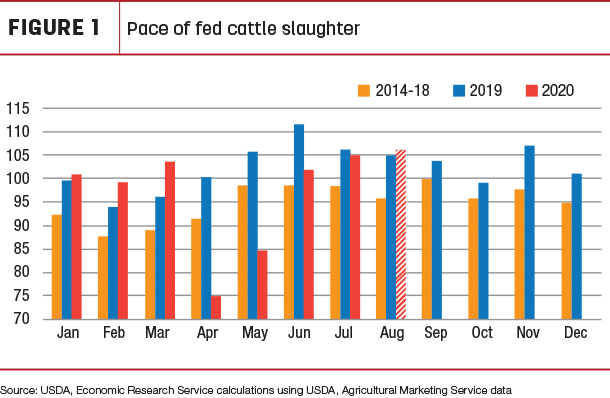

The pace of slaughter is estimated at almost 1% above August 2019.

Because of this quicker-than-expected pace of slaughter, the number of fed cattle projected to be slaughtered in third-quarter 2020 was raised. This adjustment more than offsets fewer expected cows slaughtered and a reduction in average carcass weights for the quarter, based on recent slaughter data. In fourth-quarter 2020, more cows and bulls are expected to be slaughtered. These factors raised the 2020 beef production forecast by 20 million pounds from last month to 27 billion pounds.

Based on the August USDA National Agricultural Statistics Service (NASS) Cattle on Feed report, there were 12.4% more net placements in July than in the previous year, which were greater than expected. Combined with the number of cattle in feedlots yet to be slaughtered in July because of the reduced slaughter capacity in the second quarter, the increase in placements pushed cattle on feed on Aug. 1 to above year-ago levels and to the largest number for the month since the series began in 1996.

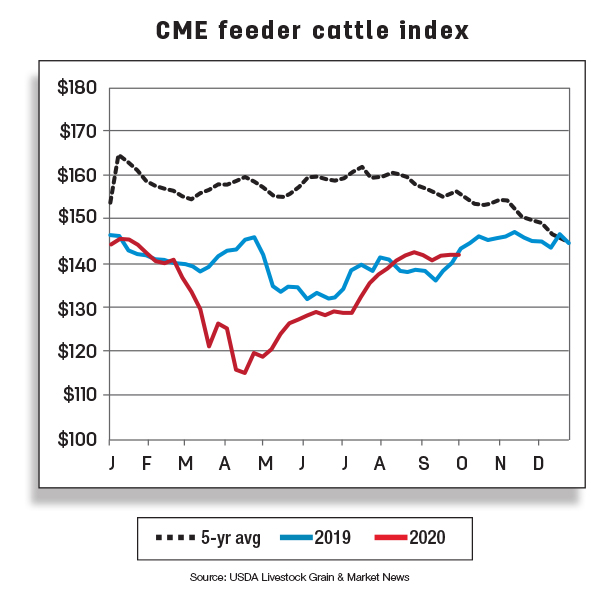

The number of feeder cattle sold in August was 15% higher than last year, based on the weekly AMS National Feeder and Stocker Cattle Summary reports for August. Because of the stronger placements in July and greater sales of feeder cattle in August, year-over-year, the anticipated number of feedlot placements in third-quarter 2020 was raised. With more placements expected in third-quarter 2020, the number of steers and heifers expected to be slaughtered in the first part of 2021 was raised.

To the extent that the proportion of cattle placed in feedlots relative to the available feeder cattle supplies on July 1 is greater than was expected the previous month, it is expected to limit the availability of supplies for placement in the first half of 2021. This pulled feedlot marketings, and consequently steer and heifer slaughter, forward from the latter quarters of 2021. With fewer steers and heifers in the slaughter mix and higher forecast feed costs affecting the length of time on feed, carcass weight gains next year will be limited. Because of this, anticipated average carcass weights were reduced in 2021. Based on these factors combined, the forecast for 2021 beef production was reduced by 265 million pounds from the previous month to 27.4 billion pounds.

