As a result, wheat-pasture cattle will likely be able to remain on pasture until mid-March before heading to feedlots.

This could lead to second-quarter 2015 net placements in feedlots of 1,000-plus head slightly higher year over year but not enough higher to push first-half placements higher year over year.

However, despite expected year-over-year lower total first-half net placements in 1,000-plus-head feedlots, second-half 2015 beef production is forecast to be near 2014 production for the same period because of longer feeding times for steers and heifers, heavier dressed weights for all cattle and more steers and dairy cows in the slaughter mix.

However, despite expected year-over-year lower total first-half net placements in 1,000-plus-head feedlots, second-half 2015 beef production is forecast to be near 2014 production for the same period because of longer feeding times for steers and heifers, heavier dressed weights for all cattle and more steers and dairy cows in the slaughter mix.

Further signs of cow herd rebuilding

The USDA National Agricultural Statistics Service’s Livestock Slaughter report, released Feb. 19, 2015, reported federally inspected (FI) slaughter that consisted of fewer heifers slaughtered in January 2015 (649,300 head) compared with January 2014 (751,500 head).

This represents 35 percent of total FI steer and heifer slaughter of 1.858 million head in January 2015 and 37 percent of 2.051 million head in January 2014.

The reduction of heifer slaughter in the steer and heifer mix is likely a result of producers retaining some extra heifers for breeding purposes.

Thus far in 2015, commercial cow slaughter appears to be largely of dairy cows, which – due to their larger size – has resulted in higher average dressed weights.

However, commercial beef cow slaughter was down by 24 percent, leaving total January commercial cow slaughter down by 11 percent year over year, but indicative of efforts to rebuild the beef cow herd. January 2015 monthly commercial dairy cow slaughter was up 2 percent year over year.

Weekly FI cow slaughter indicates a continuing pattern of relatively high dairy cow slaughter, with average dressed weights for all cows reaching a weekly record high of 663 pounds per carcass.

Incorporating the removal of cows and bulls on feed back to February 2013, the Feb. 20, 2015, Cattle on Feed reported cattle on feed in lots of 1,000-plus head were up in January 2015 compared with January 2014. January marketings were the lowest since the series began in 1996.

First- and second-quarter 2015 marketings are expected to pick up from January levels due to anticipated numbers of heavy cattle coming off of winter wheat pastures in the short term.

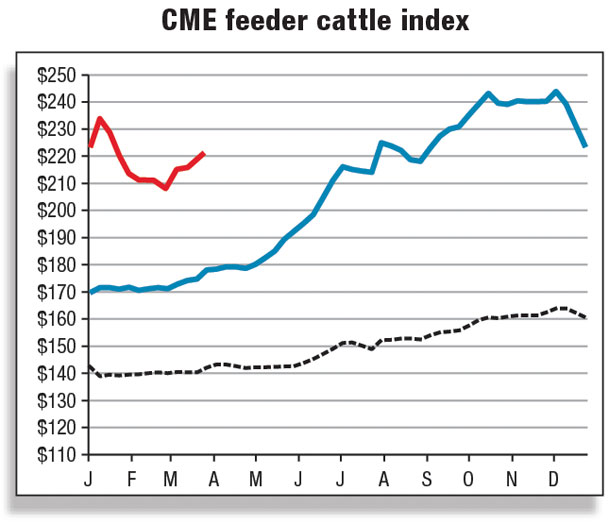

Weekly average 750- to 800-pound feeder steer prices declined through the last week in February 2015 but were still up from the same time in 2014 (figure 1).

Weekly average 750- to 800-pound feeder steer prices declined through the last week in February 2015 but were still up from the same time in 2014 (figure 1).

The combination of heavier dressed weights of cows due to more dairy cows in the slaughter mix and heavier weights for cattle on feed may not be enough to increase first-half 2015 beef production to higher year-over-year levels, but first-half beef production could be close to first-half 2014 levels.

Heavier placement weights this past fall and winter might imply more beef production during the first half of 2015, but the decline of second-half cow slaughter and moderating carcass weights are expected to result in lower second-half beef production.

Fed slaughter reduced despite record retail beef prices

The undertone in the wholesale beef market remains soft but should not be confused with poor demand. From a historical perspective, total meat consumption tends to languish during the winter quarter but is followed by a period of increased consumption as the spring grilling season approaches.

At least in the short term, packers continue to operate in the red as buyers at the wholesale level remain reluctant to significantly increase beef purchases.

