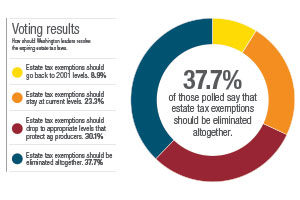

According to the results of an online poll at progressivecattle.com, nearly 38 percent believe exemptions for estate taxes should be dropped as part of repealing the estate tax altogether. Another 30 percent said estate tax exemptions should be kept, but drop to appropriate levels to protect ag producers.

Some 23 percent or respondents want to keep the current estate tax for $5.1 million per individual and $10.2 million per couple, with all income above that being taxed at 35 percent. This level of taxation will expire Jan. 1, 2013.

Another 9 percent of respondents said estate tax exemptions should go back to 2001 levels – of $650,000 per-person exemption, with income above that being taxed at 55 percent.

The estate tax exemption has been a major political issue in the 2012 presidential election. President Obama wants to reinstate the tax to 2009 levels, with a $3.5 million per-person exemption, and a 45 percent rate.

If nothing is done before Jan. 1, the exemption will drop to $1 million per individual, with the rate jumping from 35 percent to 55 percent.

Be sure to weigh in on Progressive Cattleman’s newest poll about whether to expand beef herds in 2013.