland (+4.4 million pounds).

The 2020 second-quarter forecast for beef imports was lowered by 15 million pounds to 735 million pounds, while third and fourth quarters were also reduced by 35 and 15 million pounds to 710 and 685 million pounds, respectively. The beef import forecast was lowered slightly for outlying quarters as reduced fed cattle slaughter may limit the need for lean manufacturing trimmings and as exportable supplies may tighten in Oceania.

Beef imports in first quarter 2021 are forecast at 740 million pounds, 1% less than 2020 first quarter. While lower imports are anticipated in the first quarter, imports are expected to increase later in 2021. The annual forecast for 2021 is 3.020 billion pounds, up 4% from 2020.

Beef exports are expected to fall in 2020 but recover by the second half of 2021

U.S. beef exports totaled 267.1 million pounds in March, up 21 million pounds from the previous March. The year-over-year increase occurred for some major beef export destinations, with Japan accounting for most of the U.S. exports, followed by South Korea, Canada and Taiwan. Much of the increase in exports was due to high levels of U.S. cattle slaughter and subsequent record beef production coupled with accelerated demand for animal proteins in Asia, helped by favorable export conditions as permitted under the U.S.-Japan agreement enacted in January. Conversely, shipments to Mexico and Hong Kong, two of the U.S. major destinations, were less in March 2020 relative to a year earlier.

Beef exports in the first quarter totaled 769.2 million pounds, up 73 million pounds from the first quarter in 2019. A 10.5% increase in beef exports was partly driven by the largest beef production on record for a quarter and vigorous demands for animal proteins in Asia. Beef exports to Japan increased 33.8 million pounds year-over-year, while South Korea and Canada grew by 23.9 and 11.1 million pounds more in first-quarter 2020 relative to first-quarter 2019.

The 2020 second-quarter forecast for beef exports is reduced 105 million pounds to 675 million pounds. Similarly, shipments in the third and fourth quarters are forecast as lowered 130 and 65 million pounds, to 700 and 750 million pounds, respectively. Reductions in beef exports are attributed to lower anticipated beef production for the rest of the year and decreasing exportable supplies, along with a weakening global economy.

The 2021 first-quarter forecast for beef exports is 720 million pounds, 6% less than 2020 first quarter. Annually, the 2021 forecast for beef exports is 3.14 billion pounds, almost 9% higher than 2020. Trade is projected to rise as beef production expands. ![]()

Analyst Christopher Davis assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.