Current precipitation could be sufficient in much of the country to support pasture use plans through the rest of the summer and into fall.

Weekly federally inspected beef cow slaughter has continued to decline year-over-year, reflecting the effect much-improved pasture conditions are having on the beef cow herd. At the same time, dairy cow slaughter has increased slightly year-over-year but not by enough to offset the effect of declining beef cow slaughter on total cow slaughter.

The increasing dairy cow slaughter is likely in response to lower year-over-year milk prices. Further beef cow retention will keep a lid on cow slaughter for the foreseeable future.

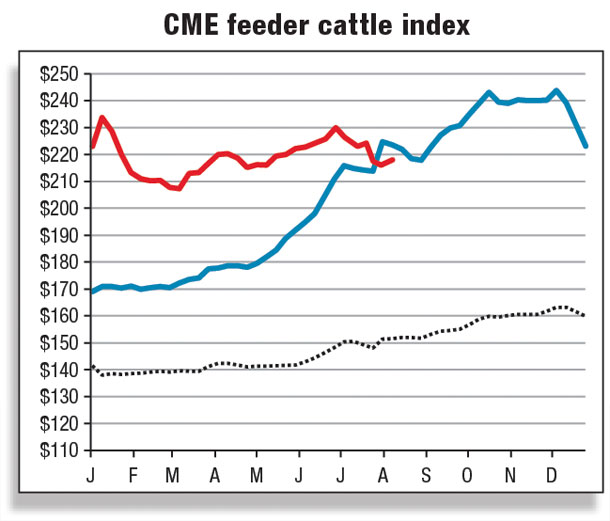

Weekly feeder cattle sale volumes at the Oklahoma National Stockyards have continued to decline year-over-year, and prices have held up in recent weeks. Prices for lightweight feeders have averaged 27 percent higher year-over-year since this past January, with heifer prices showing the most strength.

This may reflect the declining representation of heifers in steer-heifer numbers, likely due to heifer retention for expanding the cow herd.

The July Cattle report from the National Agricultural Statistics Service (NASS) will give further indication of follow-through on heifer retention and cow herd expansion plans for 2015.

In addition to providing support for feeder heifer prices, declining proportions of heifers in feedlots – along with more time on better-quality pasture – may be contributing to the slightly heavier estimated feedlot placement weights, as generally heavier steers constitute larger proportions of the mix. This is similar to the boosting effect fewer heifers in the slaughter mix is having on average dressed weights for all cattle.

The NASS’s Cattle on Feed, released June 19, 2015, showed cattle on feed in feedlots with capacity of 1,000-plus head in June up 1 percent compared with last June.

The second quarter likely experienced lower cattle placements than second-quarter 2014, in part due to producers holding cattle longer for grazing on the newly lush pasture. Cattle on Feed reported cattle greater than 800 pounds placed in May totaled 710,000 head, which is equal to May 2014 but may give 2015 the largest second-quarter share for that weight category since the series began in 1996.

In addition, May 2015 marketings were the lowest since the series began in 1996. Marketings are expected to be higher in the early part of 2016 compared with 2015 and 2014 as stocker operators and other backgrounders take advantage of good forage conditions and retain feeder cattle on pasture longer, pushing placements into feedlots further into fall and winter.

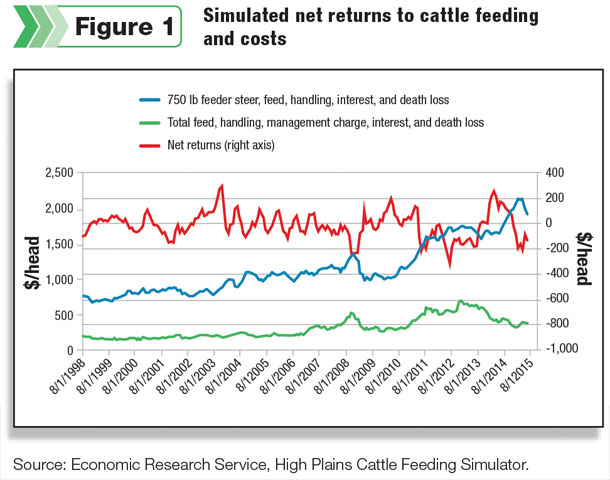

At the same time, cattle feeders lost significant ground during June as fed-cattle prices declined, widening the negative margins at levels that were already well below breakeven.

