Due to the reduced (and further shrinking) U.S. beef cow inventory, prices for cull cows (also referred to in a more consumer-friendly manner as “market” cows) have been extraordinary over the past few years. It’s remarkable to see utility slaughter cows selling today for $70 per hundredweight (cwt). Over the past two years, they have consistently sold for around $60 per cwt.

Amazingly, market cows have not really sold below $45 per cwt since the fall of 2003 – eight years ago! The added $20 per cwt has resulted in about a 50 percent increase in the per-pound selling prices of cows, adding up to about $250 per head more for a 1,250-pound beef cow.

Cow beef in high demand

One reason for these strong prices is the shrinking supply of market beef cows available for harvest. But, the demand side is contributing a large amount to market cow price as well.

In part, this is due to the strong demand for ground beef during the ongoing economic downturn, in which many consumers are choosing lower-priced ground beef over higher-priced steaks.

However, less than 50 percent of a cow’s carcass goes to ground beef, contrary to popular opinion. Much of a cow’s carcass today is cut into about 20 different wholesale cuts.

These whole-muscle cuts are sold to retailers, restaurants and the food service industry and merchandised as marinated steaks, roasts, deli and fast-food roast beef, Philly steaks, fajitas and other high-quality and high-value products.

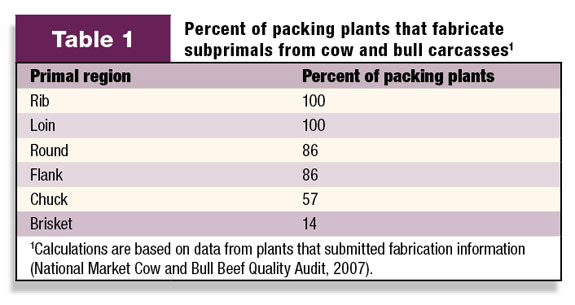

During the 2007 National Market Cow and Bull Beef Quality Audit (NMCBBQA), more than half of all packing plants indicated they are fabricating six of seven subprimals, rather than only grinding them (Table 1).

The trend of using more of each market cow carcass for higher-priced value-added products will continue.

Therefore, producers should consider methods to add value to their market cows as opportunities become available.

For instance, there is a growing demand among the retail and food service industry for packer-graded “White Cows,” which produce carcasses that have some marbling, white-colored fat, bright lean color, and a Yield Grade of 1, 2 or 3.

By identifying these carcasses, packers are attempting to provide consumers with moderately priced middle meats (ribs and loins) that are higher in quality and more palatable than cuts from traditional non-fed market cow beef.

Several cow packers are paying producers upwards of $10 per cwt (on a carcass-weight basis) above Cutter/Canner carcass price for carcasses that fit into the White Cow grade.

Selling cows at auction

Unfortunately, not all ranchers have the option of feeding cows after culling but prior to harvest.

This may be due to challenges with cash flow, tax filing or lack of facilities or feedstuffs to properly feed cows.

Additionally, current corn prices greatly discourage feeding market cows corn prior to harvest. As a result, most producers still sell their market cows via a livestock auction market.

To help ranchers acquire more premiums and avoid discounts on cows they sell at auction, a year-long survey was conducted in Idaho and Utah to identify beef cow traits that directly affect selling price at auction.

The survey focused on the incidence and severity of several Beef Quality Assurance (BQA)-related defects in market beef cows.

Unfortunately, in today’s marketplace, economic signals sent back to ranchers are still not clear enough to prevent several BQA defects from occurring in market cows and their resulting carcasses.

This was shown in the most recent NMCBBQA in 2007, where 28 percent of the beef cows evaluated in holding pens just prior to harvest had at least one visible quality defect.

To complete the auction market project, eight trained evaluators from the University of Idaho visually scored market beef cows on 23 BQA-related traits during sales at six livestock auction markets in Idaho and Utah.

Overall, 8,213 beef cow lots (consisting of 9,299 beef cows) were individually evaluated during 79 different sales in 2008.

Not surprisingly, over 60 percent of market beef cows were predominantly black-hided, and overall cows averaged 1,206 pounds, with 80 percent weighing 1,000 to 1,600 pounds.

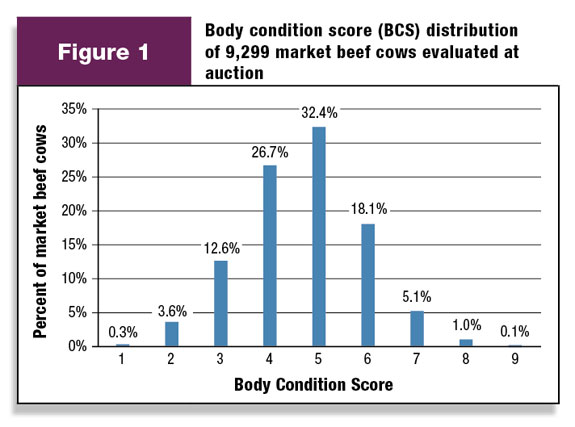

The average body condition score (BCS) on a nine-point scale (1 = emaciated, 9 = obese) was 4.7. As seen in Figure 1, 77 percent of beef cows had a desirable BCS of 4 to 6; however, 17 percent were thin (BCS 3 or less) and 4 percent were emaciated (BCS = 1) or near-emaciated (BCS = 2). Only 6 percent of cows had a BCS of 7 or greater.

The percentage of beef cows considered sound (not lame) was very high (84.9 percent), particularly compared to dairy cows that were also evaluated in this study (only 55 percent were considered sound).

