While most of the extreme cold weather has been in the Central Plains and farther north, wheat with snow cover will likely be protected from much of the winter injury and will eventually benefit from the precipitation, while wheat without snow cover is likely to be adversely affected to some degree.

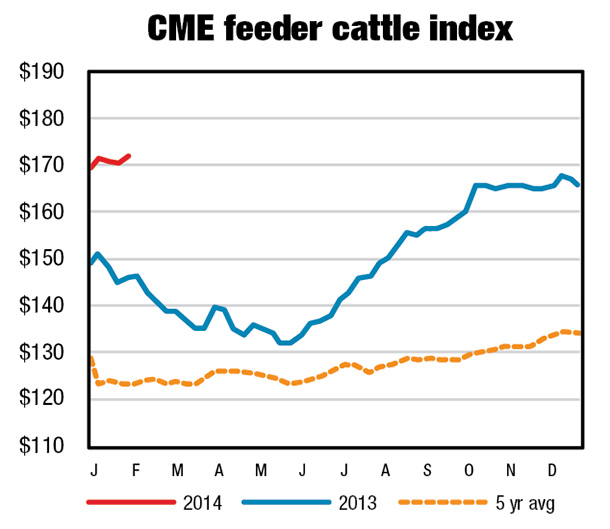

These factors could increase feeding costs for most cow-calf producers, stocker operators and cattle feeders for the short run.

Despite the likelihood of almost a 3 percent year-over-year decline in total 2013 commercial cow slaughter, the rate of total cow slaughter (ratio of slaughter to Jan. 1 total cow inventory) appears to have continued throughout 2013, matching the high rates of 2010, 2011 and 2012.

The high cow slaughter rates led to declines in cow inventories and the expectation of continuing declines in Jan. 1, 2014, cow inventory.

The USDA-NASS cattle report was released on Jan. 31. Total annual commercial cow slaughter has exceeded 15 percent of Jan. 1 total cow inventories in 11 of the years since 1980: the four consecutive years from 1983-1986, 1996 (1997 was 14.99 percent), and the six consecutive years 2008-2013.

As discussed last month, the dynamics are different for beef and dairy cows. Consistent with total cow slaughter, commercial beef cow slaughter is on track for 2013 to be the sixth consecutive year for commercial beef cow slaughter to exceed 10 percent of Jan. 1 beef cow inventories.

Since 1980, beef cow slaughter rates equaled or exceeded 10 percent of Jan. 1 cow inventories in 1983-1989 and 1996-1997.

Dairy cow slaughter is on track for the second-highest rate of slaughter relative to Jan. 1 dairy cow inventories since 1980, equaled or exceeded only in 1983-1984 (1985 was only slightly below).

Along with prices for other categories of cattle, cow prices have recovered dramatically during the last few weeks.

However, with livestock slaughter more erratic than usual for the end-of-year holiday season because of winter storm disruptions and the fact that both Christmas and the New Year holidays came during the middle of the week, disrupting slaughter schedules and markets, it is difficult to determine whether an upward trend is really developing.

At the same time, cow prices are projected higher in 2014 because of anticipated declines in cow slaughter as a result of expected efforts to rebuild cow herd inventories.

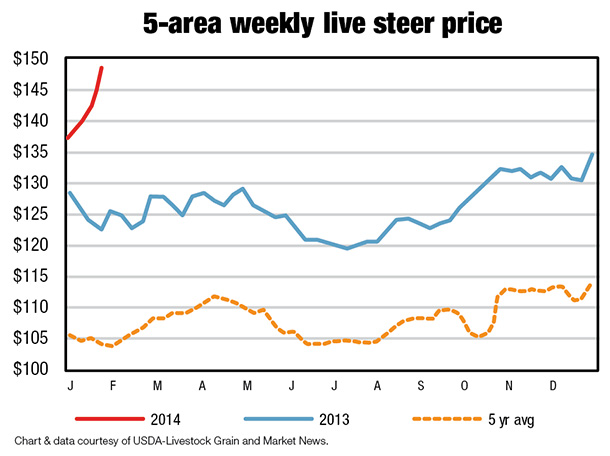

Fed cattle and beef prices jump up

Fed cattle prices jumped significantly during the weeks following Christmas. The run-up in prices has been attributed to the possibility that packers had not lined up enough cattle ahead of the holidays to maintain sufficient supplies of beef to meet the demand.

