Speaking in a CattleFax webinar on Jan. 24, analyst Mike Murphy outlined the first-half high, second-half low dynamic common to every year of beef production. But since 2014 the factors have been lower than normal.

“We still want to refresh our memories about the type of volatility this market has incurred the last few years, and the likelihood that this is going to continue into 2018,” said Murphy.

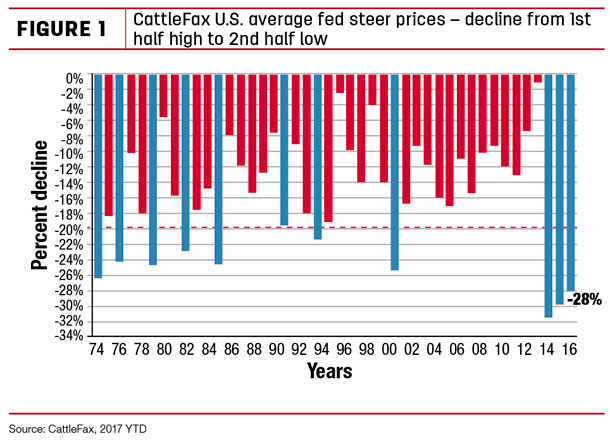

A CattleFax slide showing the U.S. average fed steer prices since 1974 shows only 10 years out of 44 when the correction from first-half highs to second-half lows was 20 percent or higher. Three of those years occurred in 2015, ’16 and ’17 (see Figure 1).

Murphy said this market slope is likely to continue in 2018.

“Not to the same degree when you look at the measurement of first-half high, second-half low, where we’ve had a 28-plus percent correction each of the last three years. But certainly don’t be surprised if we come in and have a 22 percent correction in 2018, which is still going to be an awful, awful large break from a historical standpoint.”

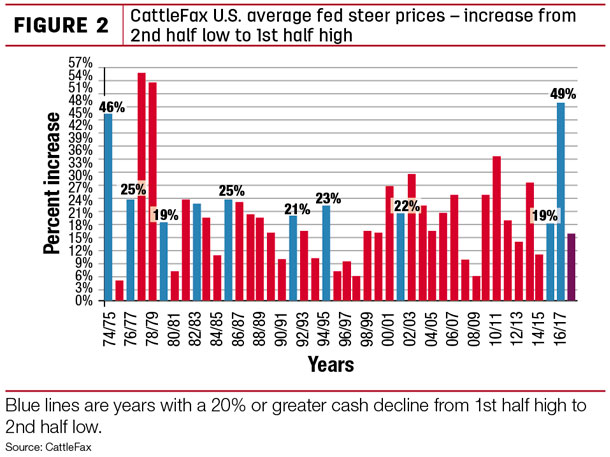

But the range has still defined profitable times for the fed cattle market. Each fall-low price period has its own recovery in price the following spring (see Figure 2.)

“Recoveries in nine of those 11 years come in to be 19 to 25 percent,” Murphy said. “So that target’s really that same 19 to 25 percent.”

Strong market factors through the first half of 2018 should again sustain a fast start for prices. CattleFax sees a strong supply of available corn and hay, high demand for beef both globally and domestically, some adequate rain forecasts for the Middle and Southern Plains, and even more beef supply hitting the market from increased slaughter rates.

Increase in slaughter

The beef cow supply was expected to jump another 700,000 head, CattleFax predicted before the Jan. 31 inventory report, keeping the total herd count in the range of 32 million head.

But Murphy said that long-term herd inventory should flatten out by 2020. “We’re running very near what we would define as capacity levels,” he said. As grassland was turned into row-crop land back in the mid-2000s, production land was lost for cattle and with it more carrying capacity.

Steer and heifer slaughter, meanwhile, took a sizeable jump to 2.58 million head and is expected to jump again to 2.65 million in 2018, with a forecast of “significant increases” of fed slaughter through August.

“We’ve got a lot of cattle we’ve got to market, upward of 600,000 more into Labor Day, than what we had a year ago.” Murphy says that raises concerns about labor time as slaughter outpaces 40-hour workweek trends.

“The packer is going to have to have a healthy margin to work through those numbers. The leverage relationship between cattle feeder and packer-processor is still one we’ve got to be cautious with,” he said. “It’s a variable that will be a limiting factor to the market here, and also create some of that downside risk.”

Exports climb again

The 2017 market broke records for the beef industry, and fed marketings again figure heavily into the equation, as 2.9 billion pounds eclipse previous records from 2011. Analysts expect a 6 percent jump overall in 2018, and again the winter plays heavily into the picture.

“Part of that drive in January and into February is South Korea; with the Winter Olympics, we feel we’re getting a bit of an added bonus for product to go [there] as we go into 2018.”

The sliding dollar is also helping U.S. exports, said Murphy. “We could lose more ground to the dollar over the course of the next several weeks, based on technical outlook.”

Strong supply, high demand

Murphy said the popularity of the product has been high over several years. “When we look at retail demand, we’re at the high end of the range,” he said. “We think that will continue on in 2018, and the reason is growth in the economy.”

The new tax reform laws, Murphy said, are already putting money into some workers’ pockets, and that translates to positive demand.

“Do we have bigger supplies for 2018, dialed in with higher slaughter and better exports? Yes, we do. We have an increase in supply on a per capita basis, a 1.6-pound increase, and it can grow to 1.7 pounds. It’s a big increase as we take note.”

Cattle price outlooks

Analyst Ethan Oberst said the forecast for prices starts with bred cows, matching the aggressive calf values seen since 2015.

“Female demand has been very good,” Oberst said. “Demand has been better than what we would have predicted for the fifth year of expansion. We probably would have said it was on a decline.”

Figures show the number of 550-pound steer calves needed to pay for a bred cow has steadily increased over the past five years to record levels. The long-term average is around 1.47 calves for a bred cow. In 2017 that figure jumped to 1.76 from 1.71 in 2016.

With 550-pound calves figuring around a cap of $155 per hundredweight (cwt), the annual average for bred cows should still hover above $1,400 a head.

In 2017, steer feeder calf prices stayed around a $168-high in spring, but the fall market provided an unexpected boost of $171 per head, almost $40 per head higher than 2016.

Prices started at $153 to kick off 2018, with drops to $130 headed into late summer and fall.

Calf values should start at $175 with a breakdown to the $140s, while the fed cattle market should average between $98 and $130 with a $115 average. ![]()

-

David Cooper

- Managing Editor

- Progressive Cattleman

- Email David Cooper