In third-quarter 2018, the pace of steer and heifer slaughter in July and August was slower than expected. Although slaughter in September will likely reflect rates of per-day slaughter slightly above last year, there is one less slaughter day in the month of September than last year.

Based on the latest NASS Cattle on Feed report, a higher percentage of steers and heifers were on feed longer than a year ago, which is not yet showing up in the weekly average dressed weights. As a result, for the week ending Sept. 1, average dressed weights for heifers were 8 pounds above last year, while steers were 2 pounds below a year ago.

The slower pace of steer and heifer slaughter may suggest some of the cattle that might have been marketed in the third quarter will be marketed in the fourth quarter. On the other hand, cow slaughter remains strong through the third quarter, but the higher proportion of typically lighter-weight cows is negating some of the seasonal increases in steer and heifer dressed weights.

As a result, the third-quarter beef production forecast is reduced as higher anticipated cow slaughter is nullified by the lower-than-expected steer and heifer slaughter and lower cattle dressed weights.

Beef production is forecast higher in fourth-quarter 2018 as a result of higher anticipated cow slaughter and the expectation some of the fed cattle that might have been marketed in the third quarter are expected to come out in the fourth quarter. This will likely elevate steer and heifer dressed weights in the fourth quarter.

The 2019 beef production forecast was left unchanged at 27.7 billion pounds.

Fall seasonal pricing to take effect

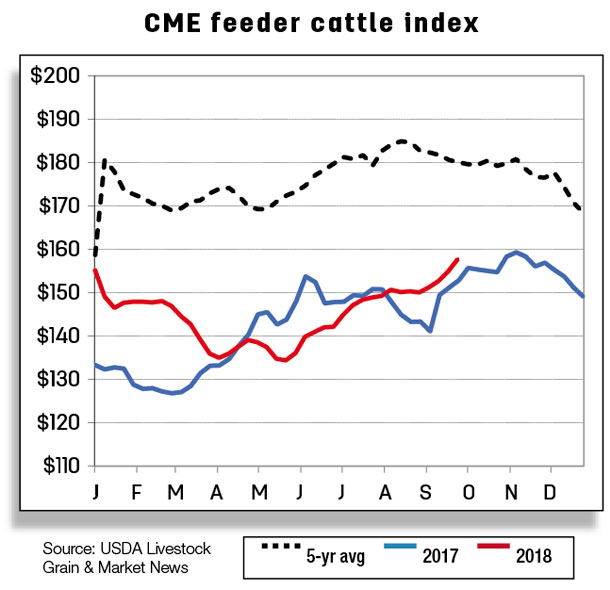

Feeder cattle prices have shown strength through the summer, but seasonal pressures will likely take hold, moving prices lower in the fourth quarter. Prices typically decrease when the spring-born calves (about two-thirds of the annual calf crop) are brought to market in the fall.

Assuming normal weather in the Great Plains, availability of winter forages for backgrounding could bolster prices in fourth-quarter 2018. Third-quarter 2018 price forecast was raised to $148 to $151 per hundredweight, and the fourth-quarter 2018 price forecast was increased to $143 to $151 per hundredweight. The forecast of the 2019 feeder steer annual price was raised to $139 to $151 per hundredweight on the basis of lower corn prices forecast for the following marketing year.

Assuming normal weather in the Great Plains, availability of winter forages for backgrounding could bolster prices in fourth-quarter 2018. Third-quarter 2018 price forecast was raised to $148 to $151 per hundredweight, and the fourth-quarter 2018 price forecast was increased to $143 to $151 per hundredweight. The forecast of the 2019 feeder steer annual price was raised to $139 to $151 per hundredweight on the basis of lower corn prices forecast for the following marketing year.

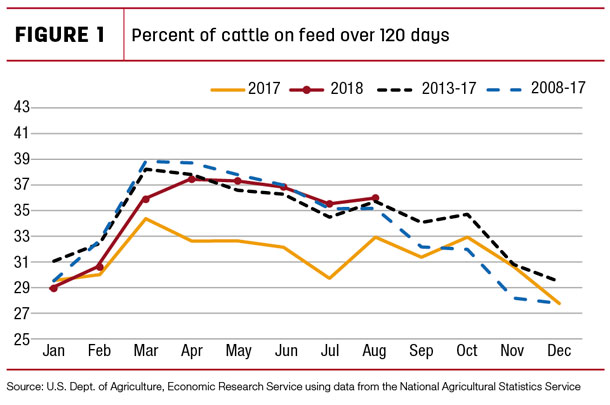

Regarding fed cattle prices in second-half 2018, feedlots seem to have resisted recent lower prices from packers, which may be reflected in a greater proportion of cattle on feed over 120 days, as shown in the figure. To the extent these cattle are remaining on feed longer as producers respond to the prospects of higher future prices, there could be a shift of some marketings from the third quarter to the fourth.

