And increasing costs, greater risk and a nationwide push to increase grain production (at the expense of our forage base) will continue to make it difficult for producers to remain profitable in the cow/calf business.

As producer numbers have declined, so has the U.S. beef cow inventory. The 35.7-million-head calf crop produced in 2010 was 1 percent lower than 2009 and the smallest calf crop since 1950 (which had 34.9 million calves).

This reduced cattle supply has benefitted many cow/calf operations, in terms of higher calf prices paid by increasingly desperate feedyards, but has also been challenging to the margin-operator segments of the industry – feedyards and packers – who are trying to overcome high overhead costs by keeping their facilities full.

Every segment of the beef industry is struggling to adjust to reduced cattle numbers, increased input costs and greater market volatility.

However, it’s important that cow/calf producers spend time now developing a strategy to survive this changing environment.

Open-minded and well-managed cow/calf operators will have access to unique opportunities if they consider three major “issues” that are redefining how U.S. beef cattle production will occur in the future, including:

1. Outrageous feed costs and market volatility

2. Impending problems with mature cow size and feed efficiency

3. Changing demand for calves based on weight and background

Input costs and market volatility

The current extreme prices for all feedstuffs, at least in relation to their historical averages, is the new reality.

Corn is selling for three times more (about $7.50 per bu today) vs. the average from the mid-1970s until 2006 ($2.38 per bu) according to CattleFax, and hay is selling for about twice as much ($120 to $150 per ton today) compared to the 1990s through the mid-2000s ($60 to $75 per ton).

Unfortunately, U.S. corn farmers have had to break records every year in terms of ‘number of acres planted’ and/or “corn yield per-acre” to keep up with growing demand for corn.

In addition to export and human food uses, in 2010 ethanol alone used over 4.5 billion bushels of corn (over one-third of U.S. production).

This has led to the transition of many hay fields to corn fields and a subsequent reduction in hay and forage supply.

Yes, corn price directly drives feedlot profitability and feeder cattle prices – a $1.00 per bu increase in corn price decreases a feeder calf’s value by $10-15 per hundredweight (cwt) or $70-100 per head.

But, more importantly, corn price drives market prices for all other feed commodities, including hay. As a result, cow wintering costs will be elevated as long as the demand for corn continues to outpace supply.

Any efforts by cow/calf producers to limit winter feeding (which accounts for about 60 to 80 percent of their variable costs) without hindering cow or calf performance will be necessary.

Market volatility will also continue to discourage new entrants into the cow/calf segment. Major market risk due to fluctuations in both input (feed, land) and output (calf) prices will require that new producers have a risk mitigation strategy, especially if they depend on using start-up or operating loans.

It’s likely that more contracts between new cow/calf producers and large-scale feeding and/or packing entities (e.g. Cargill, JBS-Swift, Five Rivers, etc.,) may emerge.

In today’s swine industry, practically the only method for a new producer to enter the business is via a signed contract with a large hog packer.

While this strategy may be frowned on by many in the beef industry (based on a general dislike of producer-packer agreements and the potential for market control) this option may be the only method to enable a new generation of ranchers into the industry.

Otherwise, the massive amount of risk compared to the relatively low potential for return on investment will discourage new producers from entering the business.

Mature cow size and efficiency

It is generally agreed that the average mature size of a U.S. beef cow is increasing rapidly and likely getting out of hand.

This is occurring with almost no simultaneous selection for improved mature cow feed efficiency. It appears that three things are occurring among many Angus seedstock operations, who have the largest share of the bull selling market:

1. Very aggressive genetic selection for growth in a breed traditionally viewed as “maternal”

2. Lack of selection to reduce mature cow size

3. No genetic selection tools available to improve mature cow feed efficiency

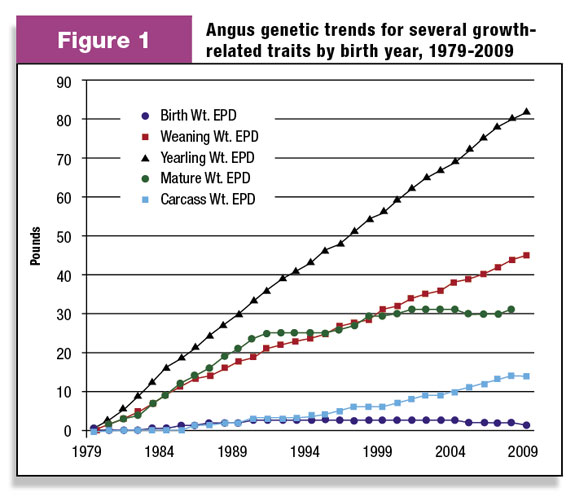

In the last 30 years, the Angus breed has had tremendous success in the genetic selection of growth traits over time, but has also seen increases in mature weight and carcass weight (Figure 1).

