The USDA National Agricultural Statistics Service (NASS) released its semiannual Cattle report on Jan. 29. The total number of cattle and calves on Jan. 1, 2021, was estimated at 93.6 million head, nearly 200,000 head lower than the previous year.

This marks a second year of contraction for cattle producers. Despite the number of beef cows declining for a second year, beef cattle producers are indicating their intentions to retain slightly more heifers for beef cow replacement, and the number of those heifers expected to calve during the year is also up. This is the first year heifers retained in the herd have increased year-over-year since 2017, further suggesting contraction has slowed. However, a different pattern is reflected on the dairy side, with milk cow numbers up 1% while heifers for milk cow replacement were estimated down 1.7%, potentially affecting the number of veal calves available in 2021.

The lower cattle inventory also reflects the revision to the 2020 calf crop that was lowered by about 664,500 head from the July 2020 Cattle report. The number of calves under 500 pounds was reported down 120,900 head from 2020 at 14.2 million head. However, steers 500 pounds and over were up 56,600 head from 2020 at 16.6 million head, and other heifers 500 pounds and over were up 52,000 head from 2020 at 9.6 million head. Fewer calves more than offset increases in the inventory of steers and other heifers. It was further reported that the number of all cattle on feed was up 49,700 head from 2020 to 14.7 million head. As a result of slightly fewer supplies of feeder cattle available on Jan. 1, 2020, and more cattle on feed than a year ago, available supplies outside feedlots were marginally reduced to start the year.

Fed cattle slaughter and carcass weights raise production

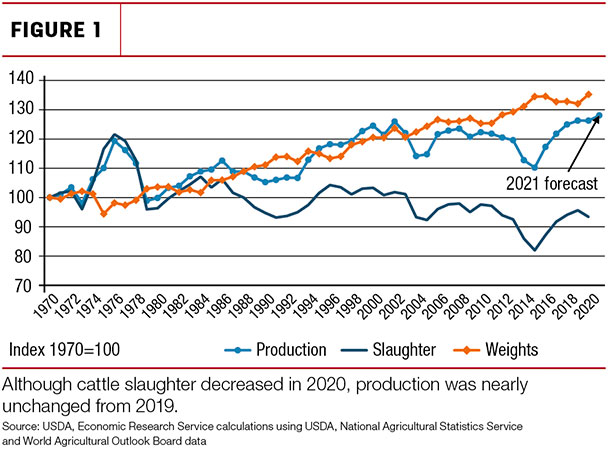

According to the USDA-NASS Livestock Slaughter report, total commercial beef production in 2020 is estimated at 27.152 billion pounds, virtually unchanged from 2019 (27.155 billion pounds). Despite cattle slaughter numbers that are down by 2.4%, the level of 2020 production was unchanged as a result of cattle on feed longer and good feeding conditions that helped cattle weights surpass 2019 by 2.4%.

Heavier anticipated carcass weights and greater fed cattle marketings are expected to lift 2021 beef production to record levels at 27.54 billion pounds, up 350 million pounds from the previous month. Based on USDA Agricultural Marketing Service (AMS) report of Actual Slaughter Under Federal Inspection for January 2021, average carcass weights are about 844.1 pounds, or more than 18 pounds above average carcass weights slaughtered under federal inspection in January 2020. Cattle carcass weights were increased in first-half 2021, reflecting higher-than-expected carcass weights in January but tempered by the frigid conditions gripping the Plains and Upper Midwest and by higher feed costs.

Further, based on the AMS Actual Slaughter Under Federal Inspection reports, January federally inspected slaughter suggests cattle slaughter is moving at a faster pace than last year. Specifically, fed cattle slaughter is up 3.7%, and cow and bull slaughter are up 3.4%. Further, based on the USDA, NASS January Cattle on Feed report, almost 1% more cattle were placed in December 2020 than December 2019, which was more than expected. Because of higher-than-expected placements in late fourth-quarter 2020 and a quicker-than-expected pace of cattle slaughter in early 2021, anticipated cattle slaughter was raised in first-half 2021.