More than 90 percent of beef cows were hornless, and evidence of cancer eye was only observed in 0.6 percent of beef cows.

Unfortunately, of cows with cancer eye, the vast majority (73 percent) were considered cancerous.

Premiums and discounts at auction

When data were collected in 2008, the average selling price for these market beef cows was $45.15 per cwt – far below today’s elevated values.

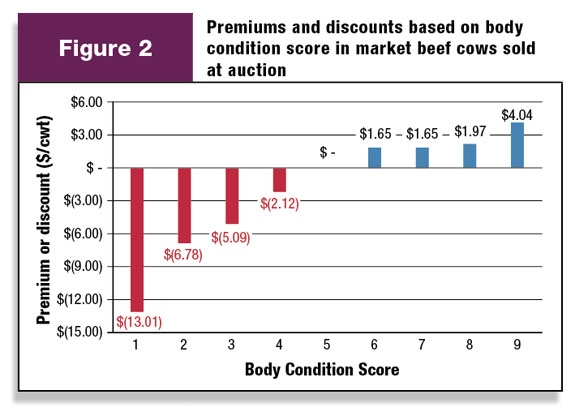

However, there was still a large amount of variation in selling price between cows, based on several factors. For instance, BCS had a major influence on selling price (Figure 2).

Compared to a BCS 5 beef cow (which was considered “par” or the “base”), thinner cows (BCS 1 to 4) were discounted $2 to $13 per cwt. In contrast, fleshier cows (BCS 6 to 9) received premiums of $1 to $4 per cwt.

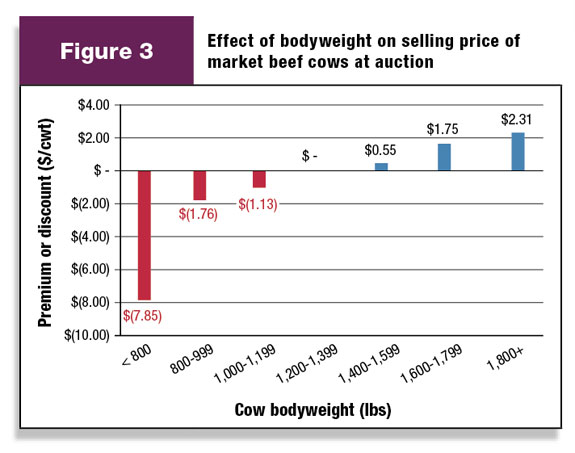

Bodyweight discounts and premiums were consistent with BCS, based on the fact that lighter-weight cows were discounted $1 to $8 per cwt and heavier-weight cows received premiums up to $2 per cwt (Figure 3).

Beef producers should consider adding value (via improved BCS and bodyweight) to thin and/or lightweight market cows before selling them at auction to acquire readily available premiums for fleshier and heavier cows.

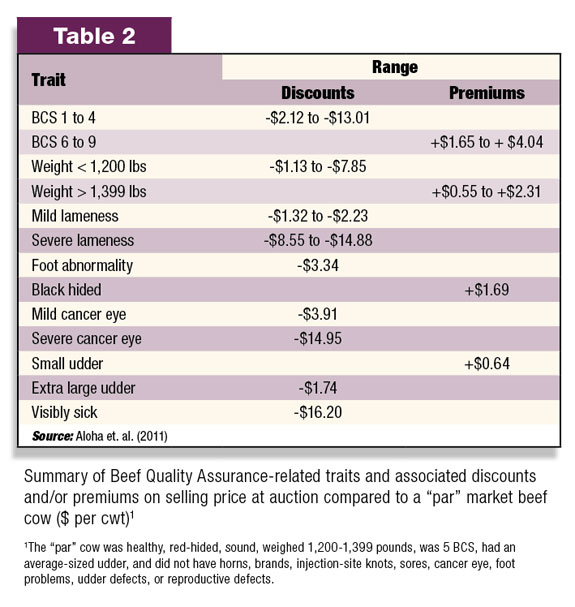

The effects of several other BQA traits on market beef cow selling price were also evaluated (Table 2).

For instance, beef cows with any evidence of lameness were discounted from $1 per cwt (if minor) up to $15 per cwt (if a cow was three-legged lame and almost non-ambulatory).

The presence of cancer eye resulted in a discount of $4 per cwt if it was precancerous, but $15 per cwt if cancerous.

The larger cancer eye discount can be attributed to an increased likelihood of whole-carcass condemnation if the cancer is advanced, suggesting cows with early signs of cancer eye should be sold immediately.

Animals that were visibly sick while in the auction ring were discounted $16 per cwt, which was associated with an animal’s likelihood of dying or becoming non-ambulatory before harvest, being condemned or yielding a poor-quality carcass at harvest.

These cows are also becoming a large animal welfare concern to livestock auction markets and packers.

In conclusion, improving BCS and weight, which producers can do at the ranch level, will positively impact sale price.

And animals that have obvious BQA defects, are visibly sick and/or have a defect associated with possible condemnation, will be discounted severely.

Ultimately, animals with minor quality defects should be sold in a timely manner before the defect advances and the discount increases, as with both lameness and cancer eye.

However, producers should hesitate before marketing cows with more advanced health problems and defects.

Disposal options for such animals should include on-farm or on-ranch euthanasia, particularly if an animal’s welfare may become jeopardized during the marketing and slaughtering process.

A complete journal article summarizing this project, which was funded by beef producers through the $1-per-head Beef Checkoff, is available by contacting the author. ![]()

Jason K. Ahola

Associate Professor

Beef Management Systems

Colorado State University

Jason.Ahola@colostate.edu