In fact, some of the most popular Angus sires in use via A.I. today are producing progeny with yearling weights equivalent to the average of the Charolais breed, at least based on breed EPDs adjusted using USDA’s across-breed EPD adjustment factors.

As a result, retained daughters of high-growth Angus bulls possess growth genetics that rival those of Charolais – a breed developed primarily for terminal use.

As mature cow size and winter feed costs climb, progressive cow/calf producers may attempt to reduce costs by considering several options: place more selection pressure on reducing cow size and/or reducing emphasis on growth, move their calving season later to more closely match forage availability and/or select for improved mature cow feed efficiency.

The main driver for cow/calf producers to select for cow feed efficiency will be high feed costs, although elevated winter feed costs since 2007 have yet to trigger such selection (or the development of necessary selection tools by the seedstock industry).

In fact, current measurements of, and genetic predictions for, feed efficiency are only for feedyard feed efficiency.

Research results comparing the relationship between feedyard feed efficiency and mature cowherd feed efficiency are still lacking, even though more than half of the feed required to produce a pound of beef at retail actually goes toward maintaining the cowherd.

Due to the beef industry’s slow pace of embracing and selecting for improved cowherd feed efficiency, as a result it’s likely that the carbon footprint of beef production vs. other animal proteins (pork, chicken) could be viewed as undesirable by consumers.

Poorer feed conversion ratios among cattle (which require two to three times more feed inputs per pound of gain than pigs, chickens or fish) and large feed resource requirements to maintain a cowherd put the beef industry at a competitive disadvantage in terms of the efficiency of meat production.

Demand for lightweight calves

Lucky for cow/calf producers, calf prices will continue to increase as the economy moves out of recession, global beef demand strengthens and cattle supplies further decline.

It’s feasible that lightweight calves (400-weight and 500-weight calves) will bump up against $200 per cwt in the next few years.

Over the past four years, the price spread between lightweight calves (400-weights and 500-weights) and heavyweight calves (600-weights and 700-weights) has increased dramatically.

The $15 per cwt difference between the per-pound selling prices of a 450-pound vs. 750-pound steer in 2008 has nearly doubled to about $29 per cwt currently, according to CattleFax data.

On a percentage basis, light steers are worth 23 percent more per pound than heavy steers, compared to just 13 percent more in 2008.

This increased spread is due in part to stronger demand for lightweight calves that can efficiently gain weight on pasture (and at a low cost of gain of about $0.50 per pound) rather than going straight to a feedyard for a lengthy feeding period (and gaining at an elevated cost of gain around $1.00 per pound).

Heavyweight calves are simply less profitable if grazed on pasture due to excess body condition and resulting poor pasture gain and feed conversion.

Due to the high corn price, the more weight a calf can gain outside of a feedyard the lower the total cost to get that animal to slaughter weight.

As a result, cow/calf producers could consider reducing the weight of calves they are marketing and selling them for a higher price per pound.

Yes, overall income will be lower since the higher per-pound selling price is not enough to completely compensate for selling fewer pounds.

However, reduced cowherd expenses should accompany the production of lighter-weight calves.

For instance, a cow/calf producer could consider changing the time of calving and/or weaning. Winter-calving operations that calve later (during late spring or early summer) will better match times of high nutritional demand (late gestation and early lactation) with forage availability and quality.

This would reduce winter feed costs by reducing feeding of high-priced harvested feeds during times of high nutritional requirements.

Similarly, cow/calf operations may consider weaning calves earlier and selling them at a lighter weight.

Early weaning reduces nutritional demand on a cow at a time when she could otherwise be storing up body condition for the impending winter.

Cows that enter the winter with greater energy stores should require less feed throughout the winter and/or have improved reproductive performance during the next year’s breeding season.

Again, producers will experience reduced income (due to selling lighter-weight calves), but earlier-weaned calves could be sold earlier in the fall (August or September) to avoid the seasonally low weaned calf market when most cow/calf operations market their calves (October and November).

Finally, cow/calf producers may consider reducing their emphasis on genetics for growth in an effort to reduce mature cow size and improve cowherd efficiency.

Instead of buying bulls primarily based on weaning and yearling weight performance, and competing with other cow/calf producers to buy those higher priced growth bulls, producers could emphasize other important traits.

These traits could include calf survival (through improved calving ease and maternal ability), reproduction (via greater heifer pregnancy and cow stayability) and/or cost-related traits such as feed efficiency. ![]()

PHOTOS

TOP: Recent price spreads have increased for lighter-weight calves that can gain more weight on pasture.

BOTTOM: Wintering costs will increase as long as the demand for corn continues to outpace supply. Photos by Paul Marchant.

Jason K. Ahola

Associate Professor

Beef Management Systems

Colorado State University

Jason.Ahola@colostate.edu