The September Cattle on Feed report released by the USDA estimated cattle in feedlots with a capacity of 1,000-plus head totaled 10.1 million head, up 1 percent from the previous year. Placements of cattle on feed during August totaled 1.88 million head, up 15 percent from the same period last year.

Average placement weights were higher than last year, likely due to cattle being held on pasture longer during the first half of the year.

Cattle placed at weights heavier than 800 pounds were up 28 percent from July and 21 percent year-over-year. The absence of a mid-year cattle report creates uncertainty as to supplies of feeder cattle outside feedlots, but placements are assumed to remain relatively large for the remainder of the year.

However, declining fed cattle prices and reduced feeder cattle margins may also affect the pace of near-term cattle-on-feed placements.

Fed cattle marketed during August totaled 1.87 million head, up 18 percent from the same period last year. The robust August marketing largely reflects the increased placement during the first part of the year.

September prices lower throughout the cattle and beef complex

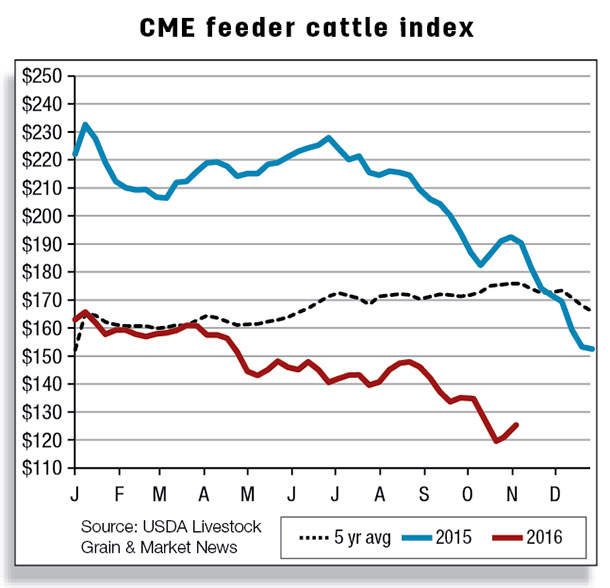

The cattle market continues to decline as large supplies of cattle and generally weak wholesale beef prices pressure the cattle complex. Medium-frame feeder steers in Oklahoma City averaged $134.08 per hundredweight in September, down 7 percent from August and the lowest levels since September 2011.

Cutter-cow prices have also seen sharp declines, with the live equivalent of the 90-percent lean, 500-plus-pounds cows falling to less than $70 per hundredweight in late September. Indications are that – given the increased supply of slaughter animals – prices will remain weak in the near term.

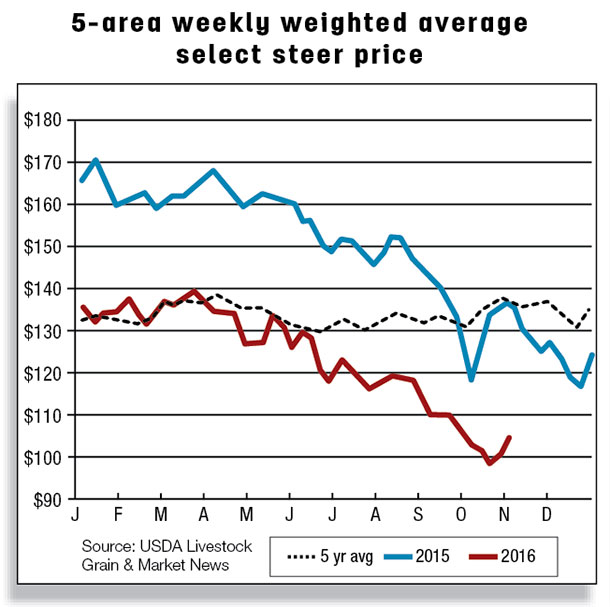

Fed cattle prices have also trended lower. The USDA 5-area fed steer price declined throughout the third quarter, falling to $105.90 in September, the lowest since January 2011. Given the healthy supply of cattle on feed in the first two quarters of 2016, the downward pressure on fed cattle prices is expected to continue in the fourth quarter.

The third-quarter 2016 5-area fed steer price averaged $113.26 per hundredweight. Lower cattle prices are slowly trickling into the retail beef market.

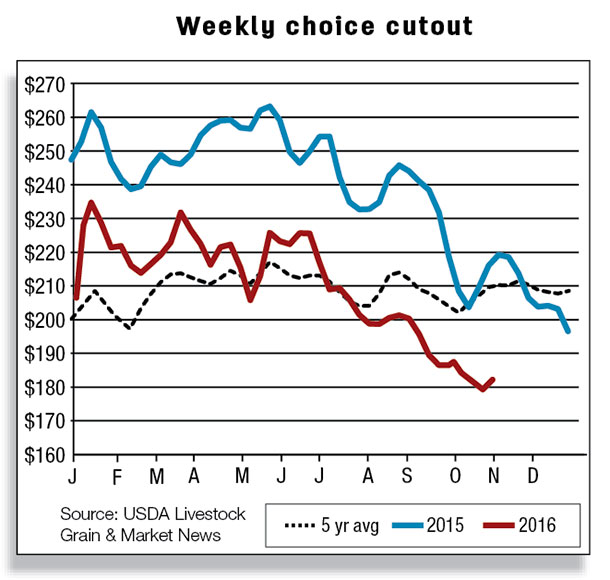

The August Choice retail beef price was quoted at $5.92 per pound. Major components of the retail beef market continued to decline in September. About one-third of the ERS Choice retail beef price is determined by ground beef prices; these have trended downward since this summer.