Although the number of cattle outside feedlots on Jan. 1 was less than a year ago, as noted, a larger proportion of cattle on small-grains pastures and dry conditions in parts of the Plains States raised prospects for higher anticipated placements in first-half 2021. As a result, marketings in second-half 2021 were increased, which also contributed to a raised production forecast.

Figure 1 is depicting changes in production, slaughter and carcass weights, indexed to 1970, that include the 2021 forecast.

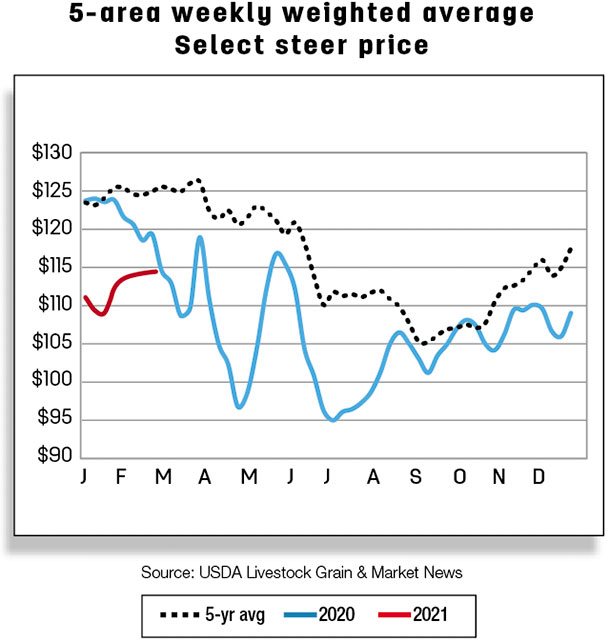

Live steer prices in the 5-area marketing region for the first week of February were reported at $113.63 per hundredweight (cwt), more than $8 below last year for the same week. Second-half 2021 price forecasts were lowered on greater expected marketings of fed cattle for an annual price of $115 per cwt, down 50 cents from the previous month.

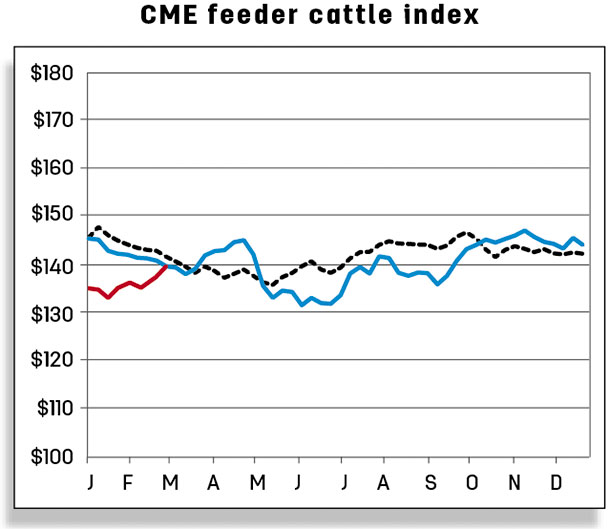

Feeder steer prices for January 2021 averaged $133.94 per cwt for steers weighing 750 to 800 pounds sold in the Oklahoma City National Stockyards, about 7% below the average for January 2020.

With prices for the first two weeks of February almost $7 below the same month last year, the first-quarter 2021 forecast was lowered $2 to $132 per cwt. Revisions to the 2020 calf crop tightened anticipated feeder cattle supplies in second-half 2021. However, higher expected feed costs offset expectations for stronger prices the rest of the year; as a result, the second-half 2021 feeder steer price forecasts are unchanged from the previous month.

