However, weather events like Winter Storm Goliath left many producers concerned about overstressed cattle and death loss.

The Climate Prediction Center’s January-March 2016 official forecast reports above-average precipitation levels and below-average temperatures in much of the Southern Plains and Southeast (National Oceanic and Atmospheric Administration).

With the combination of cooler, wetter weather and shorter grazing days, producers expect to see a seasonal drop in rates of gain in the winter months, given the challenging weather in the Southern Plains, wind chills and precipitation-stressed cattle, with snow burying pasture forages in some cases.

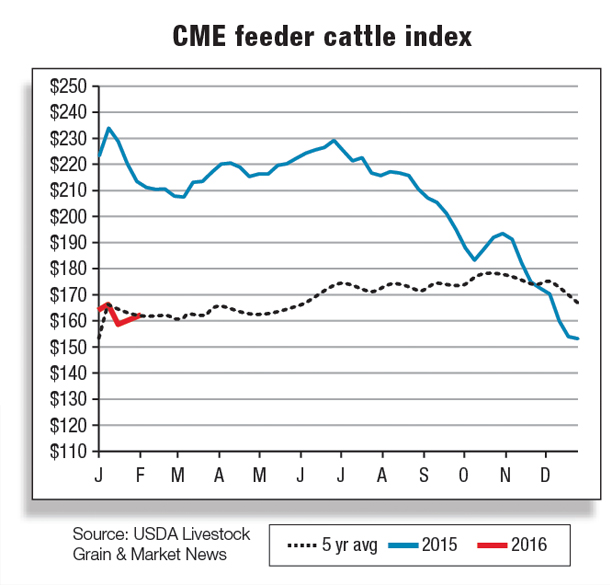

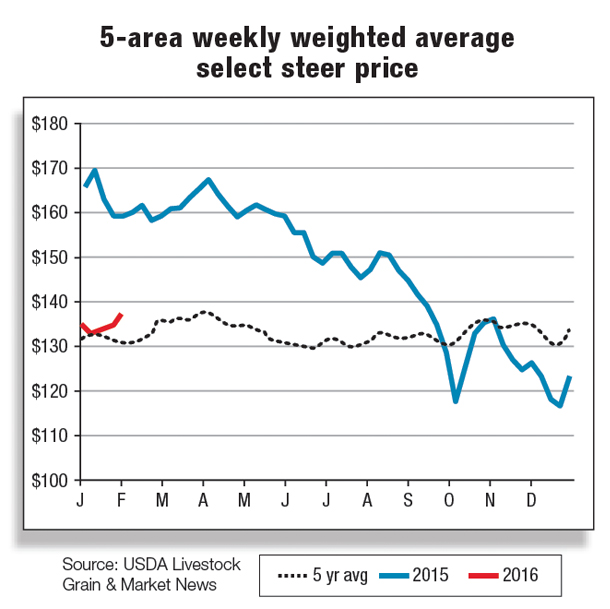

Fed and feeder cattle prices

Lower prices for competing proteins and larger beef supplies in the domestic market, among many other factors, exerted downward pressure on early December prices. Five-area, all-grade fed steer prices for fourth quarter bottomed at $116.64 per hundredweight (cwt) for the week ending Dec. 20, 2015.

For the week ending Jan. 10, 2016, five-area all-grade fed steers were $132.26 per cwt, roughly $37 lower than year-earlier fed steer prices. Despite the rally, the first-quarter 2016 five-area direct total all-grade steer price is forecast to be $128 to $134 per cwt, down more than $30 compared with first-quarter 2015.

Feeder cattle prices also declined into early December – but not to the same degree. The Oklahoma National Stockyards were closed the last two weeks in December, but on Jan. 4, 2016, medium No. 1 feeder steers weighing 750 to 800 pounds ranged between $166 and $169 per cwt, down around $50 per cwt from this time last year (Oklahoma National Stockyards).

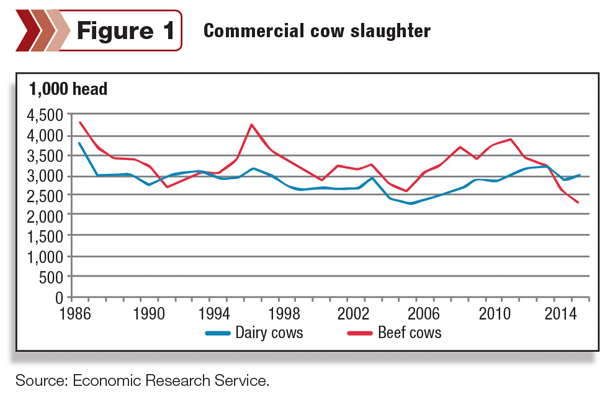

Commercial cow slaughter lowest in 10 years

Estimated total annual commercial cow slaughter for 2015 is expected to be the lowest since 2005 – the last attempt at cow herd expansion – and about 13 percent below the average for the last 29 years, largely due to the impact beef cow slaughter has had on total cow slaughter in 2015.

Estimated annual commercial dairy cow slaughter for 2015 is shaping up to be about 5 percent above the average of the last 29 years. At the same time, estimated annual commercial beef cow slaughter – 29 percent below the average for the same period – would be a record low. Beef cow slaughter is expected to have accounted for about 43 percent of annual commercial cow slaughter for 2015.

Beef cow slaughter has accounted for less than 50 percent of total annual commercial cow slaughter in only two years – 2014 and 2015 – since the early 1990s. Such a low level of beef cow slaughter could indicate potentially significant herd rebuilding.

In general, while these relative proportions could also be indicative of significant dairy cow slaughter, in 2015, they indicate both. While dairy cow slaughter was year-over-year higher in both 2012 and 2013, the beef cow share of total slaughter was still 52 and 50 percent in those years.

