According to Crop Progress for the week ending Nov. 8, 2015, 51 percent of selected states reported winter wheat conditions to be good or better – lower than this time last year. However, despite recent precipitation, the U.S. Drought Monitor continues to indicate serious drought in much of the West, especially California.

Heavy cattle placed in feedlots

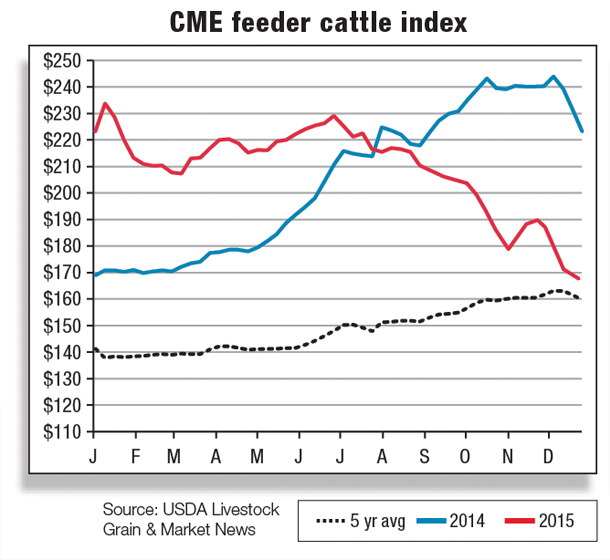

Feeder cattle supplies outside feedlots on Oct. 1, 2015, were 3.4 percent higher than Oct. 1, 2014 inventories and were higher year-over-year for all of 2015. These feeder cattle supplies persist despite the pace of placements being below year-earlier levels in seven of the first nine months of the year.

While the October release of the NASS Cattle on Feed report contained no real surprises, it did provide some insight into two ongoing phenomena: recent marketings of cattle from feedlots of 1,000 head or more and heifer retention for cow herd expansion.

The Cattle on Feed report showed ongoing year-over-year higher placements of feeder cattle weighing more than 800 pounds, a scenario that has been playing out every month in 2015 except for May, when there was no change from May 2014.

These heavy feeder cattle have accounted for an average of 40.5 percent of net placements of cattle in feedlots of 1,000-plus head for each month thus far in 2015, well above a norm in the 25 percent range.

Typically, heavy cattle are on feed for a relatively shorter period of time. For most of 2015, these cattle have been retained on feed for atypically long periods and have contributed significantly to year-over-year larger cattle-on-feed inventories and the record heavy weights of cattle marketed in 2015.

A calculated ratio of 800-plus-pound placements of cattle (lagged either five or six months) to marketings averaged 38.8 to 38.9 percent, compared with a more typical 30 percent, which implies that these heavyweight feeder cattle have likely constituted a larger-than-normal proportion of cattle marketed over the last several months.

Feeding periods could shorten and help keep feedlot inventories of market-ready cattle more current than they have been for most of 2015; however, these heavy, 800-plus-pound cattle are likely to provide large numbers of market-ready cattle – disproportionately steers – through at least the first quarter of 2016 (or longer, if 800-plus-pound feeder cattle continue to be placed in year-over-year larger numbers).

Total third-quarter cattle placements in 1,000-plus feedlots were down 3 percent compared with last year. Given that pasture conditions have improved and live cattle prices are lower than in 2014, producers may be waiting for market conditions to improve before selling cattle.

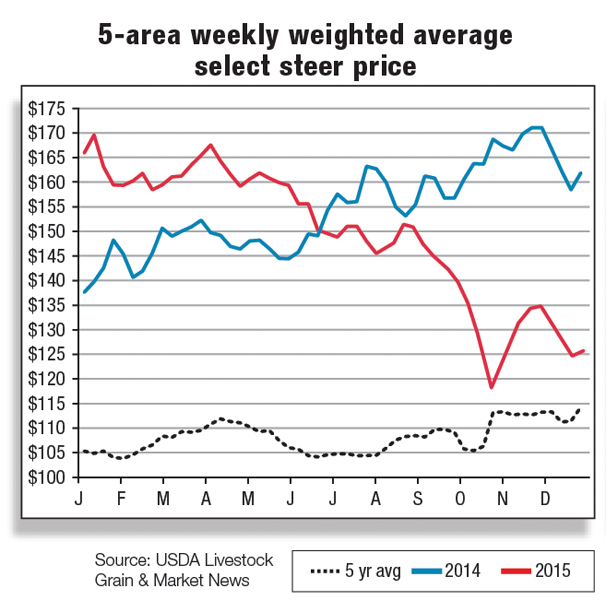

The Oklahoma National Stockyards prices on Nov. 9, 2015, for medium No. 1 feeder steers weighing 750 to 800 pounds, ranged between $169 and $177 per hundredweight – down around $40 compared with this time last year. The USDA projects fourth-quarter five-area direct total all-grades steer prices to be $130 to $134 per hundredweight, down more than $30 compared with 2014.