December beef imports declined; fourth-quarter total lower than expected

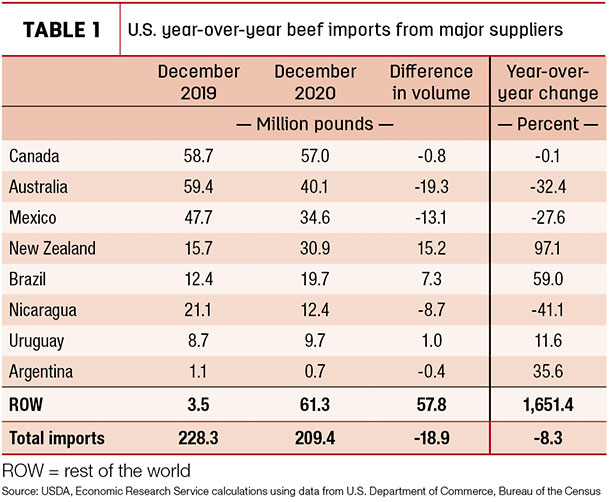

Beef imports in December totaled 209 million pounds, down 8.3% (-18.9 million pounds) from a year ago (Table 1).

Australia shipped about one-third less beef to the U.S. than a year earlier. The reduction in U.S. beef imports continued as exportable supplies from Australia and Mexico were limited. The second-largest decline in December’s beef shipments came from Mexico, which supplied 13 million pounds less year-over-year. This decline is likely due in part to Mexico’s strong economic growth in the 2020 third quarter, which may have supported a greater domestic demand for beef. Imports from Nicaragua, in conjunction with supplies from Uruguay, Canada and Argentina, were also lower relative to a year ago.

By comparison, New Zealand almost doubled beef shipments to the U.S. in December at 30.9 million pounds, and imports from Brazil were up about 59% relative to the levels recorded last December. While shipments from Uruguay also exceeded volumes a year ago, these increases from these three major suppliers were not enough to offset the substantial reduction in beef shipments from the other countries.

The fourth-quarter beef imports totaled 693 million pounds, 32 million pounds lower than the previous month’s estimate.

Beef imports in 2020 were up year-over-year

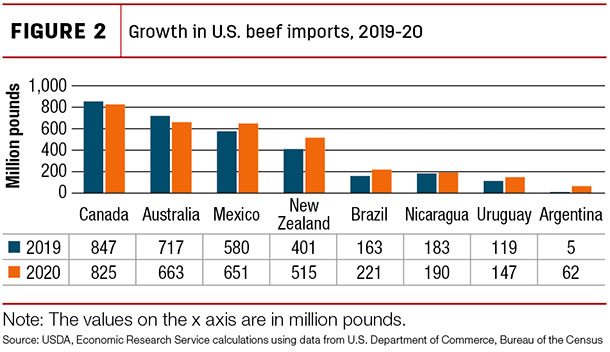

Total beef imports in 2020 were up 9.3% year-over-year at 3.34 billion pounds, the largest since 2015 (Figure 2).

Canada accounted for 24.7% of total beef imports in 2020, but Canada’s import volume was 2.6% lower than 2019. Australia was the second-largest beef supplier with 19.8% of total imports. Beef imports from Australia were down 7.5% year-over-year in 2020. Mexico, the third-largest source, was up 12.3% compared to 2019 and accounted for 19.5% of the total U.S. beef imports in 2020.

New Zealand, the No. 4 beef supplier, increased shipments 28.5% from 2019 and was the source of 15.4% of 2020 total imports. Brazil, Nicaragua, Uruguay and Argentina were the remaining major sources, whose shipments to the U.S. were 35.7%, 3.7%, 23.9% and 1166.9% higher than 2019, respectively. Overall, beef imports from Brazil totaled 6.6% of total imports, while Nicaragua, Uruguay and Argentina made up 5.7%, 4.4% and 1.9% of the total. The annual forecast for 2021 beef imports is 3.005 billion pounds, down 10.2% from a year ago. The forecast for first-quarter 2021 was lowered by 80 million pounds to 700 million pounds on continued tightness in world beef supplies and high U.S. beginning year stocks.

However, continued tightness in world supplies will likely result in smaller imports through much of the year.

