The question was not if you could make money, but how much could you make. Since that time, several things have changed within the industry: Cattle numbers have increased, grain prices have decreased, export numbers have increased and leverage within the industry has shifted.

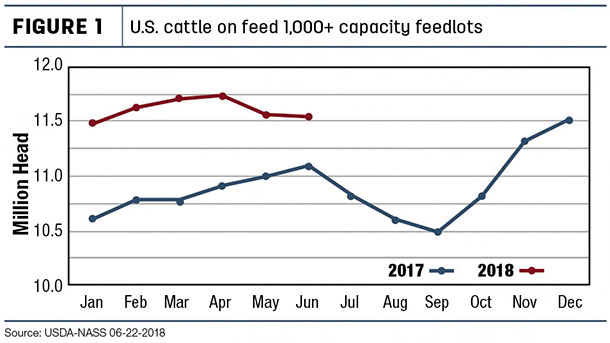

One of the driving forces in the cattle market has been the increase in cattle numbers the last several years. Figure 1 shows the increase of cattle on feed in 2018 compared to 2017.

The 2018 calf crop is also projected to be up 2.7 percent to a little over 37 million head. The 2018 cow herd is projected to increase 700,000 head to just under 32 million head. This will be the fourth year in a row of increased cow herd numbers.

We are without question in the expansion portion of the cattle cycle. The fact that cattle inventory has increased the past several years has put downward pressure on cattle prices. This helps explain why prices have declined compared to the highs of several years ago.

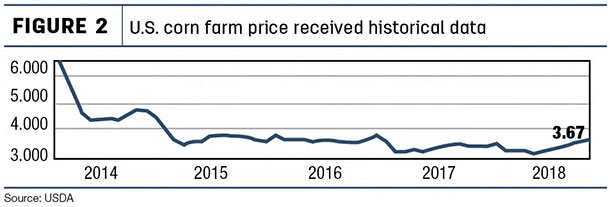

Grain prices have a large impact on feeder cattle prices. The last several years, grain prices have decreased and remained consistently low (Figure 2).

World corn stocks have remained high for several years now. China and Brazil continue to increase their production of corn, helping maintain large supplies of corn worldwide. The U.S. corn stocks to carry over are the largest since the early 2000s. These low corn prices have helped feeder cattle prices remain somewhat strong in the face of increasing cattle inventories.

American consumers have not increased their consumption of beef to any large degree over the last several years. The 2018 per capita net consumption of beef is projected to be around 58 pounds. This is up around 4 pounds from the all-time low in 2015. This number is only a fraction of the number in the mid-80s that reached nearly 80 pounds per capita.

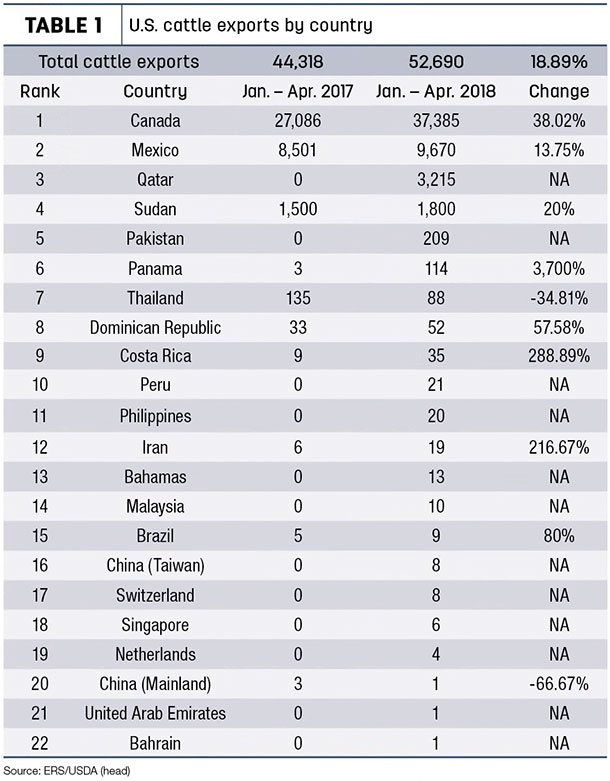

Exports have a large impact on cattle prices. Domestic consumers have a limit to how much beef they are able to consume. This means the price of cattle is extremely sensitive to export numbers. Exports have been strong so far during 2018, up almost 20 percent over 2017 (Table 1).

