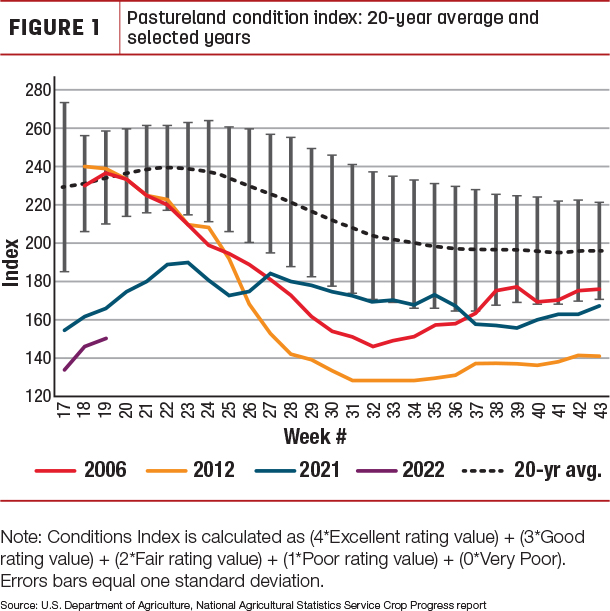

Drought is playing a significant role in the cattle cycle. Two years of drought have deteriorated pasture and forage conditions, and the pastureland condition index for 2022 is off to its worst start for the grazing season since the series began in 1995 (Figure 1).

This is pushing calves into feedlots at a faster pace, which will likely quicken the pace of fed cattle slaughter in 2022, leaving fewer supplies of cattle available for slaughter in late 2022 and 2023.

Furthermore, drought conditions and higher operating costs have encouraged the rapid culling of beef cows in first-quarter 2022 to levels not seen in decades. Also, based on the USDA Agricultural Marketing Service reports for actual weekly slaughter under federal inspection, April 2022 showed the highest number of beef cows slaughtered for the month since 1996; there were over 5 million more beef cows on Jan. 1, 1996, than Jan. 1 of this year. Subsequently, the outlook weakens for potential calf crops in 2022 and 2023, further reducing potential cattle placements year over year in late 2022 and early 2023.

The April Cattle on Feed report – released by the USDA National Agricultural Statistics Service – estimated March 2022 placements nearly unchanged and about 2% fewer marketings than March of last year, resulting in an April 1 cattle on feed number of 12.1 million head. That is a record for the month of April since the series began in 1996. March placements of cattle were greater than expected. As more calves are placed in feedlots sooner than normally expected due to drought conditions, marketings in 2022 are pulled forward into the second and third quarters, partially offsetting an expected decline in marketings in late 2022. However, the forecast for cow and bull slaughter is higher than last month, more than offsetting the net decline in fed cattle marketings in 2022. As a result, the forecast for 2022 beef production was raised 132 million pounds to 27.8 billion pounds.

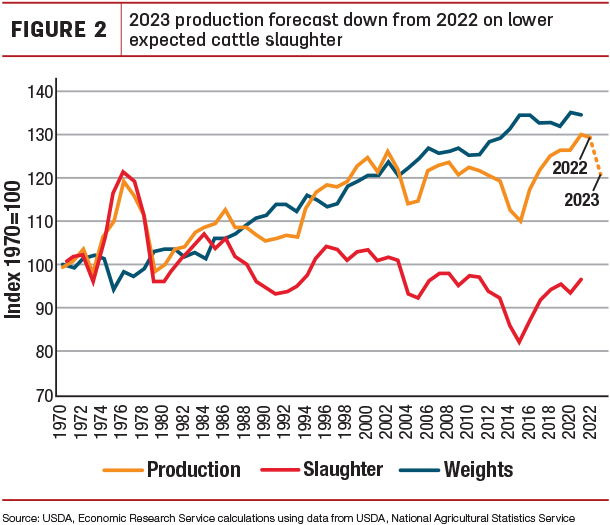

Based on anticipated tight supplies of cattle, 2023 beef production is projected to decline 6.8% from 2022 to 26 billion pounds. It will mark a second year of lower production following the record set in 2021, although the decline from 2021 to 2022 is fractional at this point in the forecast cycle. As depicted in Figure 2, it will be the lowest production level since 2016.

