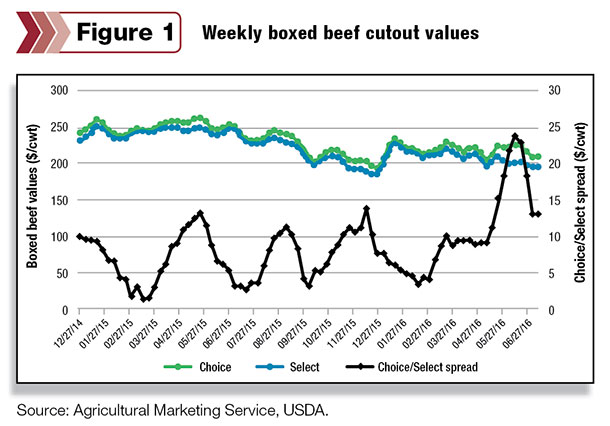

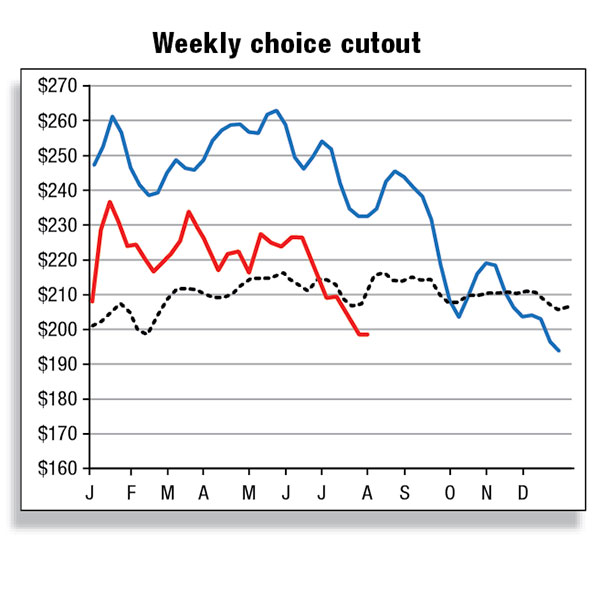

The weekly Choice/Select spread reached a record high of $23.81 per hundredweight for the week ending June 11, despite both Choice and Select cutout values being quoted at prices well below year-prior levels.

It is not atypical for the Choice/Select spread to increase in late spring and early summer, as the percentage of cattle grading Choice typically declines during a time when demand for higher-value middle meats increases with the advent of “grilling season.” However, this has not been the case this year, as the record spread between Choice and Select cutouts in June was not the result of a tightening supply of Choice beef.

In fact, packers have slaughtered larger volumes of both Choice and Select beef year-to-date than the previous year, suggesting that strong domestic demand for Choice-grade beef helped to propel the spread to record levels in June.

The trend toward a wider Choice/Select spread has lost momentum in recent weeks and has narrowed sharply in July, falling approximately $11 per hundredweight from the early June record. This narrowing spread in July is consistent with a seasonally smaller Choice/Select spread during the summer (third quarter) before it gains momentum once again during fall.

Data suggests feedlot operators more current in marketings

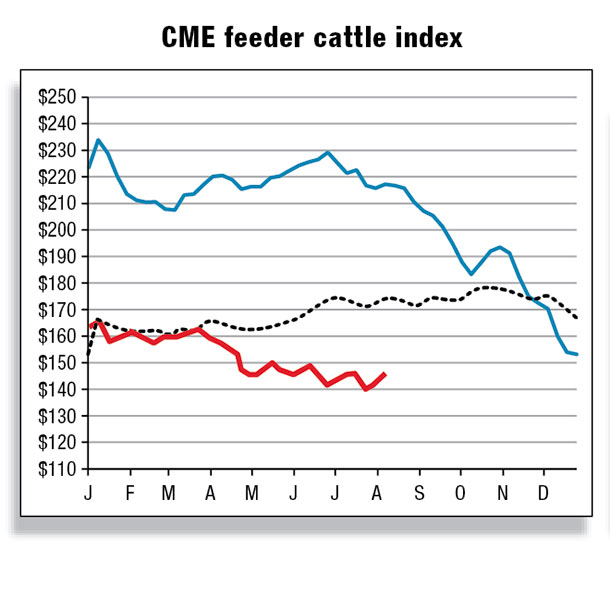

The June Cattle on Feed report estimated that on June 1 there were 1.3 percent more cattle in U.S. feedlots with a capacity of 1,000 head or greater compared to a year earlier. In May, cattle marketings were reported approximately 5 percent higher year-over-year, but when adjusted for the extra marketing day in May, feedlot operators were about par with May 2015 marketings.

The data also point to a likely shift in the marketing patterns for cattle over the past several months. Calculation of the number of cattle on feed longer than 120 days indicates that after 21 months of year-over-year higher numbers, the number of cattle on feed 120 days or more fell below year-earlier, beginning in April.

