The forecast for 2020 beef production was unchanged from the previous month at 27.7 billion pounds. However, there was a shift among the quarters due to the expected timing of cattle placements. Based on fewer expected cattle placed in feedlots in third-quarter 2019, fewer fed cattle are expected to be slaughtered in first-quarter 2020, reducing anticipated production by 90 million pounds. Further, a higher expected number of cattle placed in feedlots in fourth-quarter 2019 is expected to raise the number of fed cattle slaughtered in second-quarter 2020, increasing production by 90 million pounds.

Cattle prices rebound

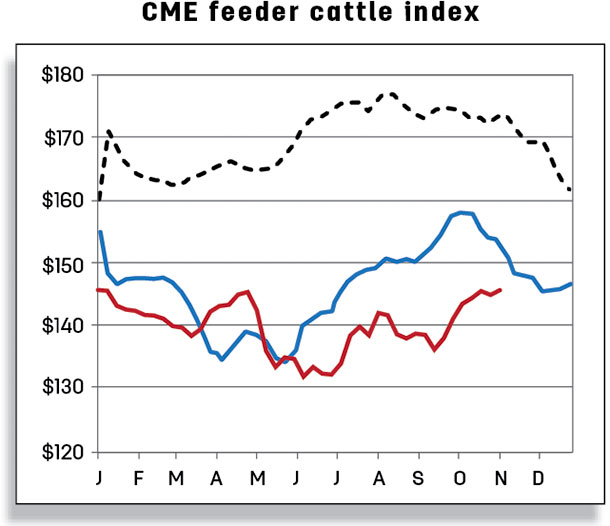

On Oct. 7 at the Oklahoma City National Stockyards, sales of feeder steers weighing 750 to 800 pounds were reported at $147.26 per hundredweight (cwt), more than $6 above prices reported the week before the fire at Tyson’s beef plant in Holcomb, Kansas, in August. Further, prices have recovered more than $12 from the recent low of $134.80 per cwt the week of Sept. 9.

The National Agricultural Statistics Service Cattle on Feed report for September 2019 estimated there were about 9% fewer cattle placed in feedlots with 1,000-head-or-greater capacity and almost 2% fewer cattle marketed in the month of August. This led to a drop in the number of cattle on feed on Sept. 1 of more than 1% compared to a year ago.

Warmer-than-expected weather patterns and improved supplies of forage may have extended cattle grazing periods, slowing the pace of placements in third-quarter 2019. However, some of these feeder cattle will likely need to be moved off grass and into the feedlots in fourth-quarter 2019, keeping feeder prices under pressure in the fourth quarter. Based on recent price data, the fourth-quarter 2019 feeder steer price was raised by $4 to $137 per cwt. The 2020 annual price forecast for feeder steers was unchanged at $141 per cwt.

Warmer-than-expected weather patterns and improved supplies of forage may have extended cattle grazing periods, slowing the pace of placements in third-quarter 2019. However, some of these feeder cattle will likely need to be moved off grass and into the feedlots in fourth-quarter 2019, keeping feeder prices under pressure in the fourth quarter. Based on recent price data, the fourth-quarter 2019 feeder steer price was raised by $4 to $137 per cwt. The 2020 annual price forecast for feeder steers was unchanged at $141 per cwt.