Other reasons included the weather-related disruptions in transporting cattle between feedlots and packing houses.

Breakeven prices in the Southern Plains are projected to fall below $130 per hundredweight (cwt) at least through April, after which weather markets will likely introduce some uncertainty.

While fed cattle prices remain at or above $130 per cwt, cattle feeding margins should continue to be positive.

As we discussed in last month’s write-up, dressed weights for all cattle could average higher in 2014 than they were in 2013 for several reasons.

Lower-priced corn will provide incentives for keeping cattle on feed longer, increasing dressed weights. More steers and fewer cows and heifers in the slaughter mix could also result in a tendency for dressed weights to be higher.

However, pulling cattle forward – placing them in feedlots at younger ages and lighter weights due to anticipated lower numbers of available feeder cattle and because of a positive relationship between placement weight and final weight – could mitigate the weight-increasing effects of lower feed prices and more steers in the slaughter mix.

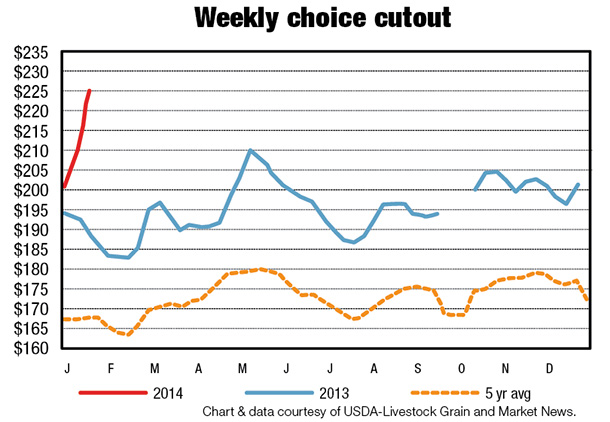

Packer margins will improve – despite the significant increases in fed cattle prices and slower-moving cutout values – if increases in cutout values sufficiently surpass increases in fed cattle prices.

This could occur if cutout values continue to increase significantly beyond the addition of roughly $2 per cwt that the USDA-AMS introduced this January by changing the way primal cuts are categorized for cutout values.

Currently, the weekly moving average cutout values continue to move up, which should be supportive of the whole cattle-feeding-meatpacking complex.

Retail beef prices are expected to average higher in 2014 than they did in 2013. However, consumer acceptance of the higher prices will be influenced to some degree by the anticipated increase in pork and poultry supplies.

Cattle imports accelerate

Through November, U.S. cattle imports were 16 percent below year-earlier levels as falling shipments from Mexico (-37 percent) outweighed higher imports from Canada (+22 percent).

Imports from Mexico were slow to start the year after several years in which drought caused herd liquidation. During the first half of 2013, imports from Mexico were down 45 percent.

Imports have strengthened in the fourth quarter as shipments typically rise this time of year due to diminished forage availability in Mexico.

Due to stronger imports from Mexico and sustained imports from Canada, the 2013 estimate of cattle imports was raised 25,000 head from last month to 1.99 million.

While nearly all cattle from Mexico are feeders, feeder cattle accounted for only 21 percent of imports from Canada in 2012.

This number rose to 31 percent in 2013 through November due to strong U.S. demand and comparatively lower prices for feeder cattle in Canada.

Cattle imports in 2014 are forecast at 1.95 million head, 2 percent lower than in 2013.

Imports from Mexico are expected to decline for the second year in a row as inventories there remain tight. Strength in feeder cattle imports from Canada is likely to continue but may be offset by lower imports of slaughter cattle.

