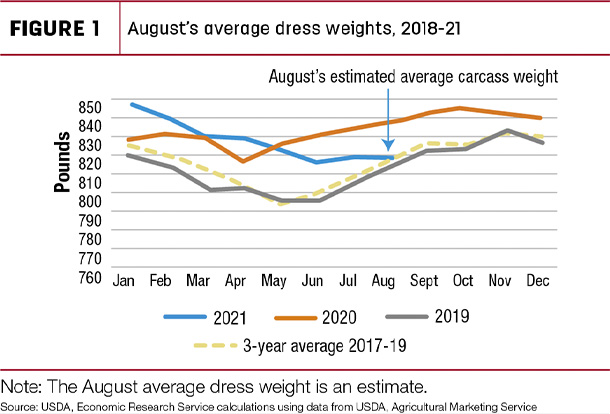

The increase in August slaughter in part reflects one additional slaughter day in August 2021 relative to last year. However, the report also shows that average cattle dressed weights remain below last year, largely due to the fact that cattle had backed up because of Covid-19 and were heavier because they had been on feed longer. For the week ending Aug. 21, average cattle carcass weights were 12 pounds below the average weight compared to the same week last year. Estimated cow, steer and heifer average carcass weights were 6, 7 and 13 pounds, respectively, below levels a year ago.

In addition, the proportion of cows in the slaughter mix has helped push the average carcass weight lower. The number of cows anticipated to be slaughtered during the second half of the year is higher than in the first half, given the persistence of the drought and weakening returns in the dairy sector. As Figure 1 shows, the August estimated average carcass weight was less than a year ago.

The average carcass weight for August 2019 was even lower than August 2021.

The forecast for 2021 beef production in the second half of this year was reduced slightly as lighter average carcass weights and lower steer and heifer slaughter are expected to more than offset the second-half increase in cow slaughter. As a result, at the time of this writing, this month’s forecast for 2021 beef production is 27.742 billion pounds, down 130 million pounds from the previous month. The forecast for 2022 beef production was lowered 90 million pounds to 26.875 billion pounds from a month ago at the time of this writing, based on the same reasons the 2021 annual forecast was revised down.

Beef prices expected to be up in second-half 2021 and into 2022

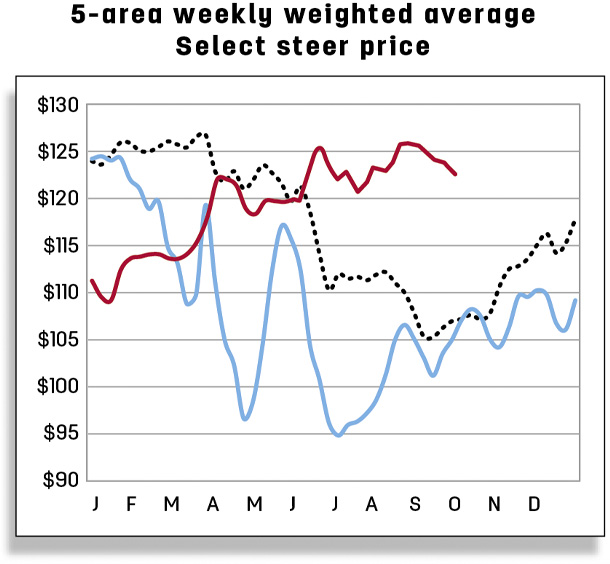

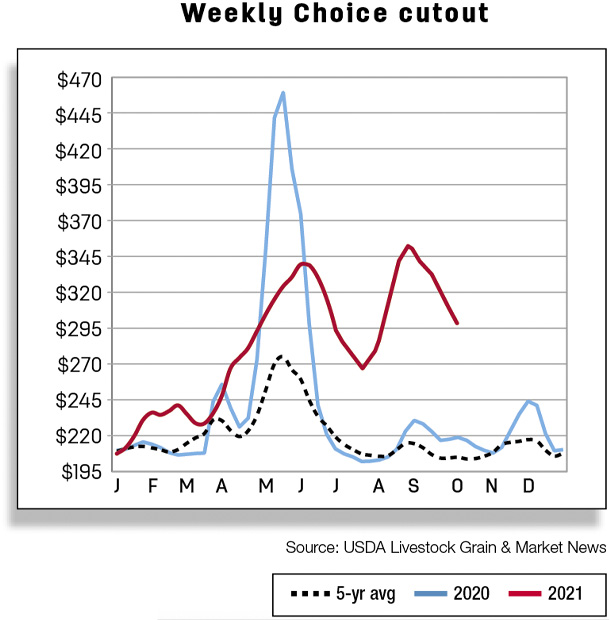

Now that Labor Day and grilling season are officially behind us, the seasonal trend is for beef prices to fall in September and October. According to the National Weekly Boxed Beef Cutout and Boxed Beef Cuts report, Choice and Select boxed beef prices for the week ending Sept. 10, 2021, were down more than $7 and nearly $11 from the prior week at $332.46 and $297.47 per hundredweight (cwt), respectively. The August average price for 5-area fed steers was $124 per cwt, almost $20 more than a year earlier, but the fed steer price for the week ending on Aug. 30 was $125.74, while the fed steer price for the week ending on Sept. 13 was $124.79 per cwt.

Relative price strength is likely to persist as demand for beef remains strong. The fourth-quarter forecast for the fed steer price was increased by $4 to $131 per cwt from a month ago at the time of this writing based on current price strength and firm demand. The 2021 annual forecast for fed steer price was raised $1 to $122.20 per cwt, while the 2022 annual forecast was revised up $2 from the previous month to $128 per cwt on tighter supplies.

