The steer and heifer slaughter rate per weekday in the fourth quarter is expected to be above levels for the same period last year. The 2019 beef production forecast was lowered by 25 million pounds to 27.8 billion pounds, reflecting lighter expected average carcass weights in early 2019.

Lower October placements; cattle on feed numbers remain high

Based on the most recent Cattle on Feed report for October – released by the National Agricultural Statistics Service (NASS) on Nov. 21 – there were 6.1 percent fewer net placements and 4.8 percent higher marketings, for a Nov. 1 cattle on feed number of 11.7 million head. Despite year-over-year lower placements, the absolute number of placements was still higher than marketings, keeping cattle on feed numbers the largest since 2011.

Among cattle on feed, there were 18.5 percent more cattle held over 150 days than at the same time in 2017. This suggests there are slaughter-ready (or near-ready) cattle supplies available. As a result, fed cattle slaughter in fourth-quarter 2018 is anticipated to be higher.

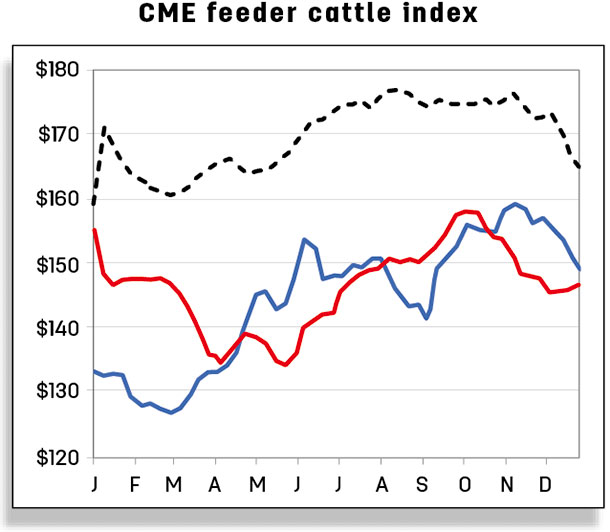

The high numbers of cattle on feed and generally poor feedlot returns are likely pressuring feeder calf prices, and feedlots may not be as willing to pay higher prices for calves this fall as compared to last year at this time. During October, Oklahoma City National Stockyards reported the highest monthly average price in 2018 for 750- to 800-pound feeder steers.

Since weekly prices peaked on Oct. 1 at $159.71 per hundredweight (cwt), they have fallen more than 14 percent to $136.93 per cwt on Dec. 10. The forecast for fourth-quarter 2018 feeder steer prices is reduced from the previous month to $146 to $149 per cwt. However, the 2019 annual price forecast is unchanged at $140 to $151 per cwt.

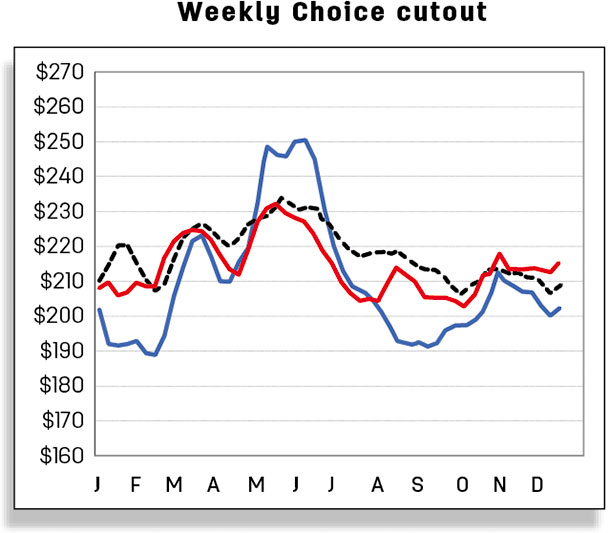

Fed cattle prices break out, reflecting seasonal packer demand

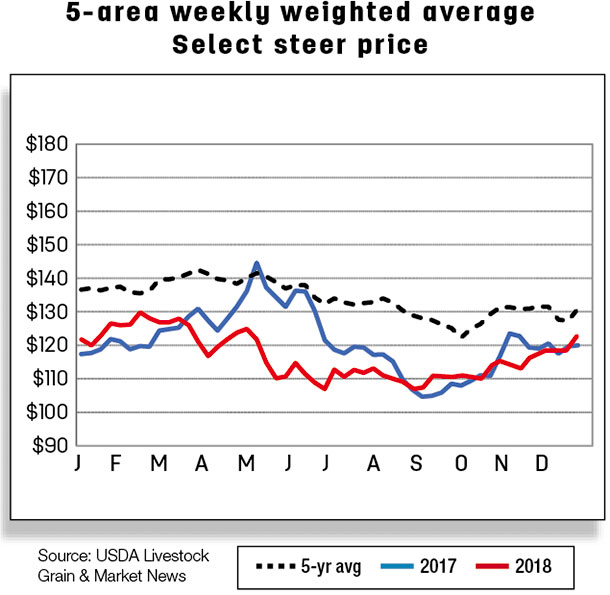

Packer demand has increased seasonally, and strong margins this year have likely encouraged packers to be strong buyers of cattle. For the week ending Dec. 8, the weekly slaughter estimate was 667,000 head. This would be the highest weekly slaughter total since the week ending May 19 (667,613 head). This demand is also reflected in prices offered for fed steers in the 5-area marketing region.