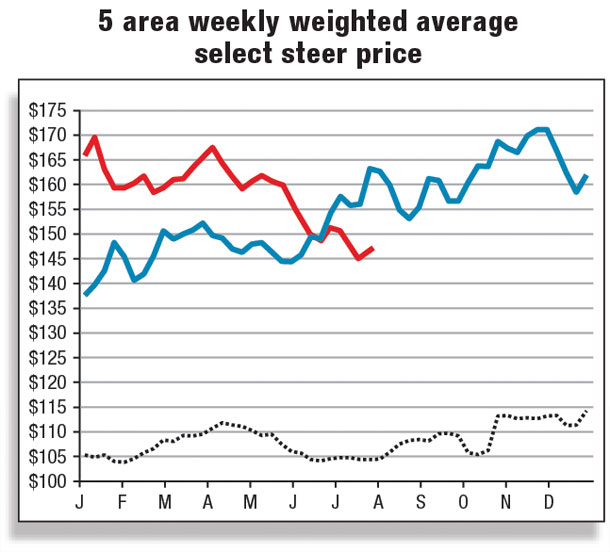

Monthly average five-area fed steer prices dropped more than $9 per hundredweight (cwt) from May to June. Evidence from the High Plains Cattle Feeding Simulator (USDA: Livestock & Meat Domestic Data) indicates that since this past January, losses have often exceeded $100 per head and are likely to continue into fall as breakevens continue to increase into the mid- to upper $160-per-cwt range, largely due to relatively high feeder-cattle prices and declining fed-cattle prices (see Figure 1).

Farmer feeders may opt for selling their corn on the market rather than buying high-priced feeder cattle and feeding corn to those animals.

June 25, 2015, the NASS’s Livestock Slaughter reported May 2015 beef production dropped 7 percent from May 2014. Commercial cattle slaughter is expected to remain tight for the remainder of 2015, slightly lower than 2014 levels.

Dressed weights of all cattle have increased year-over-year each month since June 2014. In May 2015, steers were 24 pounds heavier than in May 2014, and heifers were heavier by 17 pounds.

While dressed weights of cows were also 21 pounds heavier in May, the increase was due to the increased proportion of heavier dairy cows in the cow slaughter mix.

Dressed weights of all cattle bottomed out in April-May at greater than 800 pounds – record levels for the time of year – and appear to be increasing seasonally into the summer months. With the increase in steers and dairy cows in the slaughter mix, dressed weights for all cattle will likely set new records in the coming months.

Average dressed weights of all cattle in 2016 will likely continue at levels slightly higher than levels in 2015.

Heavy cattle weights partially offset declines in cattle slaughter

USDA reduced the second-quarter beef production forecast due to lighter-than-expected steer and heifer slaughter during May and June. Third-quarter 2015 beef production is forecast to reach 6.250 million pounds, approximately 1 percent higher than a year ago.

Fourth-quarter production is expected to be 6.025 million pounds, about even with fourth-quarter 2014. Total commercial beef production for 2015 is projected to reach 23.824 billion pounds, down 1.8 percent relative to 2014.

Cattle feeders have partially offset reductions in steer and heifer slaughter by feeding live cattle to heavier weights. The combination of heavier cattle entering feedlots due to favorable pasture conditions, extended periods of cattle on feed, and a larger proportion of steers in the slaughter mix as opposed to heifers has resulted in heavier average dressed cattle weights.

Despite the recent setbacks in the live cattle markets, cattlemen remain motivated to raise cattle to heavier weights as a result of moderate feed prices and historically strong cattle prices.

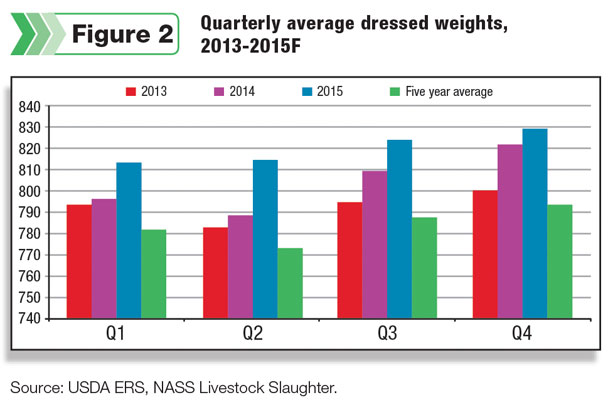

As seen in Figure 2, dressed weights typically reach their seasonal lows in the second quarter before trending heavier the last half of the calendar year.

However, this year, dressed cattle weights have not exhibited a normal seasonal decline and have remained relatively steady at 814 pounds during the second quarter.

Third- and fourth-quarter average dressed weights are expected to be record-heavy at 824 pounds and 829 pounds, respectively. The annual average dressed weight for live cattle in 2015 is expected to reach 820 pounds, approximately 17 pounds heavier than the previous year.

