The reduction in carcass weights is due to a combination of a higher proportion of cows expected in the slaughter mix and the residual impact of winter weather on fed cattle performance (i.e., on steers and heifers). Based on the USDA Agricultural Marketing Service (AMS) weekly slaughter report for the week ending March 30, 2019, steer and heifer carcass weights are down 7 and 8 pounds, respectively, from the same time a year ago. Overall, average cattle carcass weights are down 12 pounds from year-earlier levels.

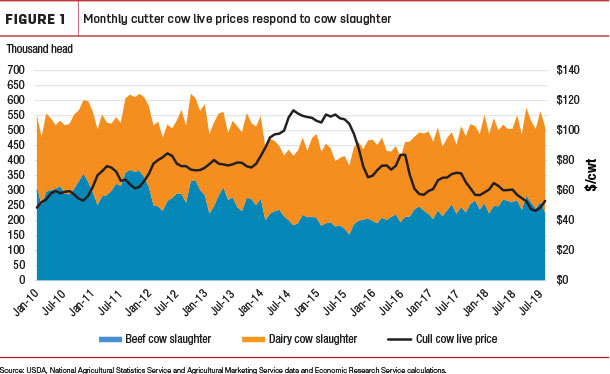

Cow slaughter is expected to be above 2018 levels, particularly of dairy cows as dairy producers respond to sustained low returns, but beef cow slaughter has also been above 2018 for much of the year. To the extent that the availability of cows for slaughter remains high, these supplies are expected to keep cull cow prices under pressure as the year progresses. Based on the expected increase in cow slaughter, the price forecast for live cutter cows is lowered to $52 to $54 per hundredweight (cwt).

This is below the 2018 average of $57.43 per cwt and well below the five-year average price of $79.22 per cwt. Note the average monthly price over the last five years occurred when the cattle herd was in expansion mode and more cows were being retained in the herd. However, as the rate of expansion has slowed since 2014, monthly cutter cow live prices have declined with the rise of monthly beef and dairy cow slaughter (Figure 1).

Cattle on feed over 150 days to return to five-year average levels

The March Cattle on Feed report – released by the USDA National Agricultural Statistics Service on March 22 – estimated there were 1.8 percent more net placements and 0.5 percent more marketings year-over-year in February, for a March 1 cattle on feed number of 11.8 million head. This was the first positive year-over-year change in placements of cattle into feedlots since August 2018.

Further, the number of cattle held on feed over 150 days continued to build. Compared to March 2018, there were almost 23 percent more cattle on feed over 150 days in March 2019. Anticipated feedlot placements and marketings of fed cattle for slaughter in the coming months will likely bring the proportion of cattle on feed over 150 days into closer alignment with the five-year average levels in the coming quarters.

Feeder calf prices raised in second- and fourth-quarter 2019

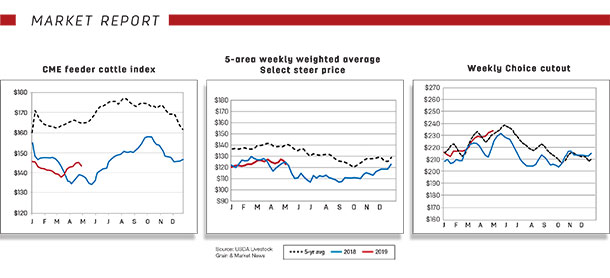

As described above and in the last few Outlook reports, large supplies of cattle in feedlots and a slower-than-expected pace of marketings in the first two months of 2019 have led to larger supplies of cattle on feed over 150 days. However, a greater proportion of market-ready cattle is expected to be sold for slaughter in the second quarter. This is expected to support the demand for feeder calves for placement into feedlots. Recent price data and expectations of stronger feedlot demand underpinned an increase in the second-quarter feeder calf price.

The second-quarter 2019 price was raised $2 at the midpoint to $144 to $150 per cwt. The fourth-quarter 2019 price was also raised $2 at the midpoint to $140 to $152 per cwt based on expected increased demand by feedlots. As a result, this month’s annual price forecast for 2019 was raised to $143 to $150 per cwt.

