Placements were up 10 percent over October of 2016.

Feedlots appear to be moving cattle as they are ready for market. Marketings of fed cattle during October were 6 percent above the same period in 2016. As marketing remained relatively high, the percentage of cattle on feed more than 120 days was below 2016.

The November 2017 Livestock Slaughter report shows average dressed weights were 826 pounds, down 17 pounds from October 2016. Carcass weights for both steers and heifers were below year-earlier in October, and preliminary data points to a similar situation in November.

The November 2017 Livestock Slaughter report shows average dressed weights were 826 pounds, down 17 pounds from October 2016. Carcass weights for both steers and heifers were below year-earlier in October, and preliminary data points to a similar situation in November.

Fourth-quarter 2017 production was lowered from the previous month due to lighter carcass weight and a slower pace of slaughter through year-end. Average dressed weights for cattle remain well below the same period in 2016.

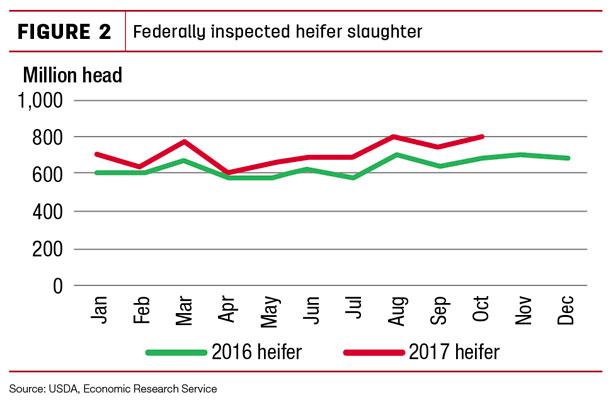

In addition to the lighter carcass weights for both steers and heifers, their composition of the slaughter mix has likely influenced average dressed weights. The proportion of heifers and cows slaughtered relative to total slaughter has increased relative to last year, and heifers and cows are typically smaller and yield lower carcass weight than steers.

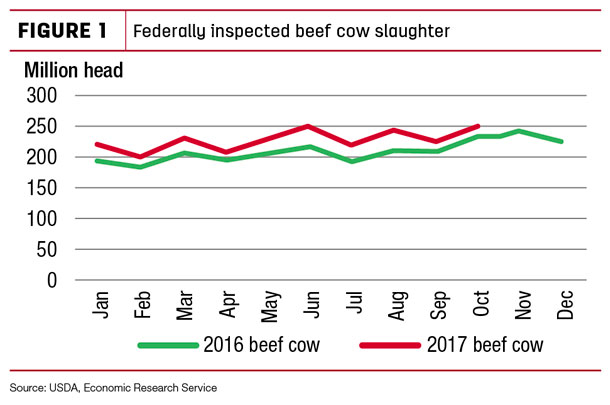

Increased beef cow and heifer slaughter signal possible slowing in beef herd expansion

The beef cow inventory has been in expansion mode since 2015, with inventories on Jan. 1, 2015, 2016 and 2017 increasing at increasing rates of 0.7 percent, 2.9 percent and 3.5 percent, respectively. However, the pace of beef cow and heifer slaughter suggests the rate of expansion may have slowed in 2017.

Beef cow slaughter through October 2017 was 11 percent higher than the same period in 2016. Preliminary federally inspected beef cow slaughter in November has also been fairly strong and higher than November last year. Heifer slaughter has also seen a 12 percent increase through October 2017, while steer slaughter has only increased by about 3 percent.

