2018 production closes with lighter weights

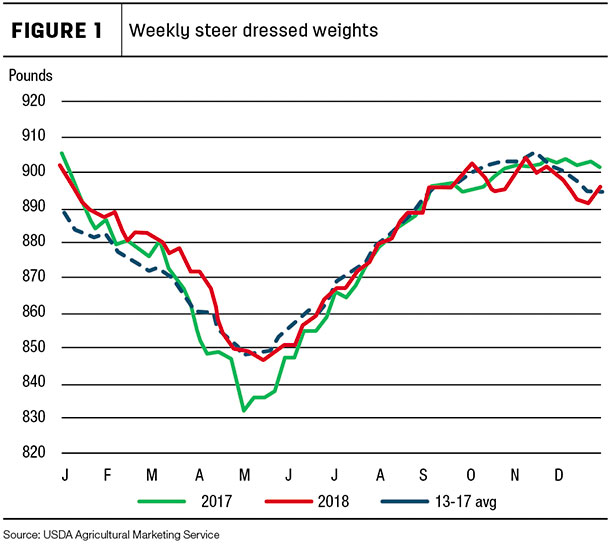

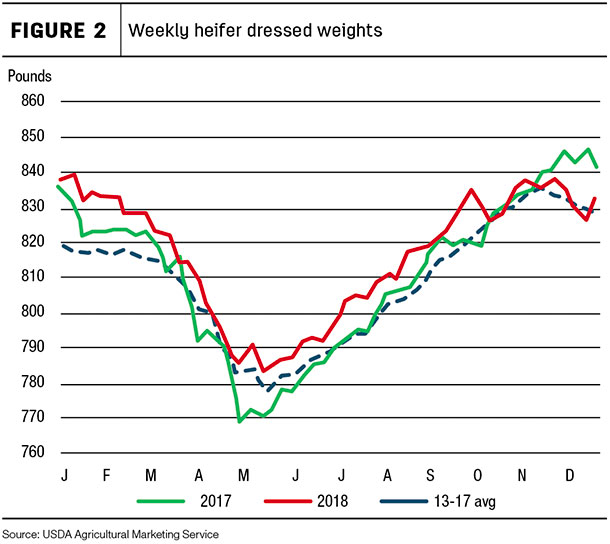

Following the end of the shutdown, the USDA’s Agricultural Marketing Service (AMS) has released actual weekly slaughter data for December, and this has provided a clearer picture of how 2018 ended. The biggest takeaway is: Average steer and heifer cattle carcass weights dropped considerably in December (see Figure 1 and 2).

This drop was likely due to weather events across cattle-feeding regions. In addition, a greater proportion of cows was slaughtered, further constraining average cattle carcass weights. While this change in weights was contrary to how 2017 ended, typically weights seasonally drop at the end of the fourth quarter.

Further limiting production expectations in December, overall cattle slaughter was less than previously expected. As a result, when compared to the December 2018 forecast, 2018 beef production in February was decreased by 75 million pounds to 26.9 billion pounds.

With limited slaughter data for January 2019, the beef production forecast for first-half 2019 is still coming into focus. Based on available data, the anticipated fed cattle slaughter forecast for first-half 2019 was lowered from December. In addition, the expectation for average carcass weights was reduced. As a result, the 2019 beef production forecast was lowered by 175 million pounds to 27.6 billion pounds.

Cattle held on feed longer heading into 2019

Based on the Cattle on Feed report for November – released by NASS on Dec. 21 – there were 5.5 percent fewer net placements and 1.4 percent higher marketings year-over-year, for a Dec. 1 cattle on feed number of 11.7 million head. However, the count of cattle on feed continued to grow as the number of placements was higher than marketings, keeping the Dec. 1 cattle on feed number the largest for the month since 2011.

Among cattle on feed, there were 20 percent more cattle held over 150 days on Dec. 1 than at the same time in 2017. With larger supplies of slaughter-ready cattle available in December, the number of fed cattle slaughtered in December was lower than expected. Winter weather events that month may have hampered feedlots’ ability to finish and market cattle in a timely manner.

Expected feeder calf demand pressures 2019 prices

Compared to fall 2017, it was expected that with improved forage conditions in the Southern Plains, producers would be able to stock a greater number of calves on winter wheat in 2018 to absorb large seasonal supplies of calves in the fall. Based on weekly data from the National Feeder and Stocker Cattle Summary, there were about 1 percent more calves sold in 2018 than in 2017. This was particularly true in fourth-quarter 2018, where about 7 percent more calves were sold than for the same period in 2017.