As mentioned, these large supplies of market-ready cattle in feedlots have experienced a tough winter, and the performance of steers and heifers in the feedlot has suffered. Given how long feedlot operations have had to feed these animals, the feedlots may be more inclined to take prices offered than to feed their cattle longer to recover the lost weight. As a result, the momentum of the weekly 5-area steer price may have limited upward support, particularly given the strong number of market-ready cattle in early 2019. However, based on expected strength of beef demand as the year progresses, the 2019 annual price forecast was left unchanged at $117 to $122 per cwt.

Beef imports increased in January

U.S. beef imports in January were 2 percent above year-earlier levels at 253 million pounds. Imports were greater from all major suppliers except New Zealand. In January, imports from New Zealand, which in January 2018 was the largest supplier to the U.S., declined 36 percent year-over-year in January 2019, the lowest for the month since 2012. Production declines, along with increasing shipments of those limited supplies to key Asian markets, were likely drivers for this decline.

The U.S. beef import forecast for 2019 was left unchanged from the previous month’s forecast at 3.01 billion pounds.

Record U.S. beef exports in 2018

Beef exports in 2018 increased about 300 million pounds, or more than 10 percent, to 3.156 billion pounds from 2017. Exports were higher from year-earlier levels to most of the major destinations, excepting Hong Kong and Canada. This was the third consecutive year of double-digit growth, each year with record-high volumes. Expected overseas demand and readily available exportable U.S. beef supplies result in the 2019 export forecast being unchanged from the previous month’s forecast at 3.255 billion pounds.

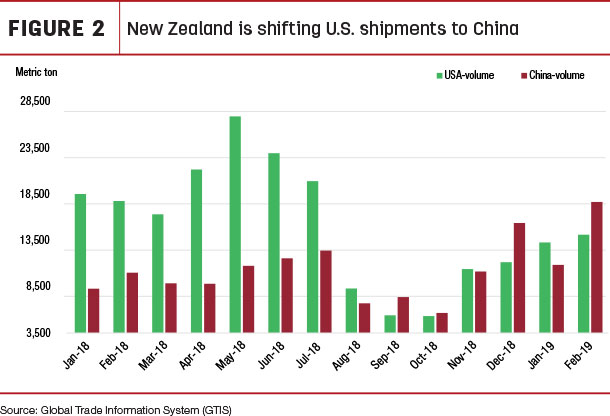

New Zealand shifting shipments to China

The price of imported beef in the U.S. declined in fourth-quarter 2018 and, as a result, many U.S. suppliers – mainly Oceania – shifted products to Asian markets. Although the price of imported beef in the U.S. has increased in early 2019, shipments from Oceania to Asian markets continue to rise, mostly to fill Chinese demand. From January through February 2019, New Zealand reported an increase of shipments to China and fewer shipments to the U.S. as compared to the same period the previous year (see Figure 2).

January beef exports declined year-over-year

U.S. beef exports in January 2019 were 238 million pounds, down 2 percent from year-earlier levels. This was the first year-over-year decline in monthly U.S. beef exports since June 2016. Declines to Hong Kong, Canada and Chile more than offset increases to the major export markets. Notably, exports to Hong Kong declined by 44 percent year-over-year, continuing a declining trend since April 2018.

The USDA Foreign Agriculture Service weekly Export Sales reports for February and March 2019 do not indicate stronger shipments. Based on lower January exports, and moderate weekly estimates for February and March, the first-quarter 2019 beef export forecast was revised downward by 10 million pounds to 760 million pounds. However, as small adjustments were made to the quarters, the 2019 full-year forecast remained unchanged from the previous month’s forecast at 3.255 billion pounds.

Cattle import forecasts higher

U.S. cattle imports in January 2019 were 142,628 head, up 25 percent year-over-year. Imports were higher from both Mexico (+19,174 head) and Canada (+9,178 head). Increased cattle production in Mexico is potentially permitting more cattle to be shipped to the U.S. The available pastures in the U.S. are likely supporting this higher shipment, as imported cattle from Mexico are often backgrounded on grass prior to feedlot placement. AMS weekly sales reports indicate stronger year-over-year imports for February and March. Based on these grounds, 2019 U.S. cattle imports were revised upward by 20,000 head to 2 million head.

In January 2019, U.S. cattle exports were 22,917 head, a threefold rise from the previous year and the highest for the month since 2001. Most of the exports were to Canada, where they have increased, likely driven by growing demand from Canadian feedlots. ![]()

Analyst Lekhnath Chalise assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.