The Australian Bureau of Statistics released estimate cattle numbers rose 9 percent to 28.8 million head last year.

Herd sizes increased in all states except Western Australia and the Northern Territory. While the optimistic forecasts will buoy some, Top End beef producers will be deflated with news that Australian exports of live cattle are forecast to fall by 31 percent to 500,000 in 2011-2012.

Some producers are still recovering from the federal government’s halt in live cattle trade to Indonesia last June over animal cruelty allegations.

Since the resumption of trade with Indonesia, shipments to that country have averaged about 36,000 head a month, compared with a monthly average of 58,000 head at the height of the trade in 2008-2009.

Producers with cattle to sell domestically can expect weighted average sale yard prices to remain relatively high over the next six months.

Sale yard prices are expected to be supported by a combination of strong domestic re-stocker demand for young cattle, limited supplies because of low slaughter rates and increased demand from emerging markets, including the Russian Federation and those in the Middle East and Southeast Asia.

Over the remainder of 2012, Australia is expected to be the primary supplier of imported chilled beef to the Republic of Korea.

But the share of Australian imports in the Korean beef import market has been declining because of inroads made by U.S. beef exporters.

Entry of the Russian Federation to the World Trade Organization is expected to result in Australia gaining improved access to that market. Beef exports to the Middle East are also forecast to increase, by about 15 percent in 2012.

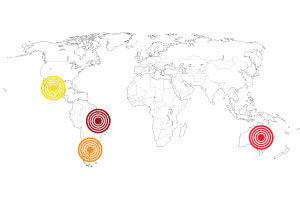

Argentina

Argentina

Low beef supplies, record domestic prices and ongoing government-imposed export restrictions have resulted in a 19 percent year-on-year fall in Argentine beef exports during 2011.

Soaring domestic prices which increased 39 percent last year (in local currency terms) have encouraged packers to sell their product in domestic markets – deferring to compete internationally.

While export prices rose 36 percent to U.S. $8,278 per metric ton, the average price of E.U. “Hilton” high-quality beef product increased only 15 percent to U.S. $14,633 per MT.

These price increases were driven by a 24 percent rise in live cattle prices last year to U.S. $93 per hundredweight (cwt) – an impressive 157 percent jump from decade-low prices in 2006.

During 2011, slaughter fell 12 percent year-on-year to 8 million head (from 12 million head during the same period in 2009). However, slaughter weights increased 7 percent.

The E.U. remains the largest market for Argentinean beef, taking about 34 percent of total Argentinean shipments, despite a 7 percent year-on-year decline in volume. Israel was the second-largest market with a 21 percent share.

The long-term decline in beef production is the result of the government’s intervention in the industry, severe drought and continued uncertainty over future government policies.

The International Meat Secretariat predicts Argentinean domestic beef consumption to decline following the tight supplies. Per capita beef consumption during 2011 averaged 120 pounds, compared with 149 pounds in 2009.

Brazil

Brazil

The Brazilian Senate approved proposed changes in the process of reforming the Brazilian Forest Code, changing legislation governing the use of land in the country.

This is seen as crucial if Brazil wants to preserve its position as one of the largest food exporters in the world and at the same time conserve 61 percent of its original forestland – 18 percent of which are in rural landholdings.

Brazil is the third-largest exporter of agricultural products in the world, behind only the U.S. and the European Union, according to the World Trade Organization.

It is the leading exporter of beef, poultry, sugar, coffee and orange juice. The Brazilian Confederation of Agriculture and Livestock (CAN), which is representing Brazilian farmers, estimates if the laws are not altered, Brazil could lose one-fifth of all the land it’s using for agriculture and livestock.

“This would result in more expensive food and higher inflation, as well as a fall in jobs, in exports and in Brazil’s GDP,” said Senator Katia Abreu, CAN president.

“These are dramatic consequences in a world of 7 billion people, which is suffering from an economic crisis and high food prices – a world that needs the good and cheap food produced in Brazil.”

The proposed bill intends to consolidate the land given up to agriculture and livestock, without increasing deforestation.

The decree for a Legal Reserve remains unchanged. This decree states that a farmer must preserve the native forests in 80 percent of their land, if the land falls within the Amazon biome, or from 20 to 35 percent if the land is in other regions of Brazil. At present, only 27.7 percent of Brazilian land is used for agriculture and livestock.

Mexico

Mexico

Most of the U.S. Meat Export Federation’s retail demand-building activities in Mexico, the largest destination for U.S. beef exports, are conducted with large, national retailers and distributors in major metropolitan areas.

But as the U.S. beef industry works to expand its presence in Mexico, the Beef Checkoff recently authorized USMEF to launch a new outreach campaign with regional supermarket chains in the northern region of the country.

The outreach campaign currently consists of staff training and development conducted through the Monterrey Institute of Technology and Higher Education, said Chad Russell, USMEF regional director.

These programs will help the regional supermarket chains modernize, expand and improve their meat departments – which, in time, will make these store locations better candidates for aggressive, point-of-sale promotion of U.S. beef.

U.S. beef and beef variety meat exports to Mexico through the first half of 2011 totaled nearly 280 million pounds valued at $475 million – an increase of 8 percent in volume and 25 percent in value over the same period in 2010. ![]()

Clint Peck is the owner of Global Beef Systems, LLC.