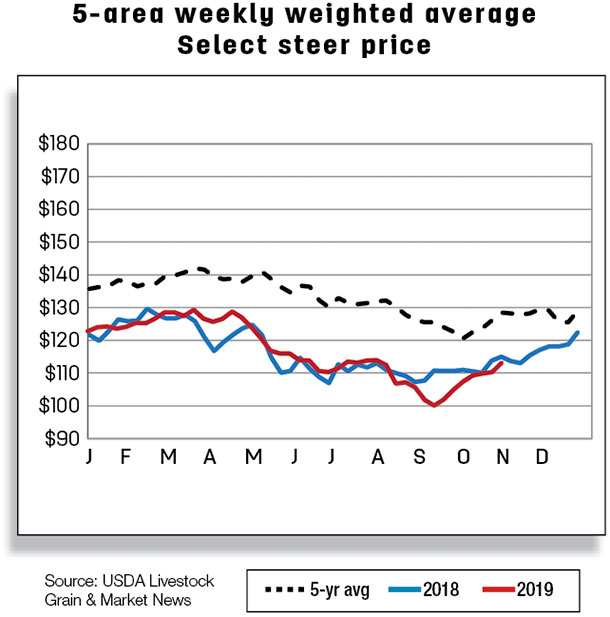

The market price for fed steers has turned upward after the low of $100.07 per cwt reached the week ending Sept. 15. Since then, the price for fed steers in the 5-area marketing region has increased more than 7% to $107.34 per cwt in the week ending Oct. 4. However, it remains almost 6% below levels prior to the Aug. 9 fire at Tyson’s beef plant. In perspective, the five-year average decline between the first week of August and the first week of October is almost 8%.

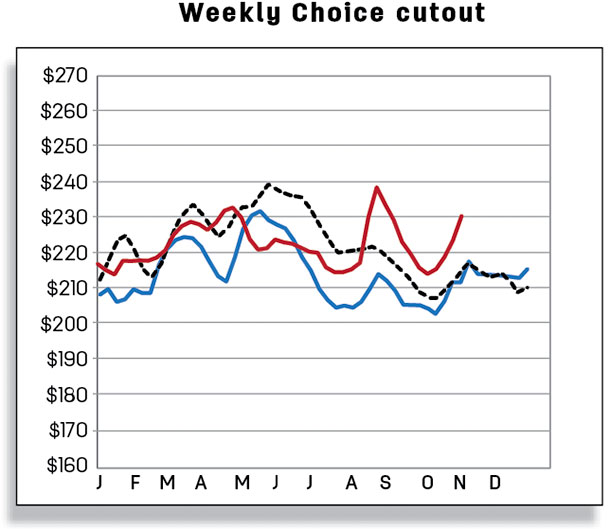

The Choice-Select price spread is abnormally high; if this incentivizes feedlots to keep cattle on feed longer, packers likely will have to pay higher prices to bid cattle out of the feedlots. The price forecast for fourth-quarter 2019 was raised by $7 to $110 per cwt. The first-quarter price forecast for 2020 was raised by $1 to $120 per cwt. As a result, the 2020 annual price forecast for fed steers increased by $1 to $116 per cwt.

August beef exports fall

In August, beef exports totaled 261 million pounds, 12 million pounds lower than July and about 27 million pounds lower than August 2018. Exports to major destinations have declined, including to Japan (-21%), Mexico (-18%), South Korea (-11%) and Hong Kong (-5%). Conversely, exports increased to several Asian countries, including Indonesia (+117%), China (+95%), Vietnam (+67%) and the Philippines (+42%).

The U.S. beef export forecast for third-quarter 2019 was revised down 15 million pounds to 810 million pounds. The U.S. beef export forecast for first-quarter 2020 was revised up from 725 million pounds to 765 million pounds, for second-quarter from 825 million pounds to 830 million pounds, and for fourth-quarter from 845 million pounds to 865 million pounds. In contrast, the beef export forecast for the third quarter of 2020 was revised down from 850 million pounds to 845 million pounds.

Total exports in 2020 are forecast up 6% to a record 3.3 billion pounds, accounting for 12% of U.S. production. The U.S. is poised to expand market share in top markets such as Japan, South Korea and Taiwan as key competitor Australia struggles to maintain its market shares, given its reduced exportable supplies and its dominance in filling China demand.

August beef imports fall

U.S. beef imports in August totaled 266 million pounds, down 2% from a year ago and over 1 million pounds lower than the previous month. U.S. beef imports from major suppliers year-to-year were ramped up from Brazil (+33%), Canada (+9%) and Mexico (+8%) but were all offset by New Zealand’s reduction in shipments to the U.S. totaling almost 15 million pounds.

For 2020, U.S. imports will likely be limited by a combination of tighter supplies in Oceania and expected increased demand for beef in Asia due to African swine fever. As a result, U.S. beef imports were revised down for 2020 first-quarter from 715 million pounds to 690 million pounds, for second-quarter from 800 million pounds to 735 million pounds, and for third-quarter from 770 million pounds to 745 million pounds. ![]()

Analyst Christopher Davis assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.