Based on the average of the weekly weights reported in Agricultural Marketing Service (AMS) Actual Slaughter Under Federal Inspection reports through the week ending Sept. 25, 2021, the estimated average cattle carcass weight for cattle was 829 pounds, 7 pounds above average carcass weights for the first four weeks of August 2021, but 14 pounds less than the similar period in September 2020. Dressed weights for steers and heifers were also heavier in September than the previous month.

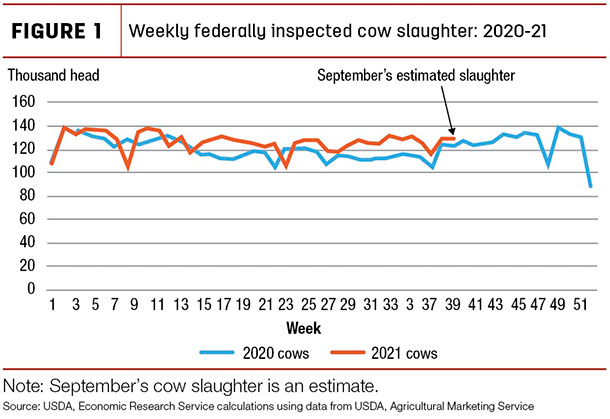

According to the National Agricultural Statistics Service (NASS) Livestock Slaughter report, the estimated pace of beef and dairy cow slaughter for August was 6% above a year ago, and estimated cow slaughter in the first four weeks of September was almost 7% higher than 2020. Figure 1 displays weekly cow slaughter in 2020 and 2021.

As shown, cow slaughter in 2021 has been above 2020 slaughter levels from the week ending April 10 (week 15) through the week ending Sept. 25 (week 39), with the exception of the week ending June 5 (week 23), when cow slaughter was about 14,000 head lower than a year ago. The increase in cow slaughter is likely the result of weaker margins in the dairy sector, which is affecting herd decisions and concerns about forage availability and continued drought in parts of the country. These conditions are expected to result in increased cow slaughter in the fourth quarter.

The 2022 annual beef production forecast was raised 120 million pounds from last month to 26.995 billion pounds on higher anticipated cattle slaughter. Dry conditions are expected to support relatively large placements in the second half of 2021, supporting a higher forecast of fed cattle slaughter in 2022. However, production in the second half of the year will reflect lower placements as a result of expected tighter supplies of cattle outside feedlots in 2022.

Cattle price forecasts lowered for fourth quarter 2021 but raised for 2022

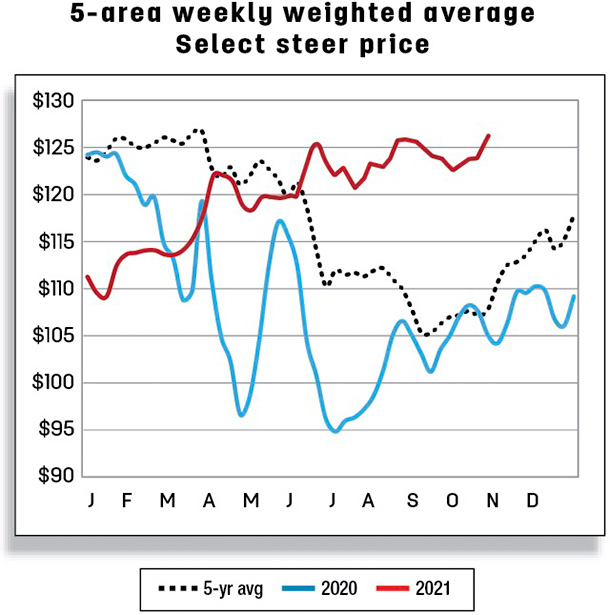

Live steer prices in the 5-area marketing region for the first week of October were reported at $122.56 per hundredweight (cwt), $15 higher than the same week last year. The fourth-quarter price forecast was lowered by $4 to $127 per cwt on seasonal trends and large supplies of fed cattle. However, the fed cattle price forecast for the second half of 2022 was raised on anticipated firm demand and tighter fed cattle supplies.

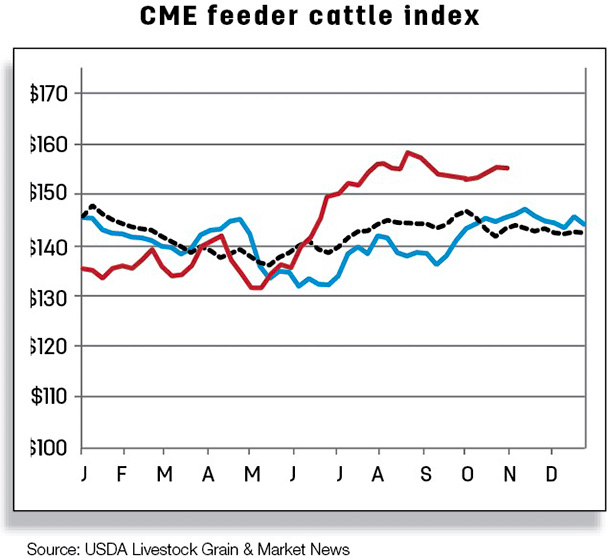

Feeder steer prices for the week ending Oct. 4, 2021 averaged $152.55 per cwt for steers weighing 750-800 pounds in the Oklahoma City National Stockyards, over $8 above the average price recorded the same week a year earlier. The fourth-quarter forecast was lowered by $4 to $151 per cwt as placements during the quarter are expected to be larger than previously expected. The 2021 annual forecast for the feeder steer price was reduced to $144.80 per cwt, down about $1 from last month. The annual forecast for 2022 was revised up to $155.50 per cwt on tighter anticipated feeder cattle supplies in the second half of the year.