With lower expected beef production contributing to higher expected prices in 2023, aggregate domestic beef disappearance next year is expected to decline almost 7% to the retail equivalent of 55.1 pounds per capita, compared with 59 pounds per capita in 2022. This will be its lowest level since 2015.

Cattle prices to climb for second year

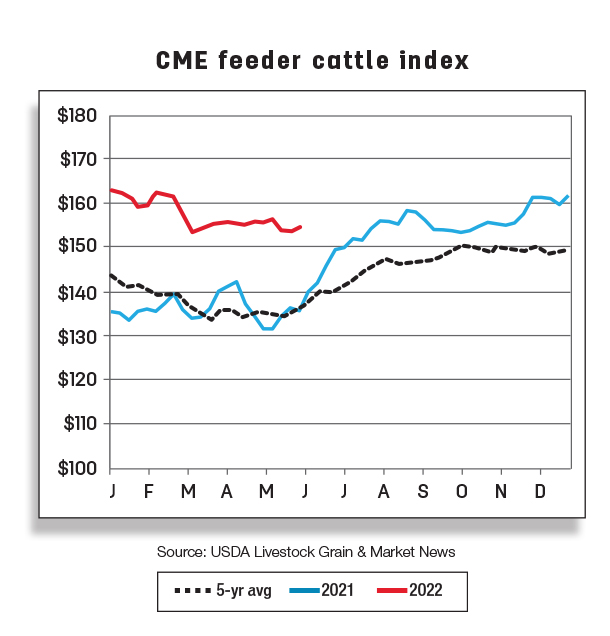

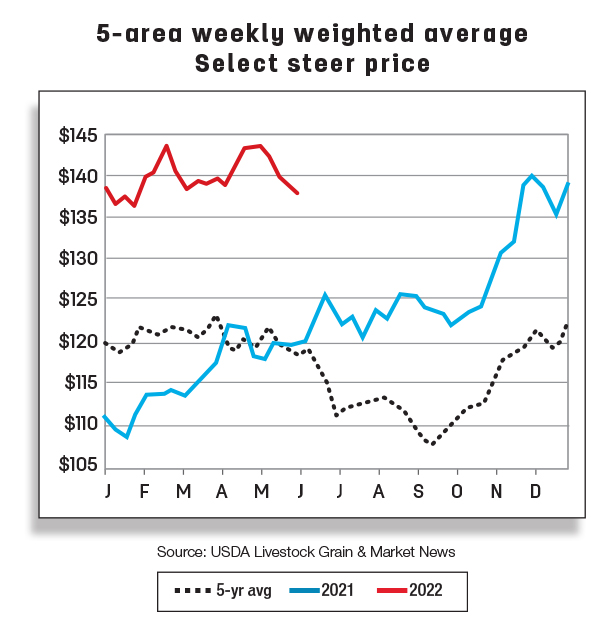

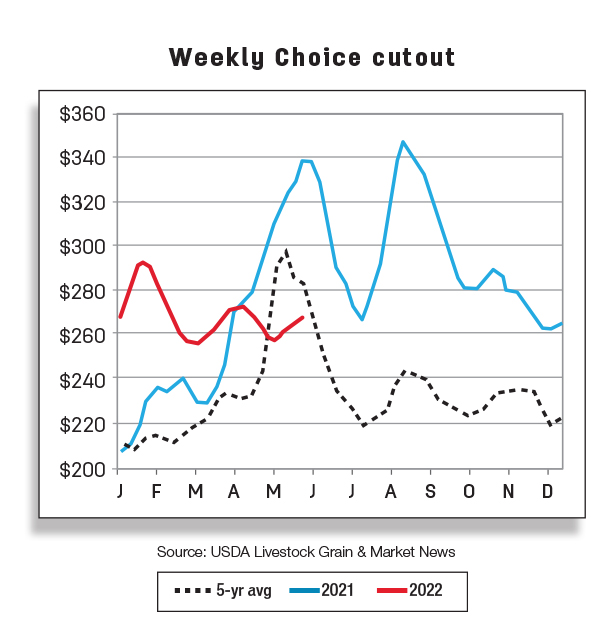

In early 2022, a faster pace of placements and slower-than-expected pace of marketings of fed cattle has resulted in the largest on-feed numbers recorded for the month of April. This has likely kept feeder calf prices restrained given late 2022 fed cattle prices implied by the futures market in late 2022. The third-quarter 2022 price forecast is raised $1, but the fourth-quarter 2022 price is lowered $2, for an annual forecast of $162.80 per hundredweight (cwt), 20 cents lower than last month’s forecast.

