At the same time, “Topsoil and subsoil moisture conditions were rated mostly adequate to short” in much of Oklahoma. Despite slight improvements, the West continues to be constrained by “D4 Exceptional Drought” conditions (U.S. Drought Monitor).

The Cattle report released by the USDA’s National Agricultural Statistics Service (NASS) on Jan. 29, 2016, included some significant revisions to 2015 inventory numbers.

After downward revision in total cattle and calves on Jan. 1, 2015, the Jan. 1, 2016, total U.S. inventory of cattle and calves increased by 3 percent. After revisions, heifers entering the cow herd in 2015 were about 8 percent above those entering the herd in 2014.

Further, 63 percent of heifers intended for replacements on Jan. 1, 2015, appeared to have made it into the Jan. 1, 2016, cow herd, contributing to an annual rate of increase of almost 3 percent in the national aggregate cow inventory. Beef heifers accounted for 55 percent of heifers entering the cow herd in 2015.

Despite the increased levels of heifer retention for rebuilding the breeding herd, on Jan. 1, 2016, the inventory of other heifers – those available for other uses, primarily for either feeding or possibly breeding but not necessarily committed to one use or the other – also increased by almost 3 percent year-over-year.

Because heifers are either retained as breeding stock or are placed on feed, and because an increase in one category implies a decrease in the other category, the inventory of heifers on feed Jan. 1, 2016, in 1,000-plus-head feedlots (Cattle on Feed) declined by a little more than 7 percent year-over-year. At the same time, the inventory of steers on feed in 1,000-plus-head feedlots increased by 3 percent.

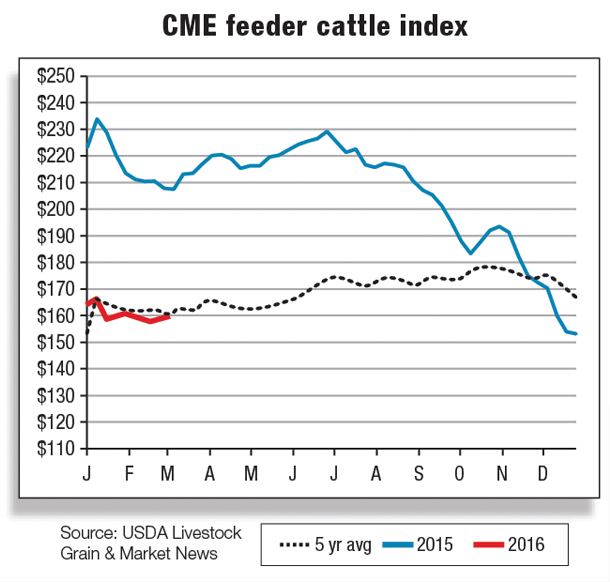

The year-over-year increases in the Jan. 1, 2016 heifer and steer inventories, combined with other inventory changes, resulted in a year-over-year increase of greater than 5 percent in supplies of feeder cattle outside feedlots and will likely dampen feeder cattle price increases during 2016.

Cattle feeding margins declining from record losses

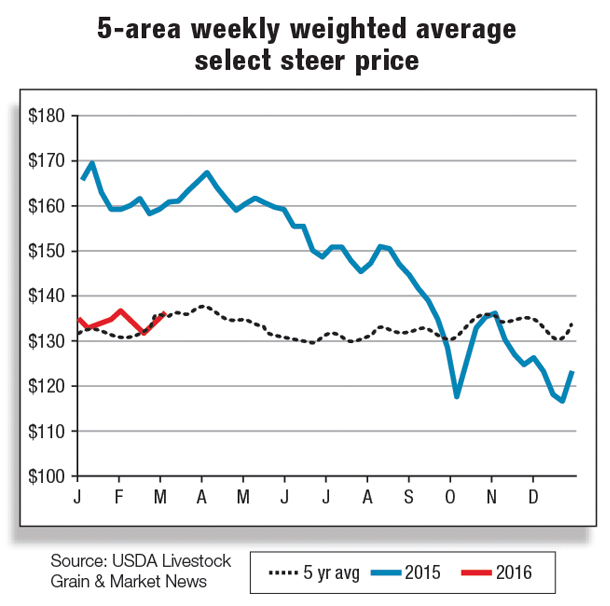

In 2015, the largest cattle feeding losses (High Plains Cattle Feeding Simulator) occurred for fed cattle marketed during October and December, due largely to relatively high feeder cattle prices.

Cattle feeding margins should move toward profitability as feeder cattle prices decline over the next few months. Cattle feeding is not expected to show positive profit margins with current prices for fed cattle until April 2016, when breakeven costs are expected to decline to the $123-per- hundredweight (cwt) range.

For the week ending Feb. 7, 2016, five-area all-grade fed steers were $134.46 per cwt, roughly $26 lower than year-earlier fed steer prices (5 area weekly average direct slaughter cattle). First-quarter 2016 five-area direct total all-grades steer prices are projected to be $131 to $135 per cwt, down greater than $29 compared with first-quarter 2015.

