Many of these types were bought on order from shippers in the Southeast, where the full advance of the stocker market was realized until late in the month when weakness prevailed. Early and mid-March gains lifted Southern calf prices to the point that, with the addition of $4/mile freight, the shipped-in cattle cost as much laid-in as those purchased locally. Plus, time grew short and there were not enough days to properly pre-condition these highly stressed co-mingled cattle before grass time in mid-April. High country backgrounders who graze cattle in the foothills of the Rockies were in need of a more straight-bred calf that is accustomed to the altitude and rugged enough to withstand a late spring snowstorm or an early blizzard on the other end of the grazing period.

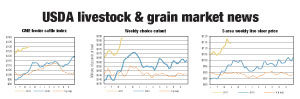

Yearling feeder cattle carrying enough weight or flesh that forced them directly into the feedlot traded very uneven through March, but ended the month with values steady to $2 higher than late February. Feedlot replacement sales started the month on the upswing but turned sharply lower by the first day of spring on global concerns. Aftershocks from Japan’s catastrophic earthquake and ensuing tsunami were felt throughout the cattle feeding community as fears from the damage to nuclear power facilities sent publicly traded agricultural markets down-the-limit for two straight days. The recent regularity of natural disasters has made them a huge economic risk and throughout the current run of historic cattle market records, producers have been on the lookout for what would come along and unset the apple cart. A combination earthquake/tsunami/nuclear scare was probably near the bottom of the list, but when an event like this is big enough to shift the earth on its axis – a midmonth adjustment to cattle and grain markets seems insignificant. Bullish fundamentals, especially from the supply side, spurred feeder markets to reclaim all their losses my month’s end as the CME Feeder Cattle Cash Index Value (based on a 750-pound steer) broke $130 on March 23 for the first time ever.

Early in March, packers “tipped their hand” as to just how short-bought they really were by aggressively raising the fed cattle market $5 to $6 to $118, which was an all-time record high for the bulk of movement in the five-area feeding region. This historic trade totally reaffirmed cattle feeders’ confidence in their recent feedlot replacement purchases, and in any question of the competition within the industry, especially since most showlists were only priced at $115 to $116 to start that week. World events caused fat cattle to trade mixed through the balance of the month, but wholesale beef demand is very good (particularly for export) and also trading at record levels. Grilling season is just around the corner and feedlot managers should continue to have the leverage in the weekly negotiations. Feeder cattle supplies continue to tighten with the March cattle-on-feed report marking the fifth month in the last six that feedlot placement weights were lower than the previous year. Cattle and beef are currently hot commodities and perhaps should be trading by the ounce, rather than the pound. ![]()