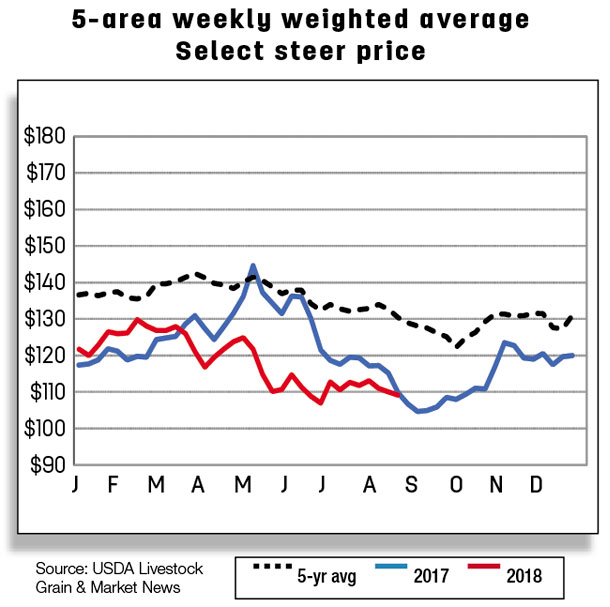

The fed steer price forecast for the 5-area marketing region in third-quarter 2018 is $108 to $111 per hundredweight, but the fourth-quarter forecast is lowered to $108 to $114 per hundredweight, in line with expectations of increased marketings. The 2019 fed steer price forecast is unchanged from the previous month.

Beef exports continue record pace

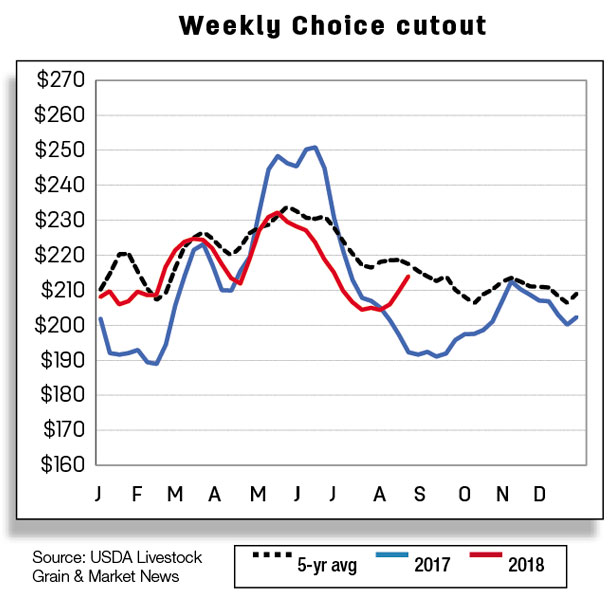

In July, U.S. beef exports reached 279 million pounds, an almost 17 percent increase from 2017, bringing total beef exports for 2018 through July to 15 percent above the same period a year ago.

Through July, the major Asian markets for the U.S. – Japan, South Korea, Taiwan, Hong Kong and the Philippines – drove this strong record pace with a combined share of nearly 65 percent of the volume of exports. U.S. beef exports to North American markets are also exhibiting positive growth, with a year-over-year share of 24 percent of the market through July, a 6 percent growth so far this year.

Through July, the major Asian markets for the U.S. – Japan, South Korea, Taiwan, Hong Kong and the Philippines – drove this strong record pace with a combined share of nearly 65 percent of the volume of exports. U.S. beef exports to North American markets are also exhibiting positive growth, with a year-over-year share of 24 percent of the market through July, a 6 percent growth so far this year.

Mexico leads North America with 10 percent year-over-year growth, while exports to Canada are 0.7 percent above last year. Based on the strong pace of exports through July and USDA Foreign Agricultural Service Export Sales reports through August, the 2018 beef export forecast was raised by 40 million pounds to 3.164 billion pounds. The 2019 beef export forecast was raised 40 million pounds from the previous month to 3.245 billion pounds.

Imports of U.S. beef in July reached 295 million pounds, down almost 2 percent from a year ago. The cumulative year total through July is 1.822 billion pounds, less than 1 percent above a year ago. The beef import forecasts for 2018 and 2019 are unchanged from last month. ![]()

Analyst Lekhnath Chalise assisted with this report.