Cattle prices in 2023 are expected to increase for a second consecutive year. Prices are expected to approach record levels set in 2014, a year when the U.S. cattle inventory was the lowest since 1952. With a smaller 2022 calf crop and higher anticipated beef cow slaughter in 2022, calf supplies are expected to contract in 2023. The average annual feeder steer price is expected to climb to $198 per cwt in 2023, $35 (or 22%) higher than the projection for 2022.

Fed steer prices for the 5-area marketing region for the week ending May 15 averaged $23 above a year ago at $142.44 per cwt. Based on the April 2022 average monthly price of $141.66 per cwt and current price data, the second-quarter 2022 fed steer price forecast is raised $1 to $140 per cwt. The fourth-quarter 2022 price is raised $2 to $145 per cwt because of fewer expected market-ready fed steers at that time. The 2022 fed steer price is forecast at $140.10 per cwt.

Despite less expected beef production in 2023, a changing economic situation could temper beef demand in 2023. The 2023 fed steer price is expected to increase 9%, or $13, to $153 per cwt, the highest price since 2014.

Record-high first-quarter 2022 U.S. beef trade; Exports and imports to slow in 2023

First-quarter 2022 was a record for U.S. beef trade, with both exports and imports reaching new highs for the quarter. U.S. beef exports in the first quarter totaled 846 million pounds, 6% higher than a year ago and 16% above the five-year average. Beef imports totaled 985 million pounds, 41% higher year over year and 36% higher than the five-year average.

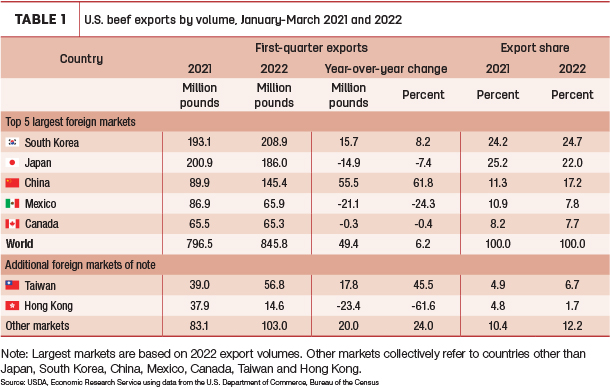

Beef exports in March were higher than March of any previous year, eclipsing the previous record set last year, and were the third largest for any month. Among the top five destinations, higher exports to China, South Korea and Canada offset lower exports to Japan and Mexico. Overall, for the first quarter, South Korea emerged as the top foreign market for U.S. beef with exports increasing 8% year over year. Despite a decrease in exports to Japan of 7% year over year, the country was the second-largest market for the quarter. Exports to China showed the largest year-over-year increase, up nearly 62%, maintaining China’s status as the third-largest market with over 17% of total exports for the quarter. Among the top five markets, the largest decrease in exports came from Mexico, with shipments down over 24% year over year.

First-quarter exports to Taiwan increased nearly 46% year over year, and the share of exports increased almost 2 percentage points. Additionally, combined exports to other markets increased 24%. Economic recovery and the return of tourism has fueled some of the demand recovery for U.S. beef in these smaller markets (Table 1).

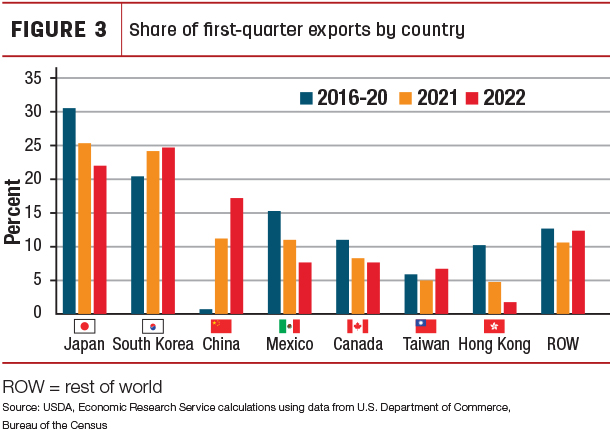

Figure 3 shows the share of first-quarter exports by country.

