This year is relatively unique for wheat calves. Very little wheat is available on the Southern Plains. Even where irrigated wheat has come up, the current value of wheat sent many winter stocker calves through the sale barn relatively early this year.

Anecdotal evidence and sale barn AMS reports indicated winter stockers started leaving pasture as early as January. Pasture conditions are also poor, with 61% of the U.S. in moderate to severe drought. These factors mean keeping calves on pasture faces pressure, despite higher calf prices year-over-year. As an aside, this earlier sale trend contributed to the record-setting cattle on feed values and a higher-than-average value for cattle placed under 700 pounds we saw the last two months at the time of this writing.

Even though most with cattle to sell may have already made that choice, it’s worth considering the outcomes if you do still have cattle you have the option to retain.

First, calf prices are strong compared to last year, despite the dip through early March. Over the last four weeks at the time of this writing, the value of four-weight calves averaged $1.75 per pound, five-weight calves averaged $1.71 per pound, six-weight calves averaged $1.65 per pound, and seven-weight calves averaged $1.53 per pound. At those prices, revenue per head would roughly pencil out to $801, $962, $1,072 and $1,147 per head, respectively. The cost of production on calves is a bit tougher to nail down across the region, much less the country, but on the Texas High Plains, the expected variable costs on a cow-calf operation are $276.95 per animal unit to produce a five-weight calf. Throw in fixed costs, and we come to a total cost of production in the neighborhood of $580 per animal unit. That translates to a break-even calf price of $143 per hundredweight.

So how does selling now compare to the retained ownership option? First, we must establish an expected cost of gain (COG). As of mid-March, the average CME Corn contract value for delivery dates out to six months was $7.28 per bushel. At the same time, the average CME Corn contract value for delivery dates a year out was $7.03 per bushel. Once we add the recent basis of 70 cents per bushel, the expected cost of corn totals $7.98 per bushel and $7.73 per bushel, respectively. Keep in mind: Under current conditions, the current trend in corn prices means COG may be lower, per pound, for calves placed on feed at lighter weights than for calves placed on feed at heavier weights. More expensive corn in the near term means calves placed on feed for a shorter period will be fed on relatively expensive corn for a greater percent of their days on feed.

To calculate the COG, simply take the total cost of feed divided by the pounds gained. The formula used to calculate feed cost is:

Total Cost of Feed = Days on Feed x Cost of Feed ($ per pound) x Pounds of Feed Per Pound of Gain x Pounds Fed Per Day

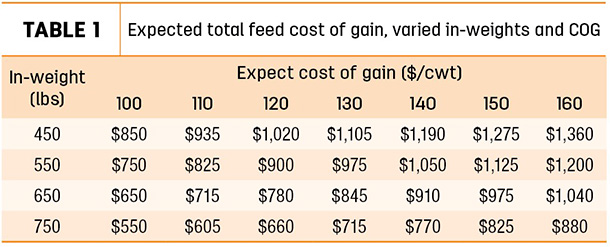

Using corn as our benchmark feed input, assuming a feed-to-gain ratio of 6.1-to-1, and assuming a target average daily gain (ADG) of 3.5 pounds, we can calculate an expected feed COG for any calf placed on feed. We then multiply the feed COG by 1.33 as a rough rule of thumb to account for other expenses like yardage and health. Your feedyard may have a lower (or higher) rate. Feed COG and yardage fees vary by yard if not by lot. Table 1 presents different expected total COG values that are realistic with cash corn priced anywhere from $7 to $8 per bushel, within the range of expected prices through March ’23.

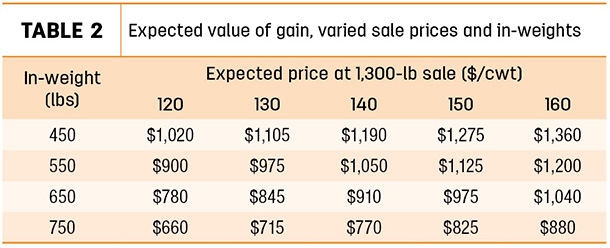

Though forecast COG are extremely high, live cattle prices are seeing support too. Table 2 projects expected revenue for calves sold at 1,300 pounds for different in-weights ranging from 450 pounds to 750 pounds. The three questions to answer using the two previous tables are:

1. Under potential COG scenarios, is retaining ownership profitable?

2. Is retaining ownership more profitable than selling a calf?

3. If retaining ownership is more profitable than selling a calf, is doing so worth the additional risk?

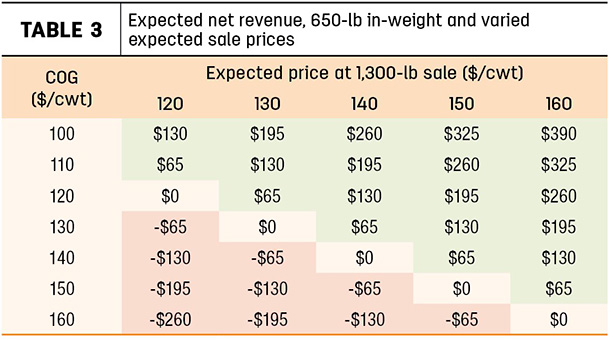

Table 3 shows expected net revenue for a calf placed on feed at 650 pounds and sold at 1,300 pounds, roughly 180 days from now.

Interestingly enough, and as a bit of a surprise to me, these returns are competitive compared to selling a five-weight calf at an auction at the time of this writing. The qualifier is obviously whether or not COG and calf prices remain in their current ranges. As of open on March 14, contract live calf prices averaged $1.40 per pound through March ’23, while contract corn prices averaged $7.03 per bushel, corresponding to roughly a feed COG of $1.02 per pound and a total COG of $1.35 per pound.