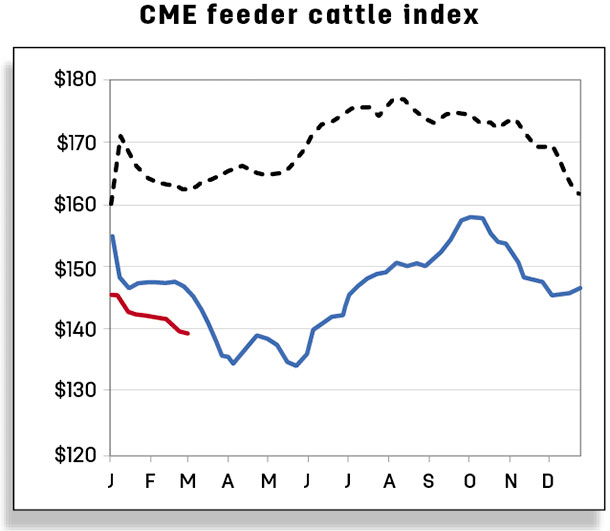

However, in late 2018, feedlots’ pace of marketings slowed more than expected. The large numbers of cattle in feedlots may have stymied feeder calf prices. The fourth-quarter 2018 feeder steer price was $147.90 per hundredweight (cwt) for an annual price of $146.93 per cwt. With continued large supplies of cattle in feedlots and a slower expected pace of placements in early 2019, feeder steer prices in first-half 2019 were lowered, bringing the annual price forecast down to $140 to $149 per cwt, with a midpoint price of $144.50 per cwt.

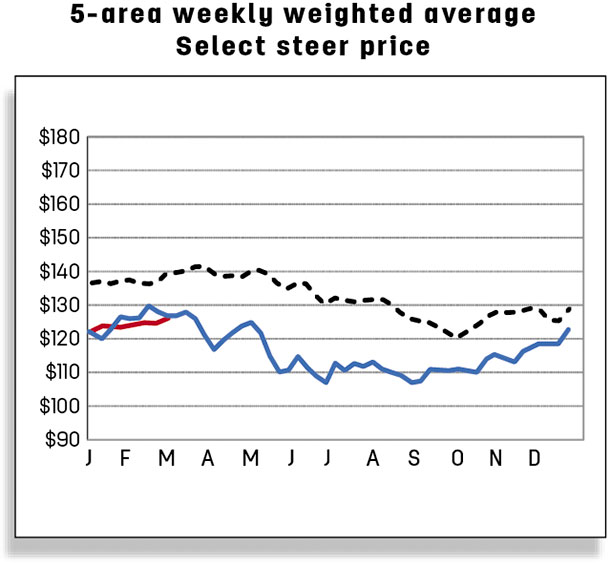

Fed cattle prices similar to last year

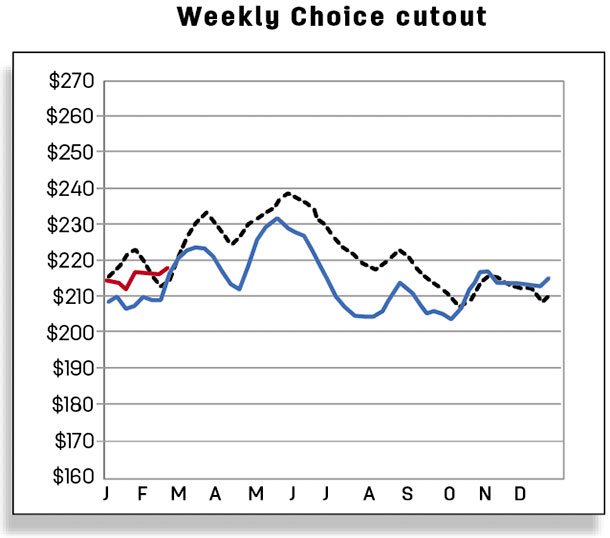

Since the December Outlook report, fed cattle prices have continued their seasonal trend upward; prices typically peak in the spring. This reflects a period when fewer fed cattle are slaughtered, carcass weights are lighter, and demand picks up in anticipation of the grilling season. The fourth-quarter 2018 price for fed steers in the 5-area marketing region was $115.32 per cwt, making the annual price $117.12 per cwt. Based on current price data and an expected slower pace of marketings in the first quarter, the price forecast for first-quarter 2019 increased to $122 to $126 per cwt, for an annual price forecast of $115 to $122 per cwt. The slower expected pace of fed cattle marketings and slaughter combined with lower carcass weights could help support higher boxed beef prices in the face of low winter beef demand.