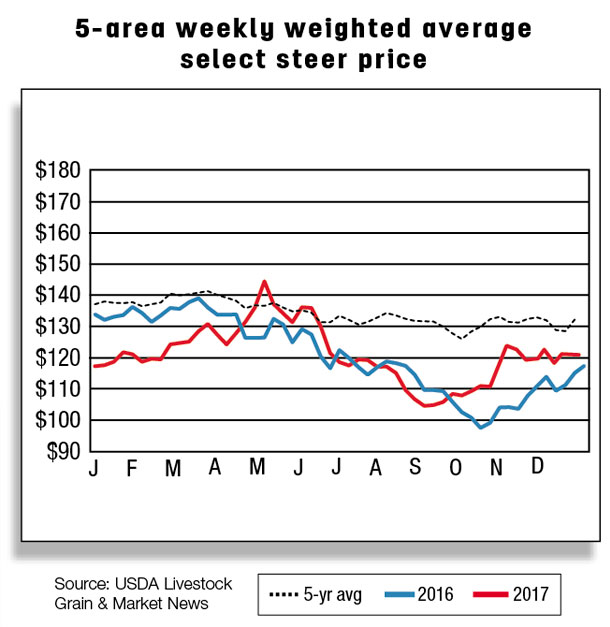

Prices pressured across the cattle complex

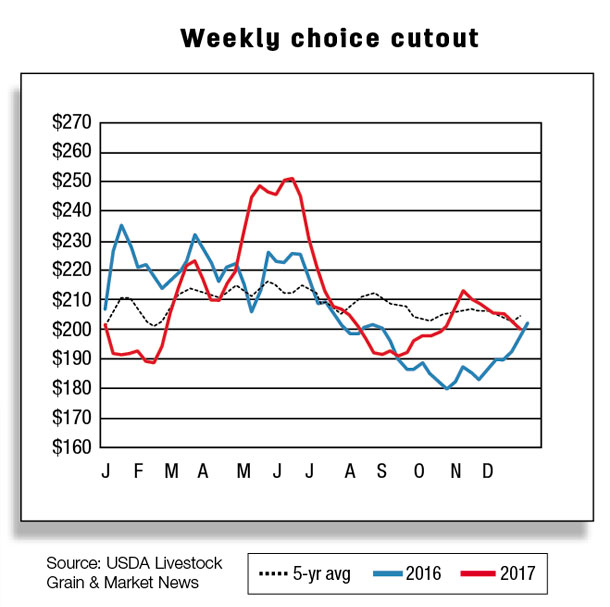

Fed cattle prices edged higher early in the fourth quarter, but the availability of market-ready cattle – and nearby futures prices, which are likely encouraging cattle feeders to remain current in their marketings – have been pressuring cash prices. In addition, wholesale prices appear to be at or near their seasonal peak.

The November fed steer price averaged $121.37 per hundredweight, but prices in early December have been trending lower. As a result, the fourth-quarter fed steer price forecast was lowered slightly to $116 to $119 per hundredweight.

The November fed steer price averaged $121.37 per hundredweight, but prices in early December have been trending lower. As a result, the fourth-quarter fed steer price forecast was lowered slightly to $116 to $119 per hundredweight.

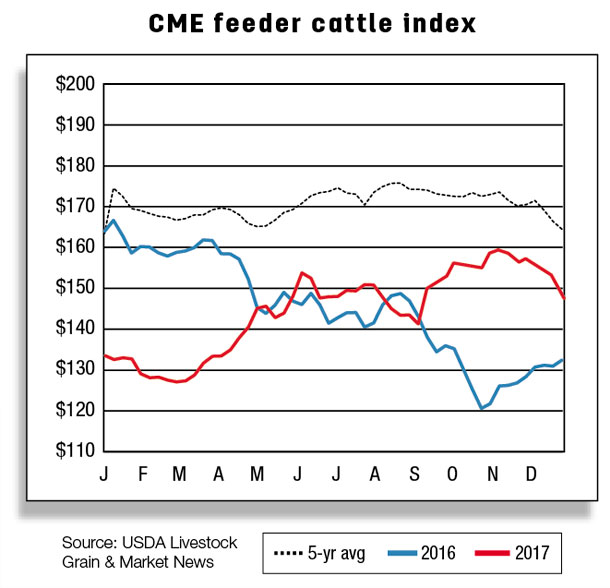

Feeder steer prices appear to have followed the pattern of fed steer prices. Prices inched up at the beginning of the fourth quarter but trended lower after mid-November. On these weakening prices, the fourth-quarter feeder cattle price forecast was lowered slightly to $155 to $159 per hundredweight.

Cow prices are seasonally lower during the fourth quarter, but prices have also come under pressure due to the higher-than-a-year-ago cow slaughter. Commercial cow slaughter, especially of beef cows, continues to be relatively heavy so far in the fourth quarter, prompting a lowering of the forecast to $56 to $58 per hundredweight.

Cow prices are seasonally lower during the fourth quarter, but prices have also come under pressure due to the higher-than-a-year-ago cow slaughter. Commercial cow slaughter, especially of beef cows, continues to be relatively heavy so far in the fourth quarter, prompting a lowering of the forecast to $56 to $58 per hundredweight.

Year-over-year higher U.S. beef exports in 2017

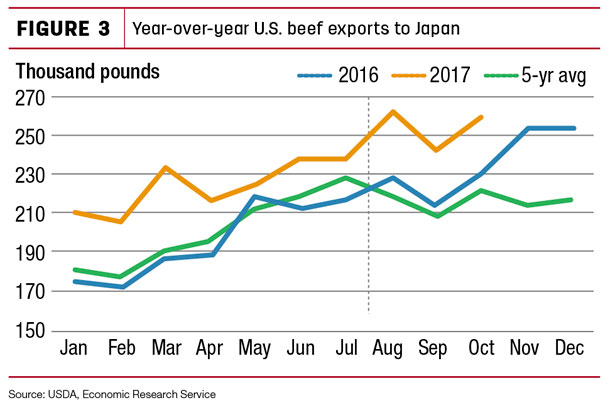

Year-over-year October 2017 U.S. beef exports were up 13.1 percent (+30 million pounds) to 260 million pounds. Higher U.S. shipments to all five major destinations – Japan (+31.4 percent), Mexico (+16.8 percent), Canada (+14.6 percent), Hong Kong (+14.1 percent) and South Korea (+2.8 percent) – during October contributed to the growth.