While September 2015 placements in the 800-plus-pound category were up nearly 8 percent over last year, the backlog of very heavy market-ready cattle in the feedlots may clear out in the fourth quarter.

In addition, packers have increased the discounts on very heavy cattle. Generally speaking, the fourth quarter tends to see a seasonal upswing in placements; they are expected to pick up in the last quarter and may spill over into the early part of 2016.

Marketings will be impacted if placements are delayed. Like third-quarter placements, marketings were down in third-quarter 2015 compared with third-quarter last year.

Cattle are spending longer periods on feed primarily because feed costs are relatively low, and the current market does not provide much incentive to sell fed cattle. Early November 2015 live cattle prices picked up compared with early October’s sharply lower prices. For the week ending Nov. 8, 2015, five-area all-grade fed steers were $130.40 per hundredweight, roughly $30 lower than year-earlier fed steer prices.

Cattle marketed in November 2014 were the last to exhibit positive cattle-feeding margins. October 2015 margins were negative by more than $500 per head and could easily continue in the red until at least January 2016 (High Plains Cattle Feeding Simulator).

These negative margins will likely exert even more downward pressure on feeder cattle prices, as well as on cow price, and could temper enthusiasm for what has appeared to be a rapid buildup in U.S. cow inventories.

Herd expansion signals

As herd rebuilding takes place, the proportion of heifers on feed continues to decrease relative to the proportion of steers on feed. The October 2015 Cattle on Feed report provided some evidence of continued herd expansion as the inventory of heifers and heifer calves on feed in 1,000-plus-head feedlots on Oct. 1, 2015, was down 7 percent year over year.

This fact, combined with the year-over-year 7 percent larger inventory of steers on feed on Oct. 1, suggests that heifers are likely being held back for breeding purposes. The Cattle report, scheduled to be released Jan. 20, 2016, will provide a clearer indication of the cattle inventory situation.

Due to the increased proportion of steers in feedlots and relatively low feed costs, producers are choosing to manage cattle at heavier-than-traditional weights.

The five-area weekly weighted average direct slaughter total of all-grades fed steer live weights was 1,489 pounds for the week ending Nov. 8, 2015, up 40 pounds compared with the same week last year.

September 2015 dressed weights for steers in federally inspected slaughter facilities climbed to an average of 920 pounds (Livestock Slaughter), for the first time in the history of the series surpassing the average dressed weight of bulls (910 pounds).

Cattle carcass weights increase, packer margins under pressure

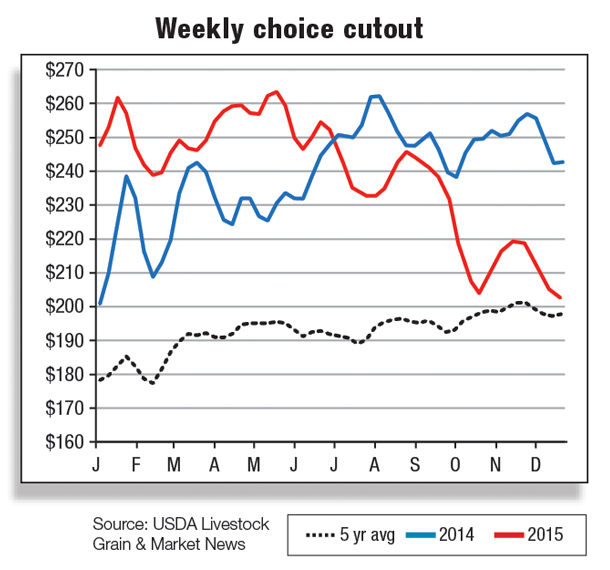

Cattle carcass weights are at record levels and continue to increase counter-seasonally. As of the week ending Oct. 24, average steer weights were reported at 927 pounds (+3 percent year-over-year) and average heifer weights at 841 pounds (+2 percent year-over-year).

Several factors have contributed to the rapid increases in cattle weight gain. First, the costs of feeding cattle have become considerably lower, and there is excess capacity in the feeding sector. Second, the number of cattle placed during the first-through-third quarters has remained well below year-prior levels, giving feedlot owners more incentive to keep animals on feed longer to extract extra revenue for each additional pound of weight gain.

The result is heavier animals being marketed and slaughtered. Last, due to favorable pasture conditions, animals have been placed in feedlots at heavier-than-normal placement weights at more than 800 pounds, as reported in the USDA NASS Cattle on Feed.

