The Texas Panhandle and Southwest Oklahoma continued with significant areas in “D2 Severe Drought” or “D3 Extreme Drought” conditions. The West, most notably California, received precipitation in December, but it was not sufficient to end the drought.

Despite continuing drought, the limited precipitation has allowed wheat pasture to remain in relatively good condition, providing some opportunity for weight gains in feeder cattle being pastured on Southern Plains wheat.

Placements in 1,000-plus-head feedlots during November dropped 4 percent below 2013. November placements were the lowest and marketings were the second lowest for the month since the series began in 1996.

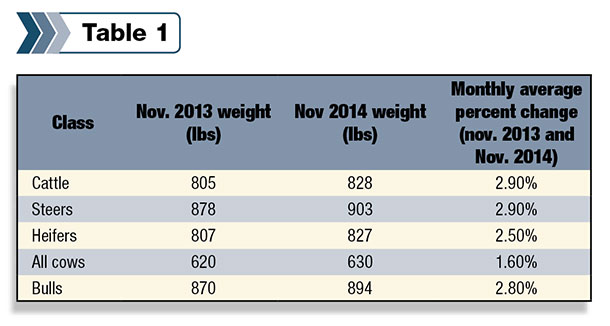

These heavier placement weights, combined with continuing relatively cheap corn and the potential for longer feeding periods, will likely result in heavier finished weights, preventing total beef production from declining as much in 2015 as reduced cattle inventories would imply.

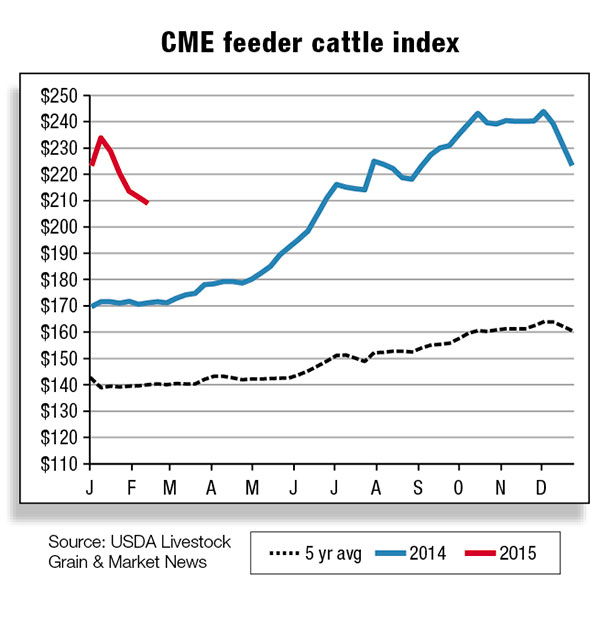

Cattle feeders could again experience negative returns beginning in December 2014, with estimated breakeven prices in the $165 per hundredweight (cwt) range for December and likely to move higher over the next several months, due primarily to higher feeder cattle prices.

Any significant retention of heifers for rebuilding the cow herd would offset increases in beef production due to heavier slaughter weights. However, cow-calf operators face significant incentives to sell heifers as feeder cattle sooner rather than selling potential calves a year or two down the road by retaining these heifers.

Commercial red meat production for the U.S. in November 2014 was down 9 percent compared with November 2013 (NASS, Livestock Slaughter, Dec. 24, 2014). Further, Livestock Slaughter showed a 10 percent drop in commercial beef production through the month of November 2014 compared with this time last year.

