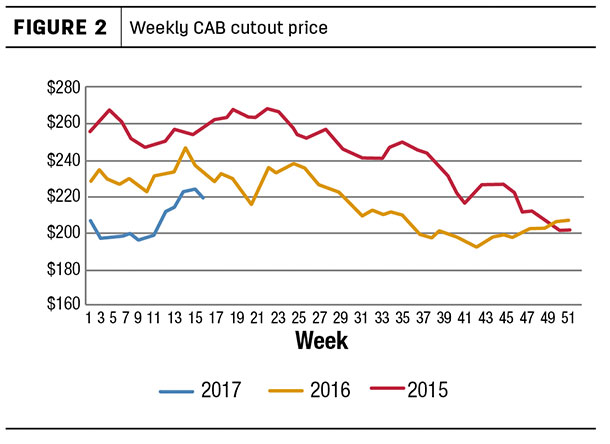

The Choice boxed beef price recovered nearly 20 percent from its January low by the end of March, to the neighborhood of $2.20 per pound. Some analysts say that’s as high as it can go, that buyers will start to back away and switch to other proteins.

Paul Dykstra, beef cattle specialist for the Certified Angus Beef (CAB) brand, says history suggests a little more support for higher beef, at least the higher quality kind.

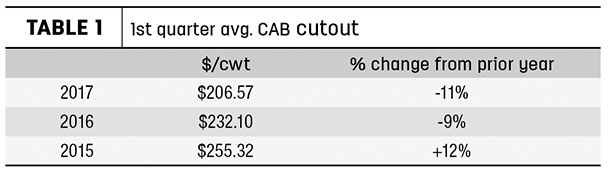

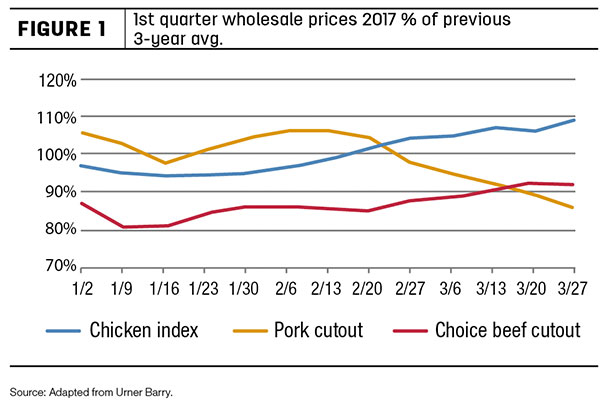

“The CAB and Choice cutout values are at 90 percent of their three-year average,” he points out, noting pork prices have been falling since February while chicken returned to its steady climb. At 110 percent of last year’s price, chicken is a less attractive alternative than pork.

“Select grade beef has shown more strength this year, mainly because supplies are down 6.5 percent so far,” Dykstra says. “The market wants less of it, and lower pork prices may keep a lid on the Select cutout moving forward.”

The main engines behind beef’s price recovery have been in the higher grades, despite greater supplies, he says. “Choice volume is up 8.5 percent and Prime up 14.7 percent for the year, very much unbalanced in modern history.”

Despite recent strength, boxed beef prices retraced a bit in a seasonal pattern and remain well below the three-year average (see Figure 1 and 2). That’s not all bad, Dykstra says.

“From the standpoint of overall affordability and moving the greater volume this year, prices have to track along this lower trend. Feedyards are doing well today because the market supports selling in a timely manner, providing large throughput to packers,” he explains.

Packers today need cattle that aren’t ready yet, which firms their bids and moderates carcass weights.

“The market shifts are keeping the game pretty fair this year,” Dykstra says. “Granted, the lower Choice cutout in the first quarter is negative to ranchers in the near-term, but we cannot sustain fed cattle at $1 dollar and 50 cents per pound and higher, nor the boxed beef prices that come with that.”

What would happen if prices could somehow remain at 2014 levels?

“We’d lose so much domestic demand that the industry would have to shrink again and we’d lose producers,” he says. “We need to see beef and cattle priced somewhere in the middle where the production segment can make a profit but not at such a large premium that beef is too expensive for most consumers.”

Dykstra says the early spring cash cattle price of $130 per hundredweight could be near a sustainable equilibrium.

“Of course, that’s not the way the market will work out going forward,” he allows. “Packers are about to gain leverage on these larger supplies and the end users must price the product to maintain positive margins no matter what. Producers clearly can’t negotiate that arrangement for themselves.” ![]()

—From Certified Angus Beef news release