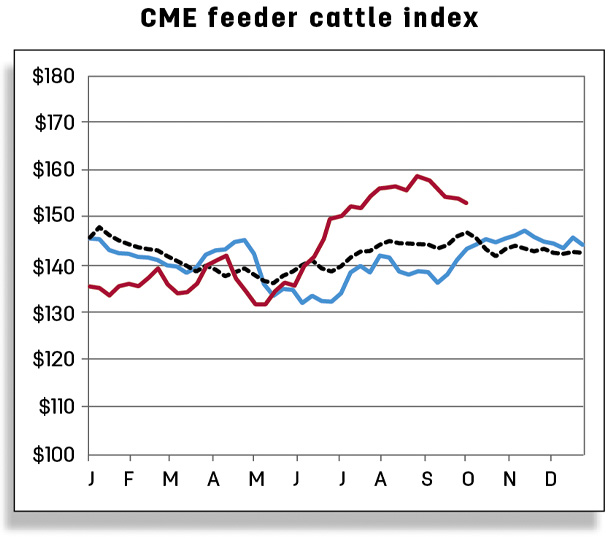

For August, Oklahoma City National Stockyards feeder steers weighing 750 to 800 pounds averaged $156.48 per cwt, $14.94 above a year ago. The third-quarter forecast was raised by $1 to $154 per cwt while the fourth-quarter forecast was increased $2 to $155 per cwt. These changes raised the 2021 annual forecast price for feeder steers to $145.90 per cwt, up 80 cents from the previous month. The annual forecast for 2022 was also raised by $3, to $155 per cwt, from a month ago at the time of this writing as lower forecast feed costs will likely support feedlot demand.

Beef imports remain strong in July; import forecasts raised

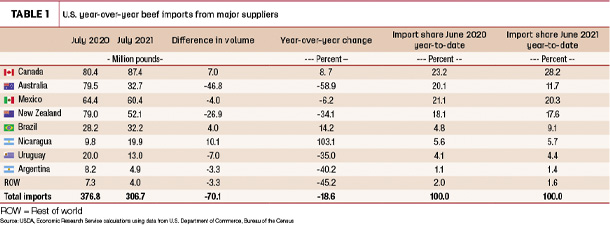

Beef imports in July totaled 307 million pounds, down from last year by 19% or 70 million pounds. July 2020 imports were the second-largest on record, making July 2021 imports look small by contrast. However, compared to 2019, July imports were up 15%, or 40 million pounds. Compared to a five-year average from 2016 to 2020, July imports were up 2%. Imports from Canada, Brazil and Nicaragua were all up notably year-over-year. Canada’s July shipment was the highest since September 2005, accounting for just over 28% of total July beef imports.

Imports were down year-over-year from Australia, Mexico, New Zealand, Uruguay and Argentina. Shipments from Australia, Mexico and New Zealand were especially strong in July 2020, so a year-over-year comparison may be misleading. Compared to July 2019, imports from Mexico and New Zealand were up. U.S. imports from Australia remain low as herd rebuilding continues in the country.

The forecast for 2021 third-quarter beef imports was raised 25 million pounds to 855 million pounds, reflecting recent trade data. The annual forecast for 2021 beef imports is raised to 3.142 billion pounds. The annual forecast for 2022 beef imports remains unchanged from the previous month at 3.15 billion pounds.

U.S. beef exports continue to rise in July

In July, U.S. beef exports totaled 297 million pounds, exceeding last July’s exports by 17.9% or 45 million pounds. The rise in part reflects large shipments of U.S. beef to China, the largest U.S. beef exports to China ever recorded, totaling almost 45 million pounds more than the previous year. Total beef exports for the January-July period in 2021 were up 21% over the first seven months of 2020, with 14.4% being shipped to China.

Of the seven major destinations for U.S. beef, Mexico – currently the fourth-largest U.S. beef importer – was the other country that contributed to the increase in beef exports in July, accounting for 8.5% of July’s total exports and 9.3% of U.S. exports year-to-date. Indonesia, a smaller destination, made a sizable contribution to the increase in beef exports in July. U.S. beef exports to Indonesia totaled 7.1 million pounds, by far the largest volume the U.S. has ever exported to that country.

Reductions in beef exports were reported for five of the U.S. top seven destinations. Hong Kong had the largest year-over-year decrease, a 9-million pound decline. The remaining reductions in beef shipments to major destinations were relatively small, less than 3.2 million pounds, year-over-year. However, the year-over-year reductions in beef exports in July were not enough to offset the year-over-year escalation in beef exports that month.

Reductions in beef exports were reported for five of the U.S. top seven destinations. Hong Kong had the largest year-over-year decrease, a 9-million pound decline. The remaining reductions in beef shipments to major destinations were relatively small, less than 3.2 million pounds, year-over-year. However, the year-over-year reductions in beef exports in July were not enough to offset the year-over-year escalation in beef exports that month.

The forecasts for 2021 third and fourth quarters were raised 20 million and 10 million pounds to 900 and 845 million pounds, respectively, on anticipated strong beef demand from key trading partners.

The annual forecast for 2021 was revised up 30 million pounds to 3.414 billion pounds. The forecast for 2022 was unchanged from the previous month at 3.27 billion pounds. ![]()

Hannah Taylor is an agricultural economist with the USDA Economic Research Service. Email Hannah Taylor.

Christopher G. Davis is an agricultural economist with the USDA Economic Research Service. Email Christopher Davis.