Although total cow slaughter will likely remain below year-ago levels in the fourth quarter, beef cows are responsible for the increase in total slaughter. Specifically, commercial beef cow slaughter levels are up from 2019 over 3% year-to-date through October, while commercial dairy cow slaughter is down almost 5% for the same period. Worsening drought conditions, lower year-over-year returns for producers and cow cull prices that are up over 7% from the previous year are likely contributing to this increase in beef cow slaughter.

In contrast, the forecast for 2021 beef production was lowered by 105 million pounds from the previous month to 27.3 billion pounds. This adjustment was based in part on the November USDA National Agricultural Statistics Service (NASS) Cattle on Feed report, which estimated 11% fewer gross placements in October 2020 than in October 2019. Further, based on weekly sales receipts from the USDA Agricultural Marketing Service (AMS) National Feeder and Stocker Summary report, feeder cattle sales for the months of October and November are almost 600,000 head behind year-ago receipts for the same period. Because of these factors, expected placements in fourth-quarter 2020 were lowered. As a result, anticipated feedlot marketings for second-quarter 2021 were reduced. This reduction is in addition to lower expectations than the previous month for cow slaughter in the first half of 2021.

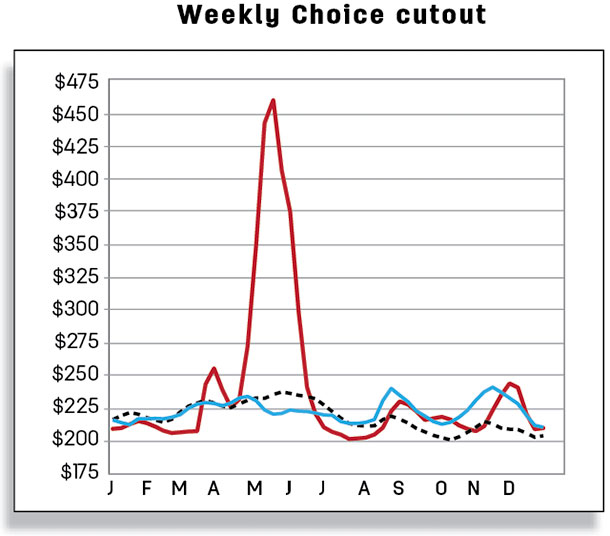

Cattle prices end the year weaker than a year ago

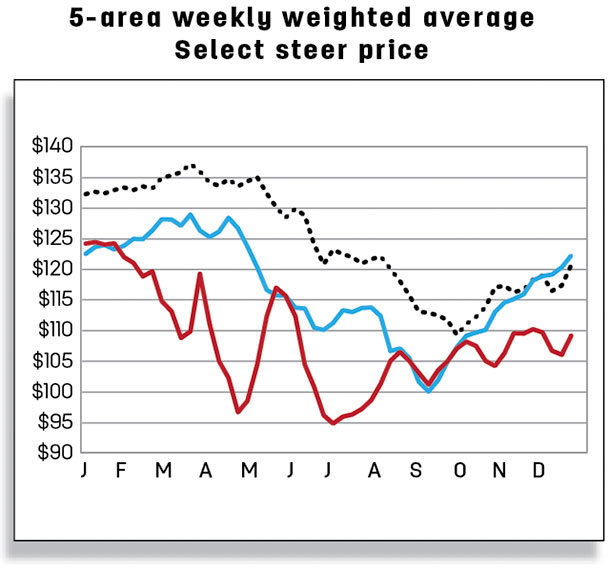

Live steer prices in the 5-area marketing region for the first week of December were reported at $109.75 per hundredweight (cwt), 8% below the previous year for the same week and the lowest December starting price since 2010. Based on this price weakness, the forecast for fourth-quarter 2020 was lowered by $1 to $108 per cwt. However, the 2021 annual price forecast was raised by $1 to $115 per cwt. This change reflects an increase of $3 in second-quarter 2021 to $113 per cwt as a result of fewer cattle expected to be available for slaughter then.