Beef import forecasts raised for 2021 and 2022

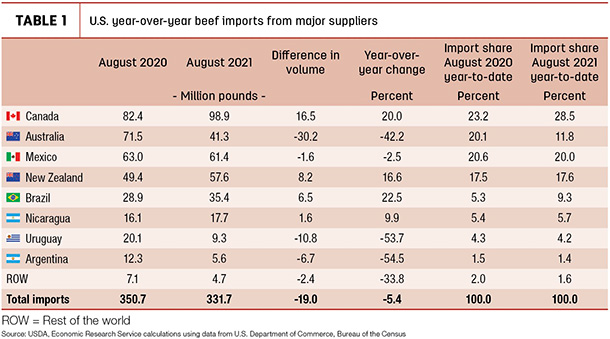

August beef imports totaled 332 million pounds, just over 5% lower year over year compared to last year’s high number (Table 1).

Beef imports in August were 25% above 2019 levels and 16% over the five-year average. These were the second-highest beef imports for the month of August, behind last year’s record number.

Monthly imports from Canada, Brazil and New Zealand were notably higher year over year. The 98.9 million pounds from Canada was a year-over-year increase of 20%, the highest monthly import since 2005. Brazil also contributed to the high monthly imports with 35 million pounds, a year-over-year increase of 6.5 million pounds, or 23%. In August, Canada and Brazil had the greatest increase in year-to-date import shares compared to last year.

Imports from New Zealand increased year over year by 17%. These imports are typically very seasonal, decreasing from a peak in June or July to a low in November. Monthly imports from New Zealand increased from July to August for the first time in 20 years.

The third-quarter beef import forecast was increased by 45 million pounds to reflect recent trade data and strong domestic beef demand. The annual forecast for 2021 was raised to 3.187 billion pounds. Annual imports for 2022 were also raised by 15 million pounds to 3.165 billion pounds, based on continued strength in beef demand and lower expected cow slaughter.

Beef exports up in August on robust shipments to China and Japan

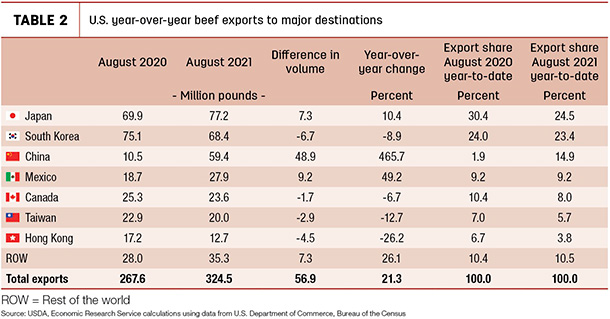

U.S. beef exports in August set a new record of 325 million pounds, an increase of 57 million pounds, or 21%, from a year ago (Table 2).

August’s increase in beef exports was driven primarily by China’s strong demand for U.S. beef. Gaining access to China’s market in March 2020, coupled with China’s low domestic pork supplies and Australia’s limited exportable beef supplies, has favored the U.S. Since July 2020, monthly exports to China have been record-large in 10 months. China is now the U.S. third-largest beef destination.

The U.S. largest beef exports in August went to Japan, totaling 77 million pounds, up 10% from the previous year. Beef exports to Japan from May to August were 13% higher compared to the same period a year ago, partially due to the lowering of Japan’s tariff rate from 38.5% to 25% on April 17. Mexico was another key trading partner that contributed to the increase in beef exports in August; U.S. beef exports to Mexico were up 9.2 million pounds, or 49%, from a year ago when exports were limited by economic weakness in Mexico and COVID-19-related constraints. Year to date, Mexico’s share of U.S. beef exports has been relatively stable at 9%.

In contrast, lower year-over-year beef exports were shipped to four of the seven major U.S. beef destinations in August. Exports to South Korea, the second-largest U.S. beef destination, were 6.7 million pounds or 9% lower, accounting for the majority of the reduction among the major U.S. beef destinations. U.S. beef exports to Hong Kong were down 26%, or 4.5 million pounds, from a year ago, while key trading partners Taiwan and Canada were 2.9 and 1.6 million pounds lower year over year, respectively. The fourth-quarter forecast for beef exports was unchanged from last month. The annual beef export forecasts for 2021 and 2022 were also unchanged from last month at 3.414 and 3.27 billion pounds, respectively. ![]()

Hannah Taylor is an agricultural economist with the USDA Economic Research Service. Email Hannah Taylor.

Christopher G. Davis is an agricultural economist with the USDA – Economic Research Service. Email Christopher G. Davis.