For instance, the U.S. produces more than 20 percent of the world’s beef; however, we are home to only 9 percent of the world’s cattle and 4 percent of the world’s people.

We were the first country to create a large, highly efficient, modern beef production system with a product in high demand. However, 40 percent of the world’s population resides in India, Brazil and China, as well as 60 percent of the world’s cattle.

Several South American countries (particularly Brazil, Uruguay, Argentina, Colombia and Paraguay) are poised to become suppliers to this large and growing population. Several of these countries have a lot of cattle.

Interestingly, in the past five years world beef cow inventory declined by approximately 3.7 million cows.

This decline is consistent with the large global drop in total cattle numbers from 1.10 billion (in 1990) to 1.02 billion (in 2009) – a 7 percent decline over 19 years.

World cattle inventory continues to decline in the face of increasing worldwide beef demand as countries like China continue to develop.

One item worth noting is that the decline in U.S. inventory since 2008 – 3.1 million beef cows – has been met with an opposite expansion in Brazil of almost 4 million beef cows during the same period.

From 1990 to 2009, while the U.S. cattle inventory declined by 5 percent, inventory increased in Brazil (by 33 percent), Uruguay (by 22 percent), and Paraguay (by 39 percent).

As a continent, South America’s cattle inventory increased from being 23 percent of the world’s total cattle in 1990 to 30 percent in 2009. South America has been expanding its cattle inventory for decades, but only recently has it been able to capitalize on growing global demand for beef.

Global beef exports

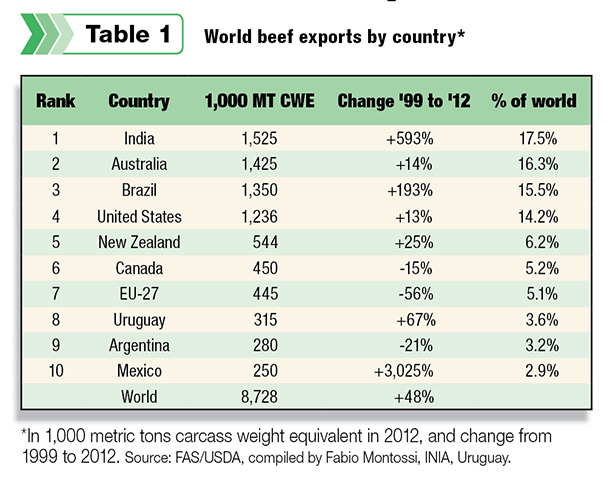

From 1999 to 2012, South America increased its share of the global beef export market from 18 to 25 percent Table 1.

This was led by tremendous increases from Brazil (193 percent increase) and Uruguay (67 percent). During that time, the U.S. experienced only a 13 percent increase in exports and currently ranks fourth for beef exportation.

Since export markets are playing an increasingly important role in the expansion of the South American beef production industry, these countries are becoming more export-driven than the U.S.

World beef demand will continue to grow, but the question remains: Which countries will be leaders in the production and exportation of beef?

Based on data from the U.S. Meat Export Federation, Asia will be a net importer of beef since it has more than half of the world’s population but only 0.32 acres of arable land per person.

On the other end of the spectrum, Oceania, North America and South America all have access to large supplies of arable land (3.9, 1.7 and 0.8 acres per person, respectively) yet fairly small populations (0.5, 5 and 8.6 percent of the world’s population, respectively) relative to their farmable land masses.

Countries on these continents are becoming net exporters of beef.

Beef production in South America

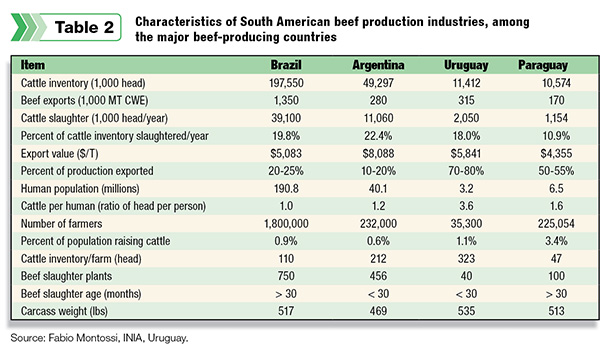

The size, productivity and efficiency of South American beef production industries vary by country, as seen in Table 2.