This trend has continued and suggests that feedlots are not holding animals on feed as long as they have in previous months. In fact, beginning in April, the percentage of cattle on feed for more than 120 days has been below the average of 2009-2013.

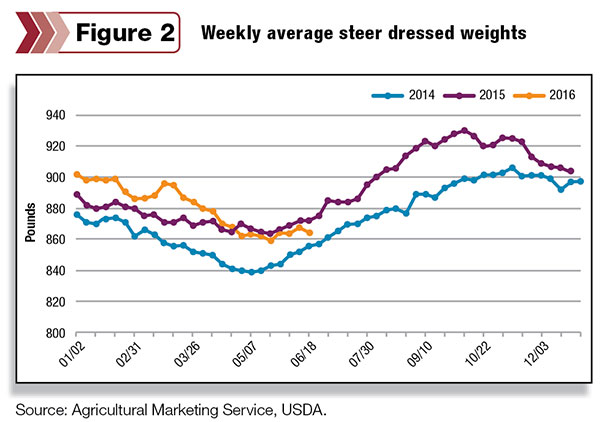

Another factor that supports the notion feedlot operators may be returning to a more “normal” marketing pace relative to 2015 is the trend toward lighter average carcass weights. Weekly AMS data (Federally inspected slaughter) show carcass weights well above 2015 at the start of the year, as feedlot operators worked diligently to clear the large backlog of historically heavy cattle carried over from the last half of 2015.

But it appears the tide has turned, as back-logged cattle have been cleared while marketing rates are increasing, resulting in cattle dressed weights slipping below year-prior levels in early April through early July. Cattle dressed weights are expected to increase seasonally over the next two quarters but are likely to remain below year-prior levels.

U.S. beef exports climb higher in May; imports decline

After a slow start the first four months of 2016, U.S. beef exports increased in May. Total beef exports in May rose about 14 percent from the previous year’s level, largely due to higher shipments to Japan (+29 percent), Mexico (+39 percent) and South Korea (+61 percent) year-over-year. Beef exports to Canada in May were modestly higher than the previous year.

May’s increase in beef exports is indicative of stronger demand for U.S. beef products by foreign buyers. Also, it is noteworthy that during the month of May, the U.S. dollar index continued to weaken relative to other major currencies, supporting higher exports from U.S. beef suppliers. Exports to South Korea, in particular, were exceptionally high in May.

The South Korean cattle inventory remains constrained, resulting in lower beef production and higher volumes of imported beef this year. Volume-wise, Japan remains the top market for U.S. beef, and cumulative beef shipments to Japan through May 2016 were up 6 percent.

Currently, the U.S. is experiencing a competitive advantage in beef production relative to other major beef-producing countries and has increased its market share to Japan and other countries at the expense of significantly lower beef exports from Australia. The 2016 forecast for U.S. beef is nearly 2.5 billion pounds, 9 percent higher than 2015. Total beef exports are expected to increase further in 2017 to 2.6 billion pounds.

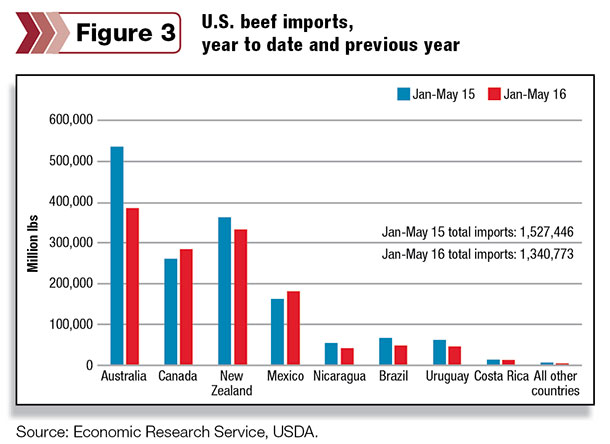

Conversely, the weak U.S. dollar index resulted in a continued weakening of U.S. beef imports in May, with an approximate 10 percent decline year-over-year. Cumulative imports through May totaled 1.3 million pounds, down approximately 12 percent from a year earlier. In May, imports were lower from Australia (-35 percent), Brazil (-23 percent) and Uruguay (-52 percent), while imports increased from New Zealand (+8 percent), Canada (+16 percent) and Mexico (+21 percent).

Processing-type beef imports from Australia are expected to decline through the remainder of the year as favorable weather continues to support herd rebuilding. Australian cattle turn-off and beef production remain well below year-prior levels, limiting the volume of Australian beef available for export.

The forecast for U.S. beef imports in 2016 was raised to approximately 2.9 billion pounds on higher-than-anticipated imports from New Zealand during the second quarter; however, beef imports from New Zealand should begin to steadily decrease over the next two quarters as the country’s rate of cattle slaughter declines. The forecast for 2017 remains unchanged from June at 2.6 billion pounds. ![]()

Analysts Mildred Haley and Keithly Jones assisted with this report.

-

Seanicaa Edwards

- Market Analyst

- USDA – ERS

- Email Seanicaa Edwards