Beef exports finished strong in December as sales to China continued to soar

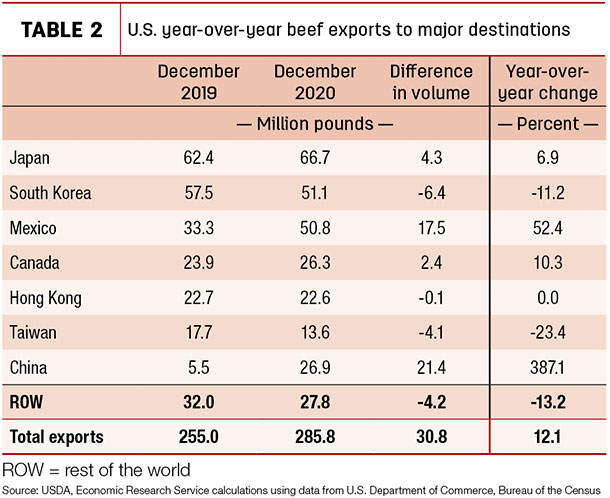

December beef exports totaled 286 million pounds, up 12.1% (or 30.8 million pounds) year-over-year (Table 2).

The U.S. largest increase in beef exports – in both volume and percentage – was to China, which has broken previous records of beef purchases for six consecutive months. The U.S. beef exports to Mexico in December had the second-largest increase in both volume and percentage. In the third quarter of 2020, Mexico’s economy grew 12%, stimulating demand for U.S. beef. Some U.S. export destinations with smaller increases year-over-year included Japan and Canada.

In contrast, there were several destinations to which the U.S. exported less beef to in December. Most of the reductions were to South Korea, which is still enforcing strict social distancing rules that have reduced operating hours for restaurants and cafes and forced these businesses to rely on takeout and delivery services. The U.S. also exported less beef to Taiwan in December. However, these reductions were not sufficient to offset the increase in beef exported to China and Mexico in December.

Beef exports were down in 2020 year-over-year but stronger in fourth quarter

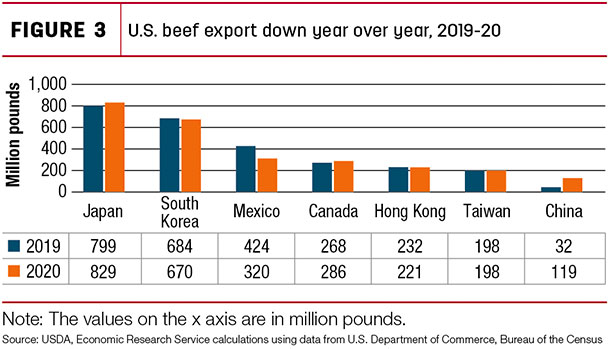

After a tremendous drop-off in the second quarter due primarily to the global pandemic, 2020 beef exports finished above 2019 levels with a strong fourth quarter totaling 821 million pounds, 9.6% above a year earlier (Figure 3).

In 2020, beef exports totaled 2.96 billion pounds, down 2.4% from a year ago. U.S. exports to Japan, the largest beef destination, increased 29.7 million pounds (volume-wise) year-over-year. Canada was up 18 million pounds compared to a year earlier. Of all the growth in 2020 beef exports, China became a noteworthy destination, emerging as the seventh-largest U.S. market over the past few months; beef exports to China more than tripled, from 32.1 million pounds in 2019 to 119.1 million pounds in 2020.

In contrast, declines in U.S. exports to major destinations were the largest to Mexico (-104.7 million pounds), followed by lower shipments to Hong Kong (-10.8 million pounds) and South Korea (-14.2 million pounds). In 2020, the U.S. top two destinations, accounting for over half of its total exports, were Japan (28%) and South Korea (22.7%).

Mexico and Canada were the third- and fourth-largest markets, representing 10.8% and 9.7%, respectively, of total exports. No. 5, No. 6 and No. 7 beef markets were Hong Kong, Taiwan and China, accounting for 7.4%, 6.7% and 4% shares of the total U.S. beef exports in 2020. Demand strength was carried over from fourth-quarter 2020 into 2021. The first-quarter forecast for 2021 beef exports was raised by 25 million pounds from the previous month to 750 million on strong demand for U.S. beef in major destinations. The annual forecast for 2021 beef exports is 3.145 billion pounds.