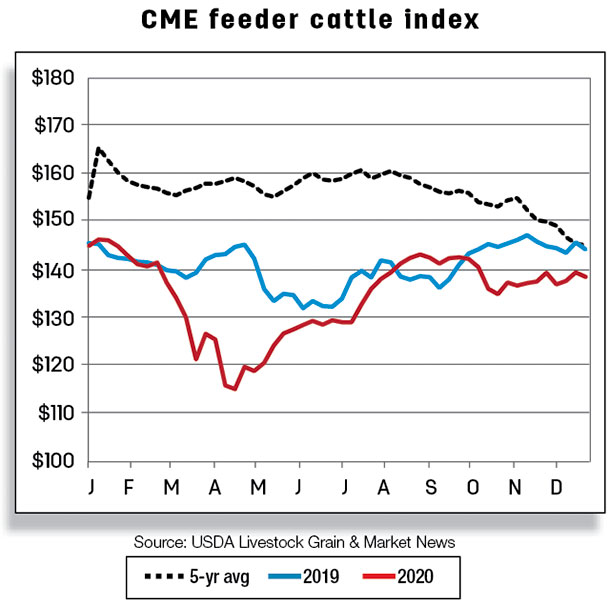

Feeder steer prices for the 750- to 800-pound category improved month-over-month in November to $138.22 per cwt but were more than $8 below a year ago. The first prices reported in December were almost $13 below the same week the previous year at $136.67. AMS reported that the Dec. 14 sale will be the last sale of the year for feeder cattle at Oklahoma City National Stockyards. Prices on Dec. 14 were reported at $137.41 per cwt, for a monthly estimate of $136.95 per cwt. The feeder steer price forecast for fourth-quarter 2020 was unchanged at $137 per cwt. Feeder prices for 2021 were also left unchanged at the annual price of $135 per cwt.

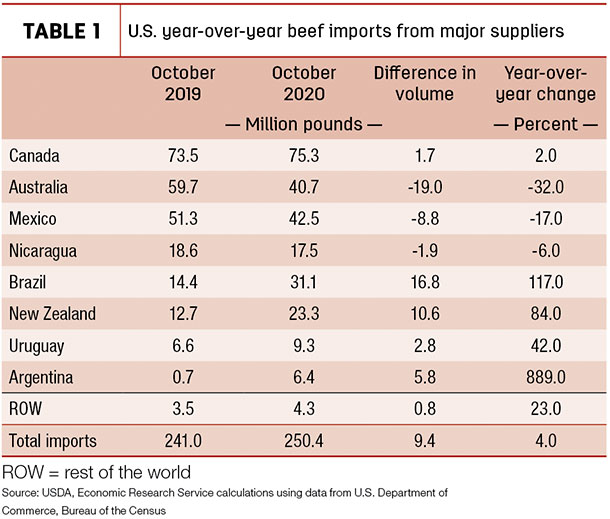

October imports are up with record shipments from Brazil

October beef imports were up 4%, or 9 million pounds year-over-year, totaling 250 million pounds. October makes the fifth straight month the U.S. has imported more beef than in the previous year. This continuous year-over-year increase reflects demand for imported lean trimmings to blend with supplies of U.S. trimmings to service robust ground beef demand. Brazil led the increase in beef imports with 17 million more pounds of beef shipments in October 2020 than a year earlier. New Zealand had a year-over-year increase of 10.6 million pounds in October. There were also higher volumes in October 2020 from Canada, Uruguay and Argentina relative to a year ago.

In contrast, the continued slowdown in beef imports from Australia since July likely reflects the country retaining heifers to rebuild the cattle herd. Shipments from Mexico and Nicaragua were also slightly lower in October. However, these reductions were not enough to offset the increases from other leading beef suppliers.

The forecast for the fourth-quarter beef imports was lowered 40 million pounds to 760 million pounds from the 800 million pounds the previous month. The revision reflects tightness in Mexican and Australian exportable supplies. The forecast for 2021 was unchanged from the previous month.

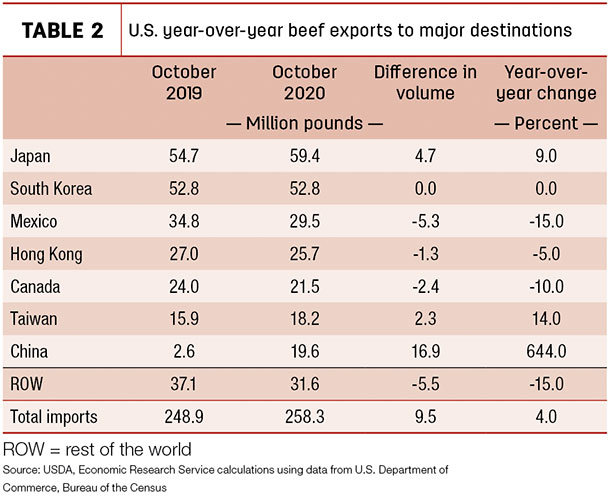

Beef exports up in October due to record sales to China

Beef exports in October totaled 258.3 million pounds, up 4% (9.5 million pounds) compared to a year ago. The increase was mostly driven by a record volume of U.S. beef shipped to China, which accounted for nearly 8% of total U.S. beef exports for the month. The last few months have signaled steady growth in U.S. beef exports to China. Exports to Japan, the largest volume destination for U.S. beef exports, were up 4.7 million pounds in October relative to October 2019. In addition to China and Japan, there was a modest increase in U.S. beef exports to Taiwan.

U.S. exports to Mexico continued to drop year-over-year due to a downturn in Mexico’s economy, a weaker peso relative to the dollar and increased Mexican production. This has led to Mexico being overtaken by Canada as the third-largest volume destination for U.S. beef exports. Lower beef shipments were also sent to Canada, Hong Kong and several smaller markets. The fourth-quarter forecast for beef exports remains unchanged from the previous month at 770 million pounds. No changes were made to the 2021 export forecast. ![]()

Analyst Christopher Davis assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.