After a particularly rough year (or a series of rough years), we may justify losses by saying, “Ranching is more about the lifestyle than it is the livelihood.” We may have even heard someone tell our dad in the ’80s he needed to “get big or get out” when it came to agriculture. Not wanting to get big or get out, we chose to get by.

Ranching can and should be profitable; the fundamental change comes when we start treating our ranch like a business and not just a lifestyle. Dave Pratt, owner of Ranch Management Consultants and founder of the “Ranching for Profit School” says, “Any business (ranching included) has only three choices: make it profitable, subsidize the business or go out of business. Whether we realize it or not, most of us choose the second option – we subsidize our businesses.”

This isn’t a suggestion to quit your off-farm job; it’s suggesting you need to treat your ranch like a business and consider the options for increasing your profitability. In Pratt’s seminars, he instructs his students to consider three options when it comes to creating greater profits: reducing overhead costs, increasing turnover and improving margins.

Let’s focus on that final point – improving your margins.

Consider the 5 percent rule

Danny Klinefelter, economist at Texas A&M University, coined the “5 percent rule” in production agriculture. In his research, he found the top 25 percent of farms were only 5 percent above the average when it came to yield, price received and cost of production, and the bottom 25 percent of farms were only 5 percent below average when it came to these same factors.

What does that mean? Changing your yields, prices and cost by as little as 5 percent can have a massive impact to your bottom line. What does that look like in practice? Consider this case study.

5 percent rule case study

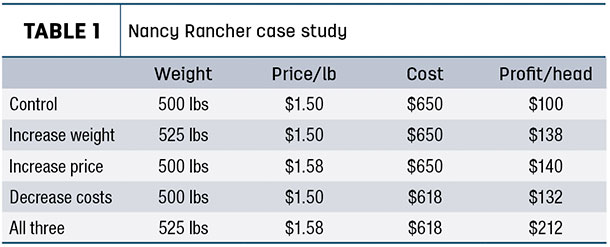

Nancy Rancher has 200 calves to sell. She weans a 500-pound calf and receives $1.50 per hundredweight (cwt) at the sale (Table 1).

Her gross profit per calf is $750. If the cost to raise that calf (cow maintenance, etc.) is $650, it results in a margin of $100 per calf. Consider the outcome if she implements the 5 percent rule on each of those factors: sale weight, price received and overall cost. Go ahead and do that math.

By applying any one of these tactics, Nancy increases her profitability by 30 percent. When she implements the 5 percent rule on all three variables, her profitability more than doubles. Considered over the long term (30 years), the net profit goes from $600,000 annually to $1.28 million annually. That kind of money is not just spare change; it is the kind of money that pays off the ranch mortgage.

However, implementing the 5 percent rule isn’t as easy as it sounds. It will take some creative “outside the box” thinking.

Creating profitability

For Joe Miller of Miller Ag LLC, outside the box is the way they have always done business, and it has proven profitable to this second-generation family operation. The Millers are not your average ranching operation; you might not even call them a ranch. They milk 1,500 dairy cows, farm 2,000-plus acres and run 800 head of commercial beef cows. In Miller’s words, they are “diversified to survive.”

They have always taken this “5 percent rule” kind of thinking seriously. Miller says, “How an operation maximizes their margin is going to be as unique as the operation itself – and our operation, it’s unique.” The Canadian Beef Cattle Research Council calls this kind of rancher a “precision rancher.” They say, “A precision rancher is someone who understands agriculture operates on small margins, so they use every technology, production practice and management technique appropriate to their climate, zone and production system.”

If this is the definition of a precision rancher, Miller Ag LLC fits right in. Miller says, “I try to have the mindset of doing things a little bit better, the mindset to improve and use everything. Every little thing that you have becomes the most important thing because margins are so small. It is like the regrowth on the barley or the corn stubble; if you can be feeding the cows for a couple weeks or a couple months more, you are creating value you wouldn’t get if you just tilled it under.”

What exactly are the Millers doing to create profitability on their ranch? Well, it’s no secret; they are considering their operation holistically and increasing yields, lowering costs and maximizing their prices. Here are a few keys to their beef cattle management strategy:

-

Buy cull cows – Miller says, “Through the years, we have stuck with these older cows. We can get them cheap and always get several more calves out of them. It’s easier at our place than most other ranches where grazing conditions are tough. When they get out to our irrigated pasture and crop stubble, they basically start a whole new life.”

-

Sell 100 percent of the calf crop – Miller says, “I have been tempted to keep some heifers, especially when we have a fantastic group, but the system we have is great for cash flow. We buy these older cows, they have a calf in the spring, and we sell it in the fall. It really speeds up the rate of return.”

-

Stretch feeding options – Miller says, “We will feed dairy pushout in the really wet months. When the dairy cows and heifers won’t touch it anymore, the beef cows eat it right up.” The Millers also feed their crop regrowth and have turned their poorer farmground into irrigated pasture.

- Reconsider genetics – Miller says, “When I am picking bulls, I am focused more on phenotype than genotype. I am not keeping any of my calves, so the genetics are less important than how they look. I want my calves to have great eye appeal when they are going across the sale ring in order to get the top bids.”

We agree these strategies may seem “out of the box,” but they work for the Millers. Will they work for your operation? Unless you too have a dairy and thousands of acres of crop ground, the answer is probably not. What the Millers’ model shows us is how to consider our operation as a whole and find creative ways to increase profitability. For you, that may mean finding a niche market, considering alternative feed sources, intensive grazing or fall calving. The solution to maximizing margins is as varied as the climate cattle are raised in.

The 5 percent rule is less about the actual numbers than it is about the concept. It gives us a standard to aim for as we creatively consider how to increase our prices, lower our costs and increase yields. As the competition for protein increases, beef producers will have to contend with other commodities to secure land, labor and capital. We can only get competitive when we are profitable – and profit is the one thing in agriculture worth banking on. ![]()

ILLUSTRATION: Getty Images.

Erica Louder is a freelance writer based in Idaho.