If you’re an American farmer or rancher looking to make an investment in ag land, not only can AgAmerica Lending help with a custom agricultural land loan, we’ve identified some very important questions you should ask before buying.

Questions to Ask When Buying Farmland or Cattle Ranch Land

- Location. Does the location work for you and your current operation?

- Water. Does the land currently have permitted water? What other water features or access to water are available?

- Soil. What is the soil quality and the soil health? Have soil tests been completed lately? The quality of the soil will determine how much work needs to be done by the buyer.

- Infrastructure. What is the existing infrastructure, and what shape is it in? Land with existing buildings and/or fencing that can be put to use for your operation will mean less work post-purchase.

- Land use. How well does the land suit your needs? How much is grazeable and how much is not? Are there dense wooded areas, sections that commonly flood, roads for easy access, etc.?

- State of the parcel. How well did the previous owner care for the land?

- Zoning requirements. Is all of the land zoned for your intended use?

Enlist the Services of Experts When Buying Agricultural Land

With 97 percent of farms in the U.S. being classified as family farms, it is important for agricultural land buyers to not only receive the best deal for the present, but for the future generation who will also be affected by the operation’s bottom line. There are two key factors that make the difference in purchasing farmland or ranch land:

- Working with a real estate agent that specializes in ag land; and

- Utilizing an ag-friendly lender like AgAmerica Lending who understands the challenges farmers and landowners face in managing a farming operation.

Work with an Agricultural Real Estate Specialist

In the real estate world, there are agents who focus on residential sales and agents who concentrate solely on land sales. The real estate agents who focus on land sales specialize in either commercial development or ag land. When selecting an agent to help facilitate your farmland or ranch land purchase, be sure they know the ins and outs of buying ag land and are familiar with the area in which you plan to make the purchase.

Select an Experienced Lender When Buying Farmland or Cattle Ranch Land

Unless you have the cash to finance your farmland or cattle ranch land purchase or are planning to work out a lease deal, you’re going to want a great lender by your side. Like your real estate agent, the best lender is one who knows your industry as well as the local environment, i.e. tax codes, regulations, land values, etc.

The first step with your lender will be to become pre-qualified for an agricultural land loan. Much like buying a home, pre-qualification helps set the expectation regarding purchase price as you begin your search for that perfect tract of land.

“The process of getting pre-approved for a home mortgage and a land loan are very similar,” explains Colin Clyne, Chief Lending Officer at AgAmerica Lending. “We will require a loan application, three years of personal and business tax returns (if purchasing the property in an entity), as well as personal financial statements, balance sheets, and a credit authorization so we can pull your credit rating. Additional items may be needed once we begin the due diligence, but all of these items will be required.”

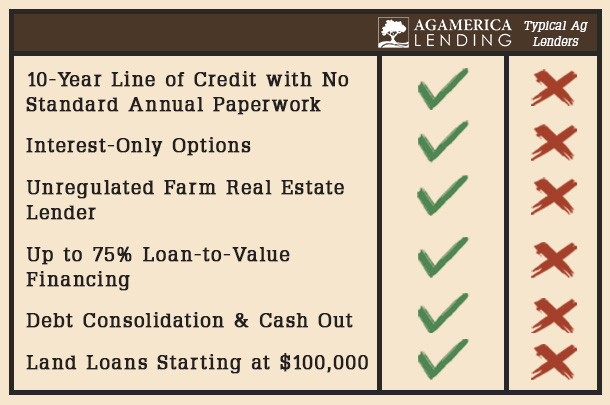

As you consider which lender to use, don’t be swayed by rates alone, choose a lender who can provide customer testimonials and reviews, as well as attractive value-added benefits. AgAmerica Lending offers an industry-unique 10-year line of credit that can be used for any business purpose in running the operation once you have purchased your land.

“No other lender out there offers this type of long-term line of credit,” says Blake Averitt, Corporate Relationship Manager at AgAmerica Lending. “Use it now or use it later…there are no penalties if it sits, and no penalties if you pay it off early. It’s a very unique interest-only financial tool for borrowers looking for a cushion in case of that ‘what if’ situation.” Here is a list of key differentiators that separate AgAmerica Lending from banks and traditional lenders:

When You Are Ready to Buy Ag Land

At AgAmerica Lending we understand land is our country’s most valuable asset, and one that we need to protect.

In addition, as farm real estate values continue to increase, buying land can be a wise investment for the future of your operation. When you are ready to purchase that prime piece of farmland or cattle ranch land, get in touch with AgAmerica Lending’s team of land loan experts to learn more about how our spectrum of financing options can help you meet your long-term goals.

Portions of this article originally appeared in the national agriculture publication, Growing America (GA) on April 18, 2018. To read the full content which appeared in GA’s Florida edition, we invite you to click here.