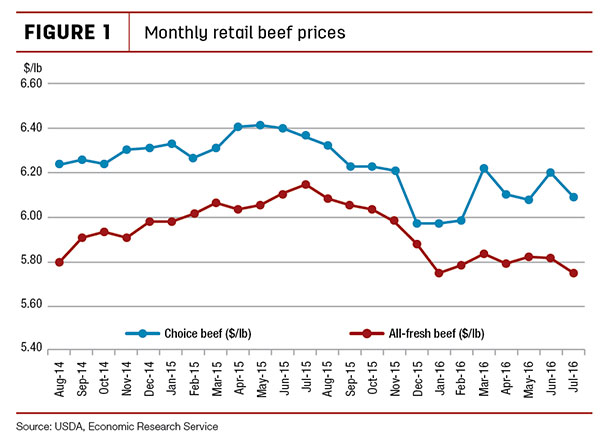

The July all-fresh beef price was $5.75 per pound, an approximate 7-cents-per-pound decline from the June price and 40 cents below the previous year.

Overall domestic meat protein supplies are large, and retail pork and poultry prices are declining as well. This could result in added pressure on the beef market.

In addition to pressure from lower pork and poultry prices, expectations of increases in year-over-year beef production through the remainder of the year and into 2017 could result in annual retail beef prices noticeably lower than 2015 and 2014 levels.