In November, monthly prices finally broke out of the five-month narrow price window of $109.90 per cwt to $112.20 per cwt to reach over $115 per cwt. Further, for the week ending Dec. 9, fed steer prices climbed to $118.11 per cwt, though still below year-earlier levels. From last month, the forecast for fourth-quarter 2018 prices for fed steers in the 5-area marketing region was raised to $113 to $116 per cwt. However, the annual forecast for 2019 fed steer prices was left unchanged at $114 to $122 per cwt.

Beef imports slowed down

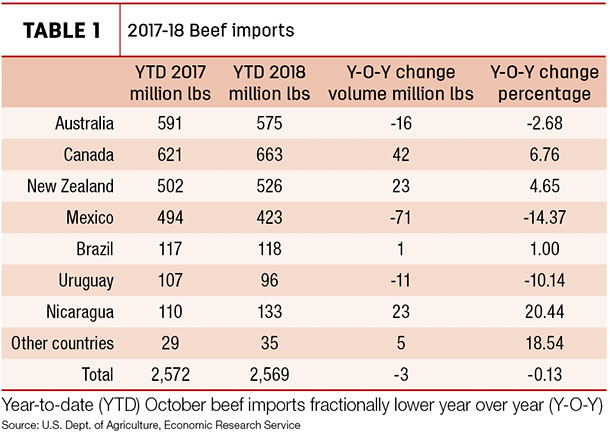

October 2018 U.S. beef imports declined by 4.8 percent year-over-year to 234 million pounds. Among major suppliers, declines were from Mexico (-19.2 percent), Australia (-11.2 percent) and New Zealand (-10.2 percent). However, January-through- October 2018 imports were only fractionally lower from a year earlier at 2.569 billion pounds (Table 1).

Based on the lower October imports, the fourth-quarter 2018 forecast is revised downward by 10 million pounds to 670 million pounds, which results in the 2018 forecast of 3.004 billion pounds. Trade data indicates Oceanian and North American suppliers have shifted their products to Asian markets, which is likely to continue due to price incentives throughout the year.

The price of imported beef (90 percent lean) in the U.S. has been improved in recent weeks, though it is lower than the previous year. Relatively lower U.S. prices are likely to continue hindering shipment from key suppliers. The 2019 beef import forecast was also adjusted downward by 40 million pounds to 3.02 billion due to expected tighter exportable supplies in Oceania.

Beef exports continue to grow

The volume of 2018 October beef exports was 272 million pounds, up 4.6 percent from a year-earlier level. Among major destinations, year-over-year higher exports to Japan (+10.8 percent), South Korea (+17.1 percent), Taiwan (+46.7 percent) and Mexico (+2.9 percent) more than offset the declines to Hong Kong (-17.3 percent) and Canada (-6.9 percent).

Outside of major destinations, notable year-over-year increases were to Vietnam, Philippines, Indonesia and Colombia. With higher exports in each month than year-earlier levels, cumulative beef exports through October 2018 were 2.627 billion pounds, up 12.3 percent year over year. South Korea, Japan and Taiwan contributed most of the growth, which is likely to continue due to strong domestic demand in those markets.

Exportable supplies available in the U.S., along with tariff advantages over key competitor Australia, continue to enhance exports to South Korea. Based on the current pace and weekly export sales estimates for November, forecasts for 2018 and 2019 were expected to be in line with the previous month’s forecast at 3.19 and 3.265 billion pounds, respectively.

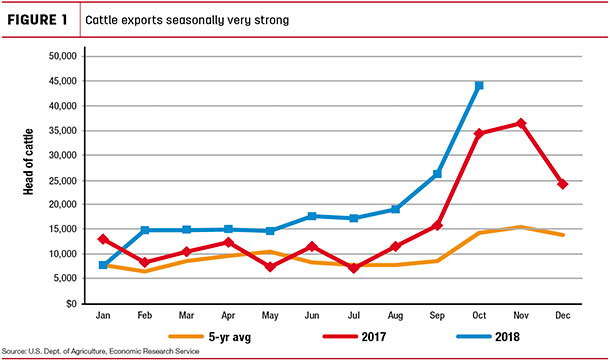

Cattle exports strengthen

October cattle exports were about 29 percent higher than a year ago at 44,203 head. Despite exports to Mexico of less than half year-earlier levels, significantly higher exports to Canada resulted in the highest monthly export volume recorded since October 2001. Besides Canada and Mexico, notable numbers of cattle were exported to Qatar (2,184 head) and Russia (1,850 head) in October. Year-over-year higher exports in each month of 2018 ( Figure 1) totaled year-to-date exports more than 45 percent above last year to 192,008 head. ![]()

Analyst Lekhnath Chalise assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.