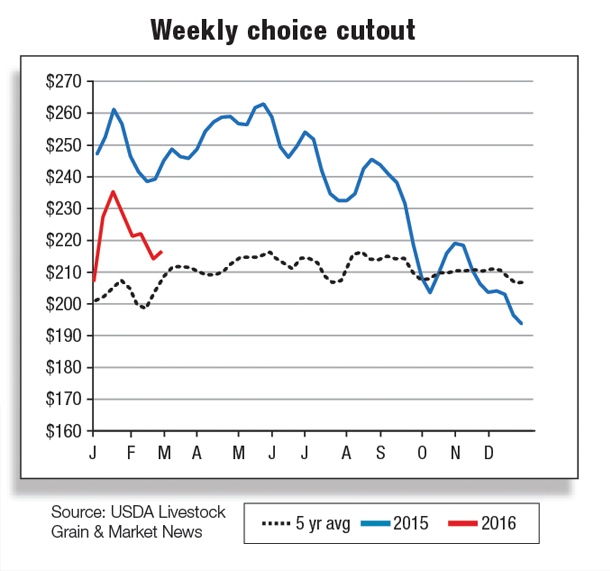

Wholesale, retail beef prices decline

Both choice and select beef cutout values are losing momentum from their mid-January highs. As of the week ending Feb. 5, the choice beef cutout was reported at $221.84 per cwt and the select cutout at $217.26 per cwt, down $12.83 per cwt and $11.20 per cwt, respectively, from their recent peaks during the week ending Jan. 15.

However, this is not entirely unexpected, as beef demand seasonally weakens heading into February, leading to lower cutout values. Adding to the downward momentum is the relative weakness in the beef trimmings complex.

Burdensome boneless beef cold storage stocks are partially accounting for lower year-over-year prices in the domestic lean beef trimmings markets. January’s Cold Storage report pegged total frozen beef stocks as of Dec. 31 at 514 million pounds, about 16 percent higher year-over-year.

Boneless beef cold storage stocks were reported at 475 million pounds, up approximately 17 percent year-over-year.

Ground beef demand remains sluggish, pressuring the all-fresh retail beef prices lower. According to the most recent ERS retail price data, monthly retail prices for all-fresh beef (which includes various ground beef products) continue to decline.

The December 2015 all-fresh retail price was reported at $5.89 per pound, down $0.10 from the previous month. The noticeable decline in the retail all-fresh beef price can partly be attributed to the sluggish demand for ground beef products during the last half of 2015.

Beef exports seen higher in 2016, imports expected to decline

December trade estimates, along with annual totals, were released earlier this month. Total beef exports for December were pegged at 196 million pounds, approximately 8 percent smaller than December 2014.

However, on an annual basis, beef exports were reported at 2.26 billion pounds, an approximate decline of 12 percent from 2014. U.S. beef exports were lower to most major trade partners in 2015, hampered by a stronger U.S. dollar, relatively high domestic beef prices and, to a lesser extent, increased global competition from Australian beef suppliers.

On an annual basis, beef exports to NAFTA trading partners Canada and Mexico were down 11 and 17 percent, respectively. Exports to Asian countries in 2015 were mixed. Japan, a top export destination for grain-fed U.S. beef, declined approximately 19 percent in 2015.

In addition, exports to Hong Kong fell about 24 percent, while shipments to South Korea and Taiwan increased 6 and 4 percent, respectively. Exports to Vietnam jumped 41 percent from a very low 2014 estimate.

It is clear from the previous 12 months of data that 2015 was not the best year for beef exports; however, the good news for U.S. beef suppliers is that global beef demand is expected to be stronger in 2016, and higher U.S. beef production at lower prices should increase export demand from major trade destinations.

On the flip side, the stronger U.S. dollar in 2015 improved the environment for beef imports. Total 2015 beef imports were reported at 3.37 billion pounds, up 14 percent year-over-year.

In aggregate, the largest increase in imports has been from Australia, as imports from that country were reported at 1.26 billion pounds, approximately 16 percent higher year-over-year.

Annual imports from New Zealand were 11 percent higher, and imports from Uruguay jumped significantly (+49 percent) in 2015. Demand for thermally processed beef was strong in 2015 as the U.S. imported more beef from both Brazil (+84 percent) and Uruguay (+49 percent) in the year.

U.S. beef imports in 2016 are expected to be lower as a result of decreased import demand for lean processing beef from Australia and overall higher domestic beef production. Total beef imports for 2016 are forecast at 2.85 billion pounds, down 16 percent from 2015.

U.S. cattle imports in 2015 totaled just greater than 1.98 million head, down 16 percent from the previous year’s levels. Cattle imports fell due to slowing shipments from Canada (-33 percent), despite higher shipments from Mexico (+3 percent). U.S. cattle imports are expected to decline in 2016 to 1.90 million head. ![]()

Kenneth Mathews is coordinating analyst for the USDA Economic Research Service. Analyst Mildred M. Haley assisted with this report.