Fed cattle prices raised in 2021 on lower production

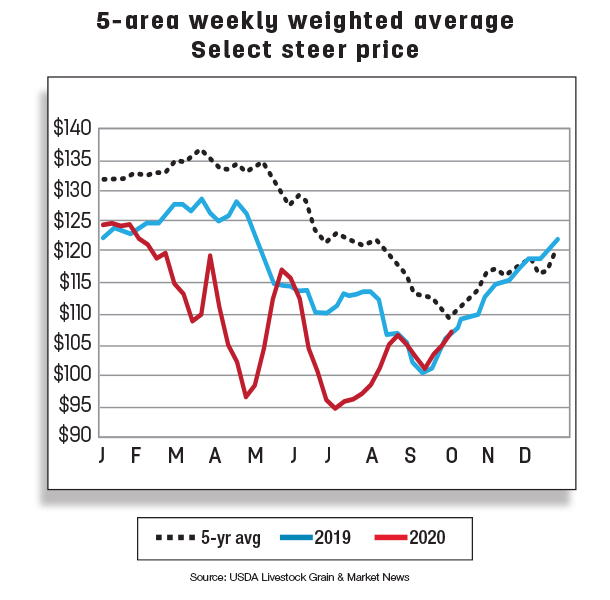

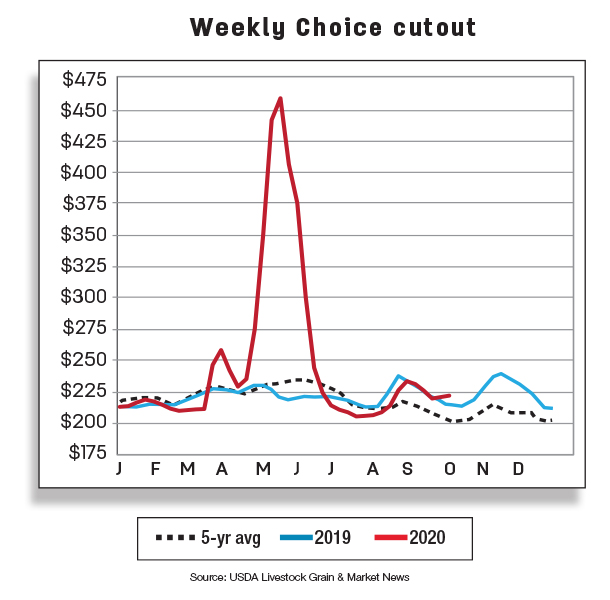

The reduction in slaughter capacity in the second quarter continues to show up in year-over-year higher number of cattle on feed over 150 days (although diminishing since June) and in the carcass weights of steers and heifers. The improved pace of slaughter, combined with an ample supply of fed cattle at heavier weights, has led to higher expected beef production in third-quarter 2020 relative to 2019, which is likely putting pressure on cattle prices. The price forecasts for third- and fourth-quarter 2020 were unchanged at $101 and $104 per hundredweight (cwt). Regarding the decline in the production forecast for 2021, the fed steer price was raised by $2 for an annual price forecast of $112 cwt.

As noted, an increase in placements is expected in second-half 2020, which implies that more feeder cattle will be placed in feedlots relative to the available supplies on July 1, 2020. The result of greater placements in second-half 2020 without increased marketings in the second half will likely keep cattle in feedlots above year-ago levels through the remainder of 2020. Because of this, anticipated feeder cattle supplies will diminish in 2021. However, the increase in fed cattle prices will likely offset higher corn prices forecast for next year. For that reason, feeder cattle prices were left unchanged from the previous month.

Beef imports continue strong in July

July 2020 beef imports totaled 377 million pounds, up 41% year over year. July’s imports were the second-largest to June 2005. Similar to June’s beef imports, July’s increase of 110 million pounds year over year was motivated by strong demand for processing-grade beef. The U.S. received large shipments from all four top beef suppliers: Australia, Canada, New Zealand and Mexico.

Combined, these four suppliers accounted for 80% of U.S. beef imports in July. Of the four, New Zealand had the largest year-over-year increase of 38 million pounds, which partly reflects a shift in destinations from China to the U.S. Shipments from New Zealand year to date are expected to continue to be stronger year over year as the U.S. becomes more of the focal point. Beef imports from South American countries, particularly Brazil and Uruguay, were robust as well. The U.S. imported 15 million pounds more from Brazil and 9 million pounds more from Uruguay, year over year. Unlike other leading beef suppliers, Nicaragua was the only major source from which the U.S. imported less beef than it did 12 months earlier.

While the top four beef suppliers year to date have accounted for 80% to 84% of U.S. total beef imports, the push that has given the U.S. year-over-year increases through July 2020 can be partly attributed to South and Central America. All seven countries highlighted have shipped more beef year to date than in the previous year. Volume-wise, three of the largest changes year to date are in shipments from Argentina, Nicaragua and Brazil. Argentina shipped over 21 million pounds more this year than last, and Nicaragua and Brazil shipped 17 and 11 million pounds more over the same period. Although the impacts of these South and Central American countries are not always discussed in these articles, their contributions have played a significant role in the growth of U.S. beef imports in 2020.

The forecasts for 2020 third and fourth quarters were raised to 925 million pounds (+115 million from last month) and 725 million pounds (+20 million) on continued strong demand for processing-grade beef. The annual forecast for 2020 was 3.272 billion pounds. The forecast for 2021 was unchanged from the previous month.

Beef exports continue to fall in July

U.S. beef exports were down 8%, or 22 million pounds, year over year, totaling 252 million pounds in July. However, this was a smaller decline compared to the sharp contraction in June. Beef exports have been down year over year for four consecutive months. Reductions in beef exports were reported for three of the U.S. top six destinations. Most of the decline was attributable to Mexico’s year-over-year reduction in beef shipments from the U.S. of 20 million pounds, which was partly due to high U.S. beef prices, Mexico’s economic recession and the depreciation of the peso relative to the dollar. The decline follows a trend: U.S. beef exports to Mexico have been lower year over year since May 2019. The U.S. beef exports to Japan and South Korea were down only slightly in July.

However, there was also some growth in U.S. beef exports, including year-over-year increases in July to Canada, Hong Kong and Taiwan. During July, the U.S. exported a record volume of beef to China. However, the year-over-year escalation in beef exports in July were not enough to offset the year-over-year reductions.

The forecast for the third quarter was unchanged from a month ago. The annual beef export forecast for 2020 was also unchanged, as was the forecast for 2021. ![]()

Analyst Christopher Davis assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.