Huge opportunity exists for increasing production efficiencies in these countries, particularly when their performance is compared to the U.S. Some aspects worthy of noting include the following.

- On average, South America slaughters 20 percent of its cattle inventory annually – this is about half of what the U.S. harvests (37 percent).

- All four of these countries export a higher percentage of their production versus the U.S. – some much higher (i.e., 70 to 80 percent from Uruguay).

- Other than Paraguay (which has the least-developed beef production system), the average South American producer has more cattle than in the U.S. (the U.S. averages 98 head of cattle per cattle operation – this includes all ranches, dairies, feedlots, etc.).

- There are more than three times as many cattle per person in South America (1.1 head per person) than in the U.S. (0.3 head per person).

- A higher percentage of the population in South America raises cattle than in the U.S. (only 0.3 percent of Americans have cattle).

- Most cattle are slaughtered close to, or at more than, 30 months old in South America – while the average U.S. feedlot steer or heifer is approximately 17 months old.

- South American carcass weights are close to 500 pounds, while the average U.S. carcass weight for steers and heifers was 833 pounds in 2012 (over 60 percent heavier).

South American momentum

Looking forward, momentum is on the side of South American cattle producers.

Assuming world cattle inventory doesn’t increase dramatically while population continues to grow and wealth is amassed in Asia, cattle operations in South America are likely to benefit more than in the U.S. This is for a variety of reasons, including the following facts.

- Beef production is a larger part of South American economies (relatively) than in the U.S., and more of the population is involved in beef production; there is more societal and governmental support for their beef industry to be successful.

- The average producer is larger and possibly more profit-driven in South America, possibly leading to more rapid improvement in production efficiencies.

- Average slaughter age is decreasing in South America; this will continue to improve end-product palatability (i.e., tenderness) and efficiency, and reduce cost of production (via fewer days of maintaining an animal).

- High-accuracy A.I. sires from the U.S. are already readily available in South America, and their use is becoming widespread; over time, much of their genetics will rival those in the U.S.

- The percentage of inventory slaughtered annually will increase due to improved genetics, better management and younger slaughter age; more pounds of beef will be produced at a lower cost per pound.

- South Americans are already much more export-driven than the U.S.; with improved end product, reduced cost, effective traceability systems and less seasonality of production (versus the U.S.), they will be increasingly competitive in export markets.

- Technologies that improve efficiency – growth-promoting implants, fed antibiotics and beta-agonists – are not being embraced in South America as a result of widespread consumer concern, giving them an advantage in export markets including Europe.

- Grain finishing in feedlots will continue to increase (currently it is only approximately 24 percent in Argentina, 10 percent in Brazil, and 6 percent in Uruguay), leading to heavier carcass weights, improved production efficiency and enhanced palatability.

- Nationwide mandatory traceability (with near-complete producer buy-in) will continue to be implemented based on initial success in Uruguay due to its effect on beef exports.

- End-product quality will continue to improve, in part due to a focus on identifying quality defects via national beef quality audits (modeled after the U.S.) that have been in place for almost a decade in places like Uruguay.

- South America’s forage base and temperate climate is better suited to raising cattle versus the U.S.; cost of production is hard to beat when little or no winter hay feeding is required on most of the continent.

The future of South American beef production looks bright, but it should be noted that they have challenges as well – some of them similar to those in the U.S.

The biggest obstacle currently is production efficiency and employing technologies, management and genetics to increase beef production per unit input (whether it be cattle inventory, feed or acres of land).

Additionally, disease outbreaks such as foot-and-mouth disease will continue to hold back South American beef exportation (both beef and live cattle), which is vital to the growth of domestic production.

Sustainable beef production that does not negatively impact the environment (particularly including the Amazon’s rainforests in Brazil) is also a major challenge.

And there are the same challenges that are occurring in the U.S. such as animal welfare, end-product quality and palatability, traceability and inadequate communication between industry segments.

Finally, escalating costs for land, labor and natural resources will hinder South America’s ability to have extremely low unit costs of production in the future.

Ultimately, in the next decade we will see tremendous changes in the South American beef industry. It will be worthwhile keeping an eye on what they are doing. ![]()

Jason Ahola

Associate Professor

Beef Management Systems

Colorado State University