Beef exports strong in August

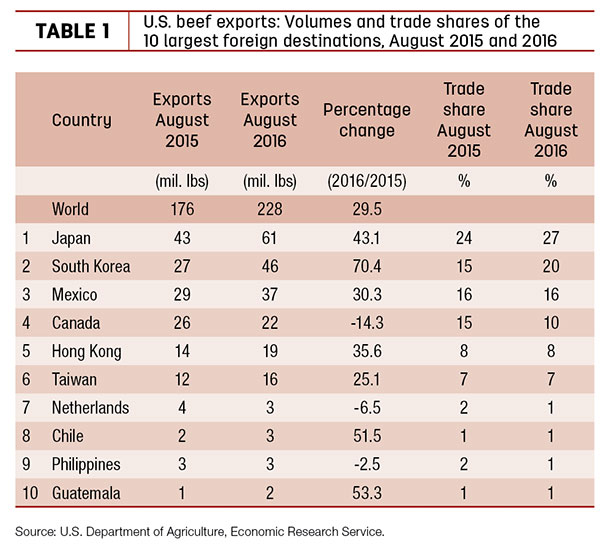

U.S. exports of beef in August were 228 million pounds, almost 30 percent higher than a year ago. Higher exports this year are being largely driven by higher beef production and lower prices in the U.S. and lower production in competitor countries.

Since last year, U.S. beef production has increased and product prices have declined as the beef industry expands after multi-year drought in major beef-producing states. Lower U.S. beef prices make U.S. beef products more competitive abroad at a time when Australia and New Zealand production declines as their production cycles bottom out.

Exports to the 10 largest foreign destinations for exported U.S. beef are summarized in a table. U.S. beef gained market share in Asia, in particular in August, as lower prices enhanced competitiveness of U.S. beef.

Shipments to NAFTA-partner countries were mixed: Exports to Canada were more than 14 percent lower than a year ago on increased production and lower domestic prices in Canada. Exports to Mexico in August were more than 30 percent higher than a year ago, but the higher percent change is somewhat a reflection of a recovery from last year’s lower levels.

With increased U.S. beef production and lower resulting beef prices, Mexican demand for U.S. beef appears to be recovering.

U.S. beef exports are expected to be 660 million pounds in the third quarter (22 percent higher than a year earlier), 655 million pounds in the fourth quarter (10 percent higher than in the fourth quarter of 2015) and 2.47 million pounds for 2016, more than 9 percent greater than 2015.

Beef imports continued year-over-year lower in August

U.S. beef imports in August were 263 million pounds, 16 percent below a year ago. Most of the decline is attributable to sharply lower imports from both Australia and New Zealand: 51 percent and 23 percent, respectively. Beef production in both countries has fallen as producers rebuild herds.

In addition, higher U.S. cow slaughter and abundant supplies of domestic feed cattle end-cuts are likely pressuring demand for imported grinding meat. Imports from Canada and Mexico, on the other hand, were higher than a year ago. Imports from Mexico were 31 percent higher than in August 2015, and shipments from Canada were almost 15 percent above a year ago.

Weaker Canadian and Mexican exchange rates vis-à-vis the U.S. dollar and lower domestic prices from stronger NAFTA beef production largely explain strong year-over-year U.S. demand for Mexican and Canadian beef.

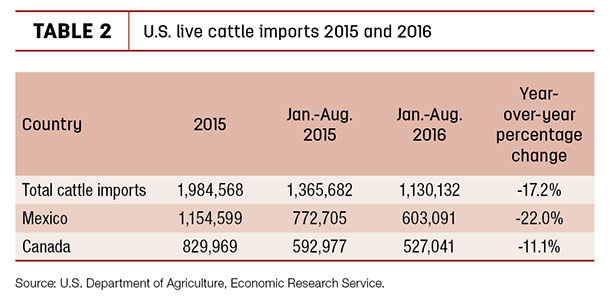

Live cattle imports down 21 percent year-over-year

The U.S. imported 98,209 head of cattle in August, 18 percent below the same period last year. Though live cattle imports from Canada were up about 1 percent in August, declines from Mexico were almost 33 percent lower. Imports began to decline around May, at the same time U.S. feeder cattle prices began to decline.

Declining U.S. feeder cattle prices and fairly good pasture conditions in Mexico are expected to continue to weigh on imports. Live imports in 2016 are forecast at 1.75 million head, down 12 percent from last year. ![]()

Keithly Jones is a market analyst with the USDA – ERS. Email Keithly Jones.