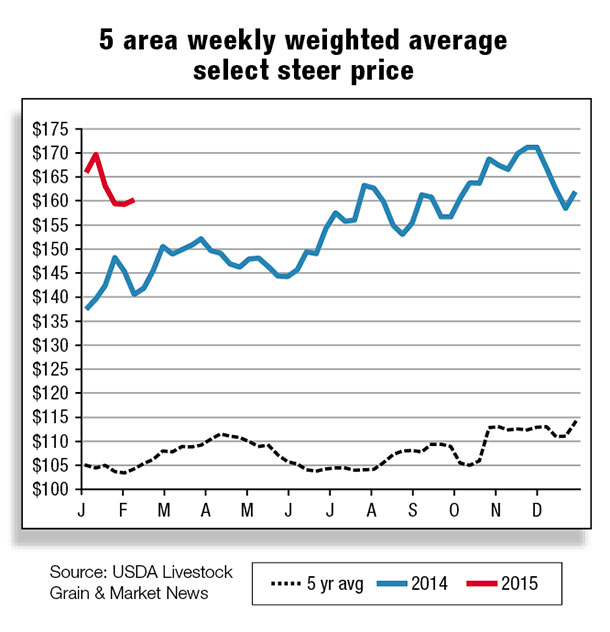

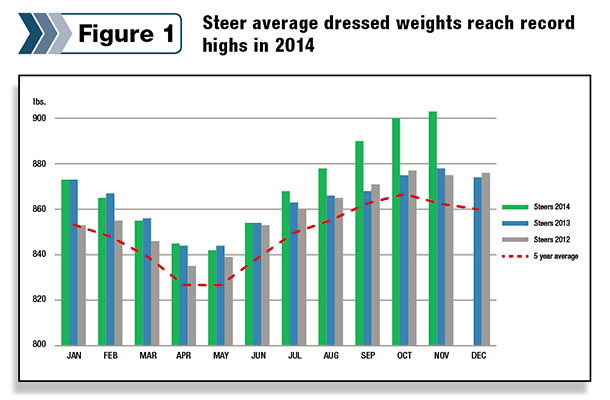

Average live weights of commercial cattle continue higher than last November, up by 24 pounds. Since September 2014, 5-Area Fed Steer (all grades) live weights have consistently exceeded 1,420 pounds (USDA Market News Service).

In addition, Livestock Slaughter reported that veal production continues to decline – down 29 percent compared with the same period in 2013. As with cattle, veal live weights are up 50 pounds compared with November 2013.

Overall, Livestock Slaughter reported that beef production was down 6 percent through the month of November 2014 compared with same period last year, and veal was down 15 percent.

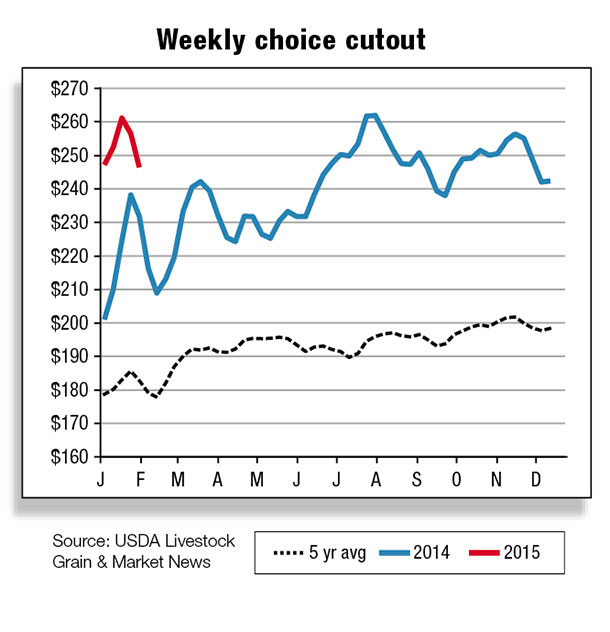

For the near term, packers remain sandwiched between relatively high fed cattle prices and near-record retail beef prices, but prices not quite high enough for positive gross margins.

Early 2015 shows high beef retail values

November 2014’s all-fresh beef retail value was $5.98 per pound, up nearly a dollar from this time last year. Retail choice beef prices in November 2014 reached a new record of $6.30 per pound, up about $0.90 from last November.