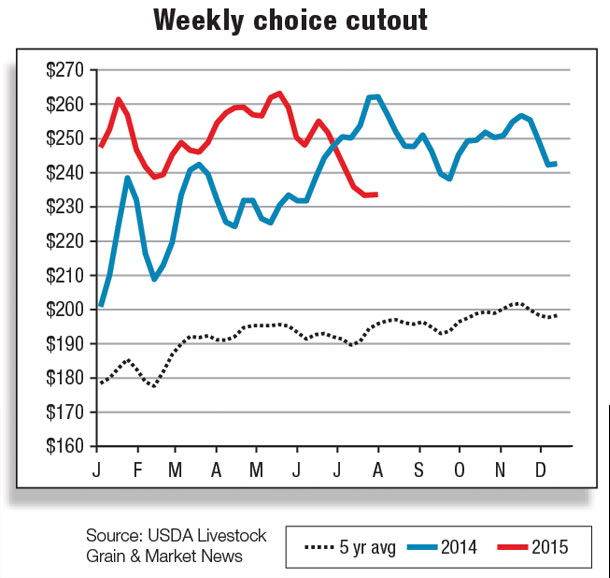

Wholesale beef prices rebounded in early July, albeit modestly, after experiencing sharp declines in late May and early June. The modest advance in beef prices is more than likely tied to strong buying interest for processing beef and popular grilling items prior to the July 4 holiday, combined with smaller-than-expected weekly fed cattle slaughter numbers.

However, wholesale beef prices declined sharply following the July 4 holiday. Packers’ margins have been squeezed, and packers are expected to remain prudent when considering the number of animals they are willing to process each week as the year continues.

Wholesale beef prices are expected to moderate through the remainder of July as interest in processing loses momentum after the July 4 holiday and consumers consider eating more affordably priced pork and chicken products. Packers are expected to remain diligent in holding weekly kills at relatively low levels in order to underpin wholesale beef prices.

Live cattle imports lower for fifth consecutive month

Total live cattle imports were lower for the fifth consecutive month in May at approximately 163,000 head. While feeder cattle imports from Mexico were brisk, imports of live cattle from Canada remain well below last year.

Through May, cumulative live imports from Mexico are 8.1 percent higher than a year earlier, while Canadian shipments into the U.S. are down 23.7 percent year-over-year.

Concerning Canada, tight domestic cattle inventories have lowered the supply base of cattle readily available for export, leading to smaller volumes shipped south. Imports of feeder cattle from Mexico will likely remain strong due to the higher prices received for feeder cattle in the U.S. Total live imports for 2015 are forecast at 2.250 million head.

Beef export demand declines in May, imports remain strong

Exports of U.S. beef were reported at 192.5 million pounds in May, down 14.4 percent from a year ago. Very high domestic prices for U.S. beef during May, combined with an appreciating U.S. dollar, likely reduced foreign buying interest for the beef. In addition, exports will likely remain constrained due to relatively small domestic beef supplies.

The forecast for U.S. beef exports for 2015 was lowered to 2.44 billion pounds due to smaller-than-anticipated beef shipments in the second quarter.

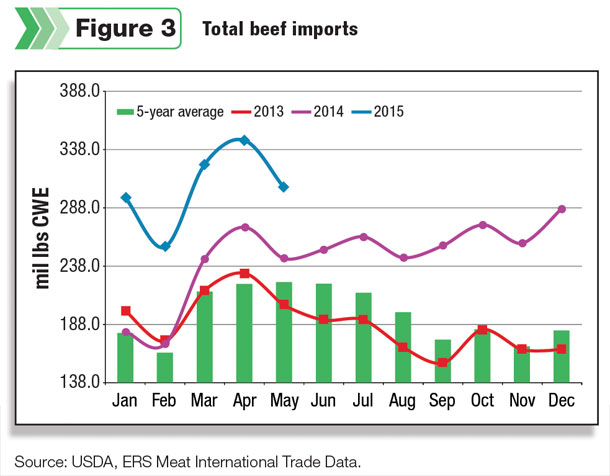

The domestic supply of lean beef in the U.S. remains constrained due to significant year-over-year declines in cow slaughter, which has been a driving factor behind strong import demand for lean processing beef.

Also, the appreciation of the U.S. dollar relative to other world currencies has contributed to the underlying strength in beef imports this year. In May, the U.S. imported more than 305 million pounds (+24.8 percent, year-over-year), with shipments from most major suppliers higher than in May 2014.

Although imports from New Zealand were higher year-over-year, it appears that the volume of beef shipped to the U.S. has slowed down. This is primarily the result of the seasonal decline in New Zealand cattle slaughter.

Trade with Australia remains robust as lingering drought conditions continue to support liquidation in major cattle-producing regions, increasing the availability of processing beef for U.S. importers.

USDA revised the 2015 beef import forecast 115 million pounds higher to 3.43 billion pounds on continued strong demand for processing lean beef and also lifted first-half 2016 exports 75 million pounds higher, bringing next year’s total beef import forecast to 2.995 billion pounds. ![]()

Kenneth Mathews is coordinating analyst for the USDA Economic Research Service. Analyst Mildred M. Haley assisted with this report.