Cattle, wholesale beef prices continue downward spiral

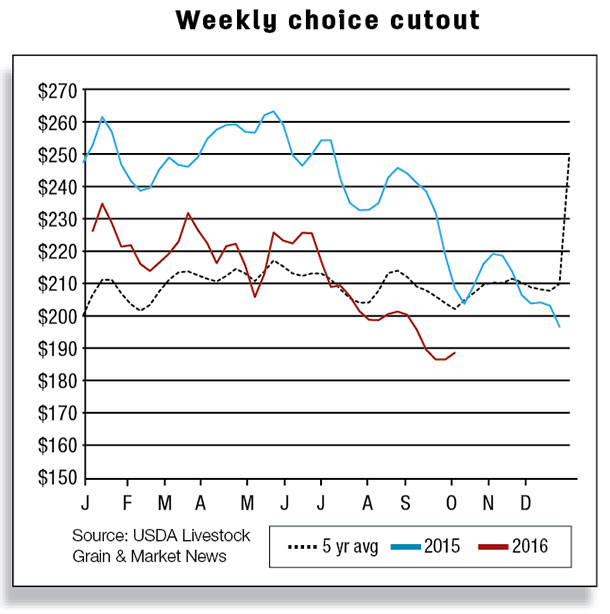

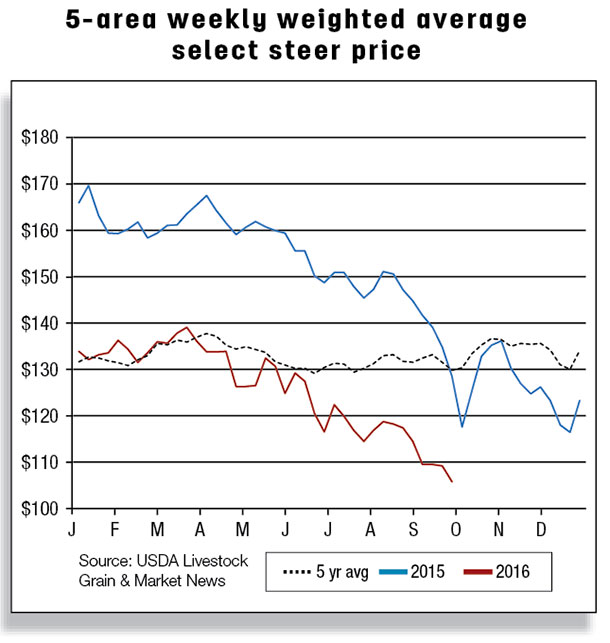

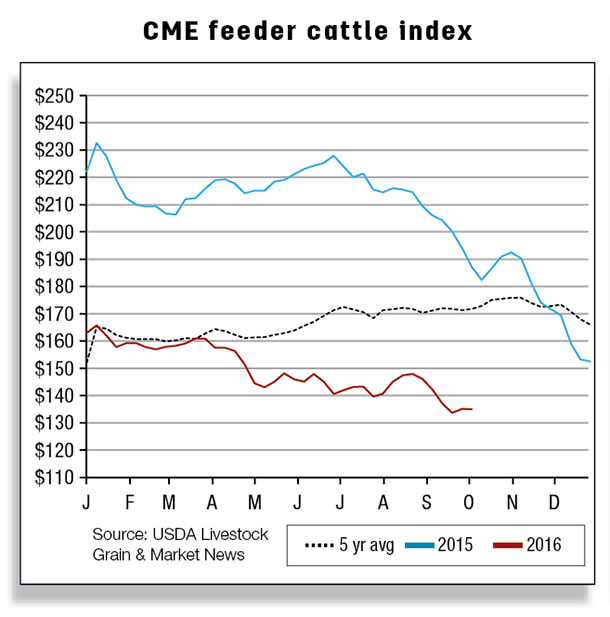

Negative psychology continues to permeate the U.S. cattle and beef industry, with both fed cattle and wholesale beef prices yet to find stability.

The weekly Choice beef cutout was last quoted at $189.49 per hundredweight (cwt) (as of the week ending September 9), down $6.18 per cwt from the previous reported week and $48.96 per cwt lower than last year.

Aggressive steer and heifer slaughter rates, coupled with the seasonal increase in carcass weights, remain bearish for the entire beef complex. Demand is also a concern as beef prices typically weaken after Labor Day and supplies of competing meats are large. Likewise, fed cattle and feeder cattle prices are on the decline.

For the week ending September 11, 2016, the five-area weighted average steer price was $105.02 per cwt. Fed steer prices are currently 21 percent below the beginning of the year and are 25 percent below 2015.

Nonetheless, there may be a silver lining on the horizon. Fed cattle prices, along with beef prices, may begin to stabilize and reverse the current trend in the fourth quarter with seasonally tighter beef supplies and stronger demand for popular beef items in anticipation of the holiday season.

Imported beef steadily declines through July

Overall, U.S. beef imports continue to decline as domestic supplies increase. However, shipments from Canada remain firm and were reported 30 percent higher on a yearly basis in July. Beef imports from New Zealand were also higher in July (+11 percent), but New Zealand beef imports should begin to trend lower through the remainder of the year as their seasonal slowdown in slaughter kicks in.

Imports from Australia were down 35 percent in July as tight cattle inventories continued to stifle exports. In July, beef imports from Brazil were down 6 percent over last year. Imports of fresh/chilled beef cuts from Brazil have yet to be reported, but it is expected that beef cuts from Brazil will pick up during the second half of 2016.

Beef exports gaining momentum

U.S. beef exports were up 8 percent year-over-year in July, supported by solid exports to most top destinations, with the exception of Canada (-22 percent). Countries leading the increase are Japan (+6 percent), Mexico (+24 percent) and South Korea (+36 percent), but exports to Hong Kong are showing signs of improving.

Exports to South Korea have been strong throughout 2016 as the country’s tight domestic supplies and high prices have resulted in higher volumes of imported beef to help meet demand.

Through July, total U.S. beef exports were approximately 3 percent higher than the same period in 2015. Despite some negative effects from the strength in the U.S. dollar relative to other currencies, the outlook for U.S. beef exports remains optimistic on expectation of stronger overall global demand for beef and lower wholesale U.S. beef prices.

Forecasts for third-quarter beef exports remain unchanged, while 10 million pounds were added to the 2016 fourth-quarter projection on the expectation of stronger demand from Asian countries and Mexico going forward. ![]()

Analysts Mildred Haley and Keithly Jones assisted with this report.

-

Seanicaa Edwards

- Market Analyst

- USDA – ERS

- Email Seanicaa Edwards