Crop yields have fallen on both sides of expectations but grain markets have indeed noticed some harvest pressure.

In addition, the last day of September saw the release of the USDA Grain Stocks Report, which estimated 164 million more bushels of corn on hand than analysts had predicted. That caused December CBOT contracts to settle below $6 per bushel for the first time since the Fourth of July.

This emboldened the already brisk feeder cattle market and helped stop the bleeding demand for October calves.

Dwindling supplies of true yearlings and early sales of long-weaned calves through the first half of October traded $4 to $5 higher than a month prior and unweaned bawling calves saw their value firm up, with some selling up to $2 higher than mid-September.

The annual sickening of the spring-born calf has been well represented this fall, with the worst in the Southern Plains where the stress of the long, hot summer was accompanied by wide temperature swings (up to 60 degrees within 24 hours recorded in Kansas), dusty pens and the separation from their mothers.

This proved to be more than many of these tender calves could stand, especially those recently purchased and trucked out of sale barns, where they were exposed to a petri dish full of airborne illnesses.

Buyers have become extremely cautious this time of year as they fill calf orders while trying to retain their customers and reputation.

Discounts for high-risk cattle are very difficult to estimate and if producers want to sell their un-preconditioned calves near the top of the market, then they need to switch exclusively to fall calving so they can cash their crop in the spring when buyers are much more aggressive and weather conditions are more favorable.

However, the woolly worm is about to turn and a widespread hard freeze will make calf purchases much easier to straighten up with less spreading of disease and temperatures more constant.

Plus, late fall usually features many more strings of top-quality ranch-raised calves with a full vaccination and weaning program.

The volume of this fall’s calf run will undoubtedly be much lighter than usual with drought forcing droves of these lightweights into the feedlot back in early summer.

Uncertainty of these cattle’s performance both on-feed and on the rail clouds their effect on the fed cattle trade through spring, but cattlemen are starting to look beyond these displaced placements where bulls rule the horizon.

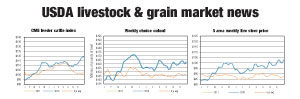

After spending most of September’s packer negotiations while holding their hat in their hands, feedlot managers moved back into the driver’s seat with authority at the end of the month with fat cattle prices gaining a full $5 to move back over $120. CME Live Cattle futures also made strides and actually made history during October’s opening-week trading session by posting the highest spot month settlement price (123.10) on record for the contract that began in 1964.

Feedcost fears are still a reality for any commercial feeders who have yet to secure their needs, as the harvest jury is still out on the high production areas of the Eastern Corn Belt that were extremely wet early in the growing season and extremely dry late.

But independent feeders are showing good demand for a winter feeding project on the western side, which clues that corn supplies are going to be better than first feared.

Meanwhile, current fall calvers and backgrounders of pee-wee calves count their chickens as they hatch, with many market watchers forecasting that a top-quality five-weight steer has a good chance to bring $2 per pound by April. ![]()