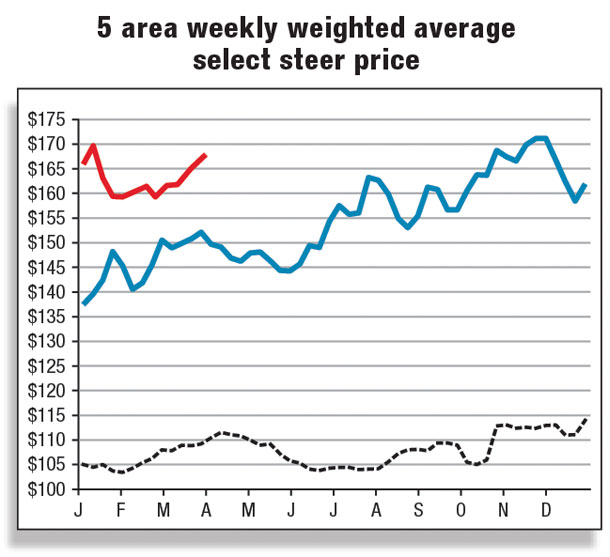

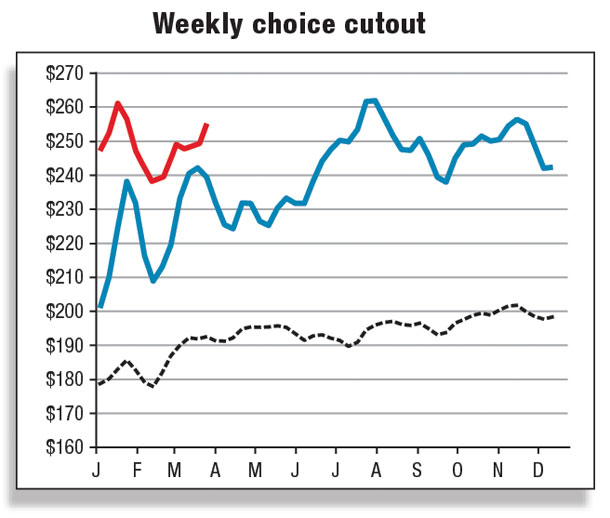

While wholesale beef cutout values did rally noticeably in late February as a result of reduced steer and heifer slaughter, prices have not been high enough for packers to experience a sustained period of positive margins, even though certain components of the cutout – such as 90 percent lean beef – remain at historical record levels.

Retail beef prices rose to record highs in January, with January 2015 choice retail beef at $6.33 per pound – up almost a dollar from this time last year – and all-fresh retail beef at $6 per pound, up more than a dollar from January 2014.

In comparison with competing markets, the spread between beef and pork and beef and chicken remains wide, and this could leave beef at a disadvantage in seasonal consumer purchasing patterns and the mix of retail features on a weekly basis.

The popularity of ground beef remains intact despite ground beef prices above 2014 levels. Lean processing beef prices subsided in February but remained well above the five-year average. Imports of lean processing beef from Australia and New Zealand remain robust and are alleviating some of the upward momentum in the spot lean processing meat markets.

Nonetheless, beef prices are not expected to undergo the large decline anticipated in the pork and poultry markets this year.

Cattle imports down to begin 2015

January cattle imports fell 13.9 percent compared with a year earlier. Imports from Mexico were 2.7 percent lower than last January, and imports of Canadian cattle were also down at 25.9 percent below a year earlier.

Imports of cattle between 400 and 700 pounds were 17.7 percent higher in January, due primarily to gains in Mexico.

The overall decline in cattle imports in January resulted from reduced imports of cattle greater than 700 pounds from Canada, which were 30.3 percent less than in January 2014.

The forecast for U.S. cattle imports in 2015 is unchanged from February and is expected to total 2.3 million head as demand for imported cattle is expected to remain strong through next year due to tight U.S. cattle inventories.

Beef imports rise in January

U.S. beef imports were up notably in January at 63.7 percent compared with a year earlier. Imports rose by the greatest volume from Australia (+123.7 percent), Nicaragua (+99.6 percent) and New Zealand (+38.2 percent).

Demand for imported processing beef expanded rapidly in 2014 due to lower domestic supplies of lean beef. The majority (57.9 percent) of the total increase in beef shipments in January came from Australia, with U.S. imports totaling 120.9 million pounds in January.

A strong U.S. dollar and relatively cheaper prices of imported products have encouraged U.S. imports of beef, which totaled 2.947 billion pounds in 2014. Imports in 2015 are forecast at 2.86 billion pounds.

At 162.7 million pounds, U.S. beef exports in January fell 19.3 percent compared with a year earlier. Despite a significant increase in U.S. beef prices, export volumes to a number of markets had risen in 2014, but January 2015 exports were down in all major markets.

Exports were down to Hong Kong (-32.6 percent), Mexico (-10.7 percent) and South Korea (-28.3 percent). Japan remains the largest market for U.S. beef, but shipments were down 15.4 percent for the year.

Exports to Canada also declined in January (-23.6 percent) as the combination of higher U.S. prices and a weaker Canadian dollar took a toll on Canadian demand for U.S. beef. Exports are forecast to fall in 2015 to 2.4 billion pounds due to lower expected U.S. beef production and a strong dollar. ![]()

On March 17, the fourth quarter 2014 and total 2014 commercial beef production estimates reported in the Red Meat Forecast table of the March 2015 Livestock, Dairy and Poultry Outlook were corrected.

The correct fourth quarter 2014 production number is 6,023 million pounds, and the correct 2014 total beef production is 24,252 million pounds.

Kenneth Mathews is coordinating analyst for the USDA Economic Research Service. Analyst Mildred M. Haley assisted with this report.