Estimated average monthly choice retail beef prices for January 2014 through November 2014 were $5.97 per pound, 13 percent above the same-period average of $5.28 for 2013. Lower December cutout values and trim prices in December are unlikely to affect the annual average for 2014 very much.

Average annual retail beef prices in 2015 are expected to be slightly higher than they were in 2014. Recent drops in gas prices have given some indication of additional spending power at the grocery store. In 2014, there was a very tight cattle supply and relatively strong demand, allowing the market to reach record prices. In 2015, an abundance of pork and poultry may limit any beef price increases.

The beginning of 2015 is expected to follow a similar market trend to that of 2014 – an expectation of a tight cattle inventory and the continuation of record-high prices.

U.S. cattle imports likely 14 percent higher in 2014

U.S. cattle imports totaled 2.1 million head through November 2014, up 18 percent from the same period in 2013. Imports were up from both Canada and Mexico as strong U.S. cattle prices, especially for feeder cattle, continue to draw in supplies from both countries.

Imports were up by the greatest volume from Canada due to rising imports of feeder cattle. Feeder cattle shipments were up 46 percent through November.

Imports of Canadian slaughter cattle were up 9 percent from a year earlier but still account for a larger proportion of imports than feeders. The forecast for U.S. cattle imports in 2015 is 2.300 million head, unchanged from last month.

Although imports are expected to decline slightly this year, similar market conditions faced in 2014 are expected to persist. Demand for cattle is expected to remain strong as herd recovery continues, while diminished inventories in both Canada and Mexico are expected to limit growth in imports.

U.S. beef imports grow, exports stable

U.S. beef imports totaled 258 million pounds during November 2014, 55 percent higher than the same month in 2013. Fourth-quarter imports are expected to have been 800 million pounds, which would bring annual imports to 2.928 billion pounds. This implies a 30 percent increase in beef shipments in 2014, as demand for imported beef has grown amid lower U.S. beef production.

U.S. federally inspected cow and bull slaughter likely finished 13 percent lower in 2014 than the previous year. While higher import demand was expected as a result, imports have been especially high due to rising shipments from Australia.

Australian cattle slaughter was 11 percent higher through October, leading to far higher beef supplies.

Australian beef exports have risen 16 percent through November, with the bulk of the increase going to the U.S. While most of the rise in U.S. imports through November has come from Australia (+396 million pounds), imports were up from nearly all origins, including Canada (+55 million pounds), New Zealand (+50 million pounds), Mexico (+47 million pounds) and Nicaragua (+36 million pounds).

The forecast for U.S. beef imports in 2015 is 2.770 billion pounds, 5 percent lower than 2014. Import demand is expected to remain robust through 2015 due to lower expected supplies of U.S. beef. However, competition for beef is expected to be strong and supplies lower as Australian slaughter is not expected to maintain its current elevated levels.

U.S. beef exports totaled 2.361 billion pounds through November 2014, nearly equivalent to the same period in 2013. Despite lower U.S. beef production and considerable growth in prices of U.S. beef, demand remains strong in several key markets.

Year-to-date exports were up to South Korea (+23 percent), Hong Kong (+16 percent), and Mexico (+11 percent). Japan remained the top destination for U.S. beef despite a 1 percent decline in volume through November.

Not all markets have grown, as exports were considerably weaker to Canada (-22 percent). Higher U.S. prices coupled with a weaker Canadian dollar have taken a toll on Canadian demand for U.S. beef.

Total U.S. beef exports are expected to have been 2.584 billion pounds in 2014, fractionally lower than 2013. The forecast for U.S. beef exports in 2015 is 2.525 billion pounds, 2 percent lower. Despite robust demand in Asian markets, a stronger U.S. dollar and elevated prices are expected to weaken overall demand for U.S. beef. ![]()

Kenneth Mathews is coordinating analyst for the USDA Economic Research Service. Analyst Mildred M. Haley assisted with this report.