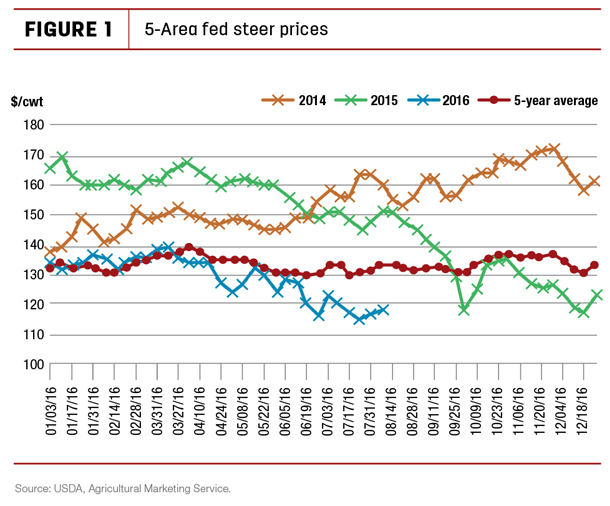

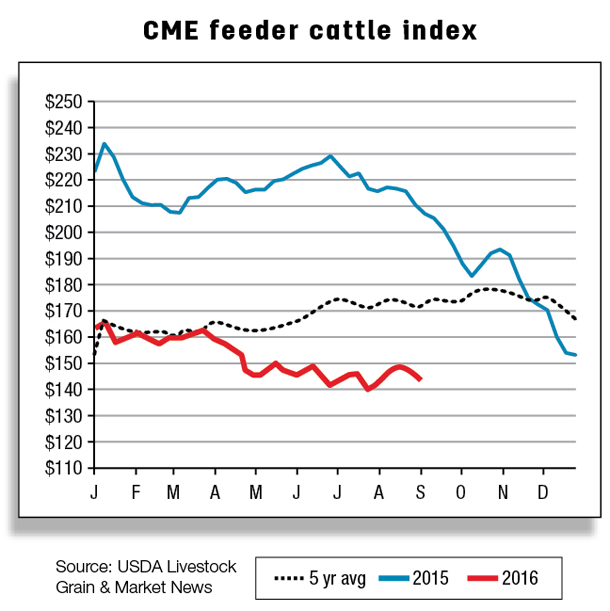

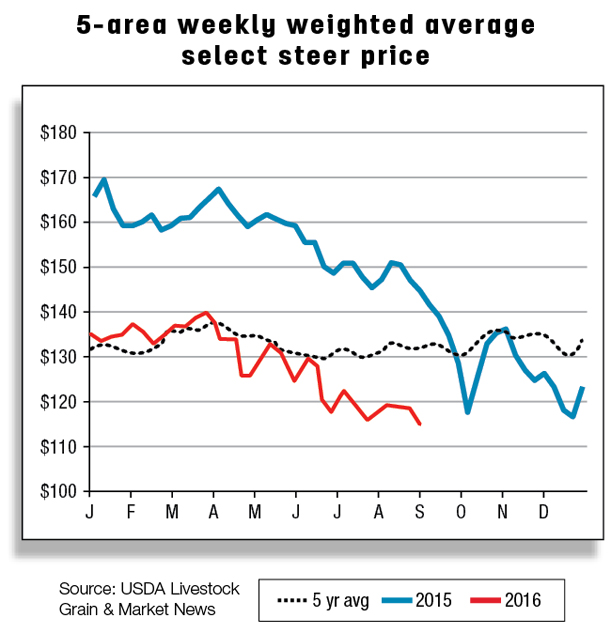

Volatile futures markets may have contributed to some of the fluctuations in fed cattle prices, but relatively large supplies of cattle on feed and higher cattle marketings from the previous year have kept fed cattle prices in check through much of 2016.

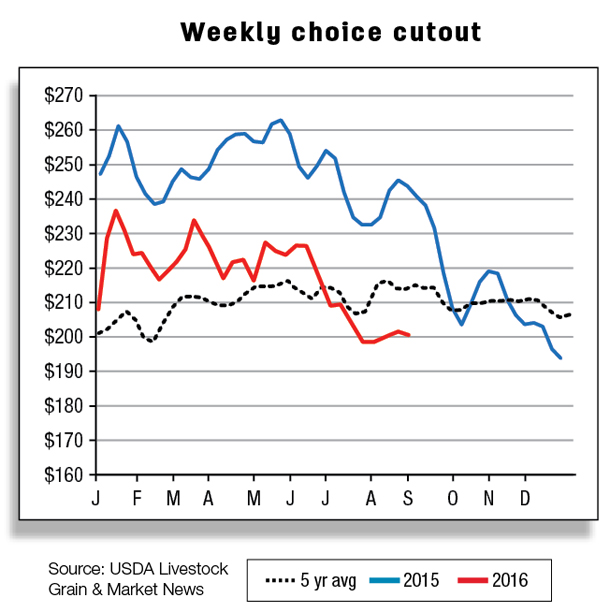

In addition, packers have not had much incentive to bid fed cattle prices higher because of lower cutout values through much of the summer. The expectation of higher cattle marketings during the second half of 2016 is expected to keep fed cattle prices under pressure.