Export shares to South Korea, China and Taiwan were higher than the first quarter of 2021 and the five-year average, while Japan, Mexico, Canada and Hong Kong accounted for smaller shares of exports. Exports to smaller markets have nearly returned to pre-pandemic levels.

Based on firm demand anticipated from Asia, the second- and third-quarter 2022 export forecasts are increased by 20 million pounds each, though still below record levels of 2021. The annual forecast for 2022 is raised to 3.36 billion pounds. Due to the expected decrease in 2023 U.S. beef production, exportable supplies are expected to be lower next year. The annual export forecast for 2023 is 2.93 billion pounds, a year-over-year decrease of about 13%.

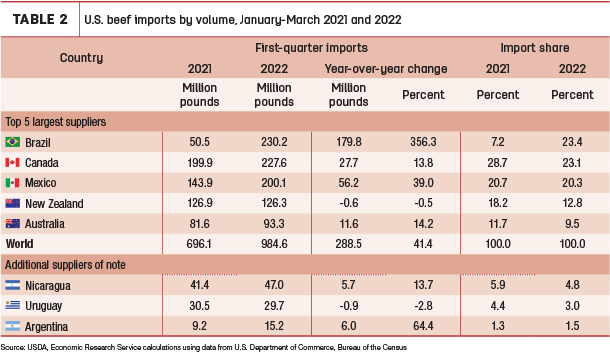

Imports in March were also a record for the month and the fourth-largest overall. Nearly all major suppliers showed year-over-year increases for the month, with the largest increases from Brazil, Mexico and Canada.

Imports from Brazil were elevated in the first quarter, making that country the largest supplier so far this year. The World Trade Organization tariff rate quota (TRQ) for fresh, chilled and frozen beef imports from countries without a country-specific quota (including Brazil) was filled as of April 4, 2022. Therefore, for the remainder of this year, imports of fresh beef from Brazil and other U.S. suppliers not under a specific TRQ will be subject to a higher tariff of 26.4% of the value of the imports. However, imports from Brazil are likely to remain elevated if U.S. beef trimmings prices also remain relatively high.

First-quarter imports from Mexico were also higher than the previous year, increasing 39%, while imports from Canada were up nearly 14%. Imports from Australia were 14% higher than a year ago, as the country emerges from two years of limited exportable supplies caused by rebuilding a drought-reduced cattle herd. The only major supplier with a year-over-year decrease was New Zealand, down less than 1%. Imports from Argentina were up 64% year over year and imports from Nicaragua increased almost 14% (Table 2).

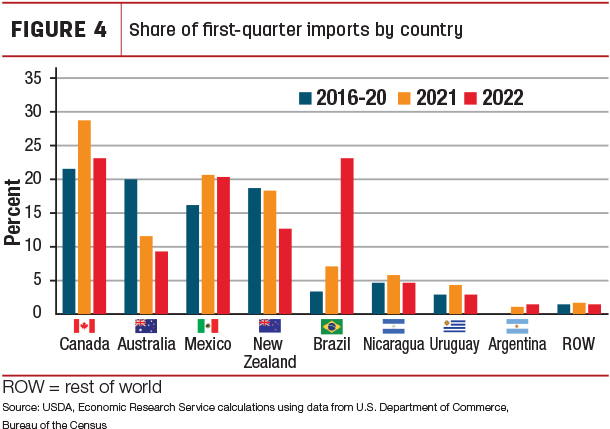

As shown in Figure 4, there have been a few major shifts in the share of imports for the first quarter over the last few years.

The share of imports from Australia has been much lower than the five-year average due to limited exportable supplies. The import share from Brazil is elevated this year; the lifting of the U.S. ban on fresh beef imports, carryover from disrupted trade with China in late 2021 and high U.S. beef prices have likely caused this spike in imports from Brazil. Increased production in Mexico has led to a higher share of total imports from Mexico in the last two years.

The second-quarter 2022 import forecast is increased 30 million pounds to 890 million, reflecting continued strong domestic demand. Forecasts for the second half of 2022 are unchanged from the previous month. The annual import forecast for 2022 is increased to 3.55 billion pounds. The annual forecast for beef imports in 2023 is 3.2 billion pounds, a decrease of about 10% compared to the relatively strong 2022 forecast.