The bottom line is that the gains in cattle carcass weights have helped to partially offset commercial beef production declines amid tight cattle supplies, a trend expected to continue during the remainder of 2015.

Beef processing margins continue to deteriorate. Even though wholesale beef prices have increased from lows posted in October, prices still remain well below last year.

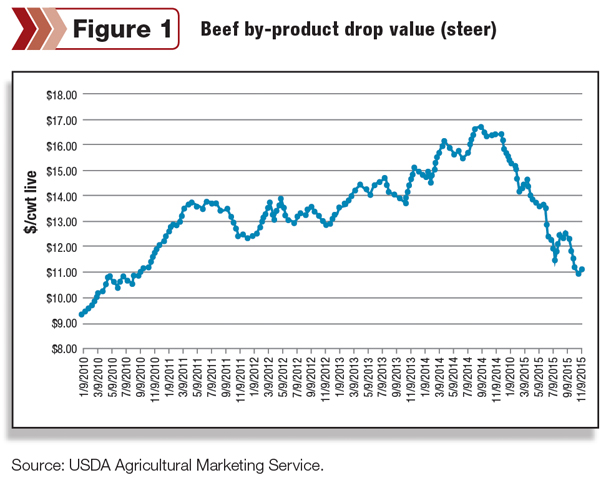

At present, beef demand appears fragile; weak interest in the ground beef complex and sharp drops in the value of byproducts such as hide and offal continue to weigh on packers’ operating margins. Packers are attempting to support their margins by constraining front-end supplies to force the live cattle market lower.

So far this year, beef packers have remained disciplined with this strategy when margin pressures arise. However, seasonal trends suggest that beef cutout values should start to move higher post-Thanksgiving, potentially improving beef processing margins.

The USDA revises live cattle imports lower in 2015 and 2016

Due to constrained cattle supplies in Canada, year-to-date live cattle imports from Canada continue to trend well below 2014 levels. From January through September, total live cattle imports from Canada were down about 23 percent compared to the previous year.

However, it is important to highlight that the bulk of the decline in total cattle imports from Canada is the result of sharp declines in slaughter-ready cattle as opposed to feeder cattle imports.

Feeder cattle imports from Canada have declined year-over-year but not to the extent that slaughter cattle imports have declined.

Year-to-date, feeder cattle imports from Canada are down approximately 4 percent relative to last year, while all cattle imports ready for slaughter declined around 34 percent relative to last year. For Mexico, however, live feeder cattle imports remain brisk relative to the pace of shipments during 2014 due to the wide price differential between Mexican feeder cattle prices and higher U.S. feeder prices.

The light pace of cattle imports from Canada is expected to continue through the end of the year, more than offsetting increased live animal shipments from Mexico, resulting in a 25,000-head reduction to the 2015 annual live import forecast from last month. As U.S. domestic inventories increase in 2016, it is expected that demand for live cattle will diminish, resulting in an 8 percent year-over-year decline in 2016.

U.S. beef exports plummet in September; imports remain historically high

The general take-away from the January-to-September period of 2015 is that the U.S. beef exports have suffered a significant setback this year, and annual 2015 exports are expected to fall below 2014 levels by 14 percent. Overall, beef exports for the month of September were reported at 165 million pounds, nearly 25 percent below year-ago levels.

Year-to-date, the U.S. has shipped approximately 1.7 billion pounds of beef abroad, 13 percent less than the same period in 2014. The relative strength of the U.S. dollar to other major currencies, high U.S. beef prices and overall tight domestic supplies remain problematic for U.S. beef exports.

However, the record pace of less expensive Australian beef has also played a significant role in the global decline for U.S. beef exports by capturing a greater percentage of global market share in top trade destinations. Increasing beef availability and lower prices are expected to spur renewed interest in U.S. beef in 2016, boosting exports more than 9 percent.

On the flip side, U.S. beef imports remain at historically high levels. Total beef imports for September were reported at 289 million pounds, with Australia accounting for 46 percent.

Currently, Australia is more than three-quarters through its tariff-free quota for the year. While the brisk pace of processing beef from Oceania has boosted 2015 beef imports into the U.S. to very high levels, it is expected that imports of lean processing beef from Australia and New Zealand will decline significantly during the fourth quarter as the two countries seek to avoid triggering their respective over-quota tariffs.

Looking ahead into 2016, overall beef imports are expected to decline by 11 percent as a result of increases in U.S. domestic supplies and decreases in the volume of processing beef shipped from Australia. ![]()

Kenneth Mathews is coordinating analyst for the USDA Economic Research Service. Analyst Mildred M. Haley assisted with this report.