Our traditional leading export countries of Canada and Mexico have led the way with large export volumes so far this year. This has helped stabilize cattle prices as cattle inventory numbers have continued to increase over the past several years.

Leverage within the cattle industry affects cattle prices. During the high feeder calf prices of 2014 and 2015, cow-calf producers possessed the most leverage within the cattle industry. Feedlots and packers were running below capacity and needed cattle to keep their investments running at full capacity.

This caused the price of calves to skyrocket, because feedlots had to compete to keep calves in their lots. Meanwhile, packing plants were also running just over 90 percent of capacity and were forced to bid the price of live cattle up to keep their plants running efficiently. These events caused feeder calf prices to skyrocket to unheard-of levels.

These events also greatly contributed to the crash of feeder cattle prices in 2016. During 2014 and 2015, several feedlots and packing plants were forced to go out of business. This caused the leverage within the cattle industry to take a drastic change.

Feedlots were coming off historic losses and were determined to recover some of their losses. This caused very conservative bids for calves in the fall of 2016. Meanwhile, packing plant capacity had been reduced, so live cattle were easier to find. This caused live cattle prices to decline in 2016. The result was a historic drop in calf prices in 2016.

In 2018, packing plants possess the largest portion of leverage within the cattle industry. They are running at almost 107 percent capacity and are in no hurry to bid up the price of live cattle. Packers are experiencing record-high profits and are in a great position.

The leverage that packers possess has tempered the ability of feedlots to turn a profit. The feedlots are passing their reduced prices on to the cow-calf producer. This has kept feeder cattle prices from increasing to any large degree.

After evaluating cattle numbers, grain prices, export numbers and leverage within the cattle industry, the question remains, what are prices going to be this year, and when should I sell my calves? Before we answer that question, let’s review what we have learned. First, cattle numbers are up and are predicted to continue to increase for the next couple of years.

This will likely put a limit on how much prices will increase over the next several years. Second, grain prices are low and stocks are near record levels. This should help support the price of calves in the near future. Third, export numbers are high but can be volatile.

Currently, increased levels of exports are helping support calf prices. Remember, exports are volatile and can change very quickly. Fourth, leverage within the cattle industry currently favors the packer. This will keep calf prices from increasing as much as would be possible otherwise.

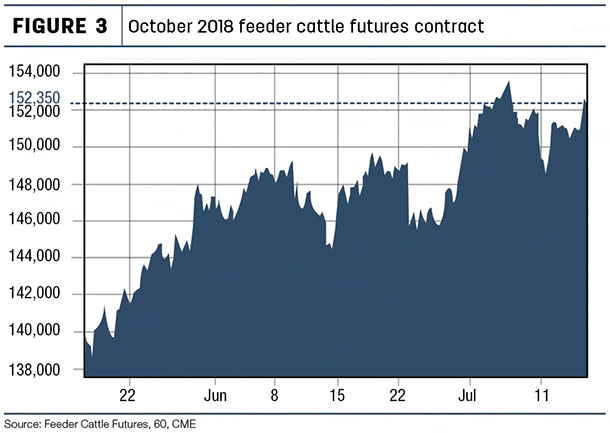

I have included a chart of the October 2018 feeder cattle futures contract (Figure 3).

It shows prices have been increasing the past several months. It would be a good idea to keep an eye on the chart for the next little while as you are trying to price your 2018 crop of calves. Summer markets can be volatile, so look for opportunities to sell when prices are high.

Calf prices are on an uptrend right now, but that could change any day. Take advantage of an opportunity to catch an uptrend in the market if prices are above your costs of production. ![]()

-

Steve Harrison

- Extension Educator

- University of Idaho

- Email Steve Harrison