The outlook for 2017 is for lower prices as well. It is expected that continued expansion in domestic cattle inventories will result in higher slaughter and beef production in 2017 than is forecast for 2016.

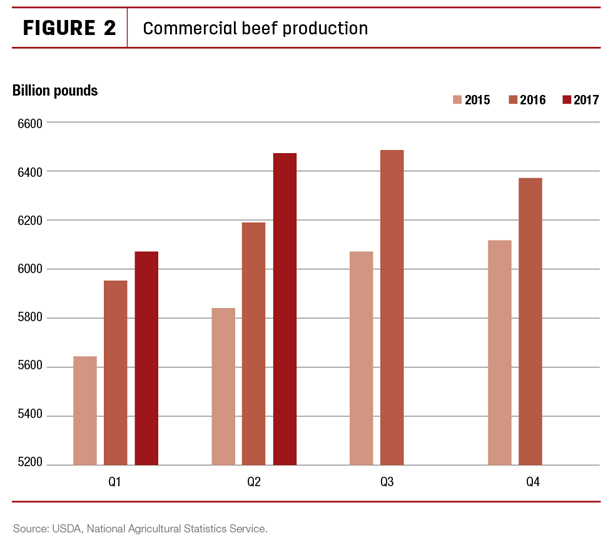

Commercial beef production for the first half of 2016 was about 5 percent above the previous year at just over 12 billion pounds. This year’s ample supply of beef is primarily driven by year-over-year increases in commercial cattle slaughter and heavy dressed weights.

First-half commercial cattle slaughter was estimated about 4 percent higher than the previous year’s slaughter, while dressed weights averaged about 7 pounds heavier than first-half 2015 dressed weights.

Lower overall feed costs are expected to encourage feedlot operators to feed animals longer and to heavier weights. Forecasts for third-quarter 2016 total cattle slaughter were raised on expectations of larger marketings and slaughter rates of steers and heifers, but the fourth-quarter forecast remains unchanged.

Forward projections show a continued gain in beef production into 2017, as the increased availability of slaughter-ready cattle and generally heavier carcasses result in more beef. Annual beef production is forecast to reach 25 billion pounds in 2016, up 5.3 percent from last year. Total commercial beef production in 2017 is forecast 3.4 percent higher at nearly 26 billion pounds.

Beef exports slow in June, imports tighten

U.S. beef exports in June were modestly lower (-0.5 percent) than the previous year, at 213 million pounds, but were down 3 percent from levels reported in May. Strong growth continues in Japan, with exports up 20 percent from June 2015.

In June, beef exports to South Korea increased only 1 percent, while beef exports to Mexico grew approximately 6 percent on a yearly basis. Noticeable declines in exports to Canada (-8 percent), Hong Kong (-32 percent) and Taiwan (-21 percent) partially offset increases in total beef exports in June.

January through June, total U.S. beef exports were 2 percent higher than a year earlier. Though beef exports appeared lackluster through June, shipments abroad are expected to gain momentum, increasing approximately 22 and 7 percent over a year earlier in the third and fourth quarters of 2016.

Total U.S. beef exports are forecast at 2.5 billion pounds in 2016, up about 8 percent over 2015. Beef exports in 2017 are forecast at 2.6 billion pounds, up 5 percent relative to 2016.

Beef imports were reported at 284 million pounds in June, down about 16 percent relative to a year ago. Through June, total imports were down 13 percent as a result of dramatically smaller volumes of beef imported from Australia and New Zealand.

Beef imports from Brazil, Uruguay and Nicaragua have also been sluggish through June, but the scenario of declining beef imports from Brazil will likely reverse later in the year.

USDA-FSIS has approved the import of fresh/frozen beef from Brazil, while Brazil approved the import of U.S. fresh/frozen beef. Fresh/frozen beef from Brazil will add to the volumes of thermally cooked and processed beef currently accepted into the U.S.

Imports of fresh/frozen beef from Brazil can enter the U.S. at a reduced duty under the “Other” countries tariff rate quota. Increases in the forecasts of second-half 2016 total beef imports (+35 million pounds) and first-half 2017 beef imports (+50 million pounds) largely reflect the expectation of larger volumes of beef flowing into the U.S. from Brazil.

The 2016 beef import forecast is 3 billion pounds, down 12 percent on a yearly basis. Beef imports are expected to decline even further in 2017 to 2.6 billion pounds. ![]()

Analysts Mildred Haley and Keithly Jones assisted with this report.

-

Seanicaa Edwards

- Market Analyst

- USDA – ERS

- Email Seanicaa Edwards