Higher exports in each month in 2017 through October resulted in a year-to-date export increase of 14.3 percent (+293 million pounds) above the previous-year level. Japan alone contributed more than half of that growth.

Higher exports in each month in 2017 through October resulted in a year-to-date export increase of 14.3 percent (+293 million pounds) above the previous-year level. Japan alone contributed more than half of that growth.

Year-over-year higher U.S. beef shipments to Japan have been continuing even since the Japanese safeguard tariff was raised from 38.5 to 50 percent on U.S. frozen beef, starting in August 2017 (see corresponding figure).

There was keen interest among industry watchers as to what the Japanese safeguard tariff on frozen beef meant for overall U.S. beef exports to Japan. Many felt if export growth were to be maintained, substitution between fresh/chilled and frozen would occur. The data show beef export growth to Japan continued to increase well above 2016 levels.

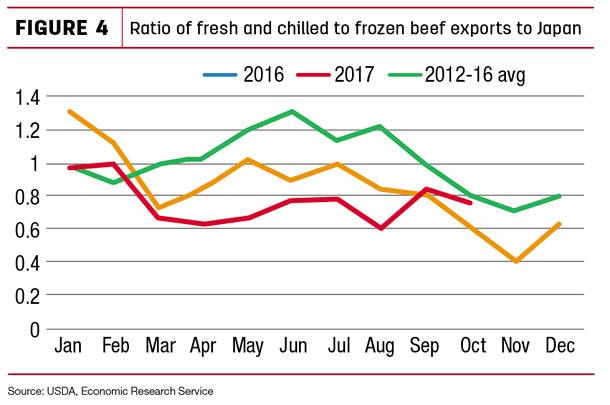

Surprisingly, the ratio of frozen to fresh/chilled beef exports to Japan since August has increased, suggesting a higher proportion of frozen beef is being shipped there than prior to the imposition of the tariff (see corresponding figure).

Surprisingly, the ratio of frozen to fresh/chilled beef exports to Japan since August has increased, suggesting a higher proportion of frozen beef is being shipped there than prior to the imposition of the tariff (see corresponding figure).

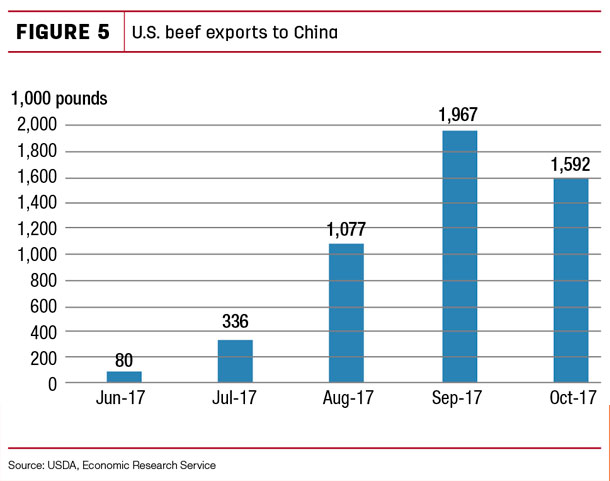

In addition to increased exports to the top five export destinations, year-to-date October 2017 U.S. exports were also higher to Vietnam (+10.8 million pounds), Philippines (+4.9 million pounds), Chile (+4.8 million pounds), Indonesia (+4.3 million pounds) and China (+5.1 million pounds) from year-earlier levels. China lifted a 14-year ban on U.S. beef entering China in June 2017.

In recent months, exports have begun to approach pre-ban levels.

Based on the continued pace of export growth reflected in the higher FAS Weekly Sales Query report estimates for November 2017 and expected strength in exports during December, the U.S. beef forecast for fourth-quarter 2017 has been revised upward by 20 million pounds from the previous month to 795 million pounds.

Anticipating the continued current pace of demand for U.S. beef in global markets, U.S. beef export forecasts for first-quarter 2018 have also been revised upward by 15 million pounds to 700 million pounds.

Anticipating the continued current pace of demand for U.S. beef in global markets, U.S. beef export forecasts for first-quarter 2018 have also been revised upward by 15 million pounds to 700 million pounds.

U.S. beef imports up in October 2017

U.S. beef imports in October 2017 increased 9.25 percent (+21 million pounds) from the previous year to 247 million pounds. Among the major suppliers, imports were higher from Australia (+29 million pounds) and Mexico (+2 million pounds) but lower from Canada (-3.9 million pounds), New Zealand (-3.1 million pounds) and Brazil (-4.1 million pounds).

This is the fifth consecutive month of higher year-over-year imports. Larger exportable supplies in Australia and increased demand for processing-grade meat in the U.S. partially explain these imports increases. However, due to lower imports in early 2017, year-to-date October 2017 imports were 1.08 percent lower than in 2016, at 2.573 billion pounds. Forecasts for beef imports are unchanged from the previous month. ![]()

Analyst Lekhnath Chalise assisted with this report.

Keithly Jones is a market analyst with the USDA – ERS. Email Keithly Jones.