Since NASS began publishing July 1 inventory data in 1973, the Jan. 1 cow inventory has exceeded the previous July 1 inventory twice (Jan. 1, 1974, and Jan. 1, 1980) and has been equal once (Jan. 1, 2015). The July 1, 2015, cow inventory was 39 million head, equal to the Jan. 1, 2015, inventory.

By historical standards, the July 1 number could imply a year-over-year lower total cow inventory on Jan. 1, 2016. On the other hand, a Jan. 1, 2016 inventory higher than the July 1, 2015 inventory would imply a significantly positive rate of cow herd expansion which, if accompanied by a relatively large inventory of heifers expected to calve in 2016, could lead to downward pressure on cattle and beef prices for 2016 and beyond.

The Jan. 1 Cattle report to be released by the National Agricultural Statistics Service (NASS) on Jan. 29 will provide estimates for total cow inventory and the number of heifers expected to calve in 2016.

Early winter weather impacted beef supplies

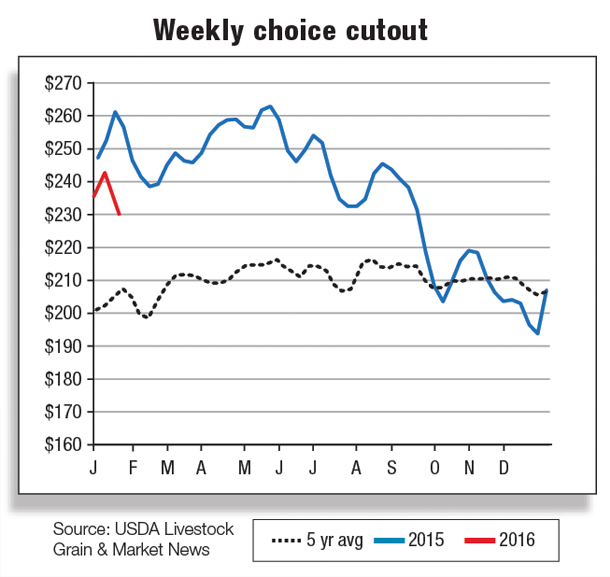

Along with frigid late-December temperatures, snow and flooding in Texas and the Southern Plains limited transportation of live cattle to feedlots and packers, creating a short-term supply crunch during two weeks of light production schedules due to holidays.

This supported rapidly rising wholesale prices the last week in December and early January. According to the USDA’s most recent boxed beef report (for the week ending Jan. 8), the choice cutout was reported at $226.24 per cwt, up $19.08 per cwt from the previous week but approximately $27 per cwt lower than last year.

However, if beef demand does not begin to show signs of improvement in the first quarter of 2016, it is expected that the recent run-up in wholesale prices will lose momentum.

According to the USDA’s most recent data, average cattle carcass weights are 839 pounds, quite heavy compared to the previous year (+11 pounds), but weights have declined approximately 16 pounds since peaking at 855 pounds in mid-October.

It is expected that fourth-quarter 2015 cattle carcass weights will be lighter than initially expected due to the abrupt decline in weight gain in December, but annual average 2015 carcass weights are forecast several pounds heavier than in 2014. However, cattle carcass weights in the weeks ahead could reflect the impact of the recent winter storm on cattle performance.

Beef exports expected to improve in 2016, beef imports set to decline

Total beef export volumes in November were reported at approximately 202 million pounds, an increase from October and slightly below November 2014 levels. Major export destinations for the month of November were Japan, Mexico, Canada, South Korea and Hong Kong. Combined, these top five destinations accounted for approximately 82 percent of total beef shipped abroad in November.

It is probable that the overall decline in domestic wholesale beef prices during the last quarter of 2015 spurred some renewed export growth in November and December, but total annual beef exports for 2015 are expected to have reached 2.26 billion pounds, down approximately 310 million pounds when compared to 2014.

The outlook for beef exports in 2016 is expected to improve as a result of lower domestic prices and an increase in beef supplies that can be shipped abroad.

However, there remain several wildcard factors that could limit export growth. The U.S. dollar is expected to remain strong at least through the first half of the year, which could partially offset any growth in export demand due to lower beef prices.

Global economic uncertainty could also stifle export growth, especially to Asian countries. The 2016 beef export forecast was raised by 50 million pounds from December to 2.48 billion pounds, up approximately 9 percent year-over-year.

U.S. beef imports declined 27 percent in November (from the previous year) as imports of processing beef from Australia and New Zealand fell dramatically. It is expected that Oceanian importers began to slow their rate of beef exports to the U.S. during the fourth quarter of the year to avoid surpassing their tariff-rate quota limits.

Australian and New Zealand beef imports declined 43 and 31 percent year-over-year in November, with expectations of further declines in December. For November, beef imports from Canada were reported lower year-over-year, while increases in beef from Mexico, Brazil and Uruguay were higher but overshadowed by the steep decline from the larger import suppliers.

Overall, U.S. beef imports in 2015 are estimated about 14 percent higher at 3.372 billion pounds, but imports are expected to decline in 2016. Beef production in the U.S. is expected to increase next year due to larger cattle supplies and heavy cattle weights and diminishing demand for imported beef, most noticeably processing beef from Australia and New Zealand.

In addition, favorable weather conditions in Australia support plans for herd expansion, while Australian slaughter data continues to show declines in weekly cattle turnoff rates, supporting the notion that Australian beef exports to the U.S. will be constrained in 2016. For the above reasons, 2016 beef imports were reduced by approximately 100 pounds to 2.845 billion pounds, down 16 percent year-over-year. ![]()

Kenneth Mathews is coordinating analyst for the USDA Economic Research Service. Analyst Mildred M. Haley assisted with this report. Email Kenneth Mathews.