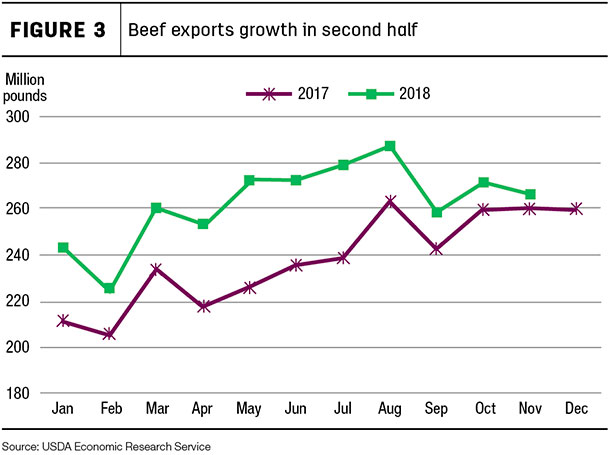

Beef export forecast reduced

November 2018 U.S. beef exports were 266 million pounds, up 2.2 percent from year-earlier levels, which was the lowest year-over-year growth in 2018. Among major destinations, year-over-year higher volumes were shipped to South Korea, Japan and Taiwan, while shipments to Hong Kong declined. January through November export growth was above 11 percent, although the pace of year-over-year export growth in 2018 has slowed since July (see Figure 3).

South Korea has reported a notable decline in beef imported from the U.S. in December from November 2018. Based on the decline reported by Korea, beef exports in fourth-quarter 2018 were revised downward by 10 million pounds from the December forecast to 825 million pounds. The new 2018 annual forecast is 3.18 billion pounds. The export forecast for 2019 was also adjusted lower, down 10 million pounds from the December forecast to 3.255 billion pounds.

Beef import forecast lower

U.S. beef imports in November 2018 increased 2.4 percent from the previous year’s level to 217 million pounds. For January through November 2018, U.S. beef imports were only fractionally higher from year-earlier levels. Among major suppliers, year-to-date increases were from Canada, New Zealand, Nicaragua and Brazil, while declines were from Mexico, Australia and Uruguay. Australia, one of the key suppliers, providing about 23 percent of total U.S. imports through November 2018, reported a decline in shipments to the U.S. in December. U.S. imports in fourth-quarter 2018 have been revised downward by 10 million pounds to 660 million pounds, with total 2018 imports forecast at 2.994 billion pounds.

Weather events in key cattle production areas in Australia are expected to continue limiting the slaughter cattle availability in 2019. Increased feed cost and tighter forage supplies are likely to result in cattle finished at lighter weights. Declines in slaughter numbers and weights are expected to tighten exportable supplies. U.S. beef imports for 2019 have been adjusted downward by 10 million pounds to 3.01 billion pounds on expected tighter exportable supplies from Australia.

Cattle imports forecast higher, exports forecast lower

November 2018 U.S. cattle imports were 208,127 head, about 1 percent above year-earlier levels. January-through-November imports totaled 1.705 million head, up 5 percent year-over-year. Increased imports from Mexico more than offset the decline from Canada and contributed to the year-to-date growth. USDA AMS weekly estimates indicate higher imports from Mexico in December. The 2018 cattle import forecast is raised by 10,000 head to 1.895 million head. The 2019 import forecast is also adjusted upward by 10,000 head to 1.97 million head.

U.S. cattle exports in November were down more than 10,000 head year-over-year to 26,237 head. Most of the decline was in shipments to Canada. October and November are typically peak months for placement of cattle into feedlots in Canada. In 2018, U.S. cattle exports to Canada peaked in October, one month earlier than the previous year, and declined in November. December 2018 exports are expected to decline further from November. Based on these data, the 2018 export forecasts are revised downward by 10,000 head to 240,000 head. Similarly, the 2019 export forecast was reduced 10,000 head to 245,000 head. ![]()

Analyst Lekhnath Chalise assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.