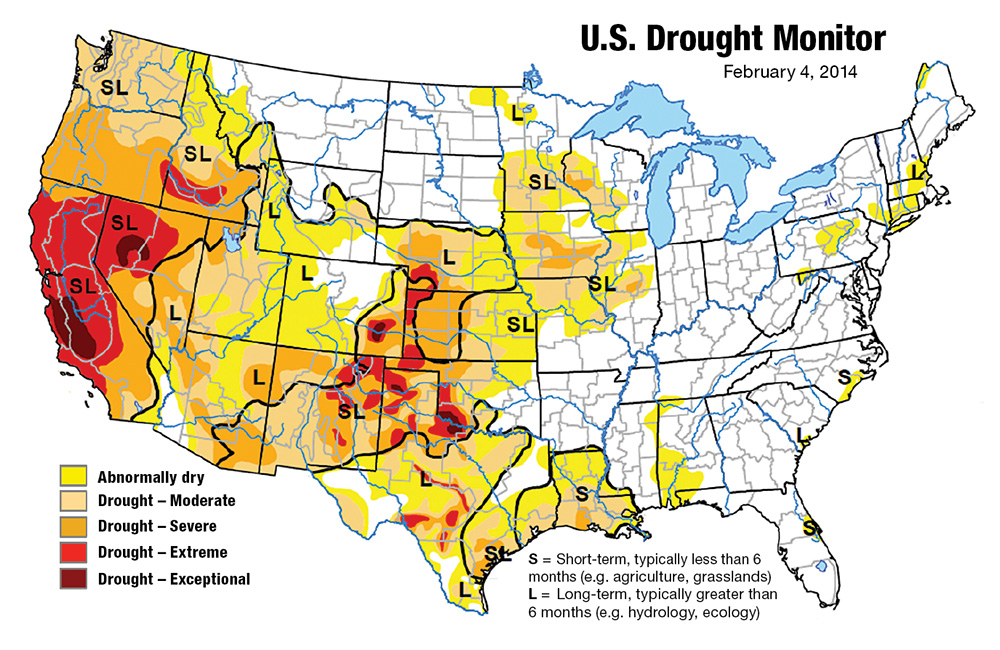

Click here or on the image above to see the U.S. Drought Monitor at full size in a new window. (342.3KB)

Beef import forecast raised in 2014

U.S. beef imports through November are up 1 percent year-over-year and are estimated to have been 2.254 billion pounds for the year.

Imports have risen this year from New Zealand (+7 percent), where an early season drought led to higher cattle slaughter and beef production.

Production rose for the same reason in Australia, but imports have fallen 6 percent due to rising demand from China.

While China accounted for 3 percent of Australian beef exports in 2012, China’s share has risen to 13 percent through November due to Chinese consumers’ stronger demand for beef.

Imports have also fallen from Canada (-2 percent), another top supplier of U.S. beef imports. The 2014 forecast for U.S. imports was raised to 2.285 billion pounds due to recent strength in imports.

The forecast for 2014 represents only a small increase in shipments from 2013 as supply will be constrained in many markets that export to the U.S.

Production is expected to decline slightly next year in Australia, the top source for U.S. beef imports in 2012 and 2013. Competition for Australian beef is likely to remain as demand continues to rise in Asia.

Beef exports strong to Asia

U.S. beef exports through November are up 4 percent for the year, largely due to strong growth in exports to Asia.

The volume of exports has risen most to Japan (+48 percent) as import restrictions were relaxed in 2013 to allow for imports of U.S. beef from cattle aged less than 30 months.

While beef consumption is flat in Japan, relaxed import restrictions have allowed the U.S. to take some market share from Australia.

Exports have also risen through November to Hong Kong (+71 percent), Taiwan (+82 percent), and Mexico (+9 percent).

Exports to Mexico have increased this year as Mexican beef production declined. Due to stronger demand from Asia and Mexico, the estimate of 2013 U.S. exports was raised to 2.534 billion pounds.

The 2014 forecast was raised to 2.335 billion pounds, but overall exports are forecast to fall 8 percent next year as U.S. production declines due to lower cattle inventories. ![]()