The impact has squeezed margins for feedlots that have failed to manage their feed input costs against fat cattle sales at stronger levels of historical profitability.

While the cost/revenue relationship is obviously changing on a daily basis, and could still benefit those feedlots that remain open in nearby marketing periods, the situation brings up an observation that is worth noting:

The best profit margin opportunities often show up well ahead of the actual marketing periods, and in some cases even before feeder cattle have been placed.

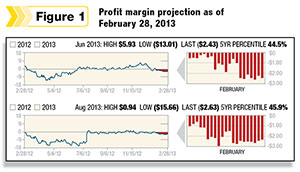

Figures 1 and 2 reflect current beef cattle margins as well as comparison graphs to those same profit margins three months ago.

Figures 1 and 2 reflect current beef cattle margins as well as comparison graphs to those same profit margins three months ago.

Two things can be seen in the figures.

First is the observation noted above: The profit margins as of February 28 clearly reflect a recent deterioration in the June and August marketing periods where the feeder cattle price has already been fixed, while the October and December  margins show a gradual improvement over the recent past.

margins show a gradual improvement over the recent past.

The second observation is: Even though the June and August marketing periods have been deteriorating and now project negative margins for feedlots with cattle already on feed, if you look at the margin graph for those marketing periods as of November 30, the margins were actually positive and at relatively high historical levels above the 80th percentile.

This demonstrates the importance of modeling profitability well in advance and taking advantage of the opportunity to protect it when margins are historically strong. It was possible to secure a profit margin for the June marketing period over $8 per hundredweight (cwt) higher than where it exists today as recently as just a few months ago.

While this opportunity is now gone, it still is possible to secure margins for the October, December and February marketing periods that exist well above the 90th percentile of the past 10 years.

The factors that have influenced margins over the past few months have not been favorable for cattle feedlots, to say the least.

On the feed side of the equation, USDA’s quarterly stocks report released in January revealed corn inventories well below trade forecasts and suggested much larger feed and residual demand during the first quarter of the marketing year than what analysts had anticipated.

December 1 stocks of 8.03 billion bushels were 180 million below the average trade guess and outside the range of pre-report expectations, which led the USDA to increase their estimate of feed and residual usage by 300 million bushels in the January WASDE.

As a result, ending stocks of 632 million bushels are historically tight, and when looked at relative to demand, the 5.6 percent stocks:use ratio has helped to support old-crop corn prices since early January.

In addition, a relatively tight cash market has led to very strong basis levels in the domestic interior. With the March corn contract now approaching expiration, no delivery notices have been posted and basis levels are at all-time highs for this time of year in many areas.

By contrast, new-crop corn prices are not reflecting these concerns and have recently posted new lows. USDA’s Outlook Forum projected 2013 corn acreage at 96.5 million, which would be down 700,000 from last year, although harvested area is projected at 88.8 million acres, which would be up 1.4 million from 2012.

The lower abandonment, combined with a higher yield forecast at 163.6 bushels per acre, would lead to production of 14.53 billion bushels, which may allow ending stocks to increase over 1.5 billion bushels from the current crop year.

While it is still necessary to plant and grow this crop, current expectations are obviously quite optimistic for high production and lower prices later this year.

An updated survey-based acreage estimate will be released at the end of March with the Prospective Plantings report, and USDA will release their first balance sheet for the 2013-14 crop year in the May WASDE report.

Looking at the revenue side of beef finishing margins, cattle has been under pressure since the beginning of the year as beef prices and poor packer margins are hurting demand.

The choice beef cutout has been trending below last year since early February, with current values down around 6.6 percent from 2012 despite expectations for tighter supplies and higher prices.

To be sure, export demand for January was encouraging with shipments of fresh and frozen beef through the first six weeks of the year reported at 92,300 tons, up 13,167 tons or 17 percent from 2012.

While there is a lot of volatility in the week-to-week data and the actual percentage increase may in fact be smaller, export demand does not appear to be a factor in lower beef prices thus far in 2013.

Domestic demand, on the other hand, is more questionable. With the sunset of the payroll tax holiday reducing take-home pay for many workers, combined with higher gas prices at the pump, many consumers are turned off by the higher cost of beef at the retail case.

At the same time, beef production for January was reported up 2.1 percent from 2012 by USDA recently when adjusting for the difference in slaughter days.

Slaughter weights are a big reason for the higher beef production, as the average steer dressed carcass weight for January was 873 pounds, about 20 pounds or 2.3 percent heavier than a year ago.

While weights are slowly starting to come down and packers are reducing their weekly slaughter runs, it does continue to appear that the market is still struggling with excess supply relative to where demand exists at current price levels.

The most recent USDA Cold Storage report showed boneless beef stocks at 420.2 million pounds at the end of January, down 1.7 percent from last year but still 7 percent above the five-year average.

Meanwhile, recent strength in the U.S. dollar may begin to negatively impact demand in the export market, which would further complicate the beef supply situation.

While margins in nearby periods are negative, the market fortunately is projecting a scenario where profit margins will improve later this year for cattle feedlots based on expectations for both lower feed costs and higher cattle prices than what currently exists in the spot market.

Whether or not that scenario comes to fruition remains to be seen; however, a cattle feedlot could contract today around these projections and secure a profit margin that historically represents the top decile of returns over the past 10 years.

Given that margins in nearby periods were once at these lofty levels also before things changed should be a motivating factor for being more proactive in managing the forward profitability in deferred periods.

It is worth bearing in mind that the best opportunities to protect forward profit margins often occur well ahead of the actual marketing periods. ![]()

Chip Whalen is a senior risk manager and director of education for Commodity & Ingredient Hedging based in Chicago, Illinois.