This examination will put this potential trade situation into some perspective.

This examination will put this potential trade situation into some perspective.

Who gets to export to the U.S.?

There are 34 countries eligible to export beef and poultry products to the U.S. (FSIS). A country is eligible to export to the U.S. if USDA Veterinary Services and APHIS personnel evaluate the countries’ disease risk and, finding it sufficiently low, allow trade to occur following completion of the federal rule-making process (APHIS).

Brazil is eligible to export processed beef, pork, lamb/mutton, and goat to the U.S. Brazil exported about 199 million pounds (carcass weight) of beef to the U.S. out of total beef exports of an estimated 3.4 billion pounds in 2009. The U.S. accounted for about 5.8 percent of total Brazilian beef exports. Exports from Brazil were equivalent to about 17 percent of its 19.7 billion pounds of production in 2009.

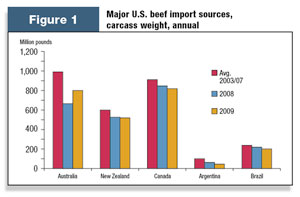

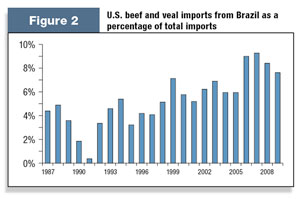

Canada, Australia, and New Zealand (our largest suppliers, in order) accounted for 81 percent of U.S. beef imports in 2009. Brazil was the U.S.’s fourth largest supplier of beef, followed by Nicaragua. Brazil’s share of total U.S. beef imports was 7.6 percent in 2009. Over the last 20 years, Brazil’s share of U.S. beef imports has ranged from 0.3 percent in 1991 to 9.2 percent in 2007.

Canada, Australia, and New Zealand (our largest suppliers, in order) accounted for 81 percent of U.S. beef imports in 2009. Brazil was the U.S.’s fourth largest supplier of beef, followed by Nicaragua. Brazil’s share of total U.S. beef imports was 7.6 percent in 2009. Over the last 20 years, Brazil’s share of U.S. beef imports has ranged from 0.3 percent in 1991 to 9.2 percent in 2007.

What next?

The World Organization for Animal Health (OIE) is the recognized group for issuing guidelines, standards, and recommendations for animal health. Adhering to OIE standards helps facilitate trade and also has helped to re-open trade sooner after disease outbreaks. However, countries often don’t follow those guidelines or partially follow them, or do whatever they want to do.

The U.S. has tended to follow the OIE guidelines and works to get other countries to follow them. In 1997, USDA published a policy statement on regionalization. That policy is that the U.S. would recognize the animal health status of regions within countries or regions including groups of countries rather than only national borders. The result is that regions within a country may be allowed to export to the U.S. while other parts of the same country are not allowed to export, for example, potentially, Santa Catarina, Brazil. Eleven risk factors are considered before a region is allowed to export to the U.S. Once the risk assessment is complete, a proposed rule is published and it goes through the federal rule-making process.

With that as background, it is going to be a while before any significant change occurs on the level of beef imports from Brazil. The amount of beef coming from Brazil to the U.S. has been relatively small and all of that is processed. Exports from Brazil (and any other country) will depend on relative prices and exchange rates, among other factors, between all potential markets. There is a lot of rule-making and evaluation still to come before any changes occur regarding exports of fresh beef from Brazil to the U.S.

With that as background, it is going to be a while before any significant change occurs on the level of beef imports from Brazil. The amount of beef coming from Brazil to the U.S. has been relatively small and all of that is processed. Exports from Brazil (and any other country) will depend on relative prices and exchange rates, among other factors, between all potential markets. There is a lot of rule-making and evaluation still to come before any changes occur regarding exports of fresh beef from Brazil to the U.S.This article originally appeared in a Texas A&M Agricultural Economics newsletter.

|

|